The Dark Cloud Cover Pattern is used by many traders. It is used to spot reversals in the market and achieve favorable risk to reward ratios. It is easy to spot but traders need to view the formation of the Dark Cloud Cover Candlestick in Conjunction with other crucial factors and avoid simply trading as soon as the pattern appears.

What is a Dark Cloud Cover Pattern ?

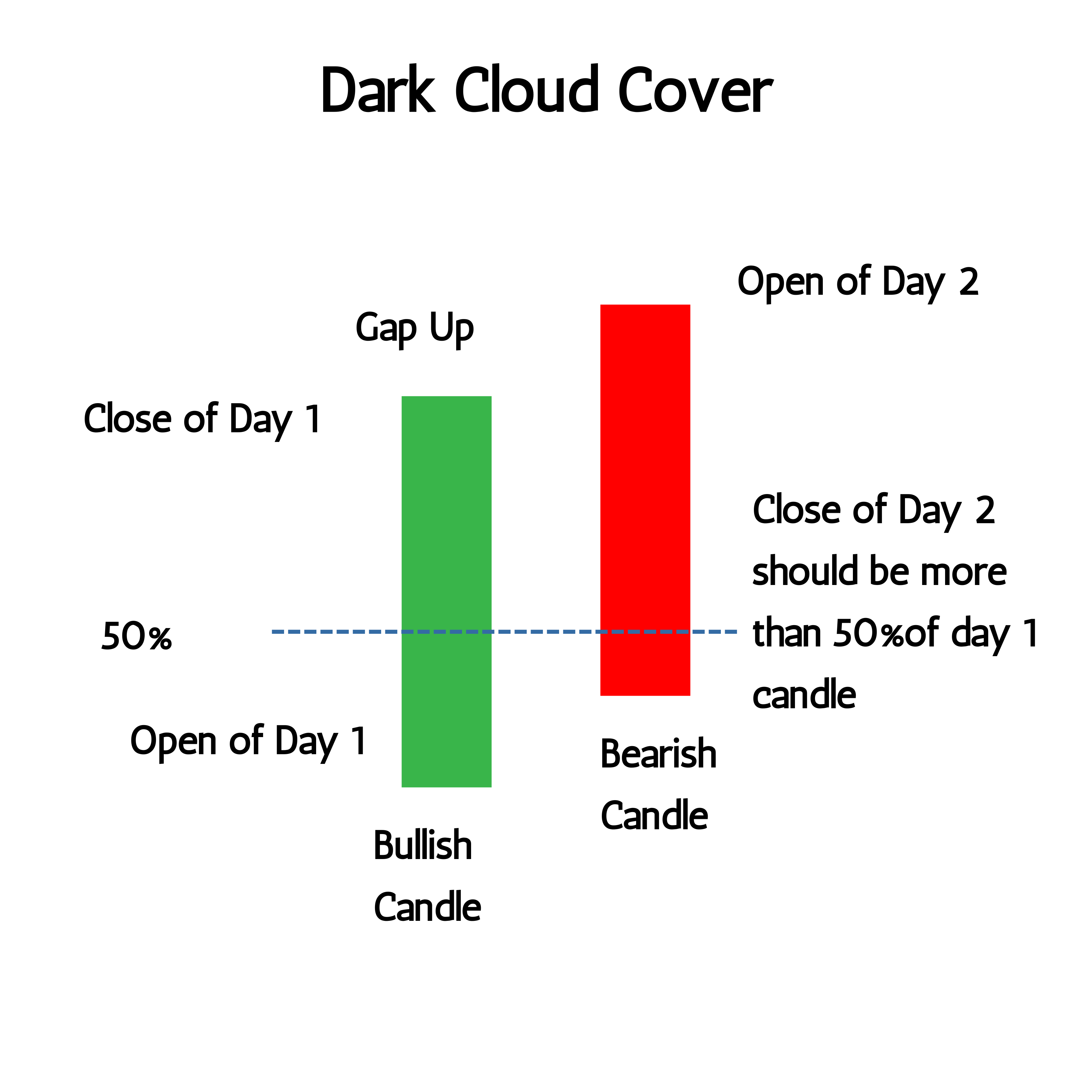

- The Dark Cloud Cover Pattern is a candlestick pattern that signals a potential reversal to the downside. It appears at the top of an uptrend and involves a large green candle which is a bullish candle, followed by a red candle that creates a new high before closing lower than the midway point of the previous green candle.

- The Dark Cloud Cover pattern includes a large black candle forming a dark cloud over the previous day candle. The buyers push the price higher at the open, but then the sellers take over later in the session and push the prices down.

- This shift from buying to selling signals that a price reversal to the downside could be forthcoming. Most traders consider the Dark Cloud Cover pattern useful only when it occurs at the end of an uptrend.

- It starts with a bullish candle in an uptrend followed by a gap up the next day. The candlestick of the next day turns to be a bearish candle. The close of this bearish candle is below the midpoint of the previous day candle. The bullish and the bearish candlesticks in this candlestick pattern have large real bodies with very short or no shadows. The formation of this pattern is confirmed by the form of a bearish candle at the end of this pattern.

Understanding Dark Cloud Cover Pattern

The Dark Cloud Cover pattern involves a large black candle forming a dark cloud over the preceding candle. Most of the traders consider the Dark Cloud Cover Pattern useful only if it occurs following an uptrend or an overall rise in price. As price rise the pattern becomes more important for marking a potential move to the downside.

There are five criteria for the Dark Cloud Cover Pattern which are

- An existing bullish uptrend.

- An up bullish candle within that uptrend

- A gap up on the following day

- The gap up turns into a down candle

- The bearish candle closes below the midpoint of the previous bullish candle.

The Dark Cloud Cover Pattern is further characteristised by white and black candlesticks that have long real bodies and relatively short or non-existent shadows. Traders might also look for a confirmation in the form of a bearish candle following the pattern. The close of the bearish candle may be used to exit long positions.

Alternatively traders may exit the following day if the price continues to decline. If entering short on the close of the bearish candle or the next period, a stop loss can be placed above the high of the bearish candle. There is no profit target for a Dark Cloud Cover Pattern.

Example of Dark Cloud Cover Pattern

We can understand the Dark Cloud Cover Pattern with the following chart.

There is a bearish trend on the candlestick which in fact opens higher but it takes away more than half of the previous candlestick profits. The candle appears optimistic at first, but suddenly “ Dark Clouds” appear as the price moves downward. If the third candle is in the sequence and closes below the first candle’s low, the bearish indication of the dark cloud cover is enhanced. Price may decrease continuously for some time after that, without any substantial upward move.

How to predict market weather when the dark cloud cover appears

Dark Cloud Cover is part of Japanese Candlestick family and it indicates all possible trend reversal after a continuous upward rise. It appears in an uptrend a bullish green candle is followed by a red bearish one, which forms in an uptrend but it closes below the midpoint of the green candle. The dark cloud pattern is a forex candlestick and used by traders.

Candlestick charts are widely used in forex and provide a wide range of information regarding forex price movement, helping traders to form effective trading strategies.

How to Spot a Dark Cloud Cover In Candlestick Charts

- Dark Cloud Cover is a bearish Candlestick Pattern that appears in the chart to indicate a trend reversal. It is quite easy to spot but if you are a new investor, you will need some practice before you successfully identify different candlestick formations.

- Two candles group together to form a dark cloud cover pattern-one green candle that is a part of the prevailing upward trend, and a red bearish candle that although forms in the uptrend, closes below the midpoint of the previous candle. It is a potential indication of a trend reversal. However traders need to confirm it with other trading tools before taking a position.

Important Points to remember

- Dark Cloud Cover Candlestick Pattern appears in an uptrend, a potential indication of a trend reversal. It is a combination of a bullish green candle and a red bearish candle, where the red candle closes below the midpoint of the green candle. The bearish candle opens higher than the green candle the difference between the closing price of the first candle and the opening price of the second one is called market gap.

- Both candles have large real bodies and short or no shadows, indicative of strong participation from traders. A third short bearish candle appears after the red candle , called the confirmation. It indicates a shift in momentum but traders must confirm its prediction with other trading tools.

Conclusion

There are various ways to confirm if a dark cloud cover formation is a potential sign of downtrend or not. Traders often use it in conjunction with other technical trading tools like support and resistance lines, trend lines and stochastic oscillator for confirmation. Traders who want to exit their long position may consider existing at the end of the bearish candle or the following day. Similarly traders planning to enter around this time can place their stop-loss above the higher point of the bearish candle.

Frequently Asked Questions (FAQs)

How to identify a dark cloud cover candlestick pattern?

The Dark Cloud Cover is a bearish candlestick pattern that signals a potential reversal in an uptrend.

- The first candle in the pattern is a long bullish (green or white) candle, indicating strong buying momentum.

- The second candle opens above the close of the first candle (ideally above the high of the first candle), showing initial buying interest.

- The second candle is a bearish (red or black) candle that closes well into the body of the first candle, typically covering at least 50% of the first candle’s body. This suggests that sellers have taken control.

How to trade using dark cloud cover pattern?

Trading using the Dark Cloud Cover pattern involves several steps, as this pattern indicates a potential bearish reversal after an uptrend.

- Identify the Pattern

- Confirmation

- Entry Point

- Set Stop Loss

- Target Price

- Risk Management

- Monitor the Trade

- Exit the trade

What is the difference between bearish engulfing and dark cloud cover?

Bearish Engulfing is stronger, more visually pronounced bearish reversal pattern where the second candle completely engulfs the first. Whereas Dark Cloud cover is a bearish reversal pattern where the second candle opens higher but closes significantly lower, covering a large portion of the first candle’s body but not engulfing it entirely.