- Study

- Slides

- Videos

2.1 Introduction

Companies may also issue preferred stock (also known as preferred shares or preference shares). Preferred stocks generally combine the characteristics of debt and equity investments, and are consequently considered to be hybrid securities.

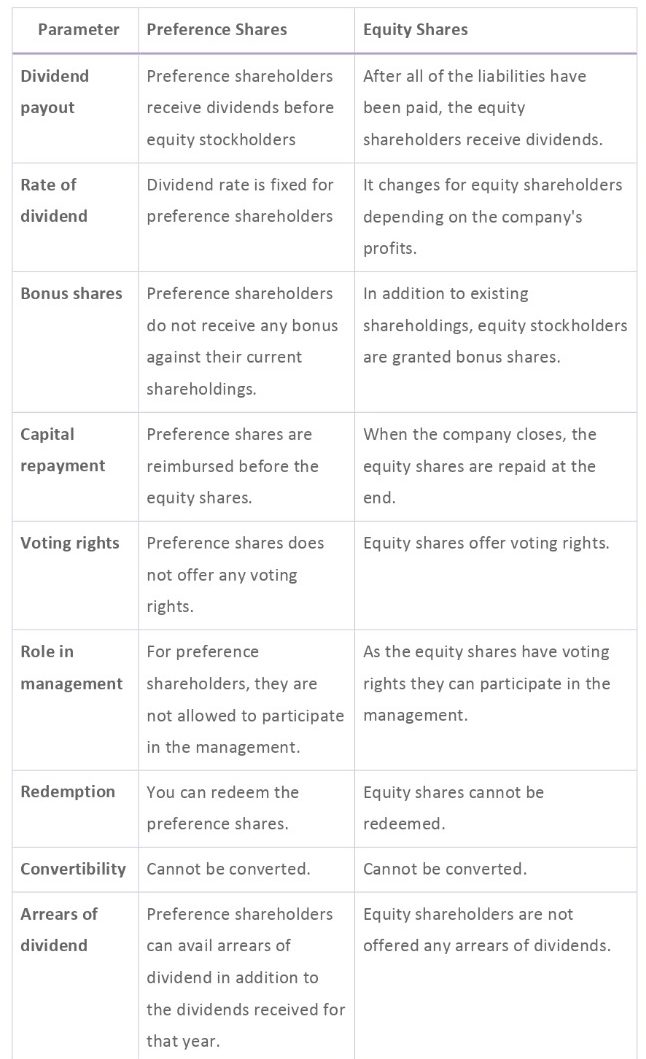

Preference shareholders experience both advantages and disadvantages. On the upside, they collect dividend payments before common stock shareholders receive such income. But on the downside, they do not enjoy the voting rights that common shareholders typically do.

So the preferred share holders generally receive dividends before common shareholders. They also have a higher claim on the company’s assets compared with common shareholders if the company ceases operations. In other words, preferred shareholders receive preferential treatment in some respects.

Preferred shares are typically issued with an assigned par value. Along with a stated dividend rate, this par value defines the amount of the annual dividend promised to preferred shareholders. Preferred share terms may provide the issuing company with the right to buy back the preferred stock from shareholders at a pre-specified price, referred to as the redemption price. In general, the pre-specified redemption price equals the par value for a preferred share. The par value of a preferred share also typically represents the amount the shareholder would be entitled to receive in a liquidation, as long as there are sufficient assets to cover the claim.

Preferred shareholders usually receive a fixed dividend, although it is not a legal obligation of the company. The preferred dividend will not increase if the company does well. If the company is performing poorly, the board of directors is often reluctant to reduce preferred dividends

2.2 Types of Preference Shares

1.Cumulative Preference Shares

In cumulative preferred shares, the preferred dividend always gets accumulated for subsequent years. Such type includes the provision, wherein the company is required to pay all dividends – Present as well as past, in subsequent years.

Suppose a company ABC Limited issues cumulative preference shares for Rs. 100 each and promises to pay 10% as dividend annually. Ideally, in a good economy, shareholders would earn Rs. 10 on their investment. However, owing to low returns, the company could only pay Rs. 5 as a dividend that year. Subsequently, in the next year with the worsening condition, the company could not pay the dividend of Rs. 10. Once profits were generated, the company decided to pay off the current dividend along with the outstanding dividend of Rs. 15 to shareholders. So cumulatively, the company paid Rs. 25 as dividend to shareholders.

2. Non Cumulative Preference Shares

Non – Cumulative Preference Shares do not collect dividends in the form of arrears. In the case of these types of shares, the dividend payout takes place from the profits made by the company in the current year. So if a company does not make any profit in a single year, then the shareholders will not receive any dividends for that year. Also, they cannot claim dividends in any future profit or year.

3. Redeemable Preference Shares

Redeemable preference shares are those shares that can be repurchased or redeemed by the issuing company at a fixed rate and date. These types of shares help the company by providing a cushion during times of inflation.

It is one of the methods that companies embrace in order to return cash to the existing shareholders of the company. It is a way of share repurchase but is different from traditional share repurchases in certain ways. The prices at which companies can repurchase these redeemable shares are already decided during the time of issuing those shares. Issuing callable preferential shares that can be redeemed in the future provides the company flexibility to choose from whether to go for share repurchase or go for shares redemption.

Let us assume example in order to see how the shares are redeemed by a company A. Let’s assume that the company while using the redeemable preferential shares, had a call option for those shares at Rs.180 at the predetermined time frame. Suppose the shares are trading at the market price of more than the callable price. Here the company can call the redeemable preferential shares when the price of the company is lesser than the call price. And the company can go for share repurchase instead of redeeming the shares. If they are not able to secure a share repurchase, they can always fall back for the option of redeeming the shares. That way, the company has greater flexibility if it has issued redeemable shares.

4. Non-Redeemable Preference Shares

Non-redeemable preference shares are those shares that cannot be redeemed or repurchased by the issuing company at a fixed date. Thus, these shares do not have any incorporated clause with respect to their redemption and thus cannot be bought back at the choice of the issuing company.

Non redeemable preference shares remain in existence so long as the company is in existence i.e., they do not have any predetermined maturity period and are perpetual in nature. These shares are only extinguished in the event that the company goes into liquidation and the shareholders receive share of assets in exchange of extinguishment of shares.

They become a permanent liability for the issuing company, in that they are obligated to pay dividend on these shares for perpetuity. Although these shares exist in theory, several jurisdictional laws have imposed restrictions on issue of non redeemable preference shares.

5. Participating Preference Share

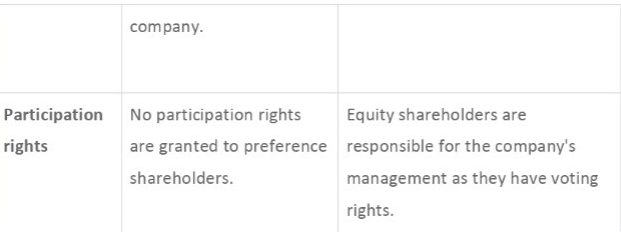

Participating preference shares gives its holder participation in the additional earnings of a business. The participation feature increases the value of the stock, allowing the issuer to sell it at a higher price. This participation is in addition to the usual fixed dividend associated with most types of preferred stock. An investor should buy participating preferred stock when he believes that a business is likely to have unusually strong earnings or be sold for a high price, so that he can participate in those gains. Participation can take several forms. For example, if the business generates a certain amount of income, the holder of participating preferred shares will be paid a certain proportion of that income, in addition to the normal dividend. Or, if the business is sold, the holder of participating preferred shares will be paid a certain proportion of the net sale price received.

These additional payments are usually made in the form of dividends. Also, participation rights are sometimes activated only when the amounts that a company earns, either through its operations or sale of the business, exceeds a certain threshold level. Depending on the level of the threshold, participation payments may be relatively rare.

Example: For example, if a company that issued Rs.1 million in participating preferred stock representing 10% of the company liquidated in a transaction for Rs.10 million, the holders of the participating preferred stock would be entitled to receive a Rs.1 million liquidation preference (or more, if specifically agreed upon), plus 10% of the remaining Rs.9 million in proceeds, for a total of Rs.1.9 million.

If the same company sold instead for Rs.15 million, the participating preferred stockholders would be entitled to Rs.1 million plus 10% of Rs.14 million for a total of Rs.2.4 million in total distributions.

6. Non-Participating Preference Shares

These shares do not benefit the shareholders the additional option of earning dividends from the surplus profits earned by the company, but they receive fixed dividends offered by the company.

Using the example above, if a company issued Rs.1 million in non-participating preferred stock (representing 10% of the company) and then liquidated in a transaction for Rs.9 million, the holders of the non-participating preferred stock would take only their Rs.1 million liquidation preference, and the remaining Rs.8 million in proceeds would be distributed to the other stockholders.

2.3 Features of Preference Shares

-

They Can Be Converted Into Common Stock- Preference shares can be easily converted into common stock. If a shareholder wants to change its holding position, they are converted into a predetermined number of preference stocks. Some preference shares inform investors that they can be converted beyond a specific date, while others may require permission and approval from the company’s board of directors to be converted.

-

Dividend Payouts– Preference shares allow shareholders to receive dividend payouts when other stockholders may receive dividends later or may not be receiving dividends.

-

Dividend Preference– When it comes to dividends, preference shareholders have the major advantage of receiving dividends first compared to equity and other shareholders.

-

Voting Rights– Preference shareholders are entitled to the right to vote in case of extraordinary events. However, this happens in only some cases. Generally, purchasing a company’s stock does not give one voting rights in the company’s management.

2.4 Advantages of Preference Shares

-

Dividends are paid first to preference shareholders

The primary advantage for shareholders is that the preference shares have a fixed dividend. This payout is typically done prior to any dividends being paid to common shareholders. If the company turns a profit, the dividends are paid on some types of preference shares. This generally permits for the aggregation of dividends that are unpaid. The preferred shareholders get priority when it comes to remitting unpaid dividends, over common shareholders.

-

Preference shareholders have a prior claim on business assets

If the business decides to file for bankruptcy or liquidates, preference shareholders can stake a higher claim on the assets of the business. This makes the risk of investment tolerable as opposed to the common shareholder. The preferred shareholders have a guaranteed dividend payout annually. In fact, if the business does opt to shut down its operations, the preferred shareholders will be adequately compensated for their investments.

-

Add-on Benefits for Investors– With preference shares, shareholders are allowed to trade in their convertible shares for a pre-decided number of common shares. If the company is able to meet a specified profit mark that was determined earlier, then the shareholder has the opportunity to experience add-on dividends. This can be an advantageous prospect, especially if the value of common shares starts increasing. In order to generate long-term income, this particular segment of preference shares are low risk and offer additional benefits as a type of investment instrument.

2.5 Disadvantages of Preference Shares

-

No voting rights – The key disadvantage of owning preferred shares is the absence of ownership rights in the business. From an investor perspective, the business is not liable to preferred shareholders as opposed to equity shareholders. If the business really turns a profit and the interest rate increases, the preferred shareholders will be stuck on the fixed dividend.

-

Higher cost than debt for issuing company– In order to finance projects, businesses will try to raise capital through debt and equity issues which are basically costs associated with operations. Usually, large corporations issue preferred stock to the public in addition to raising funds through the common stock and corporate bonds. Businesses that choose equity in place of debt issues are able to attain a lower debt to equity ratio. This offers them a significant benefit in terms of leveraging for additional financing from new investors.