- Study

- Slides

- Videos

1.1 Introduction to Dow Theory

Technical Analysis has some very solid roots, The Dow Theory. From 1900 to the time of his death in 1902, Charles Dow wrote a series of editorials published in The Wall Street Journal regarding his theory of the stock market. Dow believed the stock market was a barometer of the overall health of the economy, and, he believed the stock market moved in predictable ways. He felt that if the economy was advancing, then the stock market would reflect the healthy economy with advancing prices in stocks. Similarly, in a contracting economy, he believed the stock prices would reflect that as well.

Dow created what we know today as the Dow Jones Industrial Average, a select list of eleven large companies that encompassed a wide range of business areas. His theory was that the health of these companies would mirror the health of the economy, and, as these company’s output and revenues changed, then the economy would change as well. Today there are thirty companies that make up the DJIA, from banking to health care, manufacturing, retail, and technology.

Charles Dow was right. One can see it today as clearly as he saw it more than one hundred years ago. The market truly is a barometer of the economy. The market does and has always moved in predictable ways. When company revenues, earnings and output begin to contract, the economy is either already contracting or is not far behind. And, as companies begin to expand, the economy follows

The Dow Theory’s Basic Premise

“The Market Discounts Everything”

The stock market being a barometer of the economy’s health is only one aspect of the Dow Theory. A basic premise of the Dow Theory is, ‘market discounts everything’. Meaning, all information – past, current, and even future – is discounted into the markets and reflected in the prices of stocks and indexes.

That information includes everything from the emotions of investors to inflation and interest-rate data, along with pending earnings announcements to be made by companies after the close. Thus, the only information excluded from the current market prices is that which is unknowable, such as a massive earthquake or possibly a terrorist attack. But even then the risks of such an event are priced into the market. And no, this does not mean that market participants or the market itself can somehow predict future events. But it does mean that over any period of time, all factors – those that have happened, are expected to happen, and could happen – are priced into the market

To apply this to technical analysis today, we need only look at price movements, and not at other factors such as the balance sheet of a company. Just like mainstream technical analysis, Dow Theory is mainly focused on price and volume, because the stock price of a company is reflecting what the balance sheet of the company suggests.

Therefore, one doesn’t have to try to figure out the accounting wizardry of a company to determine whether to buy the stock or not. All one has to do is look at the stock’s price and volume, and, know how to interpret that information.

Another premise of the Dow Theory that we will use in our technical analysis is the market moves in trends.

1.2 The Market Has Three Movements

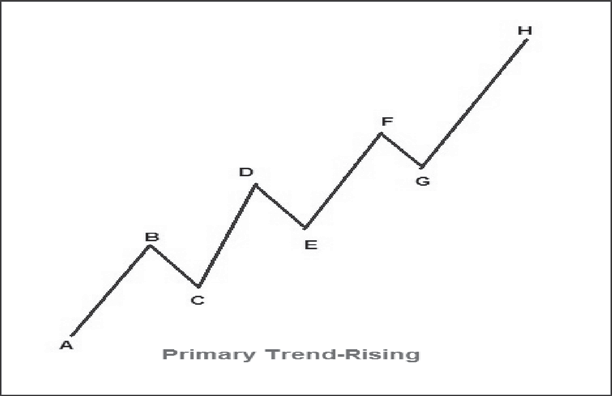

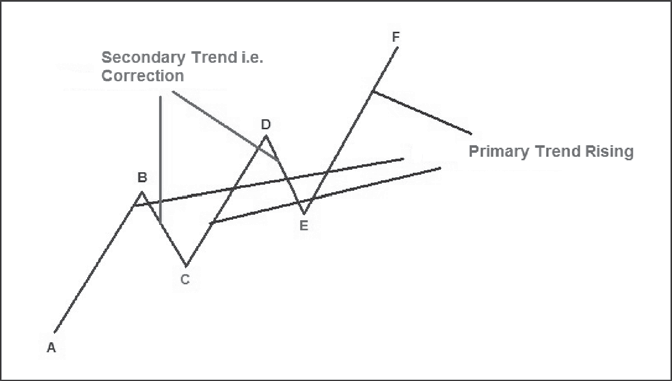

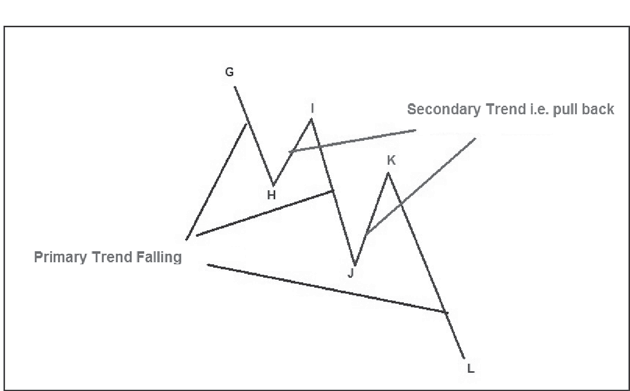

Trend followers will know that there can be trends within different timeframes, where an hourly uptrend would be discounted by a downtrend on the weekly chart. That ability to differentiate between different timeframe ‘movements’ is key. Dow states that there are three movements:

1. PRIMARY MOVEMENT/MAJOR TREND long-term. Dow states that this could be anything from less than a year to several years. However, it could be worthwhile thinking of this as relating to the long-term trend as seen through the weekly or monthly chart.

2. SECONDARY REACTION/MEDIUM SWING/INTERMEDIATE REACTION medium-term. This could be anything from ten days to three months. It makes sense to think of this as the view taken with the daily and four-hour charts.

3. SHORT SWING/MINOR MOVEMENT short-term. This is the view taken over the space of hours, up to a month. This would use the hourly chart and lower timeframes

1.3 Trends Have Three Phases

Dow recognized there are three phases to every primary trend.

1. The Accumulation phase

2. The Public Participation phase

3. The Distribution phase

The first stage of a new bull market is referred to as the accumulation phase. To get you to thinking market psychology a little, try to imagine after a considerable sell-off, the buyers that step back in to pick up the bargains are the Pros. They have seen this type of market action before and recognize the stock prices are ‘on sale’ so to speak. They are normally the ones buying in the Accumulation Phase. No, they didn’t rupee-cost-average all the way down as the market kept declining; they didn’t buy in at the previous market top and sell out at the bottom. No, they were sitting on the sidelines with cash in hand waiting for the market to hit bottom. Once it became reasonably apparent the bottom was in place, that the risk of further decline was minimal, and the chance of a future advance was very good, then, and only then, did they risk their money. Do you see the risk/reward ratio here? Risk your money when the risk is low and the reward is high

The Public Participation Phase- As the accumulation phase materializes, a new primary trend moves into what is known as the Public Participation Phase. This phase is usually the longest-lasting of the three phases. This is also the phase you want to be invested in, an advancing market.

During this phase, earnings growth and economic data improve and the public begins to tip-toe back into the market. As the economy and the related news improve, more and more investors move back in, and this sends stock prices higher. As you can see in the previous chart, during the Public Participation Phase, the market experiences a long-term advance while the primary trend moves higher with secondary trends (pullbacks) along the way. These advances can last several years. Historically, there is a bear market on the average of every three and one-half years. Therefore, an advancing bull market should last around three years before another bear market begins.

The Distribution Phase- The third phase is the distribution phase. This phase is the one that seems to always catch investors and traders unaware. The market has been in an advancing primary trend, and many think it will continue to move higher.

Dow correctly named this phase because of the trading activity going on during this phase. Remember the smart money buyers who were ‘accumulating’ during the accumulation phase, buying while there was blood in the streets? They are the ones selling in the distribution phase. The investors and traders that are often caught unaware are the ones normally doing all the buying during the distribution phase, buying from the smart money investors and traders.

Some say it is harder to call a market top than a market bottom. That is somewhat true. But a market top always has certain characteristics that can be recognized. Market tops form after a long advance. The market seems to get tired and stops advancing and begins moving sideways. The market stops making new highs. It no longer has the momentum to push higher, so it starts trading sideways and then begins to rollover. Volumes also dry up

In a Declining Market – The three phases of a market cycle change very little during a declining market. The Distribution phase is always at the top and the Accumulation Phase is at the bottom. The Public Participation Phase still resides in the middle, but normally does not cover as long a time frame as it does during an advancing market. At the end of the Public Participation Phase, there is always an Accumulation Phase. The experienced investors, who recognized the previous market top, knew the market was not likely going any higher, and sold during the Distribution Phase start stepping back in. They scoop up the bargains and position themselves for the next market advance

The Averages Must Confirm With Each Other

Dow, referred to something called as Industrial & Rail Averages- this meant that no important bull or bear market signal could take place unless both averages gave the same signal, thus confirming each other.

To understand this better- the Dow Transportation Index was seen as a key gauge of economic activity- as US rail network was extensively used to ship goods. With factories dotted throughout the country, the rise or fall of rail use was considered an important indicator. Dow said one should correlate the Dow index & Dow transport index.

Dow’s idea of seeing confirmation between two stock indices holds value even today. Taking those two indices as an example, Dow said that when both were moving in the same direction, it provided greater confidence compared to times where there is a divergence between the two. It makes sense to look for confirmation utilising the case of whether both create higher highs and higher lows for an uptrend. Nowadays traders may wish to look for alternate markets, yet the notion of using correlated and related markets to find confirmation remains valuable.

E- TRENDS ARE CONFIRMED BY VOLUME

Dow saw volume as a crucial tool for confirming or refuting a market move. When a market moves on low volume, this is thought to mean a number of possible things. One such reason could be that there is one overly aggressive buyer or seller who is attempting to move the market. However, when significant price movements occurred with high volume, Dow believed that this gave a ‘true’ market view.

F- TRENDS EXIST UNLESS PROVED OTHERWISE

Markets do not move in a straight line, and with fundamental events providing volatility, there will be times that the trend seems to come under pressure. However, Dow believed that the trend will typically remain in play despite such a ‘market noise’. The trend should thus be given the benefit of the doubt during such retracements. Dow does not provide a specific means to determine whether a trend has reversed or if it is simply in retracement move.

1.4 Significance Of Dow Theory

Even though the Dow Theory is roughly 100 years old, but it is still useful in forming a trading strategy, identifying trends, and indicating the right time to enter and exit the market. The Dow Theory is extremely important for trading. Mainly everything in trading depends on trends that are a crucial element of trade. Before trading, the investors focus on the market being bullish or bearish, or else at most deduce the direction of the primary trend. Thus, Dow Theory provides an idea about the market trends to the investors for making their trading journey fuss-free.

Critics Of Dow Theory

This theory has done well over the years in identifying major bull & bear markets, but has not escaped criticism. On average- Dow theory misses 20 to 25% of a move before generating a signal. Many traders consider this to be too late. A dow theory buy signal usually occurs in the second phase of an uptrend as price penetrates a previous intermediate peak. This is also, incidentally, about where most trend following technical systems begin to identify and participate in existing trends.

In response to this criticism, traders must remember that Dow never intended to anticipate trends, rather he sought to recognize the emergence of major bull & bear markets and to capture the large middle portion of important market moves. The available record shows that Dow’s theory has performed that function reasonably well. From 1920 to 1975, Dow theory signals captured 68% of the moves in the Industrial & Transportation Averages and 67% of those in the S&P 500 Composite Index. Those who criticize Dow Theory for failing to catch actual market tops & bottoms lack a basic understanding of the trend following philosophy.