- Introduction To Technical Analysis

- Charts

- Line & Bar Charts

- Candlestick Patterns

- Support, Resistance & Trend

- Trend Lines

- Understanding Chart Patterns & Head & Shoulder In Detail

- Double Top & Bottom Pattern In Stock Market - Explained

- Saucers & Spikes

- Continuing Patterns

- Know What Is Price Gaps & Its Types In Stock Market

- Study

- Slides

- Videos

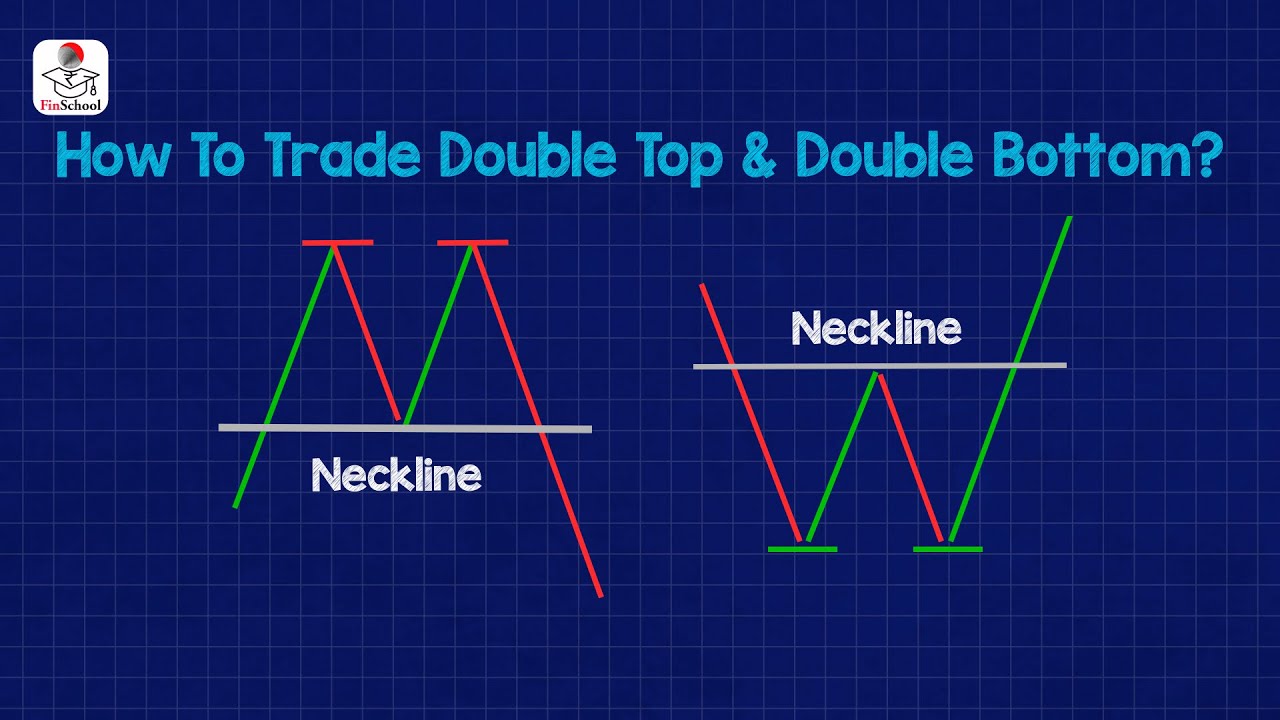

8.1 Double Top- Meaning

When an asset hits a high price two times in a row with a moderate decrease in between, a double top is a very negative technical reversal pattern. It is confirmed once the asset’s price falls below a support level equal to the low between the two prior highs.

Thus,

-

A double top is a bearish technical reversal pattern.

-

It is not as easy to spot as one would think because there needs to be a confirmation with a break below support.

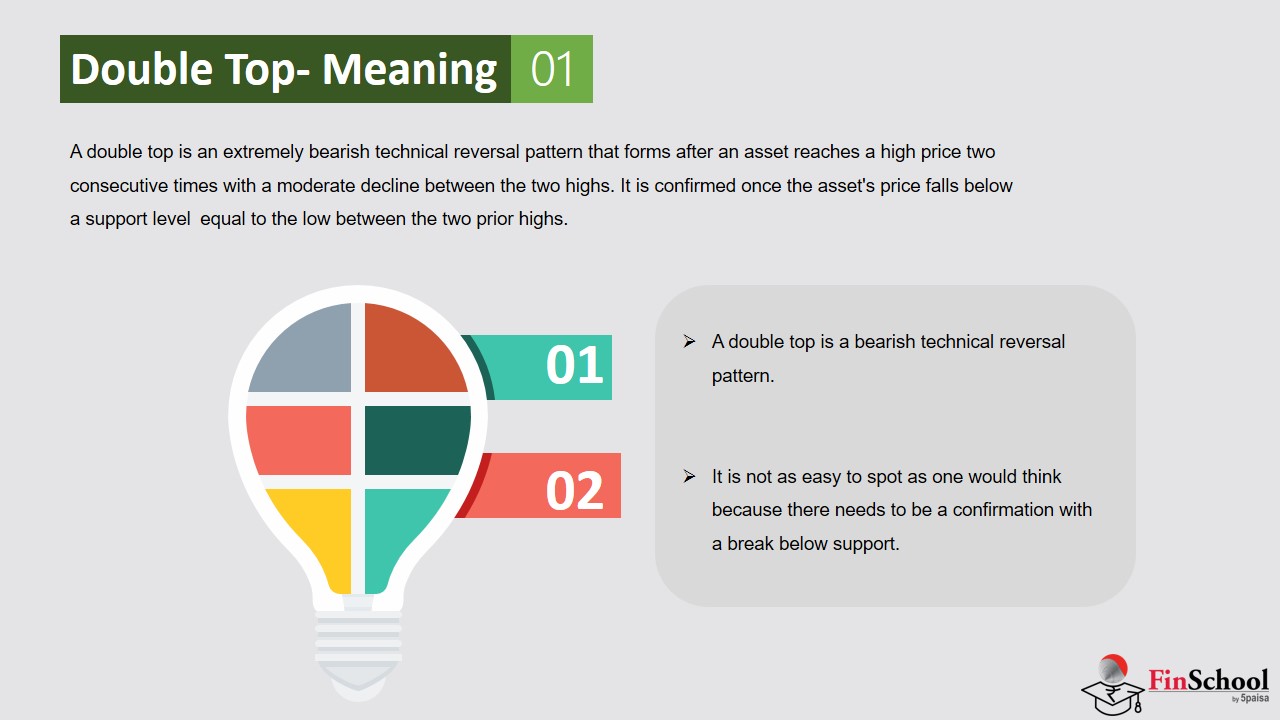

8.2 Interpretation of Double Top

This stock made a high around 140 and then pulled back. And yes, it found support around 118, and then advances again.

But then what happens? It could not make it back up to the previous high. Once the first high was formed, a resistance line could then be drawn at the top. This lets you know when the stock attempts to move higher it must break that resistance to do so. This one couldn’t do it. That is your first red flag. No higher high and a red flag if you are holding this stock in your trading account or your portfolio.

It then pulls back to the support and that doesn’t hold. That’s a huge red flag. The angle of advance is something worth noting and remembering as well. When a stock price advances creating an angle on the chart greater than 45 degrees, it is not sustainable. Reaching the first high was a sharp advance and that usually indicates euphoria. Euphoria never lasts very long in the market, and certainly is not something that will sustain a stock’s price.

If you are holding this stock, these warning signs are what you are looking for after an advance. When the second high is lower than the first, this is when you should have your stop loss tightened up, take some money off the table, or both.

8.3 Double Bottom- Meaning

A technical analysis charting pattern known as a double bottom pattern indicates a shift in trend and a momentum reversal from previous leading price action. It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original drop, and finally another rebound. The double bottom looks like the letter “W”. The twice-touched low is considered a support level.

Thus,

-

The double bottom looks like the letter “W”. The twice-touched low is considered a support level.

-

The advance of the first bottom should be a drop of 10% to 20%, then the second bottom should form within 3% to 4% of the previous low, and volume on the ensuing advance should increase.

-

The double bottom pattern always follows a major or minor downtrend in a particular security, and signals the reversal and the beginning of a potential uptrend.

8.4 Interpretation of Double Bottom

Historically, a stock will re-test the lows much more often than not. This is a signal of strength, and is what normally creates the Double Bottom on the chart.

Re-testing the lows is exactly what happened in this chart. The stock fell to around 41, found support, traded a little higher, and then fell again re-testing the low.

Interpreting this information tells us a number of things:

-

There is solid support at that price level. It is really not important that we know why. It could be that is exactly what the company is worth. It could be many different things, most of which we will never know. What is important is the fact that the chart tells us that is where there is support. The price is the footprint of money!

-

More importantly, a buying opportunity exists when the low was re-tested and held. This is confirming there is support at that level. Remember, buying close to a support level and placing a Stop Loss just below known support is a very low risk trade and the most opportune time to enter. You would be risking a minimal amount with an opportunity for a very high return.

-

The second low was slightly higher than the first. That is also a bullish sign. This means that buying interest is solid, more buyers have entered, and selling has waned.

This information is invaluable. You will see this pattern develop on numerous charts. When you see a stock that has traded down to a low, keep this pattern in mind. Watch the stock to see if it re-tests the low. If it does, and it holds, then you have a great buying opportunity

8.5 Rounded Top- Meaning

A rounding top is a price pattern used in technical analysis. It is identified by daily price movements, in particular the tops, which when graphed, form a downward sloping curve. Technical analysis of price information suggests that a rounding top may form at the end of an extended upward trend and that this price pattern may indicate a reversal in the long-term price movement.

The rounded top pattern can take many days, weeks, months, or even years to form; longer completion times indicate longer trend shifts. It may be contrasted with a rounding bottom

Thus,

-

A rounding top is a chart pattern used in technical analysis identified by price movements that, when graphed, form the shape of an upside-down “U.”

-

Rounding tops are found at the end of extended upward trends and may signify a reversal in long-term price movements.

-

The duration of the pattern may take months or sometimes years to coalesce. Investors should be aware of the potentially lengthy timeframe necessary to realize a full downturn in price.

8.6 Rounded Top Interpretation:

There are three main components to rounded top pattern

-

A rounding shape where prices trend higher, taper off, and trend lower;

-

An inverted volume pattern (high on either end, lower in the middle of the pattern);

-

The support price level found at the base of the pattern.

When following a rounding top, traders may also watch volume which is usually higher as the charted price increases and decreases on a downtrend. In a rounding top, a curved trend line following peak highs forms an inverted “U” shape. In this pattern, the price of the security will increase to a new high, then steadily decreases from a resistance level to form the rounding top. Volumes will usually be the highest when the price is increasing and may experience another high on the downtrend during the selloff phase.

Generally, a rounding top will represent a bearish future outlook for the security. However, investors should be cautious when following a rounding top as support for the security’s price can occur causing several rounding tops to follow in a double top or triple top pattern.

8.7 Rounded Bottom- Meaning

Technical analysts utilize a chart pattern called a rounded bottom, which is characterized by a sequence of price moves that visually resemble a “U.” Rounding bottoms are found at the end of extended downward trends and signify a reversal in long-term price movements. This pattern’s time frame can vary from several weeks to several months and is deemed by many traders as a rare occurrence. Ideally, volume and price will move in tandem, where volume confirms the price action.

While a rounded bottom lacks the brief downward tendency seen in the “handle” component, it nonetheless has a comparable appearance to the cup and handle design. The initial declining slope of a rounding bottom indicates an excess of supply, which forces the stock price down. The transfer to an upward trend occurs when buyers enter the market at a low price, which increases demand for the stock. Once the rounding bottom is complete, the stock breaks out and will continue in its new upward trend. The rounding bottom chart pattern is an indication of a positive market reversal, meaning investor expectations and momentum, otherwise known as sentiment, are gradually shifting from bearish to bullish.

8.8 Rounded Bottom Interpretation

The rounding bottom chart pattern gives a resemblance to a bowl-like appearance. The recovery period, much like the downturn, may take months or years to coalesce; thus, investors should be aware of the potentially lengthy patience necessary to realize a full recovery in stock price.

A rounding bottom chart can be divided into several main areas. First, the prior trend shows the buildup to the stock’s initial descent toward its low. The rounding bottom breaks out of its low point when the stock price closes above the price immediately prior to the start of the initial decline.