- Study

- Slides

- Videos

3.1 Steps To Invest In Stock Market

One cannot buy or sell directly on the stock market. For this, one needs to approach brokers who are authorized to trade on the market or stock brokerage companies that allow you to trade using their platform.

The process is simple:

- To begin investing, you have to open a trading account with a broker or a stock brokerage platform. A trading account is where you actually “trade” or place buy or sell orders.

- The broker or the stock brokerage platform opens a Demat account for you. A Demat account holds the financial securities in the traders name. These two accounts are then linked to the bank account.

- To open a trading and Demat account, one needs to provide Know Your Customer (KYC) documentation that includes verification via government-authorized identity cards such as the PAN card or Aadhaar.

- Most brokers and brokerage platforms now have an online KYC process that allows to open an account in a couple of days by submitting your verification details digitally. Once open, then the trader can trade with broker or brokerage company online via a portal or offline via phone calls.

3.2 What Does It Cost to Invest in the Share Market

One cannot buy or sell directly on the stock market. For this, one needs to approach brokers who are authorized to trade on the market or stock brokerage companies that allow you to trade using their platform.

The process is simple:

- To begin investing, you have to open a trading account with a broker or a stock brokerage platform. A trading account is where you actually “trade” or place buy or sell orders.

- The broker or the stock brokerage platform opens a Demat account for you. A Demat account holds the financial securities in the traders name. These two accounts are then linked to the bank account.

- To open a trading and Demat account, one needs to provide Know Your Customer (KYC) documentation that includes verification via government-authorized identity cards such as the PAN card or Aadhaar.

- Most brokers and brokerage platforms now have an online KYC process that allows to open an account in a couple of days by submitting your verification details digitally. Once open, then the trader can trade with broker or brokerage company online via a portal or offline via phone calls.

3.3. Types of Instruments You Can Buy In Share Market

The key financial instruments traded on the stock market are:

- Equity shares:

Issued by companies, equity shares entitle you to receive a claim to any profits paid by the company in the form of dividends. Shares are the most popular financial product of the stock exchange. When you buy shares of a company, you are actually taking a partial stake in that company and becoming a shareholder of the company. Share prices fluctuate every moment. Profits and losses are determined by this fluctuation.

2. Bonds:

Issued by companies and governments, bonds represent loans made by the investor to the issuer. These are issued at a fixed interest rate for a fixed tenure. Hence, they are also known as debt instruments or fixed income instruments. The government or companies issue bonds to raise money. In fact, by buying a bond, you are in a way lending to the issuer. The issuer pays you interest for this loan. Bonds are considered a safe investment option as they offer a fixed rate of interest to the investors. Bonds are also called fixed income securities because of their fixed income.

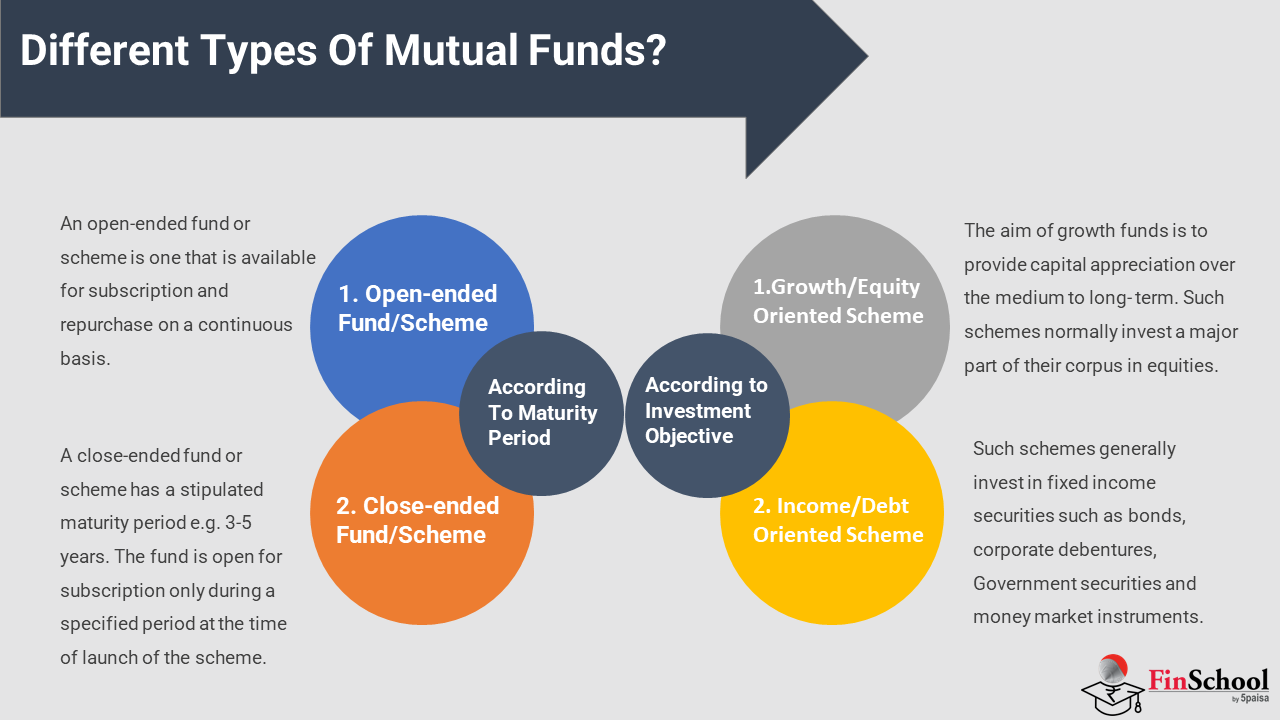

3. Mutual Funds (MFs):

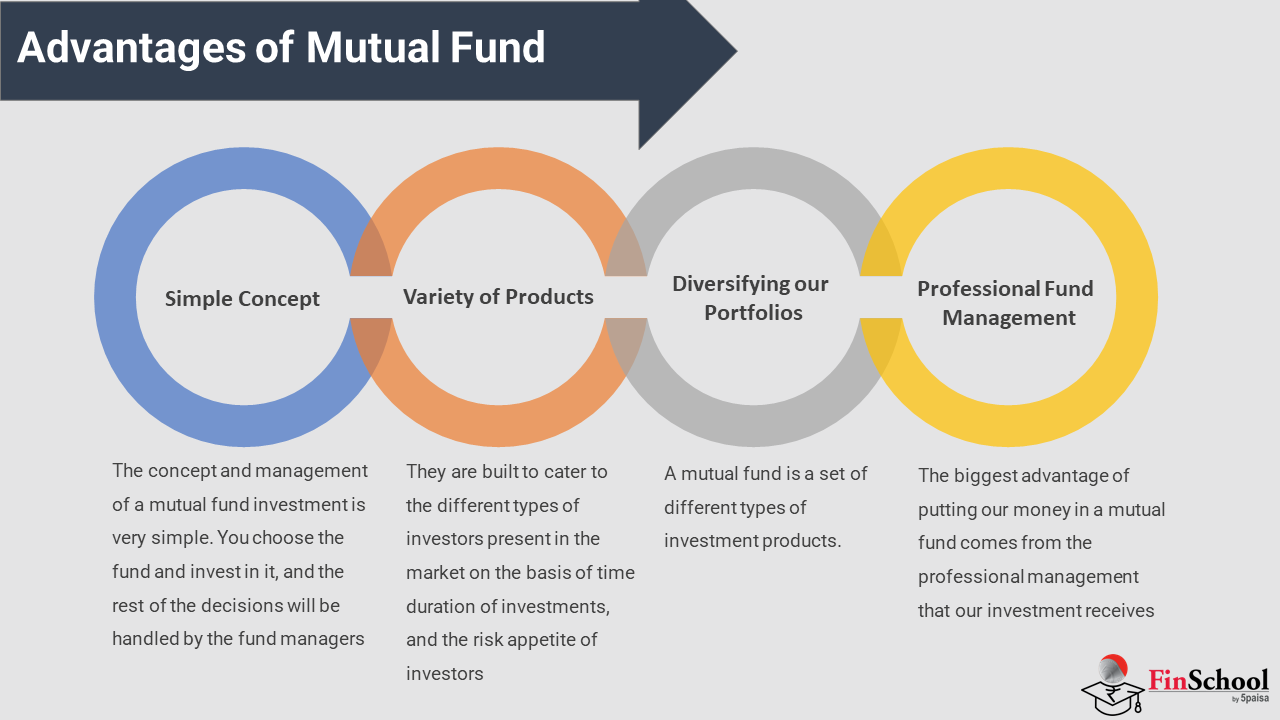

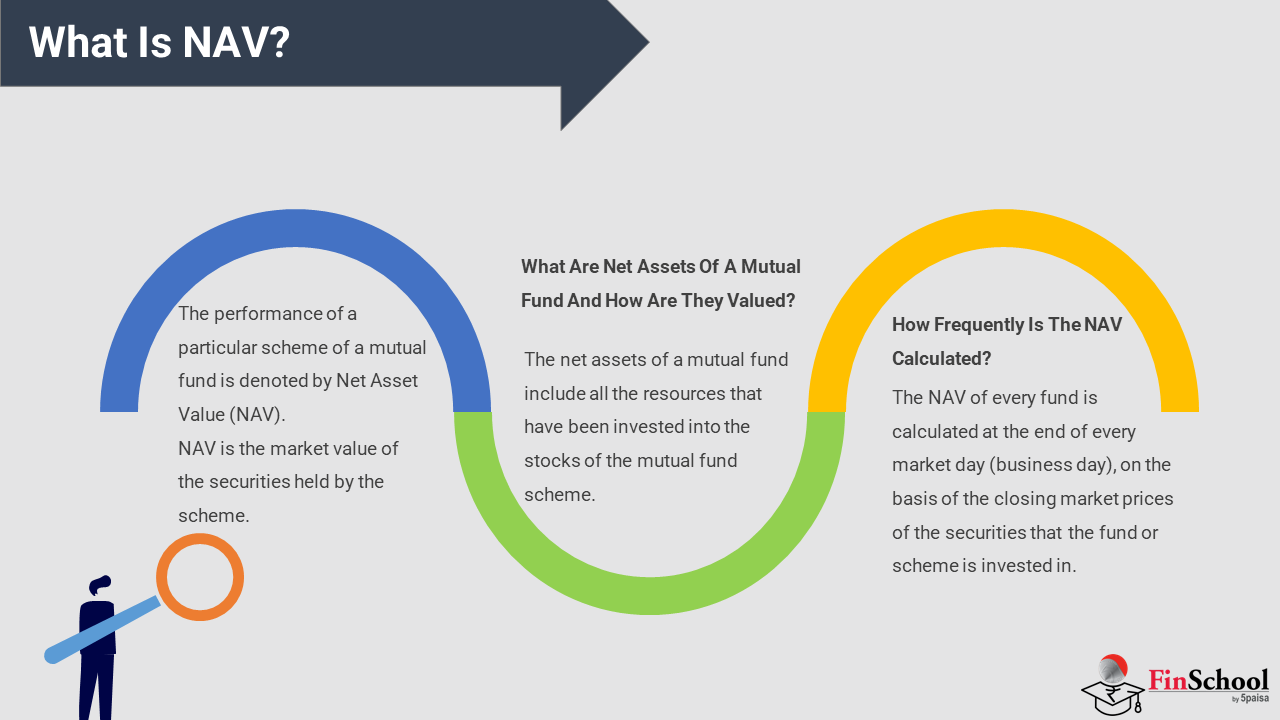

Issued and operated by financial institutions, MFs are vehicles to pool money which is then invested in different financial instruments. Profit from the investments is distributed between the investors in proportion to the number of units or investments they hold. These are called “actively” managed products where a fund manager takes calls on what to buy and sell on your behalf to generate better returns than the benchmark Mutual funds invest money in various assets such as equities, money markets, bonds, and other financial instruments by raising money from multiple investors. In this, your portfolio is managed by the fund manager, whose job is to provide high returns to the investors. Mutual funds can be a good option for new investors and those who have little knowledge of the stock market.

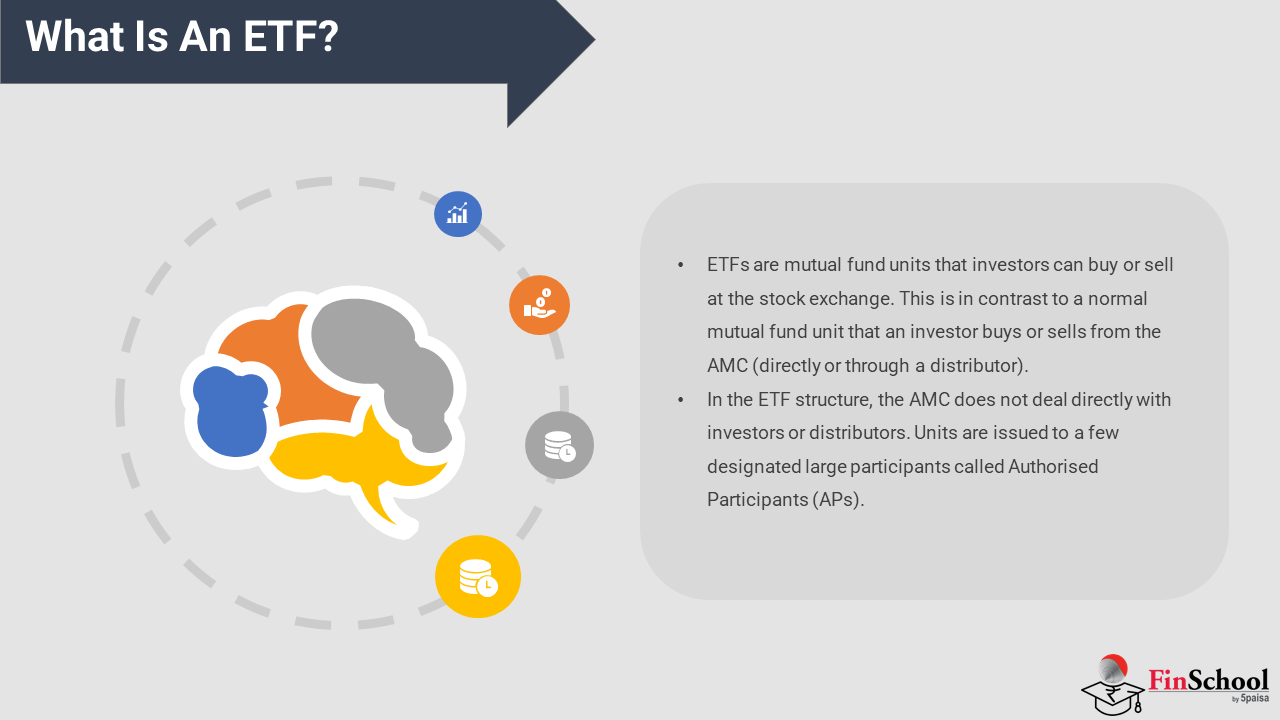

4. Exchange Traded Funds (ETFs):

Increasingly gaining popularity, ETFs essentially track an index like the NIFTY or the SENSEX. Once you buy a unit of the ETF, you hold a part of the 50 stocks in the NIFTY in the same weightage that the NIFTY holds them. These are called “passive” products, which are typically much lower in cost than MFs and give you the same risk or return profile as the index.

5. Derivatives:

A derivative derives its value from the performance of an underlying asset or asset class. These derivatives can be commodities, currencies, stocks, bonds, market indices and interest rates. A derivative is a contract between two parties. In derivatives, the investor contracts to buy or sell an asset on a specific day and at a specific rate. This asset can include shares, currencies, commodities, etc. Derivatives are also used for gold and oil. There are basically four types of derivatives – futures options, forwards, and swaps.

6. Currency

Currencies are bought and sold in the currency market i.e., forex market. Currency trading involves banks, companies, central banks, investment management firms, brokers, and general investors. In currency trading, transactions always happen in pairs. For example, USD/INR rate means how many rupees it will take to buy one US dollar. You can trade currency through exchanges like BSE, NSE, or MCX-SX.

7. Commodity

Commodities include trading in everyday items like agricultural products, energy, and metals. The best way to invest in commodities is through futures contracts. These are contracts that facilitate the purchase or sale of goods at a specified price at some future date. Trading in commodities is riskier for inexperienced investors. Trading can be done through other exchanges including Multi Commodity Exchange, National Commodity, and Derivatives Exchange.

3.4 Different Types of Stocks to Invest

When researching stocks or MFs, you will come across the term “market cap”. Market cap or market capitalization is the value of 100% of the company. Put simply, if say a company’s market cap is INR 10,000 crore, it means that is how much money it would cost you to buy all the shares of the company. Based on the market capitalization, three types of stocks categorisation exists. It is important to know this because many mutual funds and ETFs are classified based on the market caps they focus on.

- Large cap stocks:

SEBI defines large caps as the top 100 stocks by market cap. These companies are some of the largest in the country by revenue, are well-established and are usually market leaders in their respective industries. These are seen as least risky but may not grow as fast as mid or small cap stocks. But they may offer higher dividends and a safe capital reserve in the long term.

2. Mid cap stocks:

SEBI defines mid caps as stocks ranked top 101-250 by market cap. This usually implies companies with a market cap in a range between INR 8,000 to INR 25,000 crore. These companies are smaller than large caps, capable of higher growth and the potential to disrupt a large company or grow into large cap company. They are considered riskier than large caps but less risky compared to small caps.

3. Small cap stocks:

All stocks ranked top 251 and below by market cap are considered small caps by SEBI. These are stocks from small companies and are often highly volatile. Compared to the other two, these are seen as quite risky but have the potential for higher returns. Small cap stocks are also less “liquid”, which means that there aren’t as many buyers and sellers for these stocks as for large caps. Apart from market cap, stocks are categorized by the industry, how much dividend they pay, how quickly they are growing, among others.

3.5 How to Know Which Stock to Buy

- Decide your risk appetite

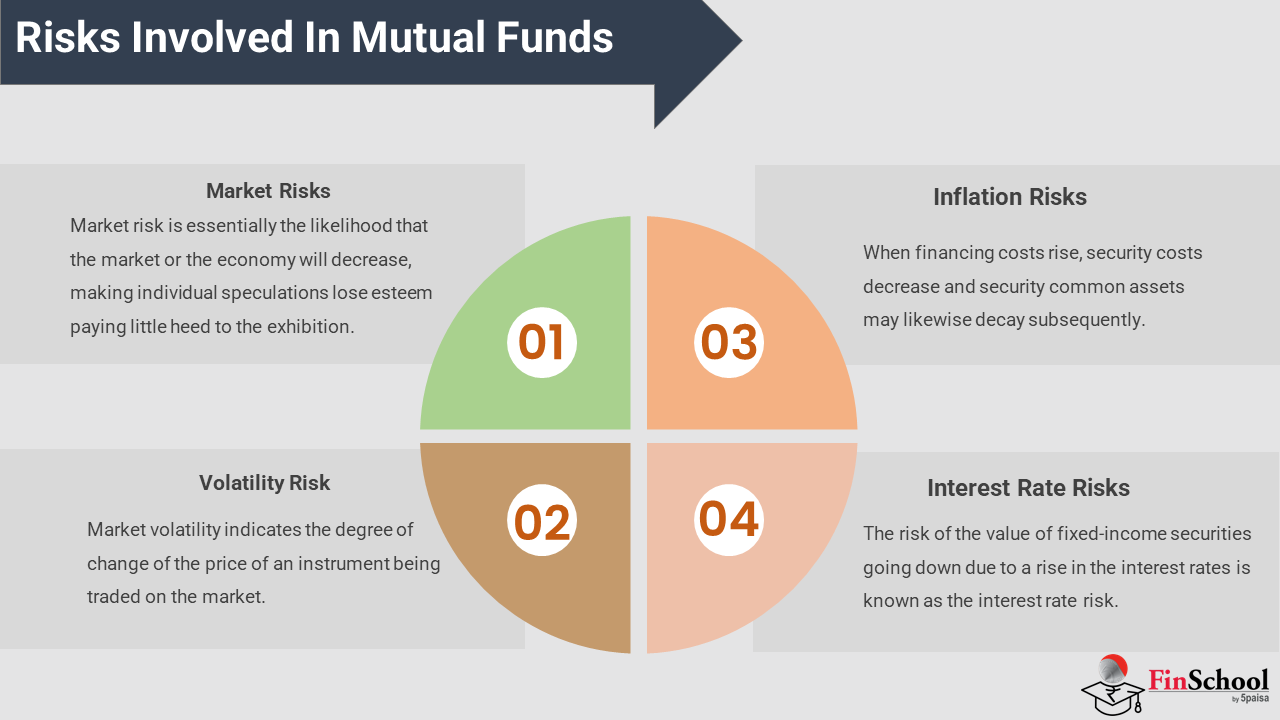

Risk appetite is the amount of risk that you can withstand. Several factors influencing risk appetite include the timeline of investment, age, goal and capital. Another key variable to keep in mind is your current liabilities. For example, if you are the sole earning member of your family then you will be less inclined to take risks. Here, maybe you’ll have more debt, large cap stocks, in your portfolio. On the other hand, if you are younger, with no dependents, you may have a high risk appetite. This may allow you higher exposure to equities vs. debt. Even within equities, you may be able to invest in more small caps, which are higher risk stocks. The starting point is to make a choice keeping in mind that risk and reward go hand in hand.

- Invest regularly

Now that you have a Demat account, you need to allocate funds for regular investment. Set a personal budget, track your expenses, and see how much you can set aside. The best way to invest in the market is to use a Systematic Investment Plan (SIP). A SIP is investing the same amount of money every month in, say, a mutual fund. This allows you to average the different market levels you come in at, maintain good investing habits and slowly increase your investments as you gain confidence.

- Build a diverse portfolio

The basic rule for building any portfolio is to invest in a diverse range of assets. This is because it minimizes the impact if a certain asset performs badly. Diversification extends within the asset class, industry, and cycles. It may be tempting to park all your money in an industry that is in an upward swing. But it is always better to distribute between industries, balancing market cap exposure, and offset the risk of equity shares with stable, but lower return bonds. Finally, use SIPs to make sure you have invested in securities across different market cycles.

4. Rebalance your portfolio

As your priorities change with time, your portfolio must also change to reflect this. You must rebalance your portfolio every couple of quarters to make sure you are not over or underexposed to any one stock or asset class. This is also necessary as you grow older and your priorities change. For instance, you may want to lower your risks when you start a family or when you are nearing retirement age.