- Study

- Slides

- Videos

5.1 What Is Meant By Secondary Market?

It is the market where shares, bonds, debentures and other securities are traded. Once these securities are floated, subscribed to and issued to the public, they are traded in the secondary market, which is called ‘Stock Market’.

Stock Market provides liquidity and easy marketability to these securities. Thus, an active secondary market in turn encourages investors to subscribe to the securities in the primary market. The growth and development of the primary market is, therefore, largely dependent upon the vibrant secondary market.

Role of Secondary Market

- It helps to measure the economic condition of a country. The rise or fall in share prices indicates a boom or recession cycle in an economy.

- It serves in allocating the capital of investors to profitable channels.

- The regulatory body of a secondary market is the Securities Exchange Board of India which safeguards the interest of entities or parties which are functional in the secondary market that are the retail investors, financial intermediaries, etc.

- It gives ready market for the purpose of buying and selling or trading of the financial instruments or securities.

- It also provides safety to transactions or trade because the secondary market is operated by the rules and regulations.

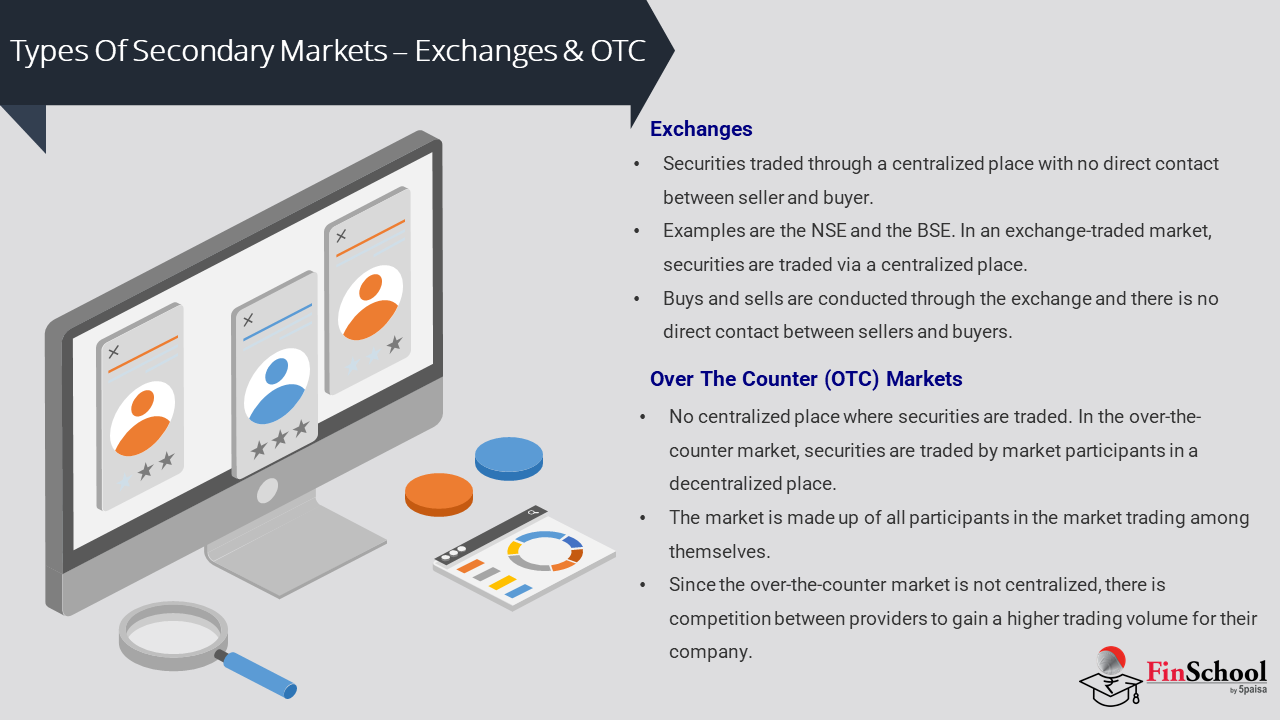

5.2 Types of Secondary Market – Exchanges & OTC

Exchanges:

Securities traded through a centralized place with no direct contact between seller and buyer. Examples are the NSE and the BSE. In an exchange-traded market, securities are traded via a centralized place. Buys and sells are conducted through the exchange and there is no direct contact between sellers and buyers. There is no counterparty risk- the exchange is the guarantor.

Exchange-traded markets are considered a safe place for investors to trade securities due to regulatory oversight. However, securities traded on an exchange-traded market face a higher transaction cost due to exchange fees and commissions.

Over The Counter (OTC) Markets:

No centralized place where securities are traded. In the over-the-counter market, securities are traded by market participants in a decentralized place. The market is made up of all participants in the market trading among themselves. Since the over-the-counter market is not centralized, there is competition between providers to gain a higher trading volume for their company.

Prices for the securities vary from company to company. Therefore, the best price may not be offered by every seller in an OTC market. Since the parties trading on the OTC market are dealing with each other, OTC markets are prone to counterparty risk.

5.3 Trading In Secondary Markets

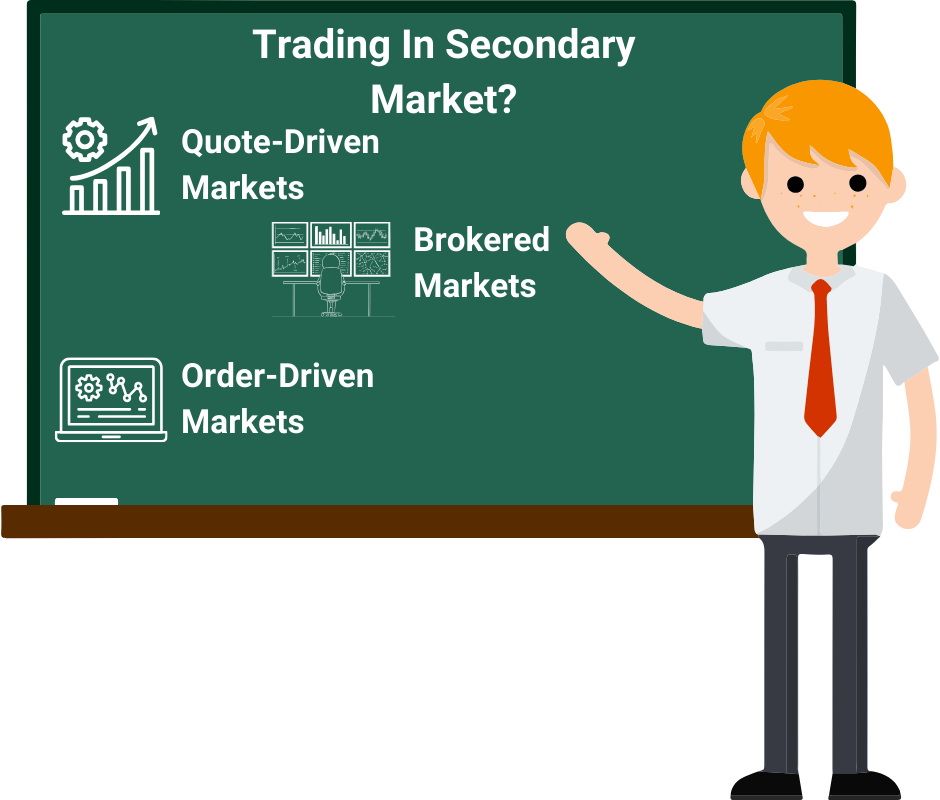

Trading in secondary markets is the successful outcome of searches in which buyers look for sellers and sellers look for buyers. A critical key to success is liquidity because when markets are liquid, the costs of finding a suitable counterparty to trade with are low. There are three main types of market structures for trading: quote-driven, order-driven, and brokered markets.

Quote-Driven Markets

- Investors trade with dealers in quote-driven marketplaces, also known as dealer markets or price-driven markets. The fact that investors trade with dealers at the prices quoted by the dealers gives rise to the name of these marketplaces. Quote-driven markets trade almost all bonds and currencies, as well as the majority of spot commodities (commodities for immediate delivery).

- Because securities used to be exchanged over a counter in a dealer’s office, quote-driven markets are commonly referred to as over-the-counter (OTC) markets. The majority of OTC market dealings are now conducted electronically, over the phone, or via instant messaging platforms.

Order-Driven Markets

- Many shares, futures contracts, and the most basic options contract trade on exchanges and other trading venues that use order-driven trading systems, in contrast to most bonds, currencies, and spot commodities that trade in quote-driven markets.

- Order-driven markets set up trades by matching buy and sell orders using rules. Traders usually specify the quantity they wish to buy or sell in their orders. Price criteria, such as the maximum price the trader will pay when purchasing or the minimum price the trader would accept when selling, may also be included in the order. Because the rules match buyers and sellers, exchanges are frequently set up between strangers.

- As a result, settlement systems are required in order for order-driven markets to ensure that buyers and sellers settle their security trades and fulfil on their contract trades. If market conditions changed and settlement became unprofitable, dishonest traders would not settle their commitments.

Brokered Markets

- The brokered market, in which brokers arrange deals among their clients, is another sort of market structure. Brokers organize markets for assets that are distinctive and consequently of interest to a small number of investors as potential investments. Large blocks of securities or real estate are examples of such assets.

- These assets are typically infrequently traded and costly to store in inventory. Because dealers are frequently unable or unwilling to maintain a big block of real estate securities in inventory, they will not make markets in them; that is, they will not be prepared to purchase or sell these assets if no one else is. As a result, establishing order-driven markets for these assets is impractical since too few traders would place orders on them.

- Brokers who organize markets in unique assets aim to get to know everyone who might be willing to trade such assets now or in the future. The majority of their time is spent on the phone and in meetings, cultivating their client networks.

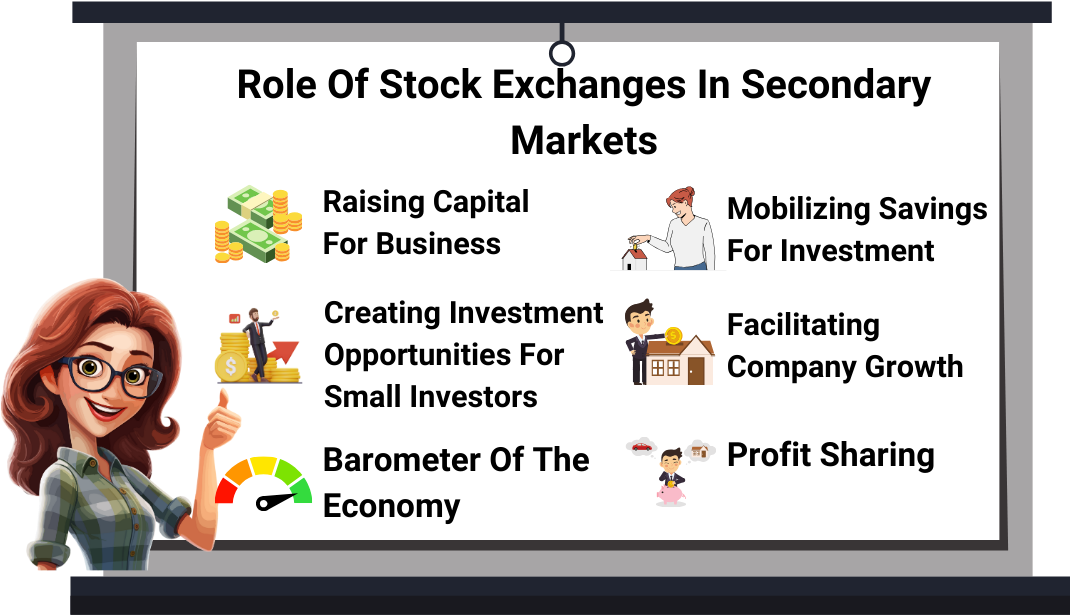

5.4 What Is The Role Of A Stock Exchange In Secondary Market?

The main function of a stock exchange is to facilitate the transactions associated with both buying and selling of securities. Buyers and sellers of shares and stocks can track the price changes of securities from the stock markets (derivatives, equity etc.) in which they operate.

Also, stock exchanges have multiple roles in an economy which make it vital. These roles include:

- Raising capital for businesses.

- Creating investment opportunities for small investors.

- Barometer of the economy.

- Mobilizing savings for investment

- Facilitating company growth

- Profit sharing

What Are The Requirements To Trade In A Stock Exchange?

Companies have to meet the requirements of the exchange in order to have their stocks listed and traded, but requirements vary by stock exchange. However, the common requirements are that to be able to trade a security on a certain stock exchange, it has to be listed there and trading is done by members only.

What Are The Benefits And Drawbacks Of Listing Your Company On A Stock Exchange?

Benefits

-

- Providing the company with an opportunity to implement share option schemes for their employees.

- Accessing additional fund raising in the future by means of new issues of shares or other securities.

- Facilitating acquisition opportunities by use of the company’s shares.

- Offering existing shareholders, a ready means of realizing their investments.

Drawbacks

-

- Becoming more vulnerable to an unwelcome takeover.

- Need to observe and adhere strictly to the rules and regulations by governing bodies.

- Increasing costs in complying with higher levels of reporting requirements.

- Relinquishing some control of the company following the public offering.

- Suffering a loss of privacy as a result of media interest.

5.5 Why Should One Trade On A Recognized Stock Exchange Only For Buying/ Selling Shares?

- An investor does not get any protection if he trades outside a stock exchange. Trading at the exchange offers investors: the best prices prevailing at the time in the market, lack of any counter-party risk which is assumed by the clearing corporation, access to investor grievance and redressal mechanism of stock exchanges, protection up to a prescribed limit, from the Investor Protection Fund etc.

Orders

- When investors want to trade a security, they issue an order that will be directed to a chosen trading venue. All orders specify what security to trade, whether to buy or sell, and how much should be bought or sold. In addition, most orders have other instructions attached to them, including order execution, exposure, and time-in-force instructions,

- Thus, order is nothing but an instruction that an investor gives to buy or retail stocks on a trading platform or to a stock broker.

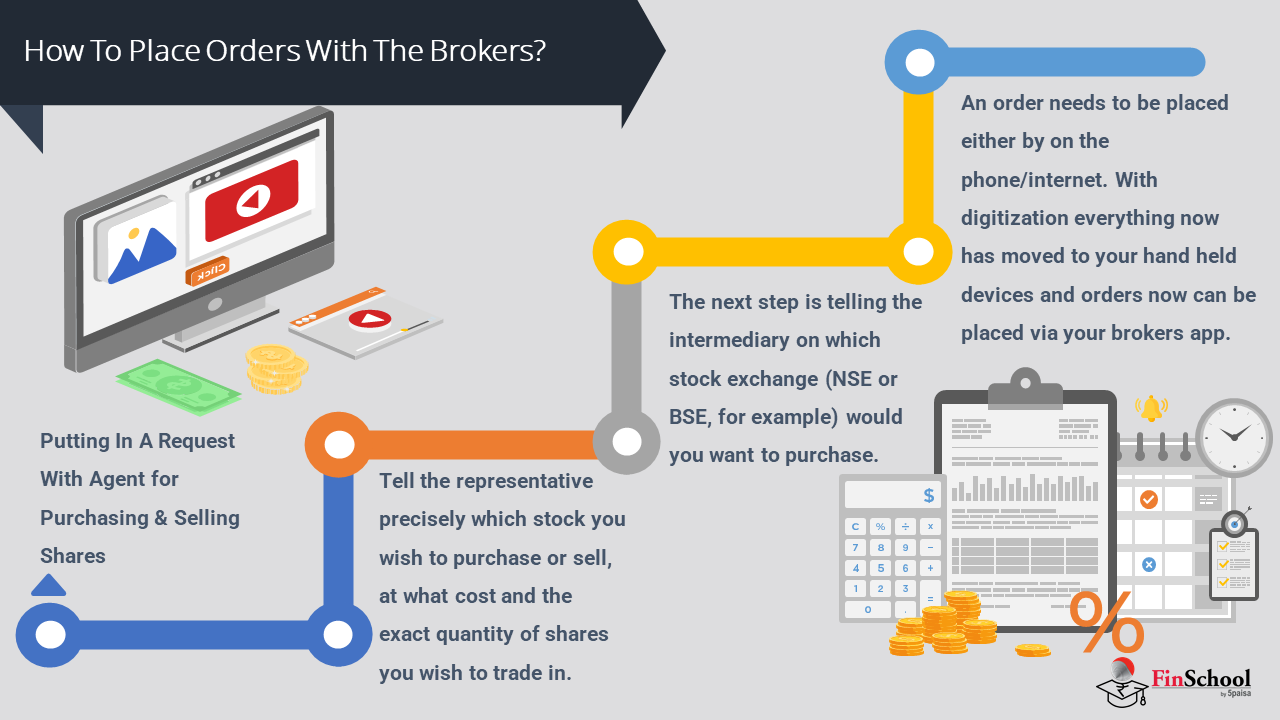

5.6 How To Place Orders With The Brokers?

While putting in a request with an agent for purchasing and selling shares, one needs to tell the representative precisely which stock one wishes to purchase or sell, at what cost and the number of them. One should likewise tell the intermediary on which stock exchange (NSE or BSE, for example) does one need to purchase those offers.

Additionally, an order needs to be placed either by going to broker’s office or place an order on the phone/internet or as defined in the Model Agreement, which every client needs to enter into with his or her broker.

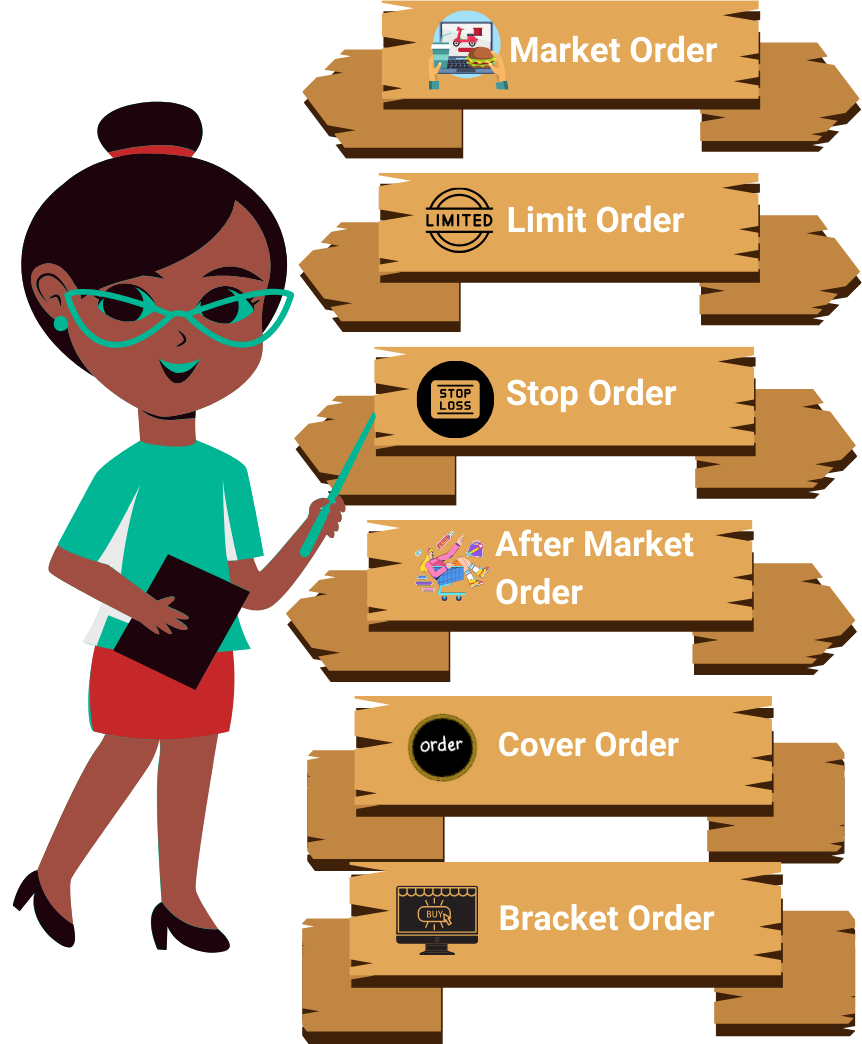

Types of Orders

- Market Order –

A market order is an order to buy or sell a stock at the market’s current best available price. A market order typically ensures an execution, but it does not guarantee a specified price. Market orders are optimal when the primary goal is to execute the trade immediately. A market order is generally appropriate when you think a stock is priced right, when you are sure you want a fill on your order, or when you want an immediate execution.

- Limit Order –

A limit order is an order to buy or sell a stock with a restriction on the maximum price to be paid or the minimum price to be received (the “limit price”). If the order is filled, it will only be at the specified limit price or better. However, there is no assurance of execution. A limit order may be appropriate when you think you can buy at a price lower than- or sell at a price higher than- the current quote.

- Stop Order –

A stop order is an order for which a trader has specified a stop price- that is, a price that triggers the conversion of a stop order into a market order. For a sell order, the trader’s order may not be filled until a trade occurs at or below the stop price. After that trade, the order becomes a market order. If the market price subsequently rises above the sell order’s stop price before the order trades, the order remains valid. For a buy order, the trader’s order becomes a market order only after a trade occurs at or above the stop price.

- After Market Order (AMO) –

Aftermarket orders are types of orders that are placed beyond market hours. The normal market hours are between 9.15 am to 3.30 pm. But, the entire period outside market hours cannot be used to place aftermarket orders. Different brokers specify a time interval, within which we can place the AMOs. There are also conditions on the price of security you can set in limit orders, normally it is in range of 5-10% of the adjusted closing price but the exact range varies among different brokers. AMOs can also be set at market price.

- Cover Order –

A cover order is a combination of a market order and a stop-loss order. This means, your buy (or sell) order is always a market order. In addition, you would also have to specify a Stop-Loss Trigger Price (STLP) and the limit price. This way, your risk exposure in the market automatically reduces.

- Bracket Order –

Bracket order combines the benefits of multiple orders placed simultaneously allowing you to fully automate a particular purchase or sale in a given security. It essentially consists of 3 Legs or individual orders, which allows you to place a buy or sell order, its target order as well as its stop loss order. This results in a fully covered order being placed on the exchange allowing you to both automatically book profits as well as automatically cover losses.

5.7 Understanding Trading Platforms

- A trading platform is essentially a network-based marketplace that allows users to place trades, browse financial instrument catalogues, and monitor accounts through financial institutions outside the bank dealer community.

- Traders can use trading platforms to keep their accounts funded and make limited trades. Investors can use trading platforms to keep their accounts financed and trade assets on a variety of exchanges.

- Most trading platforms include a combination of extra services, such as premium research, real-time quotes, news feeds, or charting tools, to provide real-time availability of trading information and frictionless negotiation among and between traders.

- Trading systems can also be customized to meet the unique requirements of specific markets, such as futures, stocks, options, or currencies. Trading platforms provide more options for how to execute and manage deals by giving capabilities specific to each market structure.

Features:

- Gives you access to a independent automated trading platform;

- You could see your bank and Demat account balances, as well as transfer funds from your bank to your trading account and vice versa.

- Provides access to a variety of online tools for stock technical analysis;

- You have complete and direct control over his portfolio.

- You can trade on both the NSE and the BSE at the same time with the same account.

- Keeps you up to date on the most recent market news and developments;

- Trading occurs quickly and without much lag.

Check the speed and features of the online trading platform, as well as the speed and quality of your broker’s services. You can read reviews about this online to get a clear picture.

5.8 Getting Started With Trading Platforms

User Id And Password

A login ID and password protect your online trading account. The broker will offer you a login ID, but you will need to create a password. For the sake of your account’s security, you should change your password on a regular basis. Also, if additional security measures are available for your account, please be sure to select them to safeguard your account’s safety.

Indices Display

The market indices will be shown in an appropriate area on your screen by the online trading platform. This allows you to keep track of the movements of all the indices, particularly the Sensex and Nifty. Most systems allow you to customize the interface to show all of the indices you want to track. This aids investors in gaining a broad understanding of market sentiments and executing their trades accordingly.

Market Watch

It’s an important screen to have in your trading account. It provides you with a tabular representation of the current market position of the selected equities. Each row contains information on a single share, such as the script name, the most recent traded price, the most recent traded quantity, the best bid and offer rate, total transacted volume, and so on. You can customize the market monitor window by selecting which columns you want to see and which ones you don’t. You can also alter the appearance of the table by changing the colours, size, and whether or not to employ a divider between the rows and columns.

Charts

Nowadays, all trading systems have a charting feature. The investor can use these charts to:

- Create intraday charts using only data from the current trading day.

- Make historical charts using data from previous days.

- Open many charts at the same time.

- Allows you to construct several types of charts, such as line, bar, and candlestick.

- You may use technical analysis tools and other indicators to analyse stocks.

- Some platforms also allow you to store charts to your computer for offline viewing.

Reports

You will have access to various reports linked to your market activities at any moment. The order book, trade book, margin, net positions, exercise book, and portfolio are all included in these reports. These reports are also dynamically updated as soon as a transaction is completed, eliminating the need to refresh them. In the reports themselves, you can do a variety of trading actions. These reports can also be saved in text or CSV file for offline use.

Market Analyzer

This feature shows you the top traded stocks, top gainers, and top losers, as well as the % change in total volume and value. It gives you the names of the stocks that have hit their highest and lowest prices in the previous 52 weeks. It aids in the identification of significant trades and provides insight about scrip activity in the market.

- Transaction Cost

Trading is expensive. The costs associated with trading are called transaction costs and include two components: explicit costs and implicit costs.

- Explicit Trading Costs

This cost represents the direct costs associated with trading. Brokerage commissions are the largest explicit trading cost.

5.9 Understanding The Concept Of Brokerage

The brokerage fee is the fee related to buying and selling of stocks. The concept of brokerage can be a little tricky to grasp initially. Aside from that, there are a number of other fees that brokers charge but do not disclose. As a result, the effective cost of brokerage differs from the one which is actually mentioned to the client.

Brokerage

- It is evaluated as a percentage of the total cost of all the shares purchased and sold. It is a fee that brokers charge for providing their services. This is not uniform and often varies from one broker to another. It also depends on the type of transactions you make.

- Often, the brokerage slabs provided by stockbrokers are dynamic, and regular clients get benefits of lower brokerage rates. The brokerage plans depend on the type of broker.

How Are Brokerage Charges Calculated For Trading?

The brokerage is calculated on the agreed percentage of on the total cost of shares either purchased or sold. Here, you are charged for intraday trading, and for delivery. Let’s understand both concepts: –

Intraday Trading:

- Intraday trading involves buying and selling of stocks on the same day and earning a profit or loss based on the price difference. You don’t carry forward any shares because you purchase and sell on the same day, and no shares enter or leave your Demat account. As a result, the cost of intraday trading brokerage is usually relatively minimal.

- Depending upon the stockbroker, intraday trading charges can range from 0.01% to 0.05% of the volume/amount transacted. The formula for calculating this charge is to multiply the market price of shares into a number of shares, again multiplied by the agreed percentage of intraday charges.

Delivery:

- In delivery trading, on the other hand, the position is not closed on the same day, and the shares are purchased and held in a Demat account. You can hold the shares for a few days, months, or even years until you achieve your goal price.

- These are the charges when you decide to hold your stocks.

- You can hold your stocks in sync with the market movements for as long as you want. Delivery charges can vary between 0.2% and 0.75% of the trading volume.

- The formula for this charge again, is to multiply the delivery charges into the number of shares and their market price

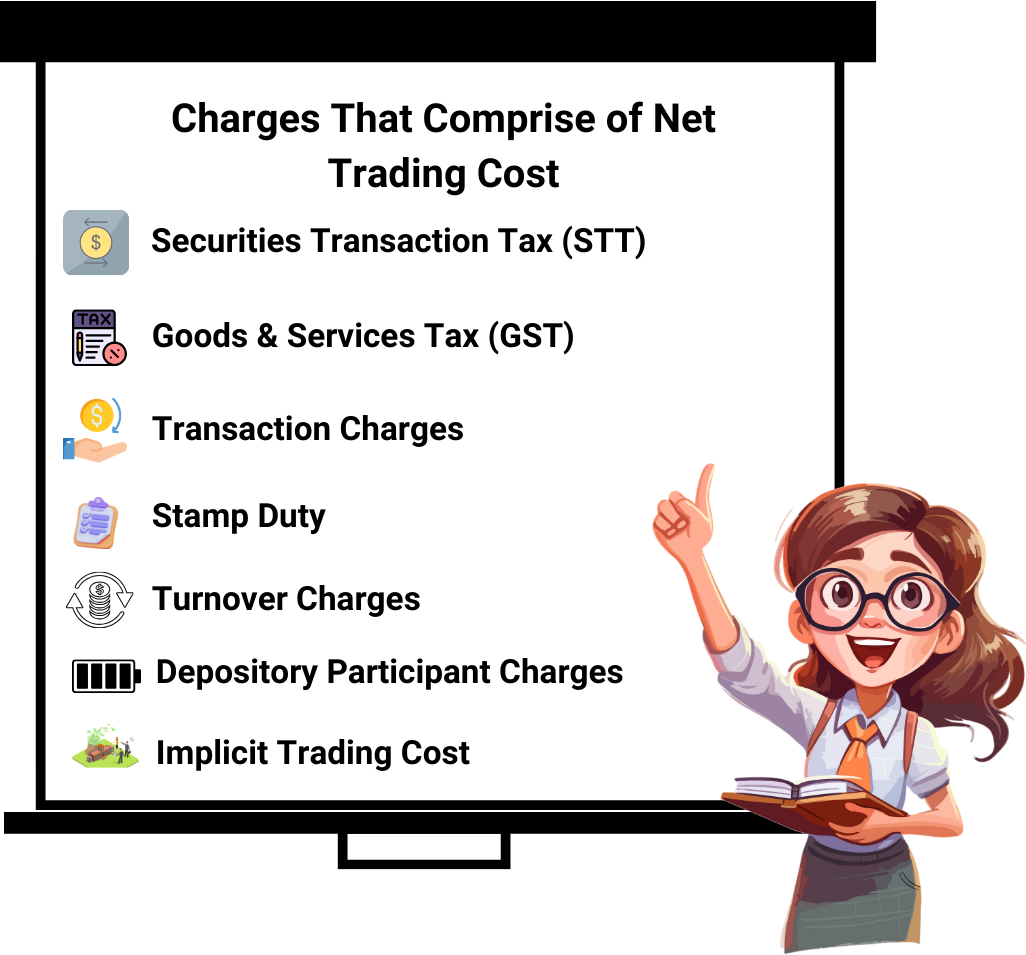

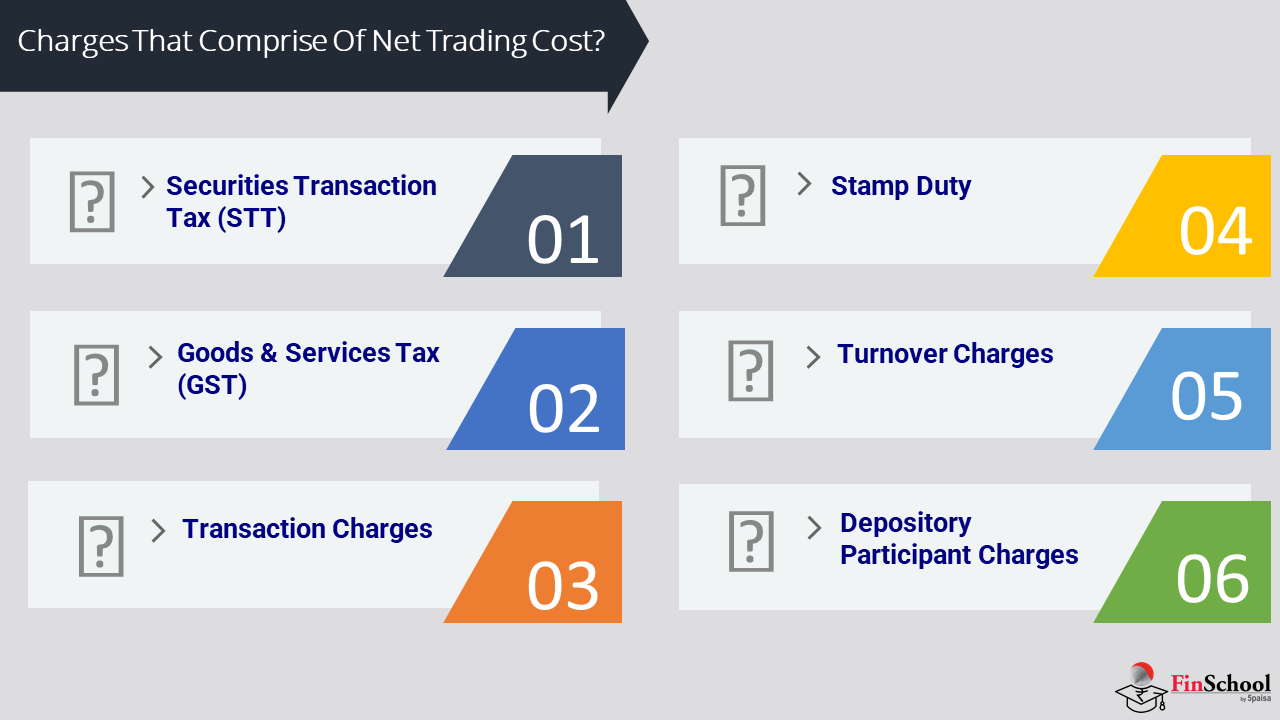

5.10 Charges That Comprise The Net Trading Cost?

Securities Transaction Tax (STT)

- After brokerage, there is a hefty additional cost. In delivery trading, STT is paid on both the purchasing and selling of shares, but in intraday trading, STT is only levied on the selling of the share.

Goods & Services Tax (GST)

- It is levied for both intraday and delivery trading; however, it is only charged on the brokerage amount and does not include stamp duty or STT.

Transaction Charges

- The stock exchanges levy these fees on both intraday and delivery trading, as well as the buying and selling of shares.

Stamp Duty

- The state government is in charge of it. As a result, each state has its own stamp duty rates. Stamp duty is levied on both the purchasing and selling of shares, and it is based on the overall transaction value.

Turnover Charges

- For both types of trading and both buying and selling of shares, the SEBI charges a turnover charge of 0.0002 percent of the entire value.

Depository Participant Charges

- National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) are the two depositories in India (CDSL). The shares are kept in electronic form by these depositories. As a result, depositories demand a nominal fee in exchange for this service. The depository participants do not charge investors directly; instead, your broker deducts funds from your bank account.

Implicit Trading Cost

Implicit trading costs are the indirect costs associated with trading. These costs result from the following:

Bid-Ask Spread

- Many investors assess a market’s liquidity by looking at the difference between bid and ask prices, called bid- ask spreads. Recall that bid prices are the prices at which dealers are willing to buy and ask prices are the prices at which dealers are willing to sell. So bid- ask spreads represent the compensation dealers expect for taking the risk of buying and selling securities.

- Bid- ask spreads tend to be wider in opaque markets because finding the best available price is harder for dealers in such markets. Transparency reduces bid-ask spreads, which benefits investors.

Price Impact

- Traders who want to trade quickly tend to purchase at higher prices than the prices at which they sell. The difference comes from the price concessions that they offer to encourage other traders to trade with them.

- For large trades, impatient buyers generally raise prices to encourage other traders to sell to them. Likewise, impatient sellers of large trades must lower prices to encourage other traders to purchase from them. These price concessions, called price impact, or market impact, often occur as large-trade buyers push prices up and large-trade sellers push them down.

Opportunity Costs

- Traders who are willing to wait until other traders want to trade with them generally incur lower transaction costs on their trades. In particular, by using limit orders instead of market orders, they can buy at the bid price or sell at the ask price.

- But these traders’ risk that they will not trade when the market is moving away from their orders. They lose the opportunity to profit if their buy orders fail to execute when prices are rising, and they lose the opportunity to avoid losses if their sell orders fail to execute when prices are falling. The costs of not trading are called opportunity costs.