- Study

- Slides

- Videos

5.1 What Is An IPO & Why Do Companies Go Public?

Nirav: I keep hearing IPOs are a big deal. What makes them so special?

Vedant: An IPO is when a private company offers shares to the public for the first time—like opening its doors to everyday investors.

Nirav: So it’s moving from a private club to a public marketplace?

Vedant: Exactly. It helps raise capital, boost credibility, and offer exits to early investors, though it comes with more scrutiny and compliance.

Nirav: Sounds like a bold move that reshapes the company’s future.

Vedant: It is. Let’s explore why companies go public, how the IPO process works, and what investors should look for. Like Meera’s chocolate business—imagine if she took it public someday!

So,

Meera has funded her chocolate business herself so far, but to expand—like opening a store or selling online—she needs more capital. Instead of taking a loan, she offers small ownership stakes to friends and neighbors in exchange for funds. That’s like going public: raising money by selling shares, sharing business updates, and gaining the means to grow faster. It’s the core idea of an IPO—turning a private venture into a public one to unlock scale and credibility.

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time by listing on a stock exchange. T

What is IPO?

An IPO, or Initial Public Offering, is the process by which a privately held company offers its shares to the general public for the first time on a stock exchange. It transforms a company from being privately owned typically by founders, employees, and early investors to one that is publicly owned, where anyone can buy a stake through the open market.

Nirav : You explained me very well, What is an IPO. But now I need to Know Why exactly does a company Go Public?

Vedant : Going public helps companies raise huge capital without borrowing. That money can be used for expansion, tech upgrades, or even clearing debt.

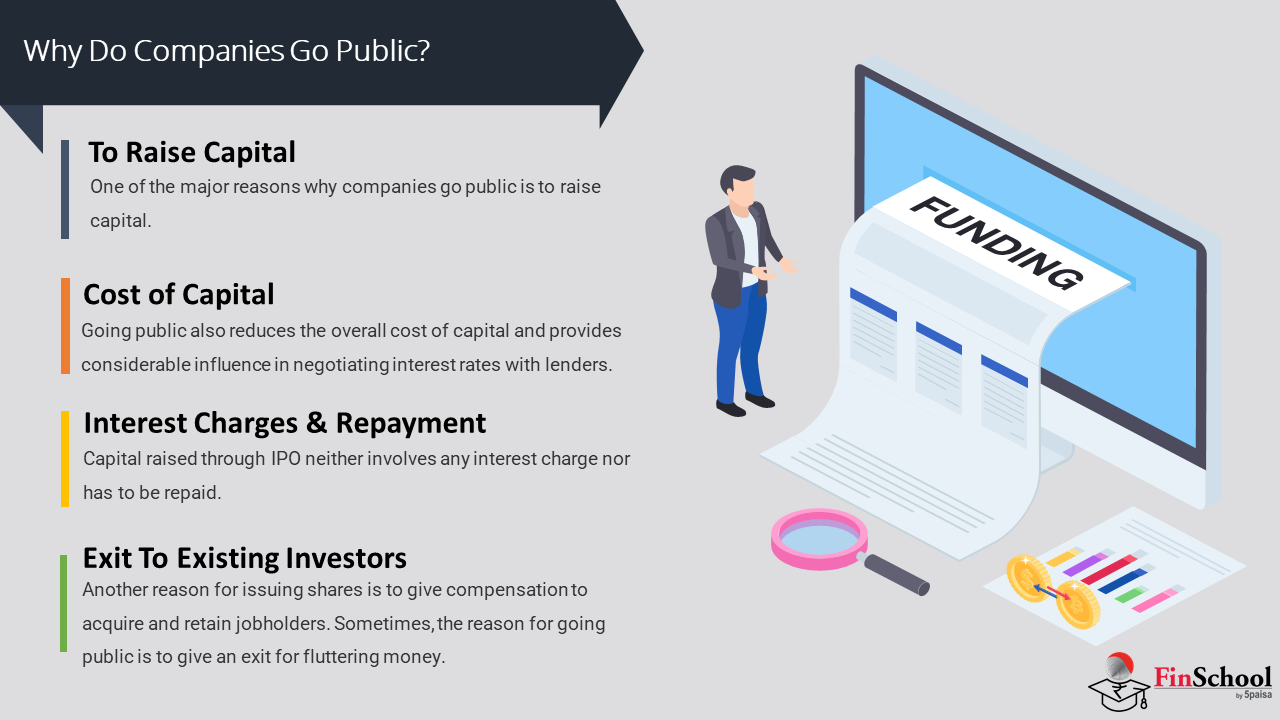

Why Do Companies Go Public?

Companies go public for a range of strategic reasons, and while the decision brings new challenges, it opens the door to exponential growth.

So,

Suppose Meera’s homemade chocolate business has grown steadily over the years. She’s built a loyal customer base, hired a small team, and even started selling online. But now she’s dreaming bigger—opening retail outlets across India, investing in automated machinery, and launching new product lines.

To raise ₹50 crore, she decides to go public, selling shares to investors instead of taking a loan. This gives her access to capital without repayment obligations.

Her brother, an early investor, uses the IPO to sell some shares and buy a house showing how IPOs provide liquidity to existing shareholders. Listing also boosts Meera’s brand credibility. Media coverage, retail interest, and supplier trust grow, positioning her chocolates as a premium product.

As a public company, analysts begin tracking her performance, helping her understand market valuation—useful for joint ventures or equity-based hiring. A year later, she launches a Follow-on Public Offer (FPO) to fund Southeast Asia expansion, leveraging her listed status for quicker fundraising.

Going public also brings governance benefits. Meera now publishes quarterly results and follows SEBI norms, pushing her team toward better financial discipline and strategic planning.

In essence, companies launch IPOs to:

- Raise capital for growth without debt

- Offer liquidity to early investors

- Boost credibility and visibility

- Benchmark valuation for strategic decisions

- Enable future fundraising

- Improve governance and accountability

Meera’s journey captures how an IPO transforms a private venture into a scalable, disciplined, and market-driven enterprise.

Nirav : Please explain the Advantages of Going Public and the Process

Vedant : Ok , Lets understand

5.2 Advantages Of Going Public & The Process For An IPO

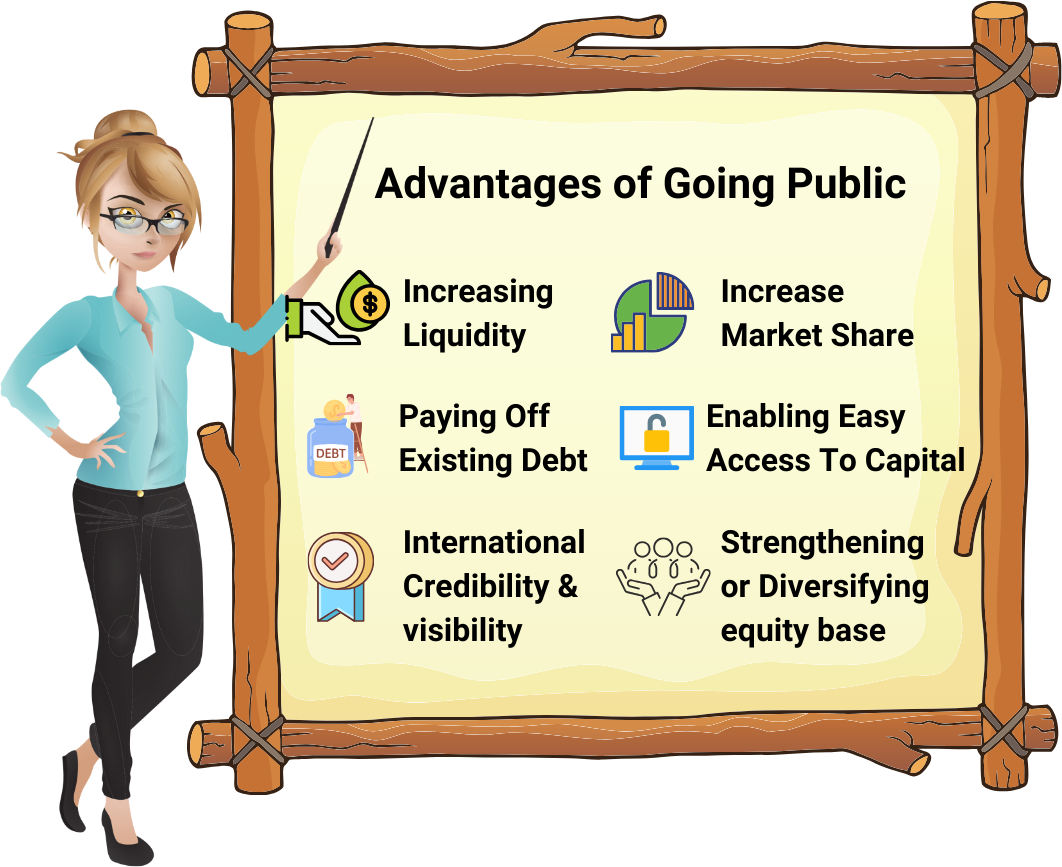

- Access to Substantial Capital

The most immediate benefit is the ability to raise large amounts of money from the public. This capital can be used for expansion, research and development, acquisitions, or reducing debt. Unlike loans, this funding doesn’t require repayment, making it a powerful tool for long-term growth.

- Liquidity for Existing Shareholders

An IPO provides a formal market for trading shares. Founders, early employees, and investors can eventually sell their holdings, converting paper wealth into real money. This liquidity also makes equity-based compensation more attractive to new talent.

- Enhanced Public Profile and Brand Visibility

Going public often brings media attention and analyst coverage. This increased visibility can boost brand recognition, attract new customers, and improve relationships with suppliers and partners. It also signals maturity and credibility to the market.

- Valuation Transparency

Public trading allows the market to determine the company’s value. This real-time valuation is useful for strategic decisions, such as mergers and acquisitions, or when negotiating with lenders and partners.

- Improved Corporate Governance

Public companies must comply with regulatory standards, including financial disclosures and board oversight. This often leads to better internal controls, transparency, and accountability, qualities that appeal to institutional investors.

- Future Fundraising Opportunities

Once listed, companies can raise additional capital more easily through follow-on public offerings (FPOs) or rights issues. This flexibility supports ongoing growth without relying solely on private funding or debt.

Nirav: What’s the actual process behind an IPO in India?

Vedant: It starts with the company ensuring it’s ready, financially and operationally. Then they appoint experts like merchant bankers and legal advisors.

Nirav: So they can’t just start selling shares?

Vedant: Nope. They file a Draft Red Herring Prospectus (DRHP) with SEBI, detailing the business and risks. SEBI reviews it and gives the go-ahead.

Nirav: What happens next?

Vedant: The company conducts roadshows to attract investors. Then comes the book-building process, investors bid within a price band, shares are allotted, and the company gets listed.

Nirav: So it’s part strategy, part compliance?

Vedant: Exactly. It’s a structured journey from private to public, built on transparency and trust.

So Lets understand

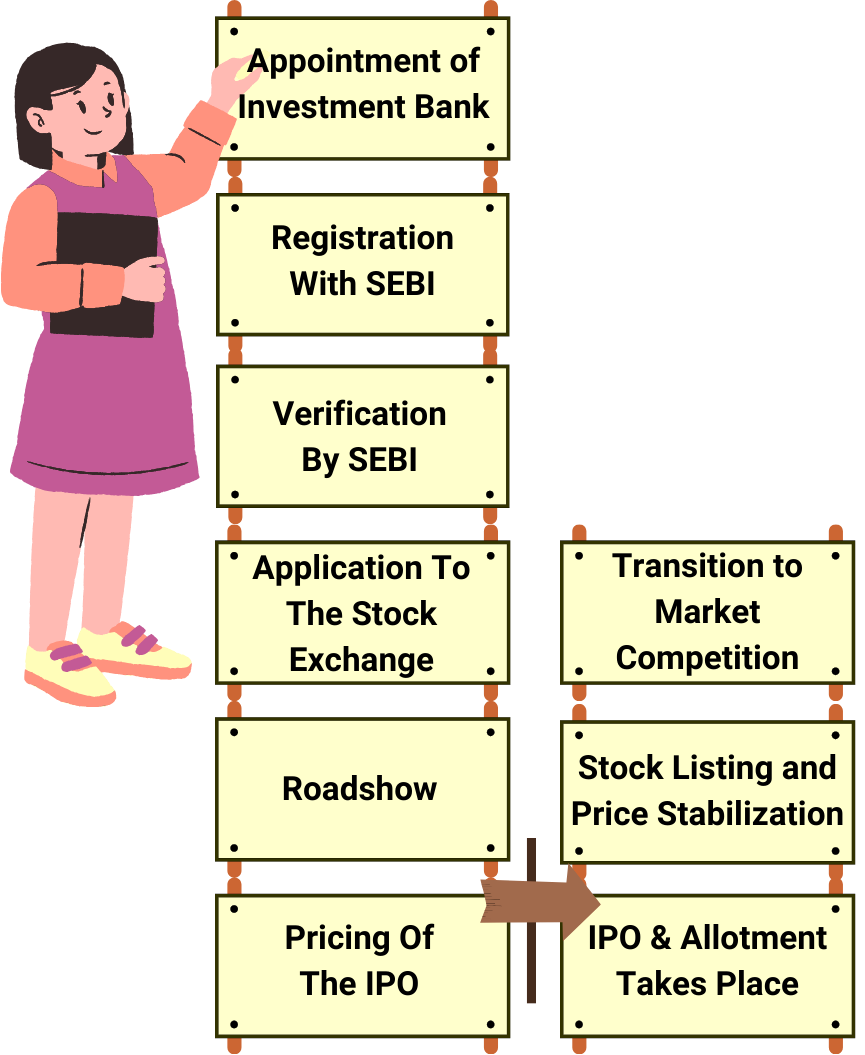

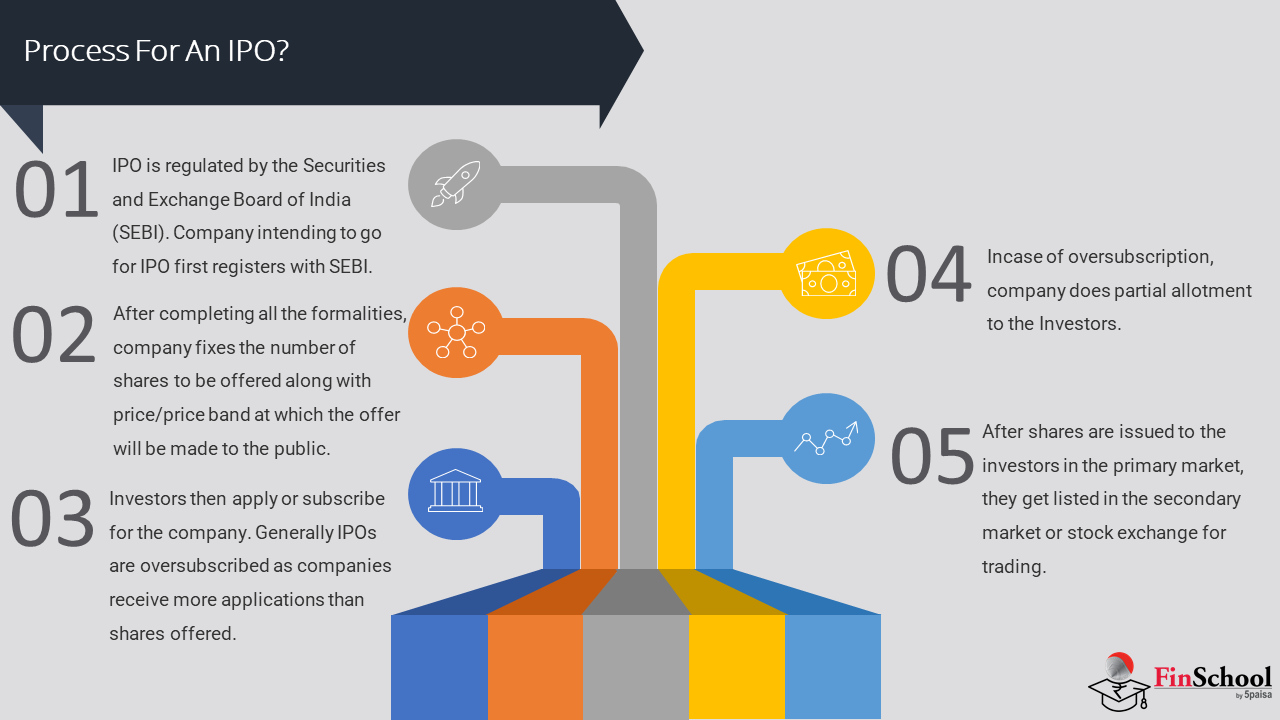

5.3 What Is An IPO Procedure In India?

Strategic Decision and Internal Readiness

Before initiating an IPO, a company must assess whether it is ready to go public. This involves evaluating its financial performance, scalability, compliance systems, and governance structures. The board and promoters must align on long-term goals, as going public introduces new responsibilities, including regulatory scrutiny and shareholder accountability.

Appointment of Intermediaries

The company appoints key professionals to manage the IPO process. These include merchant bankers (lead managers), legal advisors, auditors, and registrars. Merchant bankers underwrite the issue and guide pricing, while legal and financial experts ensure that all disclosures and documentation meet SEBI’s regulatory standards.

Due Diligence and DRHP Filing

A Draft Red Herring Prospectus (DRHP) is prepared, which includes detailed information about the company’s business model, financials, risks, and objectives of the IPO. This document is submitted to SEBI for review. Simultaneously, a thorough due diligence process is conducted to verify all legal, financial, and operational aspects of the company.

SEBI Review and Approval

SEBI reviews the DRHP and may request clarifications or modifications. Once satisfied, it issues an observation letter, which acts as a green light for the company to proceed with the IPO. This step ensures that the offering is transparent and fair to potential investors.

Marketing and Roadshows

The company, along with its merchant bankers, conducts roadshows and investor meetings to generate interest in the IPO. These presentations are aimed at institutional investors and help gauge demand. This phase is crucial for building market confidence and setting the stage for successful bidding.

Price Band and Book Building

A price band is announced, within which investors can place bids. In a book-building issue, the final price is determined based on investor demand. This dynamic pricing mechanism helps discover the fair market value of the shares and ensures efficient capital allocation.

Allotment and Listing

After the bidding period closes, shares are allotted to investors based on demand and regulatory guidelines. The company then lists its shares on stock exchanges like NSE or BSE. Once listed, the shares can be freely traded, and the company officially becomes a publicly traded entity.

Vedant: Nirav, funding a business happens in stages, not just one big investment.

Nirav: Really? I thought they just pitch and get funded.

Vedant: It starts with bootstrapping, personal savings or help from family. Then comes seed funding from angel investors to test the idea.

Nirav: And after that?

Vedant: If it grows, they raise Series A, B, C, and so on, each round for scaling. Eventually, they may go public via IPO or get acquired.

Nirav: So funding grows with the business?

Vedant: Exactly. Each stage reflects the company’s maturity and risk, guiding investor decisions.

5.4 Stages of Business Funding

Stages of Business Funding

- Bootstrapping / Pre-SeedFounders fund the idea using personal savings. Focus: MVP development and idea validation. High risk, full control.

- Seed FundingFirst formal capital from angel investors. Used for refining the product, market research, and team building. Based on vision, not revenue.

- Series AVenture capital supports scaling. Business should show product-market fit and traction. Funds go to hiring, marketing, and growth.

- Series B & CGrowth acceleration stage. Capital used for market expansion, tech upgrades, or acquisitions. Lower risk, scalable model expected.

- Bridge / MezzaninePrepares company for IPO or acquisition. Short-term funding to boost financials and compliance. Often structured as convertible debt or preferred equity.

Nirav: What are the types of IPOs? You mentioned Book Building and Fixed Price.

Vedant: Right. Book Building is dynamic—investors bid within a price range, and the final price is based on demand. Fixed Price is simpler—the company sets a price upfront.

Nirav: So Book Building is like an auction?

Vedant: Exactly. It’s market-driven, while Fixed Price stays constant regardless of demand.

Nirav: Book Building sounds flexible; Fixed Price seems easier for retail investors.

Vedant: True. Each suits different goals and investor types. Want to explore how they work in detail?

5.5 Book Building Process vs Fixed Price Mechanism

Book Building Process – A Market-Driven Approach

The Book Building Process is a dynamic method used in IPOs to determine the optimal price for issuing shares. Instead of setting a fixed price, the company provides a price band say ₹100 to ₹120 and invites investors to place bids within that range during a specific window, usually 3 to 7 working days. Investors indicate how many shares they want and at what price, helping gauge demand across different price points.

This process is similar to a bookstore launching a collector’s edition and asking customers to bid within a price range. After collecting bids, the final price is set where demand is strongest—ensuring fair pricing and efficient capital raising. Book building enhances transparency, reflects true market interest, and is commonly used for large or main-board IPOs.

How It Works

Investors submit bids indicating how many shares they want and at what price within the band. These bids are collected in a digital order book maintained by the stock exchange. At the end of the bidding period, the company, in consultation with its merchant bankers, analyzes the demand at various price points and determines the cut-off price—the price at which the issue will be allotted.

Advantages

- Efficient price discovery: The final price reflects real-time investor demand, reducing the risk of under-pricing or overpricing.

- Transparency: Demand is visible throughout the bidding period, especially for institutional investors.

- Flexibility: Investors can revise or cancel bids during the window.

- Institutional participation:Attracts Qualified Institutional Buyers (QIBs), who often anchor the issue.

Limitations

- Complexity:Retail investors may find the bidding process and price band confusing.

- Costlier:Requires more marketing, roadshows, and regulatory compliance.

- Time-consuming: The process involves more steps and coordination.

- Fixed Price Mechanism – A Simpler, Traditional Model

The Fixed Price Mechanism in IPOs is like a store launching a budget smartphone at a set price of ₹9,999, customers pay the fixed amount without negotiation. Similarly, in an IPO, the company and its merchant bankers decide a single offer price in advance, which is disclosed in the prospectus. Investors apply at that fixed rate, with no bidding or price range involved, and demand is known only after the IPO closes.

How It Works?

Investors apply for shares at the pre-decided price and pay the full amount upfront. The demand for the issue is only known after the subscription period ends. If the issue is oversubscribed, shares are allotted proportionally or via lottery.

Advantages

- Simplicity:Easy for retail investors to understand and participate.

- Predictability: Investors know the exact price they’re paying.

- Lower cost: Fewer marketing and administrative expenses compared to book building.

Limitations

- No price discovery:The price is based on internal estimates, which may not reflect true market demand.

- Demand opacity: Investors don’t know how well the issue is performing until it closes.

- Limited institutional interest:QIBs often prefer the flexibility of book building.

Key Differences at a Glance

|

Feature |

Book Building Process |

Fixed Price Mechanism |

|

Pricing |

Price band; final price based on bids |

Fixed price disclosed in advance |

|

Demand Visibility |

Real-time during bidding |

Known only after issue closes |

|

Investor Participation |

High institutional interest |

More retail-focused |

|

Cost & Complexity |

Higher due to roadshows and compliance |

Lower; simpler process |

|

Price Discovery |

Market-driven |

Company-determined |

5.6 How Can Investors Invest In IPOs

Vedant: Hey Nirav, did you check out the NSDL IPO? I applied through one of the trading platforms.

Nirav: Yeah, it was hugely oversubscribed! How was the process?

Vedant: Super smooth. I used the cut-off price, entered my UPI ID, and approved via PhonePe. Got 1 lot allotted.

Nirav: Nice! Shares credited to your Demat?

Vedant: Yup, on August 5. Listed on BSE the next day with a 15% premium. NSDL handled custody securely.

How Can Investors Invest In IPOs with Trading Platforms

- IPO Overview

- Company: National Securities Depository Ltd (NSDL)

- IPO Dates: July 30 to August 1, 2025

- Issue Size: ₹4,011.60 crore (Offer for Sale of 5.01 crore shares)

- Price Band: ₹760–₹800 per share

- Lot Size: 18 shares

- Listing Date: August 6, 2025 on BSE

- Over-subscription: 41.02 times overall; QIBs 103.97x, NIIs 34.98x, Retail 7.76×2

- Applying via Trading Platforms (Linked to NSDL)

- Demat Account: Investors opened a Demat account with Trading Platforms, which was linked to NSDL.

- Platform Access: Logged into the Trading app or website and navigated to the IPO section.

- IPO Selection: Selected “NSDL IPO” to view details like price band, lot size, and DRHP.

- Application:

- Chose number of lots (e.g., 1 lot = 18 shares)

- Selected “Cut-off price” for simplified bidding

- Entered UPI ID for payment authorization

- UPI Mandate: Approved the mandate via UPI app to block funds

- Allotment Status: Checked allotment on August 4 via Trading App or registrar’s site

- Post-Allotment via NSDL

- Credit to Demat: Allotted shares were credited to NSDL-linked Demat accounts by August 5

- Refunds: Non-allottees had their blocked funds released the same day

- Listing: Shares listed on BSE on August 6, with a projected premium of ~15% over issue price

NSDL’s Role in the Process

|

Stage |

NSDL’s Function |

|

Account Setup |

Safeguards investor holdings via Demat infrastructure |

|

Share Allotment |

Credits shares electronically to investor accounts |

|

Post-Listing |

Maintains secure custody of listed shares |

This IPO was a strong example of how NSDL not only facilitates secure shareholding but also showcases investor confidence in capital market infrastructure

Why Use Trading Platforms for IPOs?

- Seamless UPI integration for quick applications

- Real-time IPO alerts and allotment updates

- In-app research reports and IPO ratings

- No paperwork—entire process is digital and mobile-friendly

Nirav: Vedant, ,My friend applied for an IPO last week but he didn’t get any shares. Do you know how the allotment process actually works?

Vedant: Yeah, it’s a bit of a lottery sometimes—especially for retail investors. The allotment depends on how many people apply and how many shares are available. If the IPO is oversubscribed, not everyone gets a piece.

Nirav: So it’s not just about applying early?

Vedant: Nope. Timing doesn’t matter as much as demand. For retail investors, allotment is usually done through a computerized lottery system. But for institutional investors, it’s more proportional to the amount they bid.

Nirav: Interesting. What happens if the IPO isn’t fully subscribed?

Vedant: Then all valid applicants get full allotment. And if there are leftover shares, they might be reallocated to other investor categories or withdrawn. Want to walk through the full process step by step? It’s actually quite structured.

5.7 How Are Shares Alloted?

IPO share allotment is like applying for concert tickets with limited seats. If demand is low, everyone gets shares—just like an under-subscribed show. But if it’s oversubscribed, retail investors may get shares via lottery, while institutional ones receive proportional allotment.

Invalid or duplicate applications are rejected, and refunds are issued to those who don’t get shares. The process is regulated by SEBI and managed by the IPO registrar and stock exchange to ensure fairness and transparency.

- Categorization of Investors

IPO shares are divided into categories:

- Retail Individual Investors (RIIs) – typically allotted 35% of the issue

- Non-Institutional Investors (NIIs) – allotted 15%

- Qualified Institutional Buyers (QIBs) – allotted up to 50%

Each category has its own allotment rules and reservation.

- Validity of Applications

Only valid applications are considered. Invalid ones—due to incorrect PAN, multiple applications from the same investor, or mismatched bank details—are rejected.

- Undersubscription Scenario

If the IPO is under-subscribed (i.e., fewer applications than available shares), all valid applicants receive full allotment. The remaining shares may be reallocated to other categories or withdrawn.

- Over subscriptionScenario

If the IPO is oversubscribed, allotment becomes selective:

- For retail investors, allotment is done via a lottery system. Each valid applicant has an equal chance of receiving at least one lot.

- For NIIs and QIBs, shares are allotted proportionally based on the size of their bids.

- Basis of Allotment Document

The registrar prepares a “Basis of Allotment” document, which outlines how shares were distributed across categories and how over subscription was handled. This is published on the registrar’s website.

- Credit and Refund

- Allotted shares are credited to investors’ Demat accounts.

- If no shares are allotted, the blocked funds are released (in case of UPI or ASBA applications).

Nirav: Vedant, is the Red Herring Prospectus really important for IPO investors?

Vedant: Definitely. It’s the company’s pitch to the public, covering business, financials, risks, and fund usage.

Nirav: What should I focus on?

Vedant: Start with the business overview, industry analysis, and objectives of the issue. Then check financials and risk factors.

Nirav: What about the team?

Vedant: Look at management experience, capital structure, and anchor investor interest. It all signals credibility.

Nirav: So it’s like a preview before investing?

Vedant: Exactly. It won’t show the final price, but it helps you decide if the IPO is worth applying for.

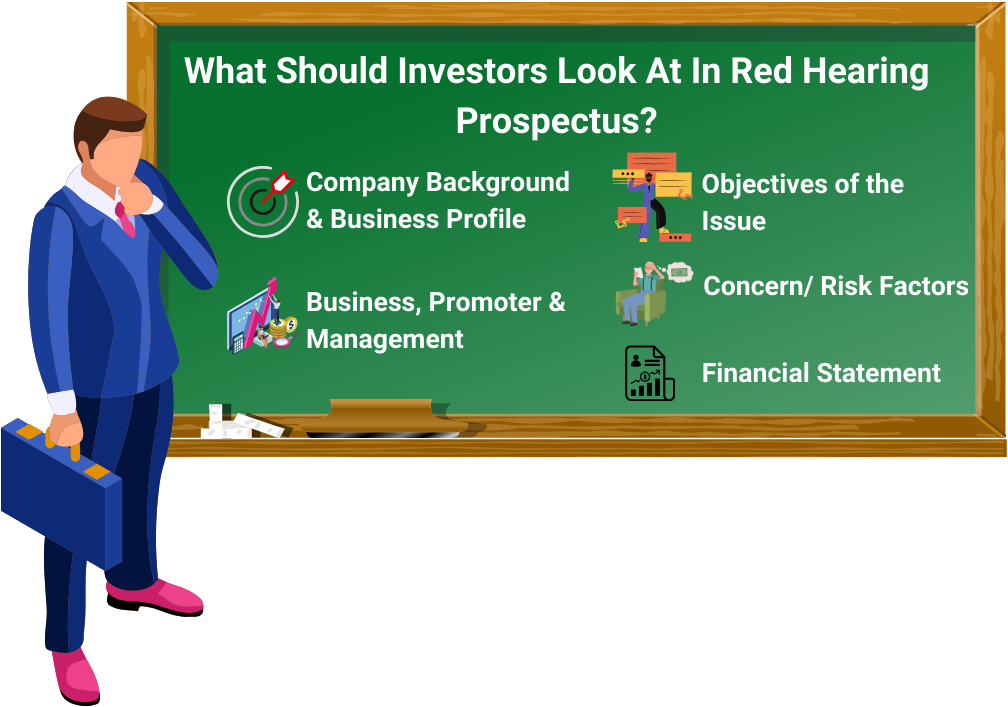

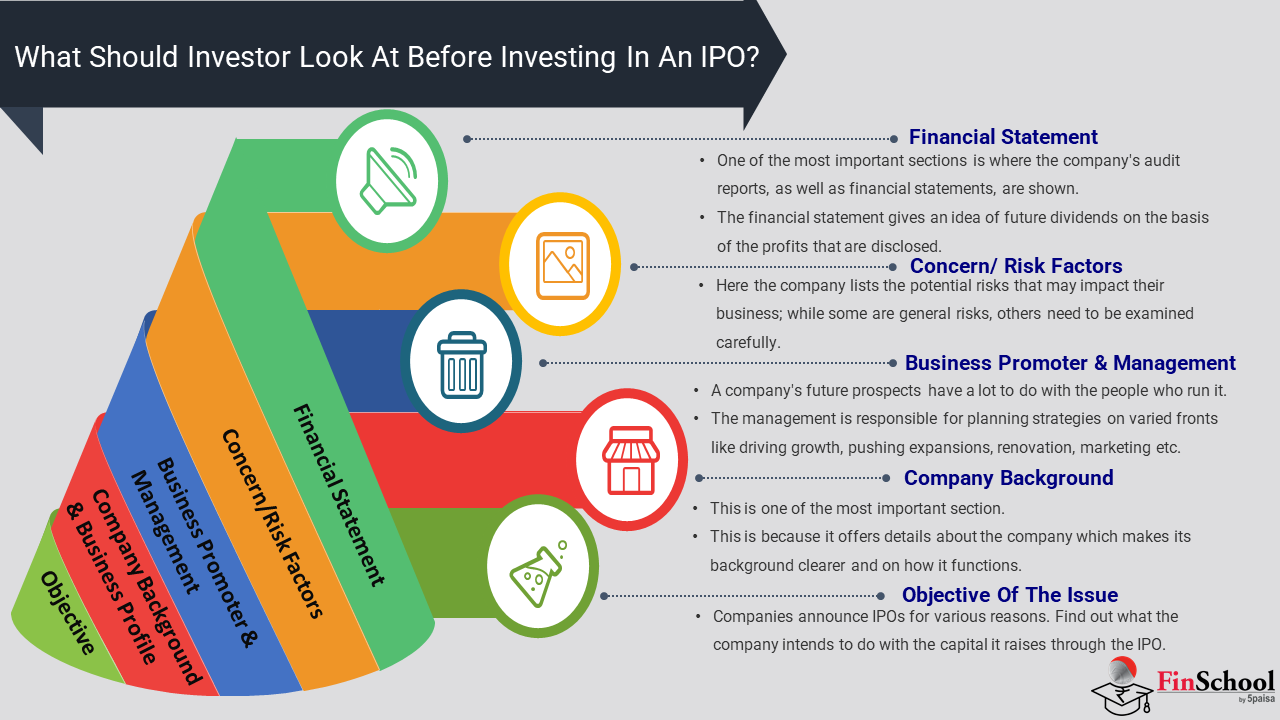

5.8 What Should Investors Look Into Red Herring Prospectus?

A Red Herring Prospectus (RHP) is a preliminary document filed with SEBI by a company planning to raise funds through an IPO. Like a brochure for an upcoming apartment project, it offers detailed insights into the company’s business model, financials, industry outlook, risks, and intended use of funds—helping investors evaluate the opportunity. However, it doesn’t include final details like the issue price or exact number of shares.

The term “red herring” comes from the bold disclaimer on the cover stating that the document isn’t final. Since the RHP is released before the IPO opens, key terms are finalized later during the book-building process. It acts as a vital disclosure tool, allowing investors to make informed decisions even with some details pending.

1. Business Overview and Industry Landscape

This section of the RHP explains the company’s business model, revenue sources, and industry position. Investors should assess the clarity of its operations, core offerings, customer base, and whether it operates in a growing or saturated market. Industry analysis in the RHP highlights trends, competition, and regulations, helping investors gauge long-term growth potential or challenges.

2. Objectives of the Issue

Explains why the company is raising funds—growth initiatives, debt repayment, or promoter exit. Investors should assess if the goals support long-term value creation.

3. Financial Performance and Key Ratios

Covers past financials and key metrics like revenue growth, ROE, and debt. Compare with peers and watch for red flags like declining margins or negative cash flows.

4. Risk Factors

Lists operational, financial, and regulatory risks. Investors should identify material risks and evaluate the company’s mitigation strategies.

5. Promoters and Management Team

Details the leadership’s background and shareholding. Look for stability, relevant experience, and any past legal or regulatory issues.

6. Capital Structure and Offer Details

Breaks down equity ownership and IPO split between fresh issue and OFS. Post-IPO shareholding reveals promoter commitment and institutional interest.

7. Valuation and Pricing Considerations

Provides data to assess IPO pricing via EPS, NAV, and valuation multiples. Compare with industry peers to judge if the pricing is justified.

Nirav: Vedant, what’s the IPO grey market?

Vedant: It’s an unofficial space where IPO shares or applications are traded before listing. Not SEBI-regulated, but it shows early investor sentiment.

Nirav: People trade shares before allotment?

Vedant: Yes. They either sell expected shares at a premium or trade applications at a fixed “Kostak rate.”

Nirav: And the Grey Market Premium?

Vedant: It’s the extra over the issue price—like ₹60 above ₹300 means shares trade at ₹360. It hints at listing expectations but isn’t foolproof.

Nirav: So helpful, but risky?

Vedant: Exactly. It’s informal, so no legal protection—but useful for gauging demand. Want to explore recent GMP trends?

5.9 What Is An IPO Grey Market?

An IPO Grey Market is an unofficial platform where shares are traded before formal listing, outside SEBI’s regulation. It reflects investor sentiment and speculation, often influencing retail interest. For example, if an IPO is priced at ₹200 and trades at ₹260 in the grey market, the ₹60 difference is the Grey Market Premium (GMP), showing bullish expectations.

Terms like Kostak Rate (price for an IPO application) and Subject to Sauda (conditional deals based on allotment) are common here. These cash-based transactions happen through informal networks. While GMP offers early demand cues, it’s driven by hype and isn’t a guarantee of listing gains.

Vedant: Nirav, ever wondered what really changes when a company goes public?

Nirav: Besides raising money, not really. Does it impact operations?

Vedant: Yes. IPOs bring capital for growth and boost market credibility. Transparency attracts serious investors and strategic partners.

Nirav: And for investors?

Vedant: Early ones get liquidity; new ones can join the growth journey. But IPOs can be volatile—hype doesn’t always match fundamentals.

Nirav: So it’s both opportunity and risk?

Vedant: Exactly. IPOs can reshape a company and reward investors, if they understand the business well.

5.10 Impact of IPO on Company & Investors

An Initial Public Offering (IPO) can be a transformative event for both the company going public and the investors participating in it.

Impact on the Company

1. Capital Infusion for Growth: IPO funds support expansion, R&D, acquisitions, or debt reduction—fueling growth without heavy reliance on loans.

2. Enhanced Visibility and Credibility: Listing boosts brand recognition, media attention, and trust—helping attract talent and strategic partners.

3. Valuation Benchmarking and Liquidity: Market-driven valuation aids future fundraising and offers liquidity to early investors and employees.

4. Governance and Compliance Pressure: Public status demands transparency and accountability, but may pressure short-term performance.

5. Market Volatility and Strategic Constraints: Stock price swings can influence decisions, sometimes limiting long-term focus and innovation.

Impact on Investors

1. Access to Early-Stage Growth Opportunities

IPOs let investors enter early in a company’s public journey, with potential for capital gains and future dividends.

2. High Risk–High Reward Potential

Strong listing gains are possible, but risks like overvaluation and volatility require careful fundamental analysis.

3. Diversification and Wealth Creation

IPOs help diversify portfolios and can generate long-term wealth, as seen with Infosys, IRCTC, and Zomato.

4. Information Asymmetry and Allotment Uncertainty

Retail investors face limited access and allotment challenges, while institutions benefit from deeper insights and access.

Nirav: Vedant, how do ESOPs connect with IPOs?

Vedant: ESOPs let employees buy shares at a set price. After an IPO, those shares gain market value, offering financial rewards.

Nirav: So employees benefit if the stock performs well?

Vedant: Exactly. A successful IPO can turn ESOPs into real gains. Companies must disclose ESOPs in the prospectus and follow SEBI rules.

Nirav: What about ex-employees?

Vedant: If they hold vested options, they may benefit—but often face restrictions under SEBI norms.

Nirav: So ESOPs help retain talent too?

Vedant: Yes. They align employee goals with company growth, and IPOs unlock their true value. For employees, it’s a financial milestone.

5.11 What is Employee Stock Options (ESOPs)

Employee Stock Options (ESOPs) and Initial Public Offerings (IPOs) are deeply interconnected especially in startups and high-growth companies where equity is used as a key incentive.

1. ESOPs Before an IPO

In private companies, ESOPs are often not liquid employees hold options or shares that can’t be sold easily. However, they’re granted with the expectation that the company will eventually go public or be acquired, creating a liquidity event. Many startups use ESOPs to compensate for lower salaries, aligning employee interests with long-term growth.

2. ESOPs During an IPO

When a company files for an IPO, it must disclose all outstanding ESOPs in its Red Herring Prospectus (RHP). SEBI regulations require clarity on how many options are granted, vested, and exercised. Some key considerations include:

- Dilution:ESOPs increase the total number of shares, which can dilute existing shareholders.

- Lock-in Periods: In some cases, ESOP shares may be subject to lock-ins post-listing.

- Promoter Classification:Founders holding ESOPs may face restrictions if they are classified as promoters, though SEBI is currently reviewing these rules.

3. ESOPs After an IPO

Once the company is listed, ESOPs become liquid employees can exercise their options and sell shares on the open market (subject to lock-in or blackout periods . This can lead to significant wealth creation, especially if the stock performs well. However, employees must also consider:

- Taxation: ESOPs are taxed at two stages on exercise as perquisite and on sale as capital gains.

- Market Volatility: Share prices may fluctuate post-IPO, affecting the value of exercised options.

4.Regulatory Developments

SEBI is currently considering reforms to allow startup founders to retain ESOPs post-IPO, addressing concerns about dilution and incentive alignment. It’s also evaluating a cooling-off period between ESOP grants and IPO filings to prevent misuse.

Nirav: Vedant, Some companies seem to soar after listing, while others crash. What makes the difference?

Vedant: That’s where historical IPO case studies come in. They show how factors like valuation, timing, and business clarity can make or break a public debut.

Nirav: Got any examples?

Vedant : Sure.

5.12 Historical IPO Case Studies

The Coal India IPO of 2010 stands as a landmark event in India’s capital market history not just for its size, but for what it represented: a rare blend of government-led disinvestment, investor enthusiasm, and strategic sector exposure.

Background and Context

Coal India Limited (CIL), a Navratna Public Sector Undertaking (PSU), is the world’s largest coal producer and a critical pillar of India’s energy infrastructure. Before the IPO, it was wholly owned by the Government of India and contributed over 80% of the country’s coal production. The IPO was part of the government’s broader disinvestment strategy to unlock value from state-owned enterprises and deepen public participation in capital markets.

IPO Details and Structure

Launched in October 2010, the IPO aimed to raise approximately ₹15,200 crore by offering 631.6 million equity shares through a book-building process. The price band was set at ₹225–₹245 per share, and the issue was open from October 18 to October 21, 2010. The shares were listed on November 4, 2010, on both NSE and BSE.

The offering was structured to appeal to a wide investor base:

- 45% reserved for Qualified Institutional Buyers (QIBs)

- 5% for Retail Individual Investors (RIIs)

- 5% for Non-Institutional Investors (NIIs)

- 10% for employees of Coal India

Investor Response and Market Impact

The IPO was a resounding success, oversubscribed by 15.28 times overall. The highest enthusiasm came from NIIs, with a subscription of 25.4 times their quota. On listing day, the stock debuted at ₹287.75, a 17.5% premium over the issue price, and closed at ₹342.35, delivering strong listing gains and signaling investor confidence in the PSU’s fundamentals.

This IPO not only broke records—it also revived retail investor interest in equity markets post the 2008 financial crisis. It demonstrated that with the right pricing, transparency, and sector strength, even government-led offerings could generate massive public participation.

Strategic Significance

Coal India’s IPO was more than a capital-raising event. It:

- Set a benchmark for future PSU disinvestments

- Enhanced transparency and governance in a traditionally opaque sector

- Broadened retail participation in India’s equity markets

- Reinforced investor appetite for resource-based, cash-rich businesses

Types of IPO Pricing Mechanisms:

- Book Buildingallows investors to bid within a price range and helps discover the optimal issue price.

- Fixed Priceoffers a set price upfront, making it simpler but less responsive to market demand.

- Stages of Business Funding: From bootstrapping to seed funding, Series A/B/C, and bridge rounds, IPOs represent the final stage of capital raising for mature companies aiming for scale and liquidity.

- Share Allotment Process: Allotment varies by investor category and demand levels. Over-subscription leads to lottery-based allotment for retail applicants, while under-subscription leads to full allotment.

- Importance of the Red Herring Prospectus (RHP): Investors must review the RHP to evaluate the company’s business model, financial health, risks, management quality, and offer structure before subscribing to an IPO.

- Historical IPO Case Studies: Examples like Coal India’s successful 2010 IPO illustrate how valuation, timing, investor perception, and sector strength influence IPO outcomes.

So here are key Takeaways for this topic

- Definition of IPO: An Initial Public Offering is the first time a private company sells its shares to the public by listing on a stock exchange, transitioning from private to public ownership.

- Purpose of Going Public: Companies launch IPOs to raise substantial capital, offer liquidity to early investors, enhance brand credibility, and support future growth ambitions.

- IPO Journey Explained Through Analogy: Meera’s chocolate business illustrates the transition from self-funded operations to raising public capital, highlighting the real-world motivation behind going public.

- Strategic Readiness: Before launching an IPO, companies must assess financial strength, regulatory compliance, scalability, and governance capabilities to handle public market responsibilities.

- Detailed IPO Procedure in India: The process includes appointing intermediaries, filing a Draft Red Herring Prospectus (DRHP), SEBI review, roadshows, price discovery through book building, and final listing.

Nirav: That IPO chapter was intense. What happens after listing—do we just hold the shares?

Vedant: Not really. That’s where the secondary market comes in—the real stock market action.

Nirav: So shares trade on NSE or BSE?

Vedant: Exactly. Investors buy and sell among themselves; no new money goes to the company.

Nirav: And all that charting and analysis?

Vedant: That’s secondary market stuff—price moves, sentiment, strategies. It’s where a stock proves its worth.

Nirav: Makes sense. Let’s explore how it works and why liquidity matters.