- Study

- Slides

- Videos

1.1 What Is Investing & Why to Invest?

“ Investing puts money to work. The only reason to save money is to invest it.”- Grant Cardone

Grant Cardone is a well-known entrepreneur, real estate investor, motivational speaker, and author. His quote explains us how important investing is. Investing puts money to work. Its True. Because in this era of rapid economic shifts , inflationary pressures, and evolving financial landscape investing is no longer optional – Its a necessity !

Today Global economy demands a protective approach to wealth building and investing wisely is the only solution for long term success.

What is Investing & Why to Invest?

Investing is the process of allocating money or resources into assets with the expectation of generating returns over time. These assets can include stocks, bonds, real estate, mutual funds, commodities, or even businesses. Unlike saving, which involves keeping money in a safe place like a bank account, investing involves putting money to work in vehicles that have the potential to grow in value.

Lets understand this with the help of an example. Nirav and Vedant are best friends. Both worked hard and earned a decent income, but they had different approaches to managing their money.

Nirav – The Saver

Nirav was cautious. Every month, he carefully set aside a portion of his salary in his savings account. He felt secure knowing he had money for emergencies. His account grew slowly, and he was content seeing his balance rise little by little.

Vedant – The Investor

Vedant, on the other hand, believed that money should grow. While he also kept some money in savings for emergencies, he invested a portion in stocks, mutual funds, and real estate. He understood that investing came with risks, but he believed in the power of compounding and market growth.

Now Imagine the situation after 10 years

Nirav had built up a reasonable savings amount, but inflation had slowly eaten away all its value. The rising cost of living meant his money wasn’t worth as much as before.

Meanwhile, Vedant’s investments had multiplied, benefiting from market growth and compound returns. His money was working for him even while he slept, and he had multiple streams of income from dividends and assets.

What did you learn from this? There are two important points

- Savings provide safety and liquidity but grow

- Investmentscome with risks but have the potential for higher returns and wealth creation.

Why Should You Invest?

- Beat Inflation & Preserve Wealth

- CompoundGrowth & Wealth Multiplication

- Create Multiple Income Streams

- Financial Independence & Security

- Smart Risk Management for Higher Returns

After understanding the what and why of investing, the next step is to explore the risks that come with it. While investing opens doors to long-term wealth creation and financial freedom, it’s important to recognize that it isn’t without challenges. Now let’s shed some light on the various risks investors face and how informed decisions can transform risk into opportunity.

1.2 Risks Associated With Investing

“ Risk comes from not knowing what you’re doing.” – Warren Buffett

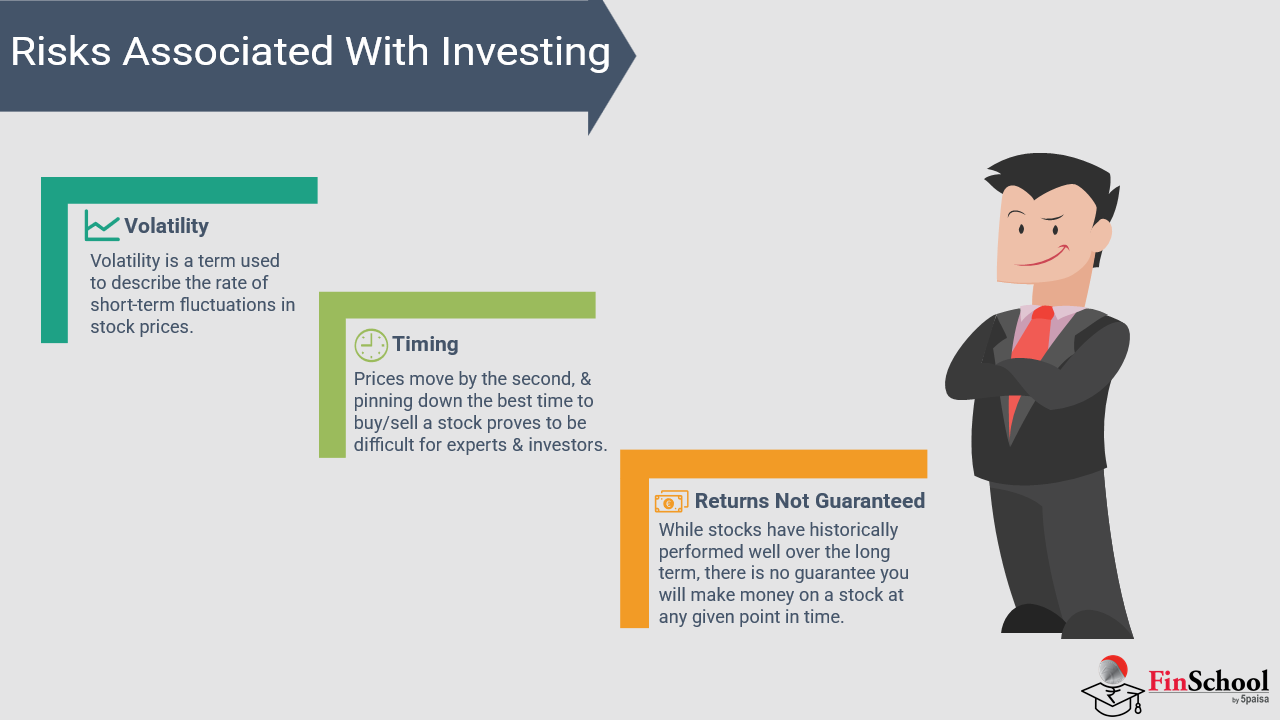

Warren Buffett stresses that the greatest investment risk comes from ignorance, not market volatility. Investors who act on emotion or follow trends without understanding what they’re investing in are essentially gambling. In contrast, informed investors who research company fundamentals, grasp market cycles, and diversify wisely can better manage uncertainty and reduce losses. While investing offers strong potential for financial growth, it also carries inherent risks, knowing and understanding these risks is key to building smart strategies that protect capital and enhance returns.

-

Market Risk

Market risk is the potential for losses due to broad market fluctuations caused by factors like economic downturns, political instability, pandemics, or financial crises. A prime example is the 2008 Global Financial Crisis, when stock markets worldwide plunged as major financial institutions collapsed and the housing bubble burst, impacting investments across stocks, bonds, and commodities,regardless of individual company strength. While market risk affects the entire financial system and cannot be eliminated, it can be managed through diversification and a long-term investment approach.

-

Inflation Risk

Inflation risk occurs when the value of money erodes over time, reducing the real returns on investments that don’t keep pace with rising prices. For instance, earning 5% annually on a fixed deposit while inflation runs at 6% results in a net loss of purchasing power. A historical example is the 1970s oil crisis, where soaring oil prices triggered global inflation, diminishing the value of fixed-income assets like bonds and savings. To preserve wealth, investors should consider assets that typically outpace inflation, such as equities, real estate, or inflation-indexed bonds.

-

Liquidity Risk

Liquidity risk arises when an investor cannot quickly sell an asset without impacting its price. While stocks and mutual funds are generally easy to trade, assets like real estate, fine art, or private equity can take much longer to liquidate. A notable example is Yes Bank’s 2020 crisis, where financial instability left depositors unable to access their funds, emphasizing the importance of evaluating an institution’s financial health and maintaining a balanced mix of liquid and long-term investments to manage this risk effectively.

-

Interest Rate Risk

Interest rate risk affects bonds and fixed-income securities, as rising interest rates typically lead to falling bond prices, reducing the value of existing holdings. Investors should closely monitor central bank policies, like RBI’s rate decisions, to anticipate such shifts. For instance, RBI’s rate hikes in 2022 caused a drop in bond prices, impacting long-term fixed-income investors. Mortgage borrowers with floating-rate loans also face this risk, as rising rates lead to higher repayments and increased financial pressure.

-

Credit Risk

Credit risk is the possibility that a borrower, whether a corporation or government, fails to meet its financial obligations, posing a threat to investors in bonds, loans, or other debt instruments. This can be mitigated by choosing high- credit-rating securities and conducting thorough financial analysis. A striking example is Kingfisher Airlines, whose owner Vijay Mallya borrowed extensively but failed to generate profits, leading to loan defaults and the airline’s collapse. Indian banks faced major losses, highlighting the dangers of lending to companies with poor financial fundamentals.

-

Business & Industry Risk

Business risk refers to challenges specific to a company or industry, such as poor management, regulatory shifts, competition, or technological disruption. A prime example is Kodak’s decline in the early 2000s, once a photography giant, it failed to adapt to the digital revolution, while rivals like Sony and Canon embraced innovation, leading to Kodak’s bankruptcy in 2012. Similarly, Jet Airways’ downfall in 2019 stemmed from mismanagement, rising fuel costs, and fierce competition from low-cost carriers like IndiGo, resulting in suspended operations and insolvency. These cases illustrate how even established firms can falter if they don’t respond effectively to evolving market dynamics. Diversifying across sectors helps mitigate such risks.

-

Exchange Rate Risk (Currency Risk)

Exchange rate risk affects investors holding foreign assets, as currency fluctuations can influence returns. For example, if the Indian Rupee depreciates against the U.S. Dollar, returns from U.S. investments may decline for Indian investors. During the COVID-19 pandemic, global uncertainties triggered volatile currency movements—while the rupee’s depreciation increased costs for import- dependent businesses and foreign debt holders, exporters benefited as their foreign earnings translated into higher INR values. Currency hedging strategies can help manage this risk and protect investment returns.

-

Emotional & Behavioral Risk

Investing isn’t just a numbers game,it’s deeply influenced by psychology. Emotional decisions driven by fear, greed, or herd mentality often lead to costly mistakes, like panic-selling during downturns or chasing high returns without understanding fundamentals. A striking example is the cryptocurrency hype in India, where many investors bought Bitcoin at peak prices due to FOMO, only to face heavy losses when the market corrected. Maintaining emotional discipline and following a well-researched strategy is key. While understanding risks helps avoid pitfalls, timing is equally crucial,starting early unlocks the power of compounding, allowing your money to grow exponentially over time and shaping a stronger financial future.

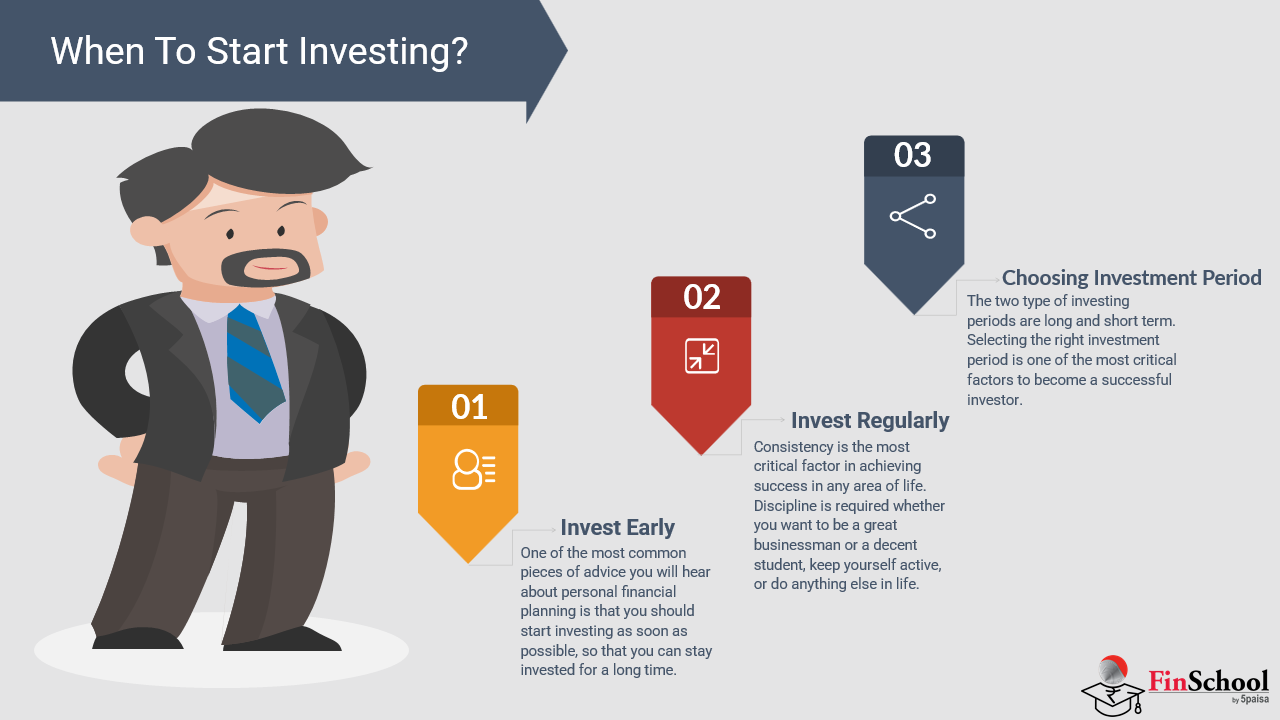

1.3 When To Start Investing?

Often even before investing the first question that comes to our mind is When to Start Investing? What is the Right time and age to start investing?

Well the answer is quite simple – As Early As Possible!

The sooner you start investing, the more time your money has to grow due to the power of compounding—where earnings generate more earnings over time. However, the right time to start investing depends on factors like financial stability, risk tolerance, and investment goals.

Lets understand this with the help of an example

Example: The Power of Early Investing

Now Nirav and Vedant example

Suppose Vedant starts to invest ₹5,000 per month at age 25, while Nirav delays investing until 35. Assuming a 10% annual return, here’s how their investments grow by the age of 55:

|

Age Started |

Monthly Investment |

Total Invested |

Value at 55 (10% return) |

|

Vedant(25) |

₹5,000 |

₹18 lakhs |

₹1.13 crore |

|

Nirav (35) |

₹5,000 |

₹12 lakhs |

₹38.71 lakhs |

CASE 1

Compounding Calculation for Vedant

The formula for compound interest is:

A=P(1+r/n)nt

Where:

- A= Future value of investment

- P= Monthly investment amount

- r= Annual interest rate (in decimal)

- n= Compounding frequency per year

- t= Number of years

For Vedant (Investing ₹5,000/month from Age 25 to 55)

- MonthlyInvestment (P): ₹5,000

- TotalYears (t): 30

- AnnualRate (r): 10% or 10

- CompoundedMonthly (n = 12)

Using the SIP formula for monthly investments:

FV=P×(1+r/n)nt−1/r/n)×(1+r/n)

Step 1: Substitute the values into the formula FV=5000×((1+0.10/12)12×30−1/0.10/12)×(1+0.10/12)

Step 2: Solve for (1 + r/n)

1+0.10/12=1+0.0083333=1.0083333

Step 3: Calculate the exponent 12×30

(1.0083333)360

Using exponentiation: (1.0083333)360≈19.92

Step 4: Solve the fraction inside the brackets

(19.92−1)/0.0083333

=18.92/0.0083333

=2,271.84

Step 5: Multiply by (1 + r/n)

(1+0.0083333)=1.0083333

2,271.84×1.0083333=2,290.81

Step 6: Multiply by the monthly investment

FV=5000×2,290.81

FV=₹1.14 Crore

Vedant’s investment grows to ₹1.14 crore lakhs at age 55. Compounding Table Showing Vedant’s Investment Growth- AGE-25

|

Age |

Total Invested (₹) |

Future Value (₹) |

|

25 |

₹ 60,000 |

₹ 62,811 |

|

26 |

₹ 1,20,000 |

₹ 1,31,828 |

|

27 |

₹ 1,80,000 |

₹ 2,06,183 |

|

28 |

₹ 2,40,000 |

₹ 2,86,224 |

|

29 |

₹ 3,00,000 |

₹ 3,72,320 |

|

30 |

₹ 3,60,000 |

₹ 4,64,866 |

|

31 |

₹ 4,20,000 |

₹ 5,64,288 |

|

32 |

₹ 4,80,000 |

₹ 6,71,051 |

|

33 |

₹ 5,40,000 |

₹ 7,85,659 |

|

34 |

₹ 6,00,000 |

₹ 9,08,648 |

|

35 |

₹ 6,60,000 |

₹ 10,40,593 |

|

36 |

₹ 7,20,000 |

₹ 11,82,105 |

|

37 |

₹ 7,80,000 |

₹ 13,33,832 |

|

38 |

₹ 8,40,000 |

₹ 14,96,472 |

|

39 |

₹ 9,00,000 |

₹ 16,70,773 |

|

40 |

₹ 9,60,000 |

₹ 18,57,531 |

|

41 |

₹ 10,20,000 |

₹ 20,57,602 |

|

42 |

₹ 10,80,000 |

₹ 22,71,896 |

|

43 |

₹ 11,40,000 |

₹ 25,01,377 |

|

44 |

₹ 12,00,000 |

₹ 27,47,069 |

|

45 |

₹ 12,60,000 |

₹ 30,10,059 |

|

46 |

₹ 13,20,000 |

₹ 32,91,492 |

|

47 |

₹ 13,80,000 |

₹ 35,92,576 |

|

48 |

₹ 14,40,000 |

₹ 39,14,589 |

|

49 |

₹ 15,00,000 |

₹ 42,58,870 |

|

50 |

₹ 15,60,000 |

₹ 46,26,827 |

|

51 |

₹ 16,20,000 |

₹ 50,19,932 |

|

52 |

₹ 16,80,000 |

₹ 54,39,720 |

|

53 |

₹ 17,40,000 |

₹ 58,87,795 |

|

54 |

₹ 18,00,000 |

₹ 63,65,830 |

|

55 |

₹ 18,60,000 |

₹ 1,14,00,230 |

CASE 2- For Nirav (Investing ₹5,000/month from Age 35 to 55)

- MonthlyInvestment (P): ₹5,000

- TotalYears (t): 20

- AnnualRate (r): 10% or 10

- CompoundedMonthly (n = 12)

Step 1: Substitute values into the formula

FV=5000×((1+0.10/12)12×20−1/0.10/12)×(1+0.10/12)

Step 2: Solve for (1 + r/n)

1+0.10/12=1.0083333

Step 3: Calculate the exponent 12×20

(1.0083333)240

Using exponentiation: (1.0083333)240 ≈7.39

Step 4: Solve the fraction inside the brackets

(7.39−1)/0.0083333

=6.39/0.0083333

=767.88

Step 5: Multiply by (1 + r/n)

(1+0.0083333)=1.0083333

767.88×1.0083333=774.28

Step 6: Multiply by the monthly investment

FV=5000×774.28

FV=₹38.71 lakhs

Compounding Table Showing Nirav’s Investment Growth-

AGE- 35

|

Age |

Total Invested (₹) |

Future Value (₹) |

|

35 |

₹60,000 |

₹62,811 |

|

36 |

₹1,20,000 |

₹1,31,828 |

|

37 |

₹1,80,000 |

₹2,06,183 |

|

38 |

₹2,40,000 |

₹2,86,224 |

|

39 |

₹3,00,000 |

₹3,72,320 |

|

40 |

₹3,60,000 |

₹4,64,866 |

|

41 |

₹4,20,000 |

₹5,64,288 |

|

42 |

₹4,80,000 |

₹6,71,051 |

|

43 |

₹5,40,000 |

₹7,85,659 |

|

44 |

₹6,00,000 |

₹9,08,648 |

|

45 |

₹6,60,000 |

₹10,40,593 |

|

46 |

₹7,20,000 |

₹11,82,105 |

|

47 |

₹7,80,000 |

₹13,33,832 |

|

48 |

₹8,40,000 |

₹14,96,472 |

|

49 |

₹9,00,000 |

₹16,70,773 |

|

50 |

₹9,60,000 |

₹18,57,531 |

|

51 |

₹10,20,000 |

₹20,57,602 |

|

52 |

₹10,80,000 |

₹22,71,896 |

|

53 |

₹11,40,000 |

₹25,01,377 |

|

54 |

₹12,00,000 |

₹27,47,069 |

|

55 |

₹12,60,000 |

₹38,71,062 |

Nirav’s investment grows to ₹38.71 lakhs at age 55. What did you Learn?

Just observe the difference. Vedant started 10 years earlier with just ₹6 lakhs more in contributions, yet his final corpus is more than double than Nirav. This is the magic of starting early and letting compounding do its work.

Now that we’ve seen the incredible advantage of starting early, it becomes equally important to understand the cost of not investing. Delays and inaction come with a silent price tag, lost growth, diminished purchasing power, and compromised financial security. Read further to understand how deeply missed investment opportunities can affect your future.

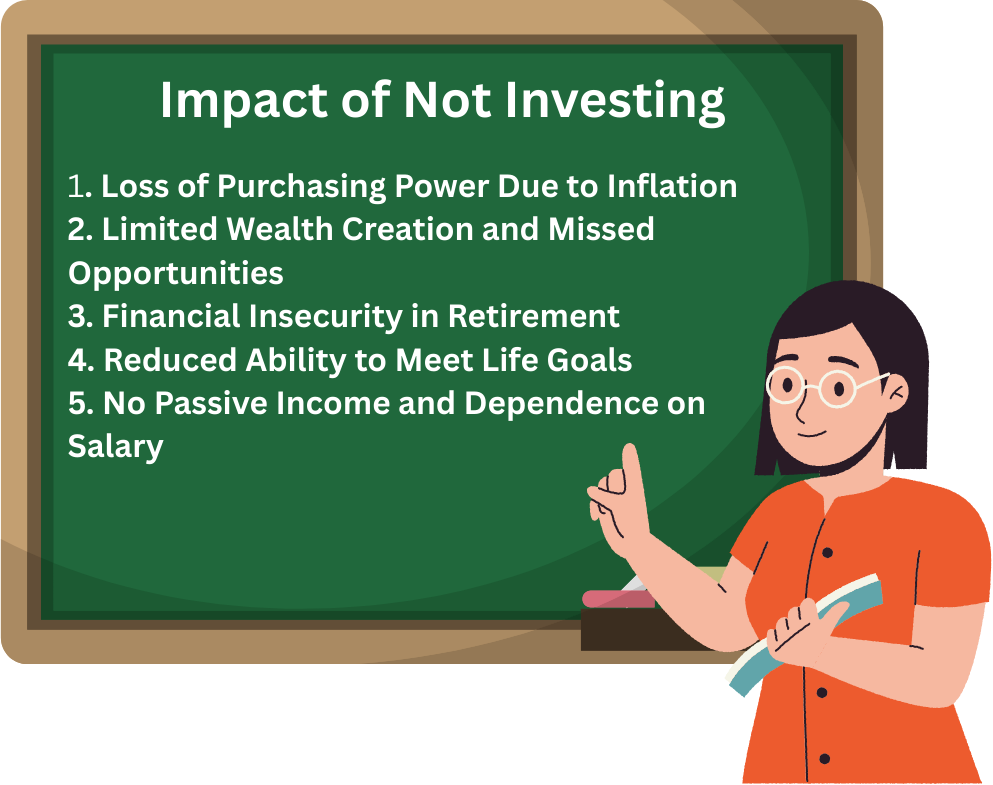

1.4 Impact of Not Investing

Not investing can have long-term consequences that affect financial growth, stability, and future opportunities. Many people assume saving money is enough, but inflation, wealth accumulation, and economic security require active investment strategies.

-

Loss of Purchasing Power Due to Inflation

While saving is important, inflation steadily erodes the purchasing power of idle cash. For instance, keeping ₹1,00,000 in a savings account earning 3% interest while inflation runs at 6% results in a net loss in real value. Over time, this gap widens, reducing financial stability and future opportunities. Active investment strategies are essential to grow wealth, preserve value, and secure long-term economic well-being.

-

Limited Wealth Creation and Missed Opportunities

Investing is a powerful tool for building wealth through compound growth, passive income, and asset appreciation. Without it, financial progress remains slow and limited. Consider the example of Nirav and Vedant: both save ₹5,000 per month, but Vedant invests his savings at a 10% annual return, while Nirav keeps his money in a regular savings account. After 30 years, Vedant accumulates over ₹1.13 crore, whereas Nirav ends up with just ₹38 lakhs. This stark contrast highlights how investing significantly accelerates wealth creation compared to mere saving.

-

Financial Insecurity in Retirement

Relying solely on savings without investing can pose serious financial challenges during retirement, as non-invested funds gradually diminish and fail to keep pace with inflation. In contrast, passive income from investments like mutual funds, stocks, or bonds offers long-term financial stability and helps maintain purchasing power. For instance, a person who invests consistently throughout their working years can retire with a secure income stream, while someone who avoids investing may face retirement with limited financial resources and increased vulnerability.

-

Reduced Ability to Meet Life Goals

Investments play a key role in achieving life milestones such as home ownership, education funding, or travel. Without investments, individuals may need to rely on loans or delay important financial goals. Investing in equity funds or real estate early can help a person afford a home more comfortably, compared to someone relying solely on accumulated savings.

-

No Passive Income and Dependence on Salary

Without investments, individuals depend entirely on active income such as salary or wages. Investing in dividend stocks, rental properties, or interest-bearing assets creates passive income streams, reducing financial dependency. Someone who invests in dividend-paying stocks builds an additional income source, while those who don’t invest must always rely on their primary job. Once we realize the true cost of inaction, the next natural step is to prepare wisely before taking the plunge. Successful investing is more than enthusiasm—it’s built on informed choices, strong strategies, and discipline. Before you commit your capital, it’s essential to understand a few critical aspects that can shape your investment outcome

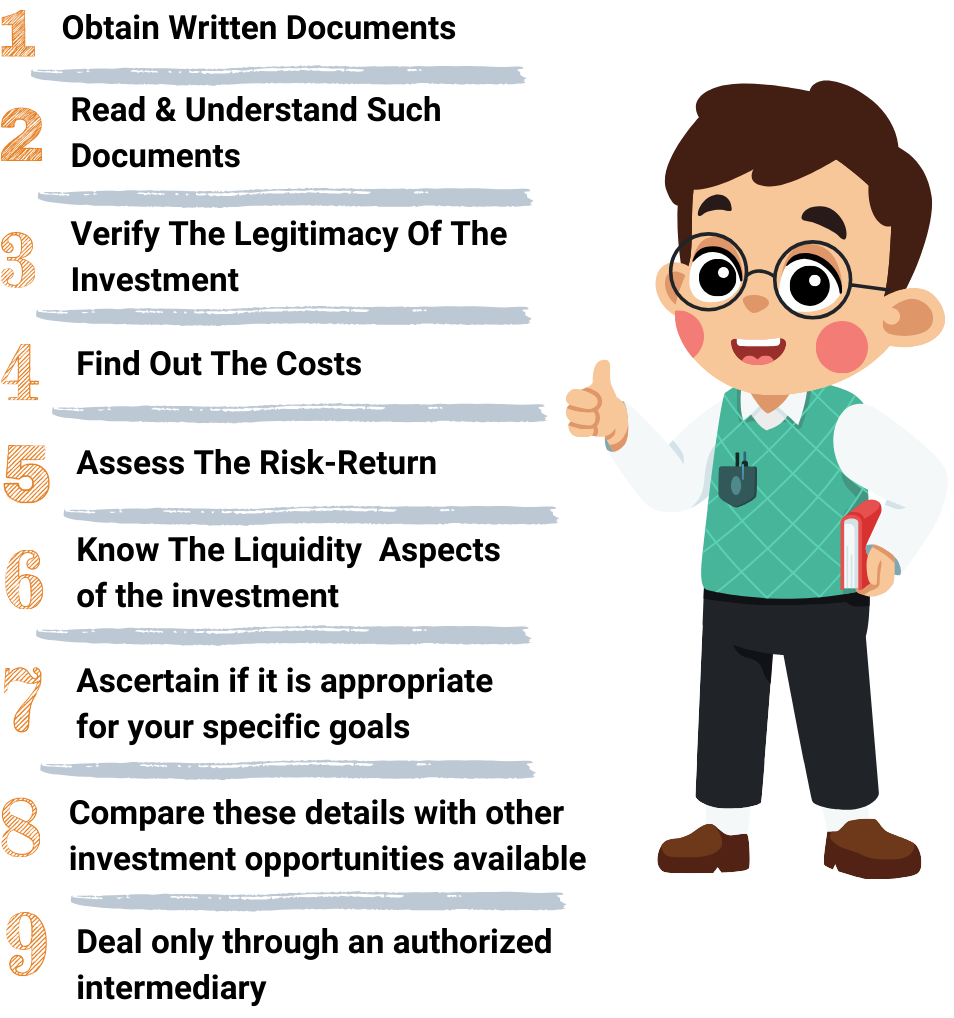

1.5 Things to know before investing

Trading is like playing a fast-paced sport such as competitive tennis, you need skill, strategy, mental sharpness, and the ability to make split-second decisions based on your opponent’s moves. In the same way, traders must read market signals, manage risks, and adjust positions quickly as prices change. In contrast, long-term investing resembles planting a tree: you select the right seed, nurture it, and allow time to foster steady growth. While trading demands constant vigilance and emotional resilience, investing focuses on patience and consistency. Before entering the financial markets as a trader, it’s essential to understand market behavior, develop strong risk management skills, and prepare mentally for the emotional ups and downs, this foundation is key to making strategic decisions rather than costly mistakes.

-

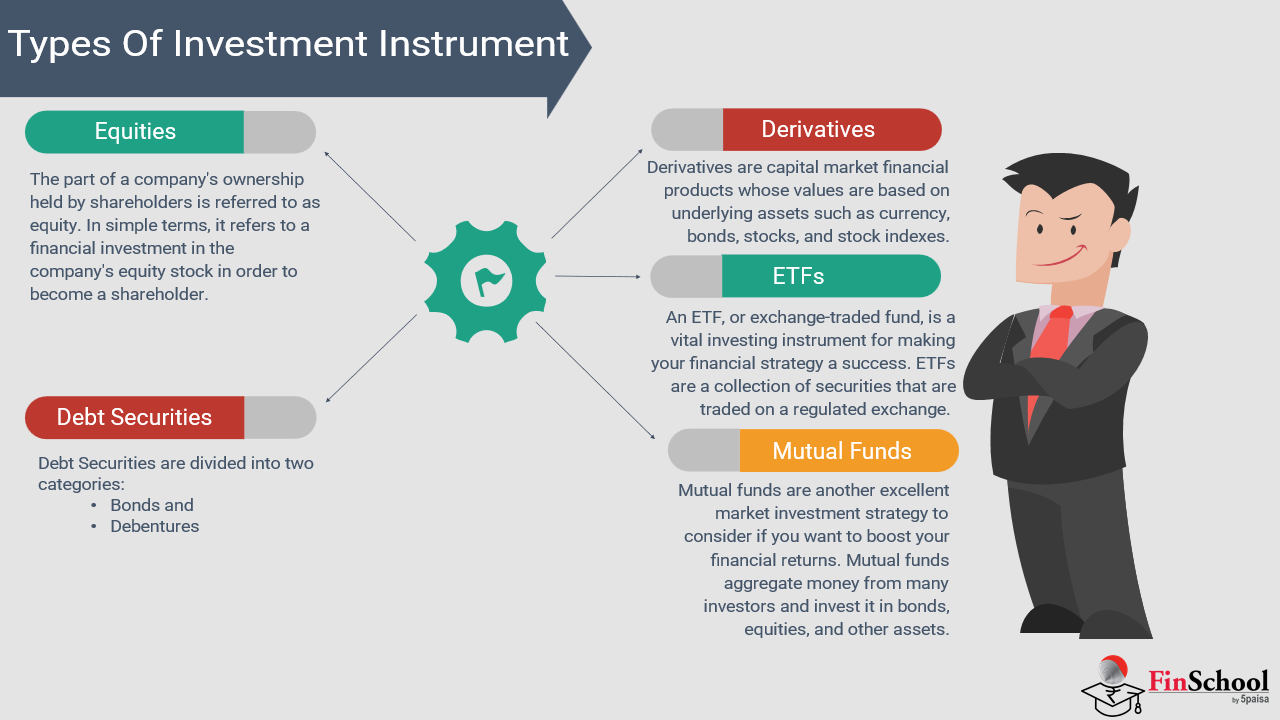

Understanding Market Structure and Asset Classes

When you step into the world of trading, you’re not just clicking buttons, you’re operating in a marketplace that has its own structure, its own rules, and a whole mix of asset classes. Think stocks, commodities like gold and oil, currencies, and more complex instruments like derivatives. Each of these has a distinct personality and risk profile. Lets understand each of them.

- Equities (Stocks)offer opportunities for both short-term gains and long-term appreciation, but they are susceptible to volatility influenced by corporate earnings, macroeconomic policies, and global events.

- Commodities (Gold, Oil, Agricultural Products)fluctuate based on supply and demand, geopolitical stability, and economic cycles.

- Foreign Exchange (Forex)trading involves currency pairs and is heavily impacted by interest rate decisions, inflation, and international trade policies.

- Derivatives (Options and Futures)provide leverage and hedging opportunities but require advanced strategies to manage risks effectively.

-

Technical vs. Fundamental Analysis

There are two ways to read the market. One is technical analysis like checking the heartbeat of a stock through its past movements and chart patterns. The other is fundamental analysis diving into earnings, policies, and economic indicators to understand what’s truly driving prices. Think of technical as short-term signals and fundamental as long-term insights.

- Technical analysisfocuses on historical price movements, chart patterns, and market trends. Traders use indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to identify entry and exit points. For better understanding of Technical analysis click on the link . Here you will get a detailed analysis all chart patterns and how indicators help traders to decide their entry and exit points

- Fundamental analysisexamines financial reports, economic indicators, and company performance. Earnings reports, interest rate decisions, and macroeconomic trends play a crucial role in shaping market sentiment.

-

Risk Management and Capital Protection

Smart trading is like driving with a seatbelt and brakes. Without tools like stop losses or proper position sizing, a single bad move can wreck your capital. Knowing when to cut losses, when to take profit, and how much to risk per trade that’s how pros stay in the game.

- Position Sizing:Limiting exposure per trade prevents overcommitment and balances portfolio risks.

- Stop Loss and Take Profit Orders:Setting predefined exit points ensures traders minimize losses while securing profits.

- Risk-Reward Ratio:A well-planned trade should offer a favorable risk-to-reward ratio to justify the investment.

- Leverage Control:While leverage enhances profits, excessive use can magnify losses significantly.

-

Market Psychology and Emotional Discipline

Trading isn’t just about numbers—it’s about your mindset. Fear makes you panic-sell, greed pushes you to over trade, and FOMO gets you into bad trades. A clear head and a disciplined plan make all the difference. Emotion-led trading is a shortcut to regret.

- Fear of missing out (FOMO)leads traders to chase trends, increasing the risk of buying at peak prices.

- Overtradingarises from excessive confidence, resulting in poor decision-making and unnecessary losses.

- Panic sellingduring market downturns can lead traders to exit profitable positions too early.

Developing emotional discipline through structured strategies and rational decision-making enhances trading efficiency. A well-defined plan prevents traders from reacting impulsively to market fluctuations.

-

Importance of Liquidity and Market Timing

Suppose You are trying to sell an expensive piece of art vs. selling a popular phone, it’s way easier to find a buyer for the latter. That’s liquidity. Trade in highly liquid markets like major stocks and forex for easier entries and exits. Also, timing matters news releases and opening bells often bring price swings.

- High liquidity assets, like major stocks and currency pairs, allow smooth transactions with minimal price slippage.

- Non liquid assets can experience extreme price fluctuations due to fewer buyers and sellers, increasing risks.

Additionally, market timing plays a crucial role in trading profitability. Some strategies work best during high volatility sessions, such as the opening and closing hours of stock markets. Understanding the impact of news releases and earnings reports can prevent unnecessary exposure to sharp price movements.

-

Trading Strategies and Choosing the Right Approach

Different strategies fit different personalities. Are you someone who thrives on action? You might like day trading. Prefer a more relaxed pace? Swing trading could be for you. Scalping is ultra-fast and intense. And if you’re tech-savvy, algo trading lets you automate everything. Match your strategy to your style and risk comfort.

- Day Trading:Short-term trading where positions are closed within the same day. Requires quick decision-making and constant monitoring of charts.

- Swing Trading:Holding assets for multiple days or weeks to capture short- to mid-term trends. Suitable for traders who prefer moderate risk exposure.

- Scalping:Extremely short-term trading where positions are opened and closed within minutes. Designed for capturing small price movements with high frequency.

- Algorithmic Trading:Automated trading using mathematical models and pre-defined conditions. Requires expertise in coding and market analysis.

Selecting the right strategy depends on a trader’s risk tolerance, time commitment, and expertise level.

-

Transaction Costs, Taxes, and Regulations

Every trade has hidden costs—brokerage fees, taxes, and compliance rules. Neglect these and your profits may shrink fast. Staying informed and organized helps you keep more of what you earn and avoid unwanted surprises.

- Brokerage Fees:Frequent traders should account for commission costs, spreads, and exchange fees.

- Taxes on Capital Gains:Depending on the country’s tax policies, short-term trading profits may be subject to taxation.

- Regulatory Compliance:Traders must be aware of legal requirements set by financial authorities to prevent fraud or penalties.

Understanding financial obligations helps traders optimize their net profits while staying compliant with market regulations.

-

Continuous Learning and Adapting to Market Conditions

Markets evolve like fast-moving technology. What worked yesterday might flop tomorrow. Stay sharp by reading, testing strategies, and learning from others. It’s not a one-time setup—it’s a journey of growth and adaptation.

- Reading financial reports, economic forecasts, and regulatory changes enhances decision-making.

- Back-testing strategies using historical data verifies performance before implementing them in live markets.

- Learning from experienced traders through mentorship, courses, or trading communities accelerates progress.

Here are some investment instruments and diverse tools available to shape your wealth-building journey.

1.6 Types Of Investment Instruments

Investment instruments are financial assets used to grow wealth, generate income, or hedge risks. Each instrument serves different financial objectives, and selecting the right ones depends on an investor’s risk tolerance, time horizon, and market knowledge.

By now we all are aware that investment is done in instruments other than your normal savings bank account. As mentioned earlier investment instruments are financial assets such as equities, fixed income securities , Mutual Funds and ETFs , Commodities and Precious Metals, Derivatives etc.

Lets understand them in detail

Equities

Equity investments involve buying shares of a company, making investors partial owners with a claim on its assets and earnings. These investments offer potential returns through capital appreciation, when share prices rise, and dividends, which are portions of profits shared with shareholders. However, they carry market risk, as share values fluctuate based on factors like economic conditions, company performance, and investor sentiment. For instance, purchasing 100 shares at ₹100 totals ₹10,000; if the price rises to ₹150, the value becomes ₹15,000, a 50% gain. But if it drops to ₹80, the value falls to ₹8,000, showing the risk involved. Equity value typically grows when a company performs well, but poor results can lead to losses.

There are two types of equity investments

- Common Stocks

Common stocks are the most prevalent form of equity investment, granting shareholders voting rights in company decisions, such as electing board members. Investors primarily earn returns through:

- Capital Appreciation:If a company grows, its stock price increases, allowing investors to sell shares at a higher price than they bought them for.

- Dividends:Some companies distribute a portion of their profits to shareholders as dividends, providing additional income.

Example: Infosys pays dividends to shareholders, alongside long-term stock price appreciation, making it attractive to both growth and income investors.

- Preferred Stocks

Preferred stocks differ from common stocks because they provide fixed dividends, meaning investors receive guaranteed periodic payouts regardless of company profits.

- Stable Income:Preferred stockholders receive dividends before common shareholders.

- Limited Voting Rights:Unlike common stocks, preferred stocks often do not grant shareholders voting power in company decisions.

- Priority in Bankruptcy:If a company faces financial trouble, preferred shareholders are paid before common stockholders.

Example: Certain banks and financial institutions issue preferred shares with fixed dividends, making them ideal for conservative investors seeking stable returns rather than high growth potential.

Fixed Income Securities

Fixed income securities are investments that offer regular interest payments and return the principal at maturity, providing stability and predictability, much like Nirav lending money to his cousin and receiving ₹500 monthly until the full amount is repaid. Instead of lending to family, investors lend to governments, corporations, or municipalities, earning consistent interest with lower volatility than equities. Government bonds like Treasury Bills and RBI Bonds are low-risk due to sovereign backing, while corporate bonds offer higher returns but come with credit risk. Municipal bonds help fund public infrastructure, and zero-coupon bonds, sold at a discount,pay no periodic interest but are redeemed at full value. These instruments are ideal for conservative investors, retirees, or anyone seeking reliable income and capital preservation, making them a key component of a diversified portfolio.

Mutual Funds and ETFs

Mutual funds are like Nirav and his neighbors planning a festive meal, everyone contributes money, and Vedant, the skilled cook (fund manager), selects the best ingredients for a balanced feast of stocks, bonds, and commodities. ETFs are like Nirav’s cousin Arjun picking a ready-made combo meal anytime,offering similar diversification but with more flexibility. Mutual funds offer equity for growth, debt for stability, and hybrid for balance, while index funds track benchmarks like Nifty 50. ETFs trade on stock exchanges, providing liquidity, transparency, and lower costs. Both simplify investing through professional management, ideal for beginners and seasoned investors alike.

Commodities and Precious Metals

Commodity investing is like splitting costs for a weekend trip—each person covers a different expense to make the whole plan work. Similarly, investors allocate money across essentials like oil, wheat, and gold to balance risk and protect against inflation and market volatility. Commodities include physical assets such as metals, energy products, and agricultural goods, all vital to global trade. Precious metals like gold and silver act as safe havens during economic uncertainty, while energy commodities such as crude oil and natural gas respond to geopolitical and supply-demand shifts. Agricultural commodities like wheat and coffee are shaped by climate and consumption trends. Though commodity trading requires expertise due to price volatility, it offers valuable diversification and inflation protection, making it a strategic choice for institutional and seasoned investors.

Derivatives (Futures and Options)

Derivatives are financial instruments that derive value from underlying assets like stocks, commodities, or currencies, and help manage uncertainty—much like everyday agreements. For example, locking in today’s mango price for next month mirrors a futures contract, while paying a small amount for the option to buy a concert ticket later reflects an options contract, offering flexibility without obligation. Swaps involve exchanging financial terms, like two friends swapping loan types to balance risk, and forwards resemble a café owner fixing cocoa prices in advance to avoid future cost spikes. These tools—futures, options, swaps, and forwards—are used for hedging or speculation, often by experienced traders due to their complexity and leverage. As part of a broader investment toolkit that includes equities, bonds, mutual funds, and commodities, derivatives allow investors to tailor portfolios to their goals, risk appetite, and time horizon. Yet, the deeper financial question remains: should you save or invest? Understanding both approaches is key to securing your financial future.

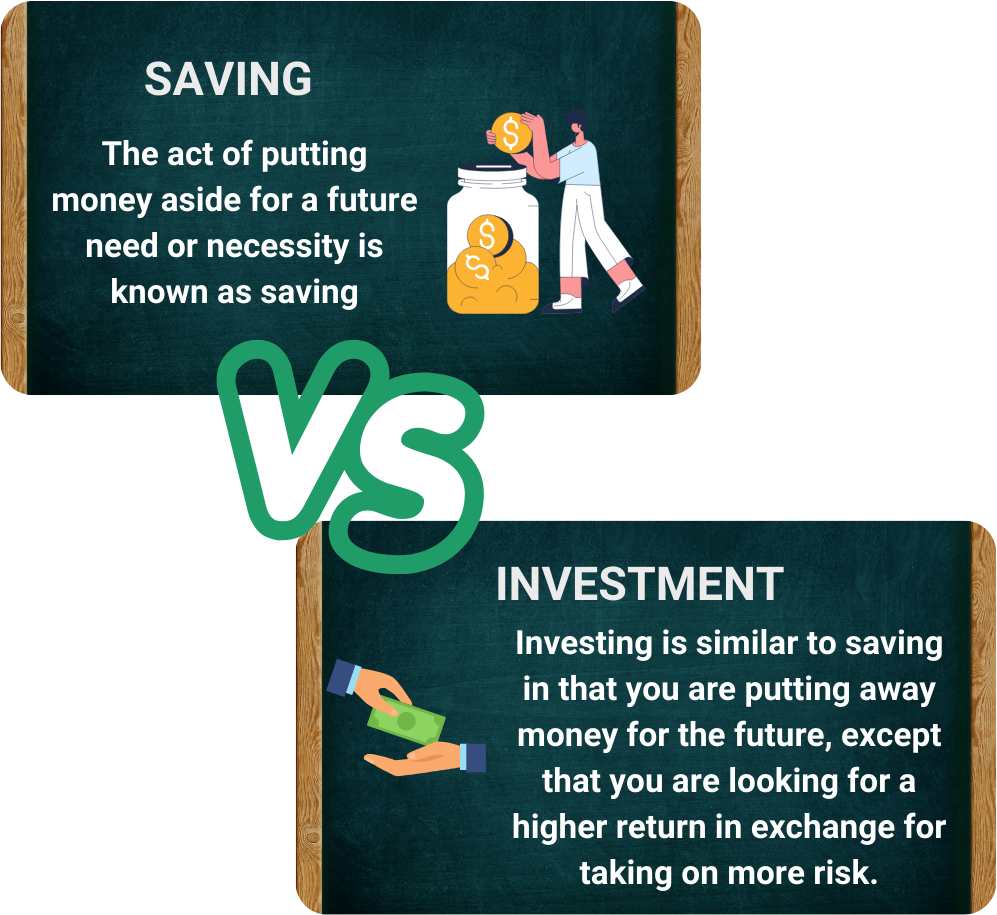

1.7 Saving Or Investment – The Better Option

From example of Nirav and Vedant now we do know that Investing is always a better option rather than just saving and also the debate between saving and investing is central to financial planning. While both have unique benefits, their impact on wealth creation differs significantly. Traders and investors recognize that simply saving money may not be enough to build financial security—investment is necessary for long-term wealth accumulation.

Understanding the Core Difference

|

Aspect |

Saving |

Investing |

|

Purpose |

Security, emergency funds |

Wealth creation, long-term growth |

|

Risk Level |

Low |

Medium to high, depending on assets |

|

Returns |

Minimal, often below inflation rate |

Potential for higher returns, especially in equities |

|

Liquidity |

High—money is readily available |

Variable—some investments have lock-in periods |

|

Time Horizon |

Short-term focus |

Long-term wealth-building strategy |

The Impact of Inflation on Savings vs. Investments

One of the biggest risks with relying solely on savings is inflation. If inflation averages 6% per year, a savings account earning 3% interest is losing purchasing power annually. Investing combats inflation by offering higher returns over time.

Example: ₹1 Lakh Growth in Savings vs. Investment Over 20 Years

|

Year |

₹1 Lakh in Savings (3% Annual Interest) |

₹1 Lakh in Investments (10% Annual Return) |

|

1 |

₹1,03,000 |

₹1,10,000 |

|

5 |

₹1,15,927 |

₹1,61,051 |

|

10 |

₹1,34,391 |

₹2,59,374 |

|

15 |

₹1,55,797 |

₹4,17,724 |

|

20 |

₹1,80,611 |

₹6,72,750 |

Risk vs. Reward:

Traders and investors must balance risk and reward. While savings provide immediate liquidity, investments grow wealth through stocks, bonds, mutual funds, commodities, and real estate.

Risk Hierarchy of Investment Instruments:

- Low Risk:Fixed Deposits, Government Bonds, PPF

- Moderate Risk:Mutual Funds, REITs, Corporate Bonds

- High Risk:Equities, Derivatives, Cryptocurrencies

The Power of Compounding in Investment

Example: ₹5,000 Monthly Investment vs. ₹5,000 Monthly Savings Over 30 Years

Investment Growth (Assuming 10% Annual Return):

FV=P×((1+r/n)nt−1)/r/n)×(1+r/n)

Where:

- P= ₹5,000

- r= 10%

- n= 12 (compounded monthly)

- t= 30 years

Using the formula, investing ₹5,000 per month would grow to ₹1.13 crore, while simple savings at 3% interest would total only ₹28 lakhs—a difference of ₹85 lakhs over 30 years.

1.8 How Investing Helps for Retirement Planning?

Retirement planning is not just about saving—it’s about investing smartly to ensure financial stability and a comfortable post-work life. Many individuals rely solely on savings accounts, but inflation, medical expenses, and a longer lifespan make investment-based retirement planning a necessity.

Let us take an example for understanding the concept of Retirement Planning

Nirav is a 30-year-old professional earning ₹75,000 per month. He dreams of retiring at 60 with financial independence and a monthly passive income of ₹1 lakh to sustain his lifestyle. If he relies solely on savings, he risks inflation erosion, healthcare costs, and outliving his money. Investing strategically is the only way to secure his retirement.

Define Retirement Goals and Timeline

Nirav must first determine his target retirement age and estimate his monthly expenses during retirement. Questions to consider:

- When does he want to retire (e.g., 60 years old)?

- What lifestyle does he aim for—basic expenses or luxury living?

- Does he plan to travel or invest in post-retirement ventures?

Estimate Required Retirement Corpus

Using the 4% withdrawal rule, Nirav can estimate how much money he needs to retire comfortably. For example, if he wants ₹1 lakh per month (₹12 lakh per year) in retirement, his corpus should be:

Corpus=Annual Expense÷4%

Corpus= ₹12,00,000÷0.04= ₹3Crores

Action Step: Nirav must build a ₹3 Crore portfolio by the time he retires to ensure financial stability.

Power of Investing Over 30 Years

|

Investment Type |

Annual Return |

Value After 30 Years (Starting ₹1 Lakh) |

|

Savings Account |

3% |

₹2.42 Lakhs |

|

Fixed Deposit (FDs) |

6% |

₹5.74 Lakhs |

|

Mutual Funds |

10% |

₹17.45 Lakhs |

|

Equity Investment |

12% |

₹29.96 Lakhs |

Inflation and Its Impact on Retirement Savings

With 6% average inflation, Nirav realizes that today’s ₹1 lakh monthly expense will cost ₹5.74 lakhs in 30 years. Without investing, he may not afford basic necessities.

Investment Options for Retirement Planning

Nirav builds a diversified portfolio to balance growth and stability:

- Equity Mutual Funds & Stocks: 50% allocation for long-term appreciation.

- Fixed Income (Bonds, FDs): 20% for capital protection.

- Pension Plans (NPS, EPF): 20% for structured retirement savings.

- Real Estate: 10% rental properties to generate passive income.

Diversification ensures high returns while reducing risk, securing Nirav’s financial stability post-retirement.

How Compounding Strengthens Retirement Investments

Nirav starts investing ₹10,000 per month in an equity mutual fund at 12% return.

|

Age Started |

Total Invested |

Value at Retirement (12% return) |

|

30 |

₹36 Lakhs |

₹3.5 Crores |

|

40 |

₹24 Lakhs |

₹1.1 Crores |

|

50 |

₹12 Lakhs |

₹40 Lakhs |

Withdrawal Strategy for Nirav’s Retirement

Nirav plans his retirement withdrawals wisely:

- The 4% Rule:Withdraw ₹1.4 lakh per month from his ₹3.5 crore corpus to sustain expenses.

- Dividend Stocks & Rental Income: Passive earnings ensure financial security.

Planning for Medical Expenses & Emergencies

Nirav invests in health insurance, long-term care policies, and emergency funds to safeguard against medical expenses without depleting his retirement savings. His disciplined approach ensures financial independence, stable passive income, and a retirement free from reliance on employment or savings alone, highlighting that investing isn’t optional but essential for long-term security. Once you’ve weighed saving versus investing and understood the power of compounding, the next step is to explore where investments grow, especially in India. To navigate opportunities wisely, it’s vital to understand how the Indian stock market operates, who the key players are, and how various assets are traded.

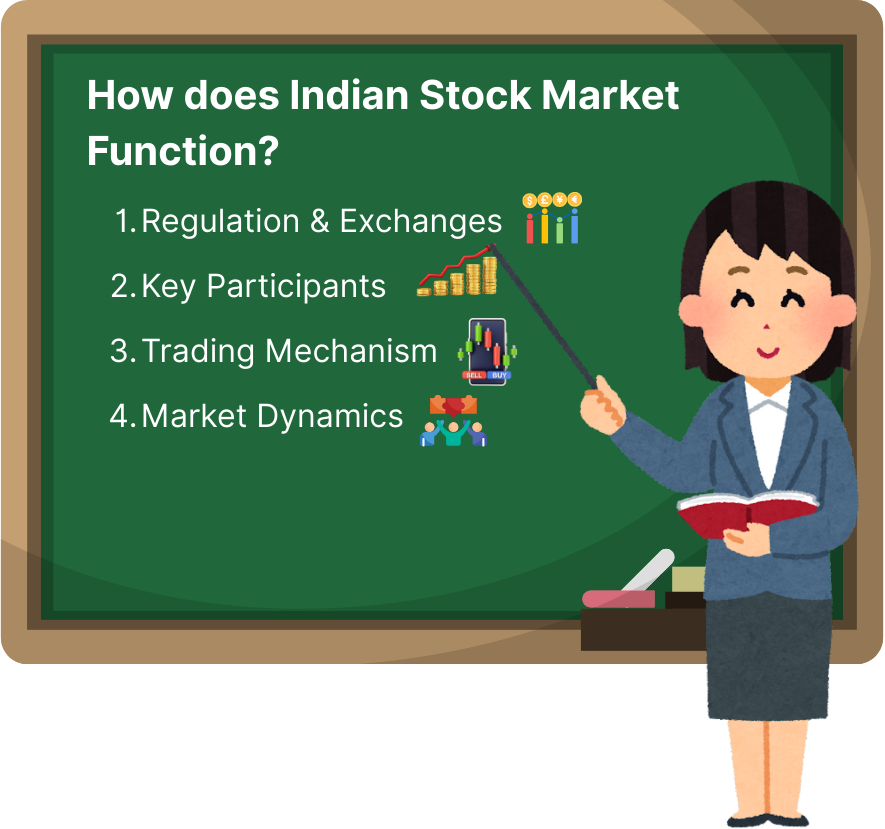

1.9 How does Indian Stock Market Function?

The Indian stock market operates as a platform where investors buy and sell securities, including stocks, bonds, derivatives, and mutual funds. It is regulated by the Securities and Exchange Board of India (SEBI) to ensure transparency, protect investors, and maintain market integrity. The two primary exchanges in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Key Entities Involved

Several participants facilitate stock market operations:

- Stock Exchanges: NSE and BSE provide the infrastructure for trading.

- SEBI (Regulator):Ensures fair practices and prevents fraud.

- Companies (Issuers): List their shares for public trading via IPOs.

- Brokers & Traders: Intermediaries executing trades on behalf of investors.

- Retail & Institutional Investors: Individuals and large institutions participating in stock transactions.

Stock Trading Mechanism

The trading process in the Indian stock market follows a structured approach:

- Pre-Open Session (9:00 – 9:15 AM): Allows price discovery before market opening.

- Regular Trading Session (9:15 AM – 3:30 PM): Continuous electronic trading of stocks.

- Post-Closing Session (3:40 – 4:00 PM): Determines the closing price for stocks.

Shares are bought and sold through the order-matching system, ensuring liquidity and efficient transactions.

Investment Instruments Traded

Investors in India can trade various financial instruments, including:

- Equities (Stocks): Ownership in companies, with prices influenced by earnings, economic conditions, and market demand.

- Derivatives (Futures & Options): Contracts based on underlying stocks or indices, used for speculation or hedging risks.

- Commodities: Gold, oil, agricultural products traded on the Multi Commodity Exchange (MCX).

- Forex (Currency Trading): INR-based currency pairs traded in specialized markets.

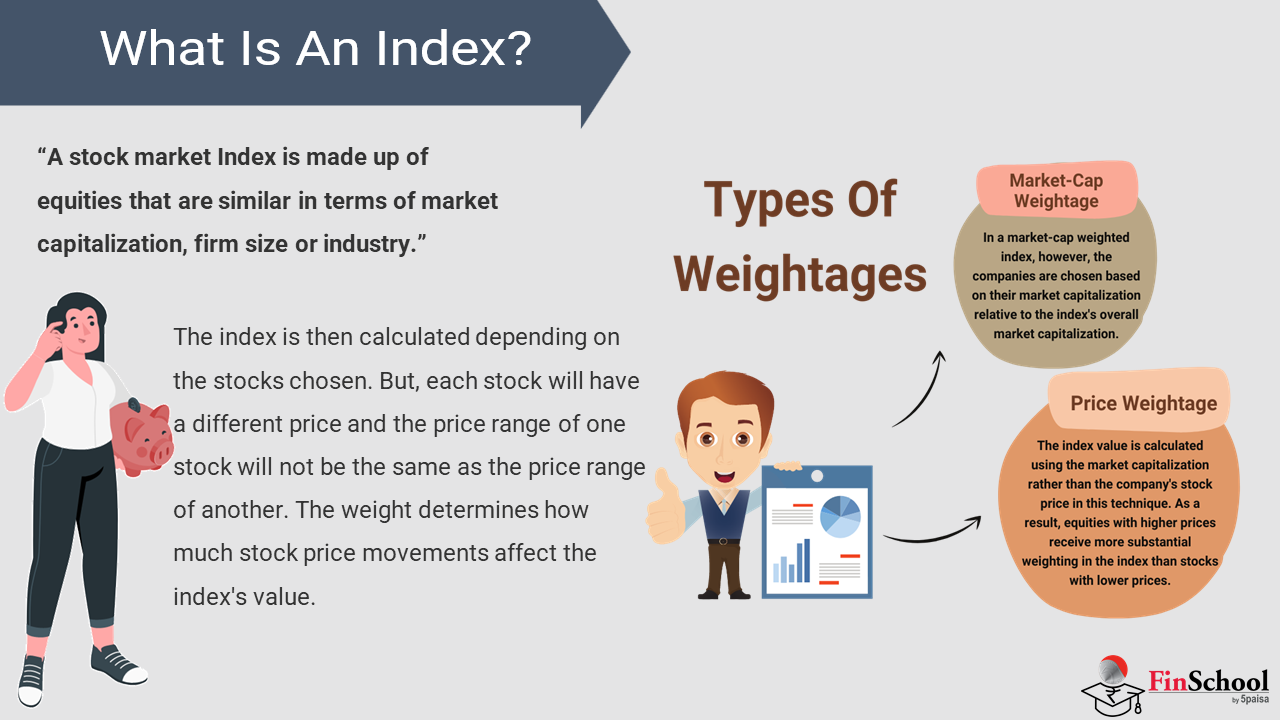

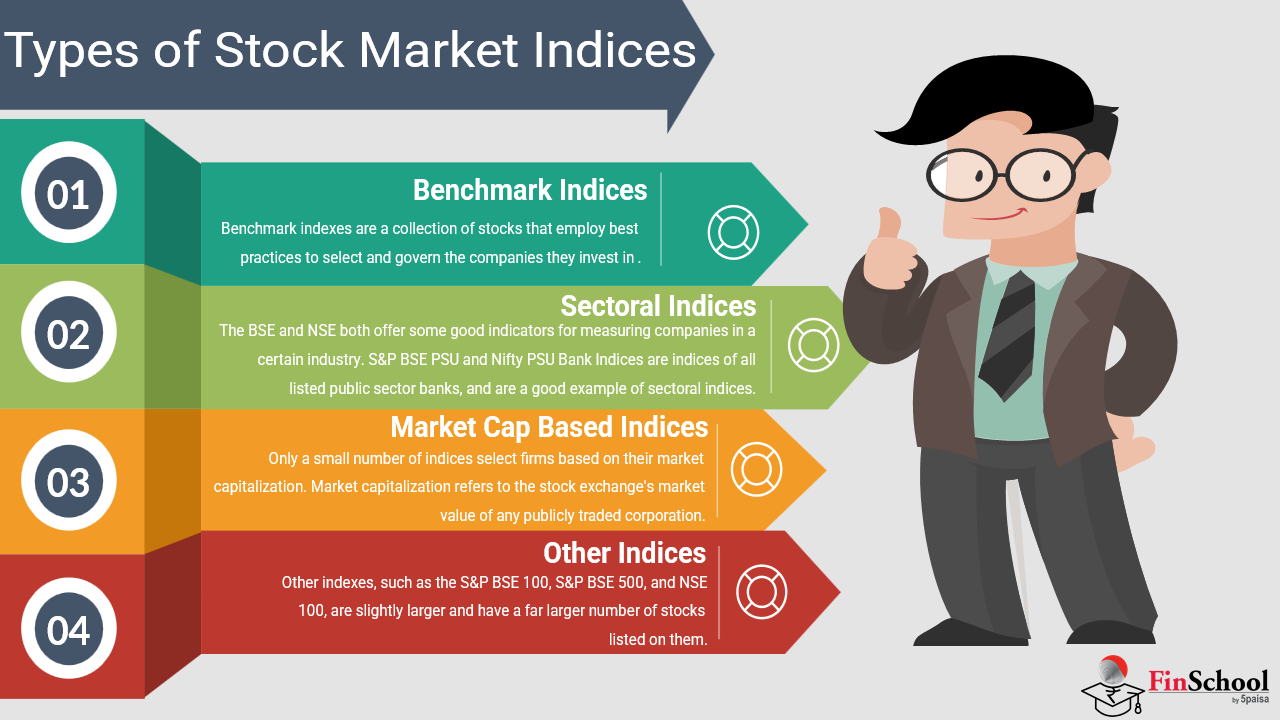

Market Index & Price Movements

Stock indices such as Sensex (BSE) and Nifty 50 (NSE) track the performance of top companies, reflecting market trends. Prices fluctuate based on:

- Company Performance: Earnings, revenue, management decisions.

- Economic Policies: RBI interest rate decisions, inflation, GDP growth.

- Global Events: International market trends, geopolitical developments.

- Investor Sentiment: Market confidence, demand-supply dynamics.

Regulatory & Risk Management

SEBI enforces strict corporate governance and financial reporting norms to protect investors. Additionally, risk management tools such as circuit breakers, margin requirements, and stop-loss mechanisms help prevent excessive market volatility.

1.10 Key Takeaways

- Investing is essential for long-term financial security, especially in an inflation-driven economy.

- Saving offers safety, but investing provides higher returns through compounding and market growth.

- Early investment multiplies wealth dramatically, as shown by the Nirav Vedantexample.

- Smart investing builds multiple income streams and creates financial independence.

- Risks like market, inflation, and liquidity can be managed through diversification and knowledge.

- Not investing leads to eroded savings, missed opportunities, and poor retirement readiness.

- Traders must understand asset classes, technical vs. fundamental analysis, and emotional discipline.

- There are various investment instruments including equities, mutual funds, bonds, and commodities.

- The Indian stock market operates under SEBI’s regulation through NSE and BSE platforms.

After building a strong foundation on the importance of investing, its timing, types of instruments, and the broader financial mindset required, it’s time to zoom in on the actual building blocks of the investment ecosystem—Securities. These financial instruments form the core of most investment strategies, whether you’re dabbling in stocks, bonds, or derivatives.