- Introduction To Mutual Funds

- Funding Your Financial Plans

- Reaching Your Financial Goals

- Understanding Money Market Fund

- Understanding Bond Funds

- Understanding Stock Funds

- Know What Your Fund Owns

- Understanding The Performance Of Your Fund

- Understand The Risks

- Know Your Fund Manager

- Assess The Cost

- Monitoring Your Portfolio

- Mutual Fund Myths

- Important Documents In A Mutual Fund

- Study

- Slides

- Videos

7.1 Understanding Style Box

Most of us wouldn’t buy a new home just because it looked good from the outside. We would do a thorough walk-through first. We’d examine the furnace, check for a leaky roof, and look for cracks in the foundation. Mutual fund investing requires the same careful investigation. You need to give a fund more than a surface-level once-over before investing in it. Knowing that the fund has been a good performer in the past isn’t enough to warrant risking your money. You need to understand what’s inside its portfolio – or how it invests. You must find out what a fund owns to know if it’s right for you.

The stocks and bonds in a fund’s portfolio are so important that you should spend time on the subject. Knowing what a fund owns helps you understand its past behavior, set realistic expectations for what it might do in the future, and figure out how it will work with the other funds you own.

At the most basic level, a fund can own stocks, bonds, cash, or a combination of the three. If it invests in stocks, it could focus on Indian companies. If the fund owns Indian companies, it might invest in giants such as Infosys or reliance or seek out tiny companies that most of us have never heard of. A manager may focus on fast-growing companies that command high prices or on slow-growth (or no-growth) firms trading at bargain-basement prices. Finally, managers can own anywhere from 30 to hundreds of stocks. How a manager chooses to invest your money has a big impact on performance. For example, if your manager devotes much of the portfolio to a single volatile area such as technology stocks, your fund may generate high returns at times but will also be very risky.

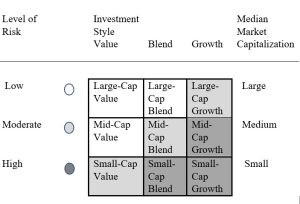

One should look at the matrix given below to analyse the kind of companies the fund owns in the portfolio. This matrix is called as the style box. You can find this on morning star website.

Understanding the difference between a growth stock and a value stock is critical to understanding what makes a fund tick. Growth stocks typically enjoy strong growth in earnings that is often related to a hot new product or service. Because the market expects good things from these fast growers, and earnings growth usually drives a higher share price, investors are willing to pay more for the shares than they will pay for slower growers. Value stocks, on the other hand, look like growth stocks’ less successful cousins. These companies’ earnings are usually growing slowly, if at all, and they often operate in industries that are prone to boom-and-bust cycles. So why does anyone bother with these underachievers? The answer is, because they’re cheap. Managers who focus on value stocks are willing to put up with unattractive historical earnings growth because they think the market is being overly pessimistic about the company’s future. Should things turn out better than the market thinks, the bargain-hunting fund manager stands to profit.

As you might expect, different-style funds tend to behave differently in various market and economic environments, which is why the style box can be so handy. Quickly eyeballing a fund’s style box can give you some indication of how it might perform in good markets and in bad. As a rule of thumb, the large-cap value square of the style box is considered the safest because large-cap companies typically are more stable than small ones. And in down markets, when investors are concerned that stock prices could be too high across the board, value funds’ budget-priced stocks don’t have very far to fall.

Funds that hit the small-growth square of the style box are usually the riskiest. The success of a single product can make or break a small company, and because small-growth stocks often trade at lofty prices, they can take a disastrous tumble if one of the company’s products or services fails to take off as the market expects.

7.2. Examining Sector Weights

Checking a fund’s style box can go a long way toward helping you know what a fund is all about, but it may not tell the whole story. Not all funds that land in the same style box will behave the same way. Both Kotak Bluechip Growth and ICICI Pru Blue chip fund land in the large-cap growth category. Yet they have tended to own very different kinds of large growth stocks. Some funds may go over weight on technology and some may choose to go on financial service.

One can look at a fund’s sector exposure based on the percentage of its portfolio that is committed to stocks in each of 12 industry groupings. They can be further clustered those sectors into one of three “supersectors”: information, services, and manufacturing.

Then the broader classification system because the sectors within our supersector groupings tend to behave in a similar way in various stock market environments. The broader classification system can be developed basis the supersector grouping because the sectors within the supersector groupings tend to behave in a similar way in various stock market environments.

|

Information Economy |

Service Economy |

Manufacturing Economy |

|

Software |

Health Care |

Consumer Goods |

|

Hardware |

Consumer Services |

Industrial Materials |

|

Telecommunications |

Business Services |

Energy |

|

Media |

Financial Services |

Utilities |

|

|

|

In the recent market downturn every sector in our information supersector-hardware, software, telecommunications, and media-incurred terrible losses. If all the funds in your portfolio heavily concentrate their holdings in a certain supersector, it can be a strong indication that your portfolio needs exposure to other parts of the economy. Similarly, if you have a job in a technology-related field, you will want your portfolio to have plenty of exposure outside the information supersector because much of your economic well-being (through your job) is already tied to that area

7.3. Examining Number of Holdings

To understand what a particular fund is up to, knowing the number of stocks it owns can be just as important as any of the other factors we have discussed. For obvious reasons, whether your fund holds 10 stocks or hundreds of them will make a big difference in its behavior. (Because SEBI regulations limit the percentage of its assets that a fund can commit to each holding, fund portfolios rarely have very few stocks).

Funds, which divides its portfolio among a small number of stocks, is likely to see a lot more gyrations in its performance-for better and for worse-than one that spreads its money wide even if both funds are in the same style box

7.4 Checking Up on the Frequency of Portfolio Changes

In addition to style boxes, sectors, and number of holdings, a fund’s turnover rate is another important factor when you’re judging a fund’s style. Turnover measures how much the portfolio has changed during the past year and shows approximately how long a manager typically holds a stock. For example, a fund with a turnover rate of 100 % has a typical holding period of one year; a fund with 25% turnover holds a stock for four years on average.

Turnover is a pretty simple calculation: To figure it out, fund accountants just divide a fund’s total investment sales or purchases (whichever is less) by its average monthly assets for the year.

A fund’s turnover rate can give you important insights into a manager’s style. It can tell you whether a manager tends to buy and hold, picking stocks and sticking with them for the long haul instead of frequently trading in and out of them. To give you a basis for comparison, stock funds on average have turnover rates of 100-120%

Insights about turnover are useful because managers who keep turnover low tend to practice low-risk strategies, whereas high-turnover funds tend to be aggressive and much riskier. That gets back to investment style: As a rule of thumb, the more value-conscious your manager is, the more patient he or she will tend to be with the holdings in the portfolio. Meanwhile, growth oriented fund managers often employ high-turnover strategies, and as we mentioned, higher-priced stocks often equal more risk.

High-turnover funds can incur higher trading costs than low-turnover offerings. When we say trading costs we’re not just referring to the amount that the fund pays its brokers to execute the trade (though those charges can cut into your returns, too). Rather, we’re also referring to the fact that big funds can “move the market” when buying and selling their shares.

Say a big fund like ICICI Pru Bluechip wants to get out of one of its largest positions in a hurry. Because ICICI Pru is flooding the market with shares, it may have to accept lower and lower prices for those shares as it unloads its position. The more the fund engages in such trading, the less attractive its average purchase and sale prices will be, and the less its shareholders will profit. For all these reasons, one could greatly improve your portfolio’s odds of good long-term performance if you put the bulk of your assets in low turnover funds.

Examples of turnover ratio of various bluechip funds. Kotak bluechip fund has the lowest turnover ration amongst all these funds

|

|

ICICI Prudential Bluechip Fund |

Kotak Bluechip Fund |

Axis Bluechip Fund |

|

3 year return |

15.53% |

17.43% |

15.38% |

|

Turnover Ratio |

22 |

11.27 |

51 |