- Introduction

- NFO & Offer Documents

- Learn About Classification of Mutual Funds From Mutual Fund Course

- Things To Know Before Buying MFs

- Understand Measures of Risk & Return in Mutual Fund

- What Are ETFs

- What Are Liquid Funds

- Taxation of Mutual Funds

- Mutual Fund Investment & Redemption Plan

- Regulation of Mutual Funds

- Study

- Slides

- Videos

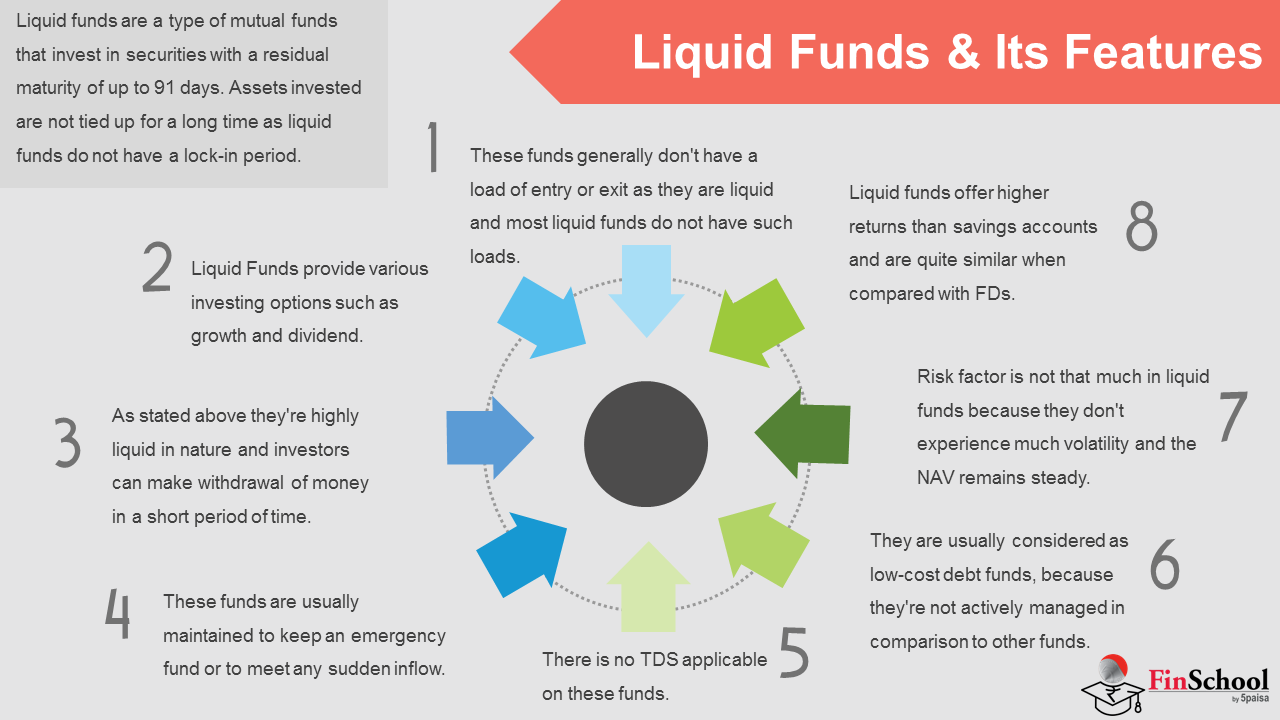

7.1 Liquid Funds & Its features

Liquid funds are a type of mutual funds that invest in securities with a residual maturity of up to 91 days. Assets invested are not tied up for a long time as liquid funds do not have a lock-in period.

The main Features these funds have.

- These funds generally don’t have a load of entry or exit as they are liquid and most liquid funds do not have such loads.

- Liquid Funds provide various investing options such as growth and dividend. And if you choose a dividend then they pay the dividend on a daily, monthly or quarterly basis.

- As stated above they’re highly liquid in nature and investors can make withdrawal of money in a short period of time.

- There is no TDS applicable on these funds.

- Liquid funds offer higher returns than savings accounts and are quite similar when compared with FDs. The returns can range from 7% to 9%.

- Risk factor is not that much in liquid funds because they don’t experience much volatility and the NAV remains steady. Short maturities make these funds less prone to interest rate risk (these risks arise while investing in fixed income instruments with fluctuating interest rate) as compared to other funds.

- They are usually considered as low-cost debt funds, because they’re not actively managed in comparison to other funds.

- These funds are usually maintained to keep an emergency fund or to meet any sudden inflow.

7.2 What Is Portfolio Churning In Liquid Funds?

- A liquid fund can perpetually modify its portfolio, this can be as a result of the paper that it invests in is extraordinarily short term in nature. frequently some papers would be maturing and therefore the scheme can get the money back. The fund manager can use this money to purchase new securities and hence the portfolio can keep changing perpetually.

- As it is understood from this, Liquid Funds can have an especially high portfolio turnover. Liquid Funds see tons of inflows and outflows on a common place. The nature of such schemes is that money is posed for an extremely short term. Also, investors want choices like daily or weekly dividends. All this could mean, the back-end activity for a liquid fund should be quite high-thanks to the massive sizes of the transactions and to the massive volumes. As in equities, we’ve completely different indices for small caps, Midcaps & large caps, equally in bound we’ve indices relying upon the maturity profile of the constituent bonds.

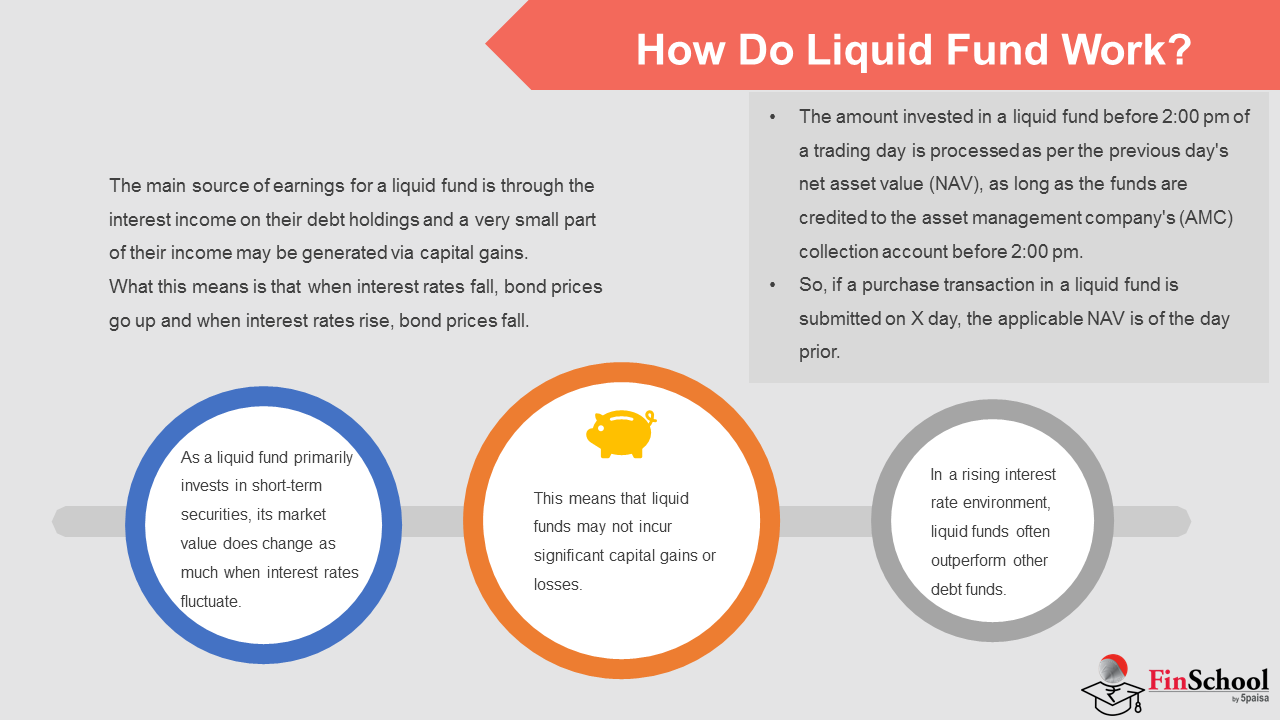

7.3 How Do liquid Fund Work?

The amount invested in a liquid fund before 2:00 pm of a trading day is processed as per the previous day’s net asset value (NAV), as long as the funds are credited to the asset management company’s (AMC) collection account before 2:00 pm. So, if a purchase transaction in a liquid fund is submitted on X day, the applicable NAV is of the day prior.

In case of redemption, the redemption is credited in the investor’s account on the next working day. For instance, redemptions received on Friday before 3.00 pm will be processed on Sunday’s NAV and the payout happens on Monday.

The main source of earnings for a liquid fund is through the interest income on their debt holdings and a very small part of their income may be generated via capital gains. What this means is that when interest rates fall, bond prices go up and when interest rates rise, bond prices fall.

- As a liquid fund primarily invests in short-term securities, its market value does change as much when interest rates fluctuate.

- This means that liquid funds may not incur significant capital gains or losses.

- In a rising interest rate environment, liquid funds often outperform other debt funds because while their interest earnings go up (as maturing shorter tenure securities get parked in higher interest bearing new ones), their market values suffer only to a limited extent due to their relatively lower capital losses (less sensitive to interest rate movements on account of lower maturity investments) vis-à-vis other debt funds.

Liquid Funds are not totally risk-free. For instance, as liquid funds predominantly invest in debt instruments, they are a subject to interest rate risk. So, any change in the prevailing interest rates may cause a rise or fall in the price of the debt instruments, thereby impacting returns of the fund, which vary on a daily basis. Debt instruments also carry credit risk. However, credit risk can be considerably mitigated through conservative investment policy like investing in government securities and high grade credit instruments viz. AAA rated securities.

7.4 Types of Liquid Fund & Features

Liquid funds invest in debt instruments. And to decide which debt instruments they can invest in one has to look at the features of debt instruments.

Main Features

-

Issue date and issue price

Debt securities will always come with an issue date and an issue price at which investors buy the securities when first issued.

-

Coupon rate

Issuers are also warranted to pay an interest rate, also called as the coupon rate. The coupon rate is fixed throughout the life of the security. Coupons are declared either by stating the number (example: 8%) or with a benchmark rate (example: LIBOR+0.5%). It is usually represented as a percentage of the face value or the par value of the bond.

-

Maturity date

Maturity date refers to when the issuer must repay the principal and remaining interest.

The maturity date becomes the critical factor to decide if a particular investment would qualify for a liquid fund or not. As liquid funds can only invest in securities with maturity date of upto 91 days the debt instruments which qualify for investment by liquid mutual funds are:

-

Commercial Papers- Also referred to as “commercial bills,” are unsecured, short-term debt instruments that a corporation or other private organization uses to ensure it has adequate cash on hand to cover operating costs. They usually have very short maturities, often maturing overnight, and are typically issued at market interest rates.

-

Treasury Bill- Just like a Private organisation issues commercial paper when they are in need of money- Government issues treasury bill when they need money from public. They are basically instruments for short term (maturities less than one year) borrowing by the Central Government. At present, the active T-Bills have maturity of 91-days, 182-day and 364-days. Liquid funds can only invest in T-bills of upto 91 days maturity.

7.5 Who Should Invest In Liquid Fund?

- Liquid funds are ideal for people who have idle cash and are looking for short-term investments which generate higher return than a typical savings account. These funds can be used to funnel money into equity funds through a systematic transfer plan (STP).

- STP offers a two-pronged benefit; first, it earns some returns on the money parked in the liquid fund and second, it helps average down the cost of investment in equity, thereby reducing risk related to equity investments. Further, investors who have received windfall gains or come into a large amount of money, but are undecided about where to invest it, can also use liquid funds to park funds for the short-term.