- Introduction

- NFO & Offer Documents

- Learn About Classification of Mutual Funds From Mutual Fund Course

- Things To Know Before Buying MFs

- Understand Measures of Risk & Return in Mutual Fund

- What Are ETFs

- What Are Liquid Funds

- Taxation of Mutual Funds

- Mutual Fund Investment & Redemption Plan

- Regulation of Mutual Funds

- Study

- Slides

- Videos

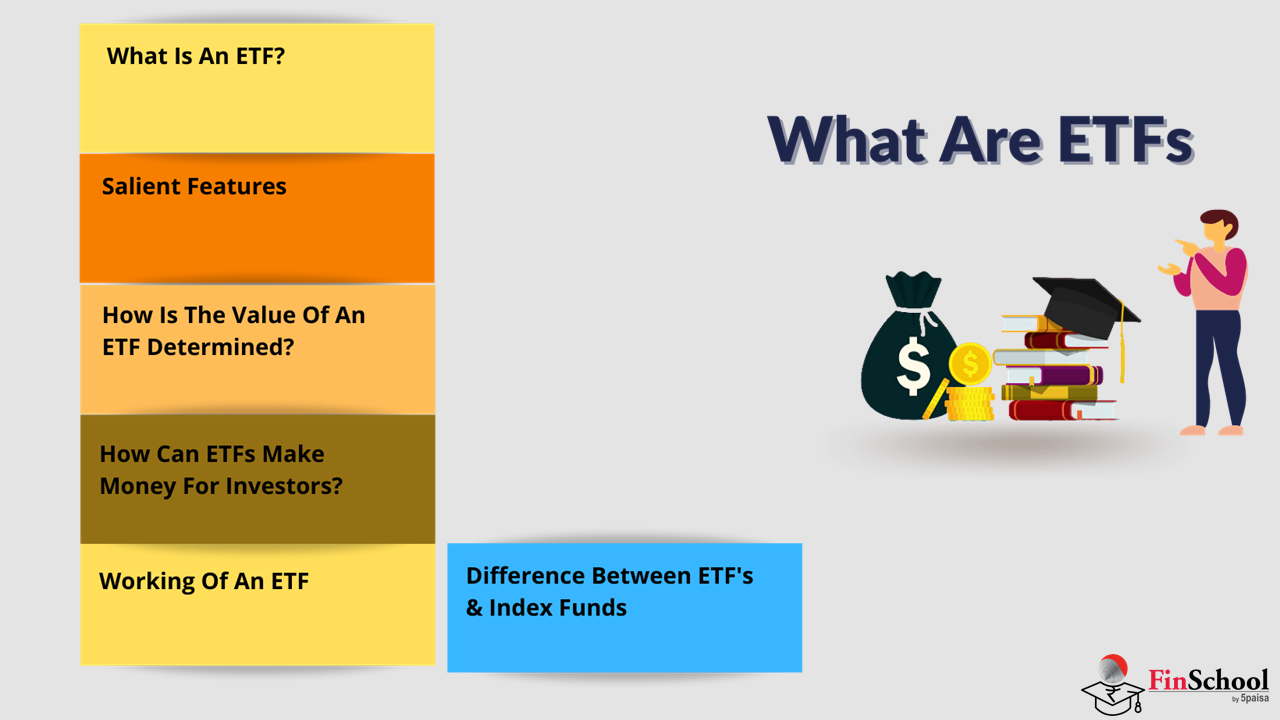

6.1 What Is An ETF?

- An exchange-traded fund (“ETF”) is an investment fund (commonly aiming to track an index) where shares in the investment fund are traded on a stock exchange(s) and can be bought or sold by investors at the current market price throughout trading hours (i.e. it allows for “intra-day” trading).

- It can track an index, sector, commodity, or other asset and may be bought and sold on a stock exchange much like a regular stock. An ETF can be set up to track anything from a single commodity’s price to a big and diverse group of securities. ETFs can even be built to follow certain investing.

- In terms of form, regulation, and administration, ETF funds are comparable to mutual funds. Furthermore, they are a pooled equity fund, similar to mutual funds, that offers diversified investing into numerous asset classes such as stocks, commodities, bonds, currencies, options, or a combination of these. Moreover, they can also be traded like stocks.

- Exchange-Traded Funds (ETFs) come in a variety of shapes and sizes (ETFs). Almost all investors will be able to find an ETF that meets their needs.

Individuals Can Invest in the Following Types of ETFs

- Bond exchange-traded funds (ETFs)These are standard ETFs that aim to provide exposure to various bond kinds. Bonds are a fantastic method to diversify a portfolio and lessen the ups and downs of investment.

- Currency exchange-traded funds (ETFs): These funds allow investors to participate in currency market transactions without having to buy a specific currency. The goal of these investments is to track and profit from changes in the price of a single currency or a means of exchange.

- Liquid ETFs: These funds that invest in a basket of short-term treasury bonds, such as money and money market instruments with short – term bonds, in order to reduce price risk and increase returns while maintaining liquidity.

- Gold ETFs: These securities allow investors to participate in the bullion market without having to purchase gold bars. ETFs that focus on precious metals in general are also available.

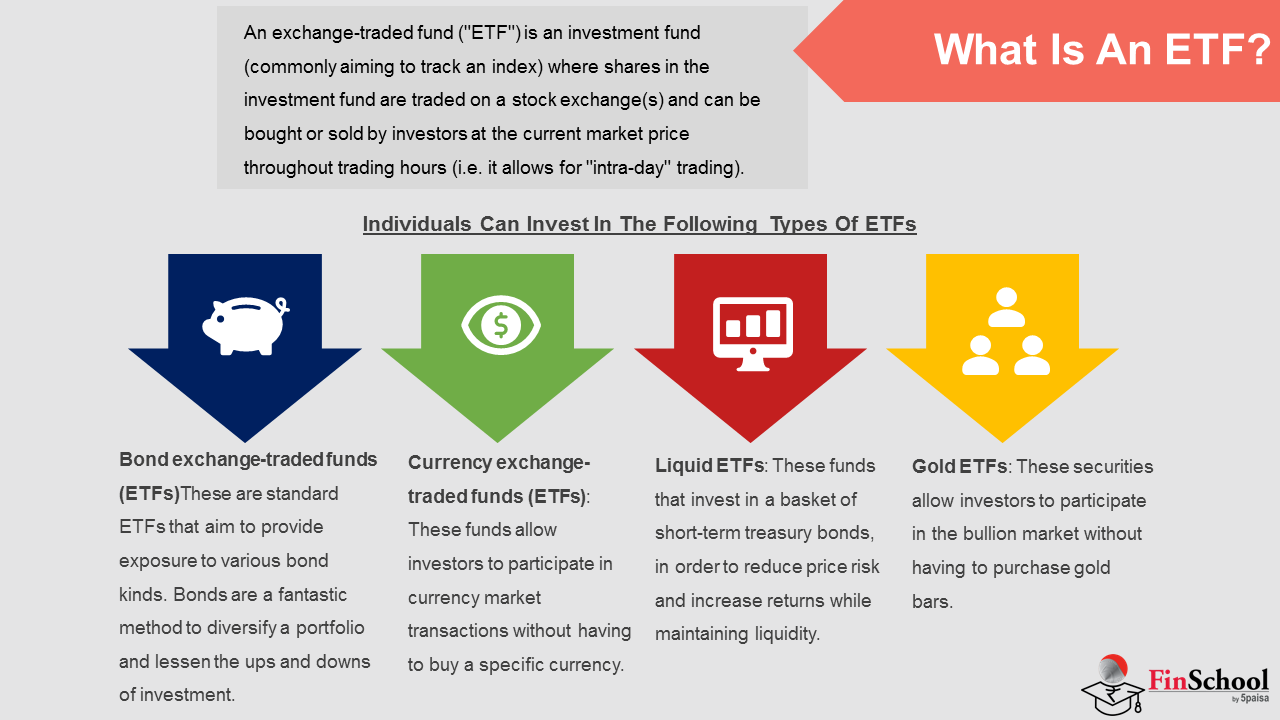

6.2 Salient Features

ETFs, or Exchange-Traded Funds, are index funds that trade on stock markets. ETFs are similar to stock exchanges in that they allow you to buy and sell numerous companies’ equities. ETFs, like index mutual funds, replicate an underlying index, such as the Nifty NSE, BSE Sensex, and so on. An ETF may also develop its own index. As a result, an ETF that tracks the Nifty NSE will contain the same 50 stocks that make up the Nifty NSE, in the same percentage.

Salient features of ETFs are as Follows

-

Investment Style: Passive

The majority of equity and debt funds operate in an active manner. To generate higher returns, the fund management modifies the portfolio and buys/sells securities on a regular basis. ETFs, on the other hand, are a passive investing option. The fund manager’s sole objective is to replicate the composition of the benchmark as closely as possible.

-

Lower Expense-to-Revenue Ratio

ETFs offer a lower expense ratio due to their passive management strategy. This is because ETFs do not require the regular buying and selling that other forms of funds do. After the portfolio is formed according to the underlying benchmark, adjustments are only required if the underlying benchmark changes.

-

Less Risky Than Investing in Direct Equity

Because ETFs are made up of a variety of securities, the risk is much smaller than if you invested in a single stock or a few distinct stocks. In addition, indices like the Nifty and Sensex are made up entirely of high-quality stocks. So, by investing in an ETF mutual mix of stocks with these benchmarks, you are implicitly investing in only high-quality stocks, lowering your risk.

-

Ideal for First-Time Investors

Stock selection is a challenge for new investors who want to invest in the stock market. They can invest in equity through ETFs even if they lack the necessary stock selecting abilities. Because investments are constantly made in line with the pugh, neither the client nor the fund management are needed to look for profit-making possibilities on a frequent basis.

-

Diversification is simple.

Nifty is a stock index that includes firms from a variety of industries, including banking and finance, technology, pharmaceuticals, automobiles, oil and gas, and much more. As a result, investing in an ETF that tracks the Nifty naturally diversifies an investor’s portfolio. Selecting high-quality stocks from a variety of industries necessitates not only a great deal of expertise but also a sizable expenditure. Diversification is made easier and more cost-effective using ETFs.

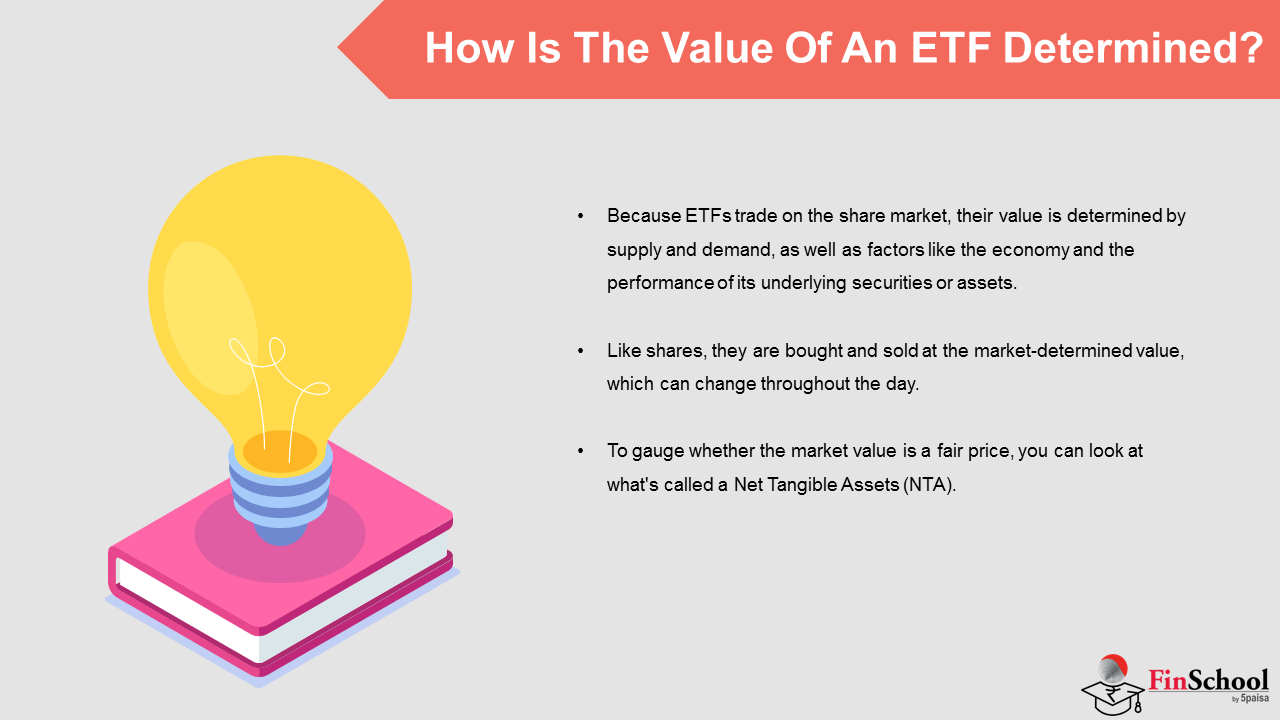

6.3 How Is The Value Of An ETF Determined?

- Because ETFs trade on the share market, their value is determined by supply and demand, as well as factors like the economy and the performance of its underlying securities or assets. Like shares, they are bought and sold at the market-determined value, which can change throughout the day.

- To gauge whether the market value is a fair price, you can look at what’s called a Net Tangible Assets (NTA).

- The NTA is an important calculation that provides what is considered the actual value of the underlying assets for each unit of an ETF. The NTA can be found along with other pricing information about an ETF. By looking at the NTA, an investor can generally see if the ETF is trading above the actual value (called ‘trading at a premium’) or below actual value (called ‘trading at a discount’).

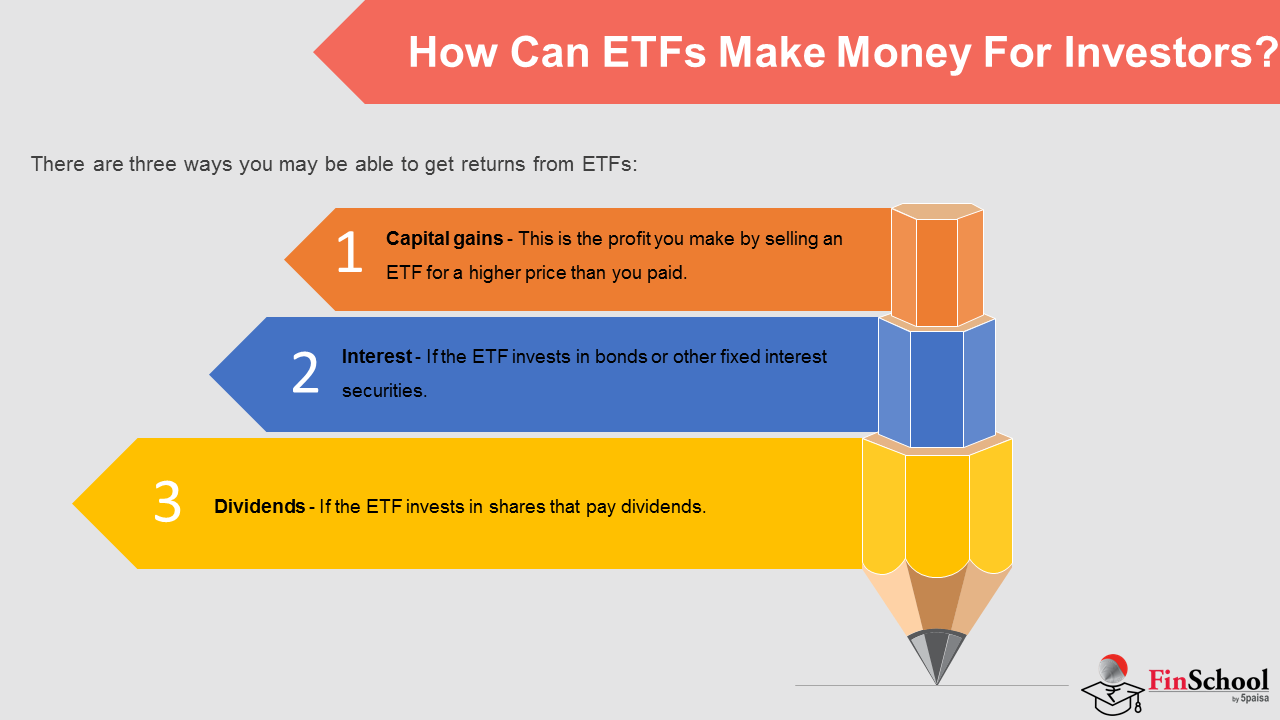

6.4 How Can ETFs Make Money For Investors?

How an ETF makes money depends on the ETF, but generally, there are three ways you may be able to get returns from ETFs:

- Dividends – if the ETF invests in shares that pay dividends.

- Interest – if the ETF invests in bonds or other fixed interest securities.

- Capital gains – this is the profit you make by selling an ETF for a higher price than you paid.

Distributions, or pay-outs, from dividends and interest are usually paid quarterly, semi-annually or yearly – depending on the ETF – and any fund management fees are deducted before distributions are made. Every ETF is different so it is important to read the ETFs product disclosure statement for more details.

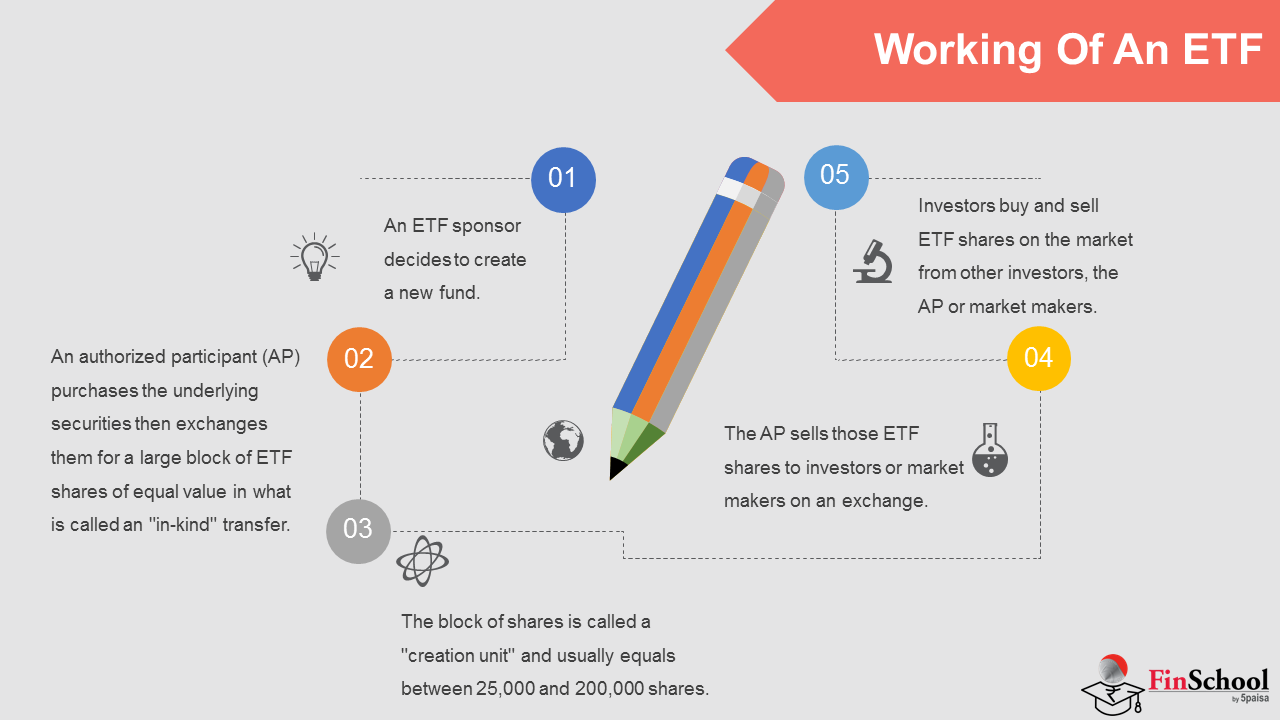

6.5 Working Of An ETF

An exchange traded fund provider relies on other entities called authorised participants, which are usually investment banks, to create and redeem the ETF shares that are available in what is known as the secondary market for ordinary investors to buy and sell.

Authorised participants are appointed by the ETF provider but are not required to trade and nor do they receive fees for their services. Instead they are motivated to participate because they can take advantage of the differences between the net asset value and the trading price of ETF shares to make money. They do this through the so-called creation-redemption mechanism.

Here is How it Works:

- An ETF sponsor decides to create a new fund.

- An authorized participant (AP) purchases the underlying securities then exchanges them for a large block of ETF shares of equal value in what is called an “in-kind” transfer. It is an “in-kind” transaction because the AP is exchanging the same exact securities with the same value; rather than exchanging for cash.

- The block of shares is called a “creation unit” and usually equals between 25,000 and 200,000 shares.

- The AP sells those ETF shares to investors or market makers on an exchange.

- Investors buy and sell ETF shares on the market from other investors, the AP or market makers.

It is worth noting that an AP can also redeem ETF shares by executing this process in reverse. The AP does this by purchasing enough ETF shares to form a creation unit and redeeming them for the same value of underlying securities, thereby removing those ETF shares from the market. This can be an important mechanism for keeping share prices in line with value

The Mechanics Of Share Creation

Because of the way ETF shares are created, bought and sold, they have the potential for lower costs and fewer capital gains than mutual funds.

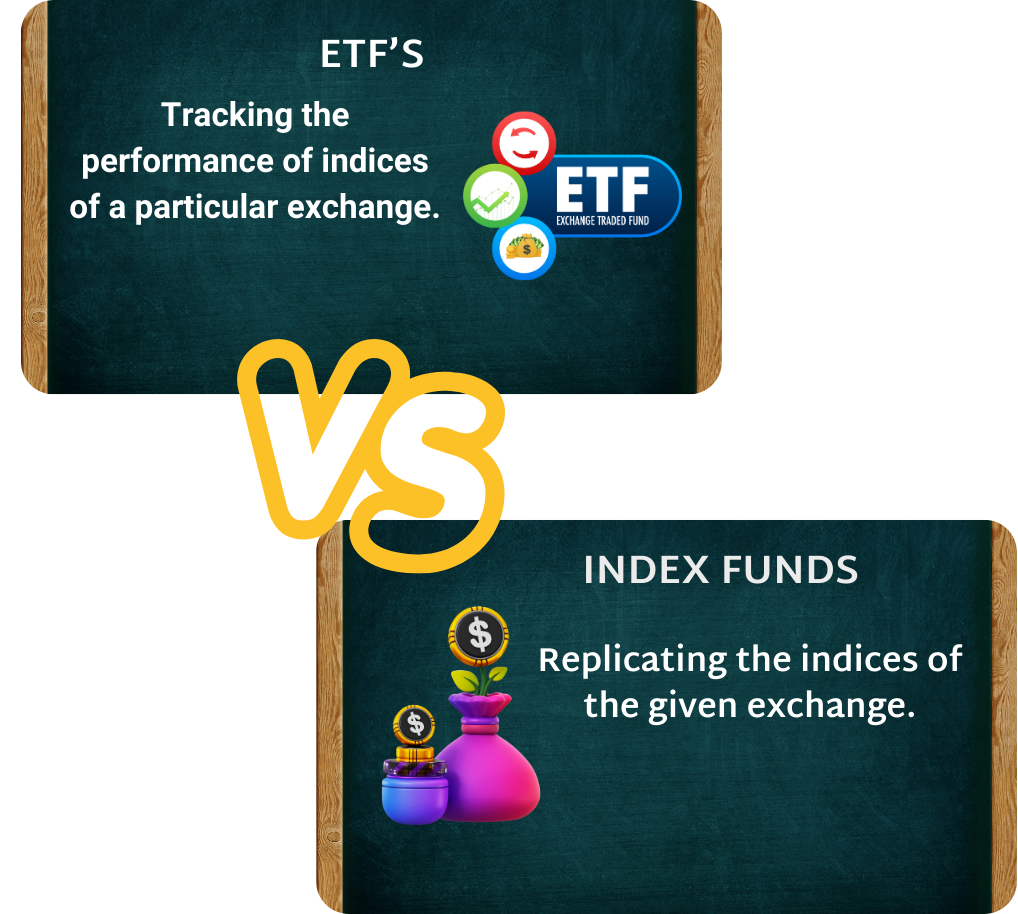

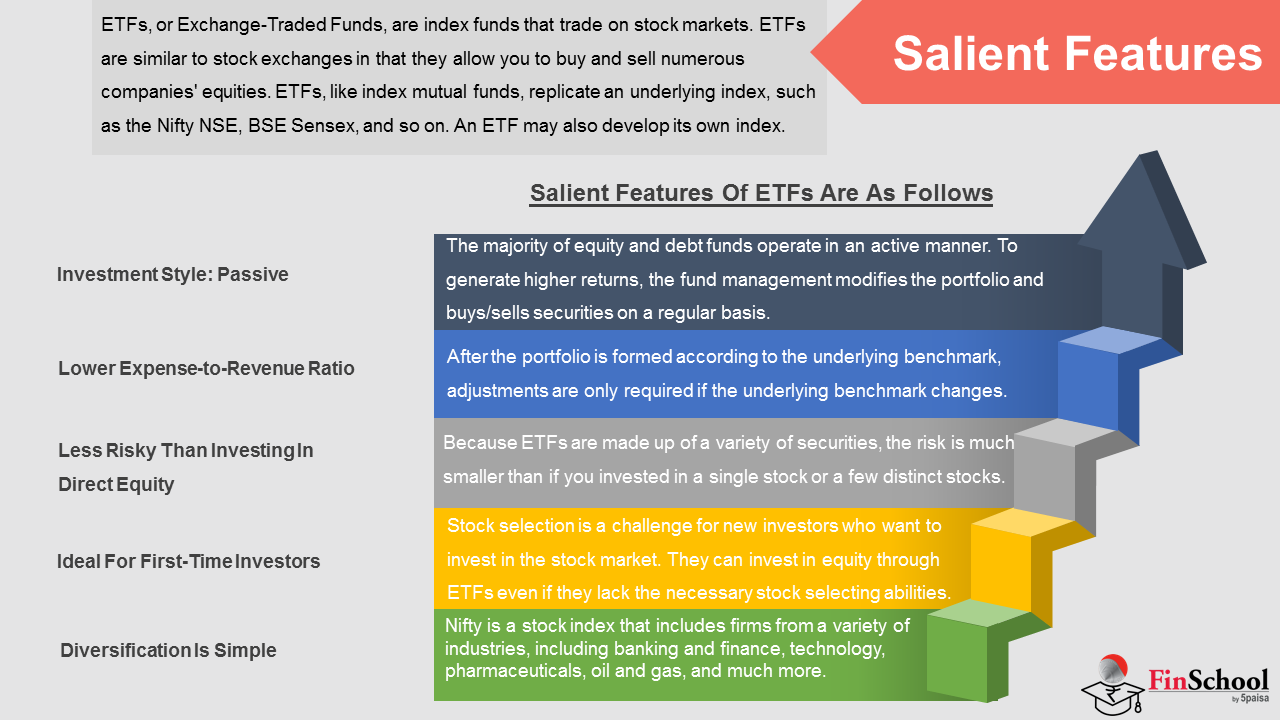

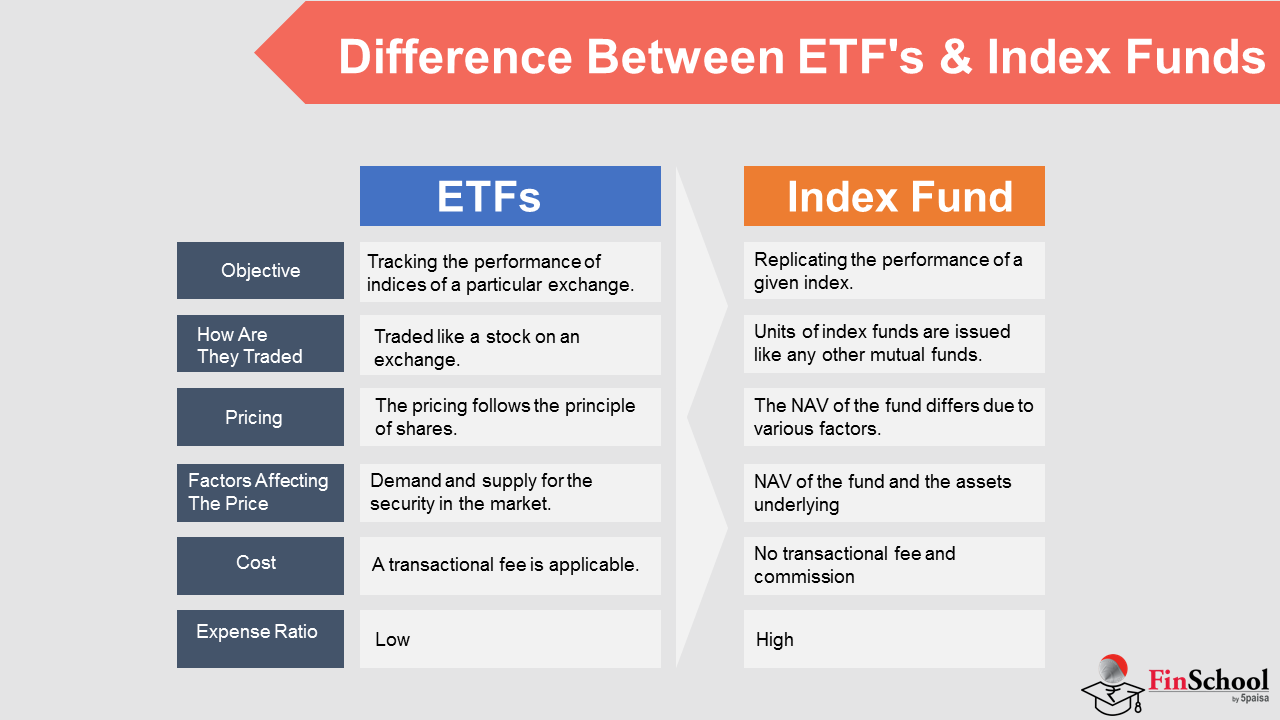

6.6 Difference Between ETF’s & Index Funds

Difference Between ETFs V/s Index Funds: –