- Introduction

- NFO & Offer Documents

- Learn About Classification of Mutual Funds From Mutual Fund Course

- Things To Know Before Buying MFs

- Understand Measures of Risk & Return in Mutual Fund

- What Are ETFs

- What Are Liquid Funds

- Taxation of Mutual Funds

- Mutual Fund Investment & Redemption Plan

- Regulation of Mutual Funds

- Study

- Slides

- Videos

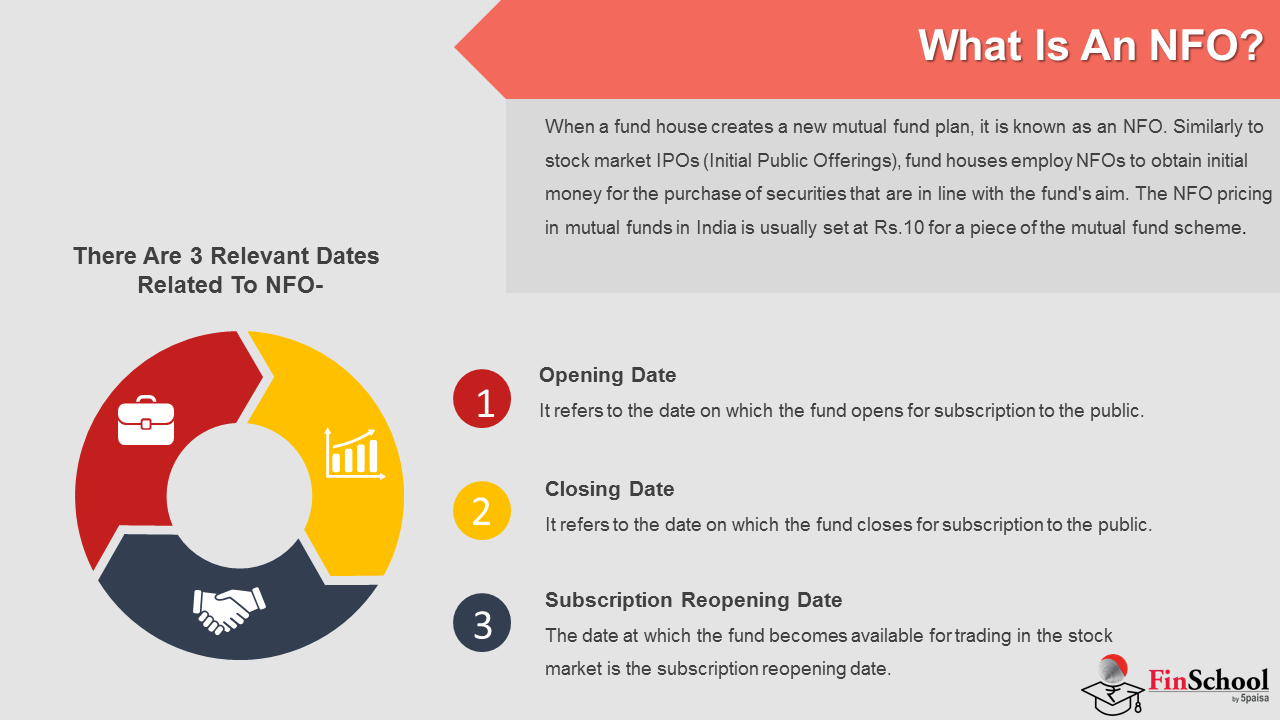

2.1 What Is An NFO?

- A first-time subscription offer for a new scheme offered by asset management businesses is known as a new fund offer (NFO). A new fund offering has been launched in the market to generate funds from the general public in order to purchase securities such as stocks and government bonds.

- An initial public offering (IPO) is analogous to a new fund offer (NFO). Both are initiatives to raise funds to expand operations. New fund offerings may be followed by strong marketing initiatives designed to encourage investors to invest in the fund’s shares. After they start trading publicly, new fund offers often have the potential for great returns.

- In other words, When a fund house creates a new mutual fund plan, it is known as an NFO. Similarly to stock market IPOs (Initial Public Offerings), fund houses employ NFOs to obtain initial money for the purchase of securities that are in line with the fund’s aim.

- The NFO is only open for a limited time, and investors can only invest in the programme at the initial offer during that time. The NFO pricing in mutual funds in India is usually set at Rs. 10 for a piece of the mutual fund scheme. After the NFO period has ended, current and new investors can only buy units in the plan at a set price, which is considerably greater than the NFO price.

There are 3 relevant dates related to NFO –

- Opening Date

It refers to the date on which the fund opens for subscription to the public.

- Closing Date

It refers to the date on which the fund closes for subscription to the public.

- Subscription Reopening Date

After the NFO is over, the scheme will be open for entry and exit as it will now be a listed fund. The date at which the fund becomes available for trading in the stock market is the subscription reopening date.

2.2 Procedure For Investing In An NFO

There are two ways in which one can invest in NFO. Investing in NFO is a relatively painless process, and you can use any of the options listed below to do so. All of the methods have their own advantages; let’s take a closer look and see what they are.

- Using a Broker

This is likely the most simple technique of investing in an NFO. You can always contact a broker for assistance in investing in a new fund offer. Always double-check that the broker you’re speaking with is a licensed one. Your broker can assist you in completing all of the necessary paperwork for the NFO application. One of the most significant advantages of investing through a broker is that you get doorstep services as well as information on the fund’s future results.

- Through a Trading Account on the Internet

This is a different way to invest that is also very convenient. You must have an online trading account if you currently invest in stocks and mutual funds. NFOs can also be invested using the same account. The NFO units can be bought and sold via the internet. The Net Asset Value (NAV) of the investments made can also be tracked using the online trading account.

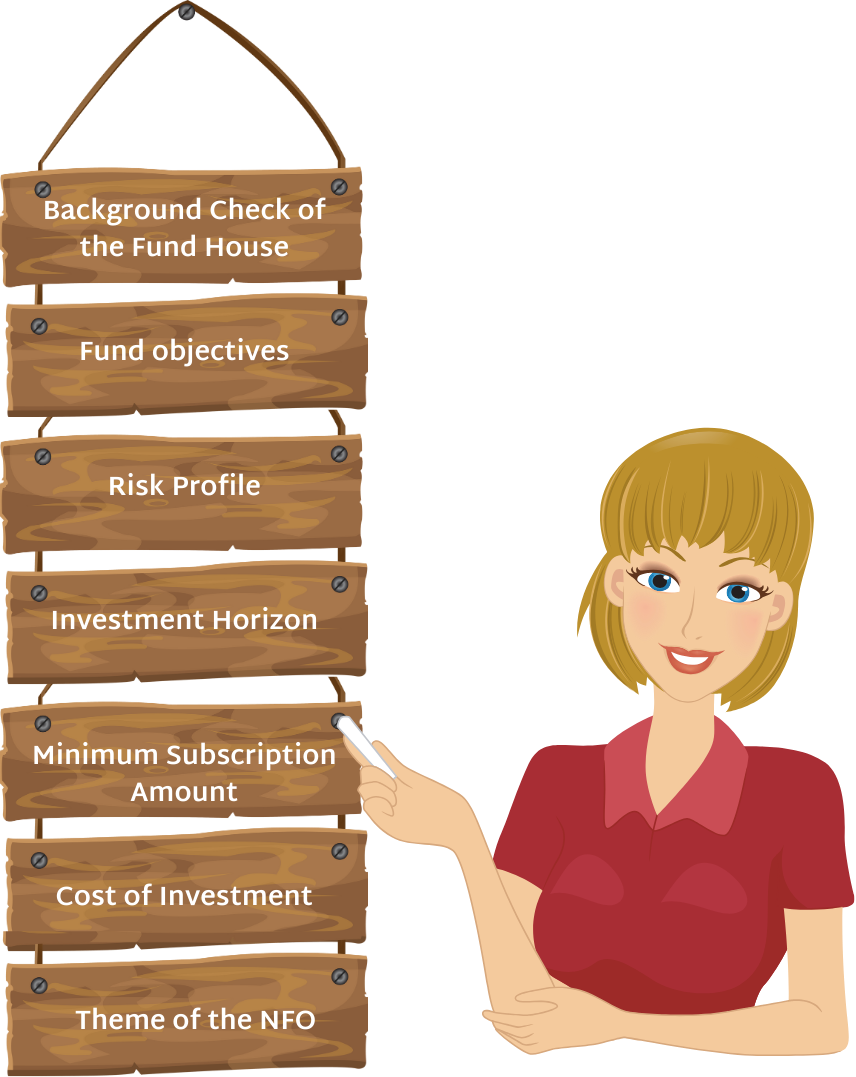

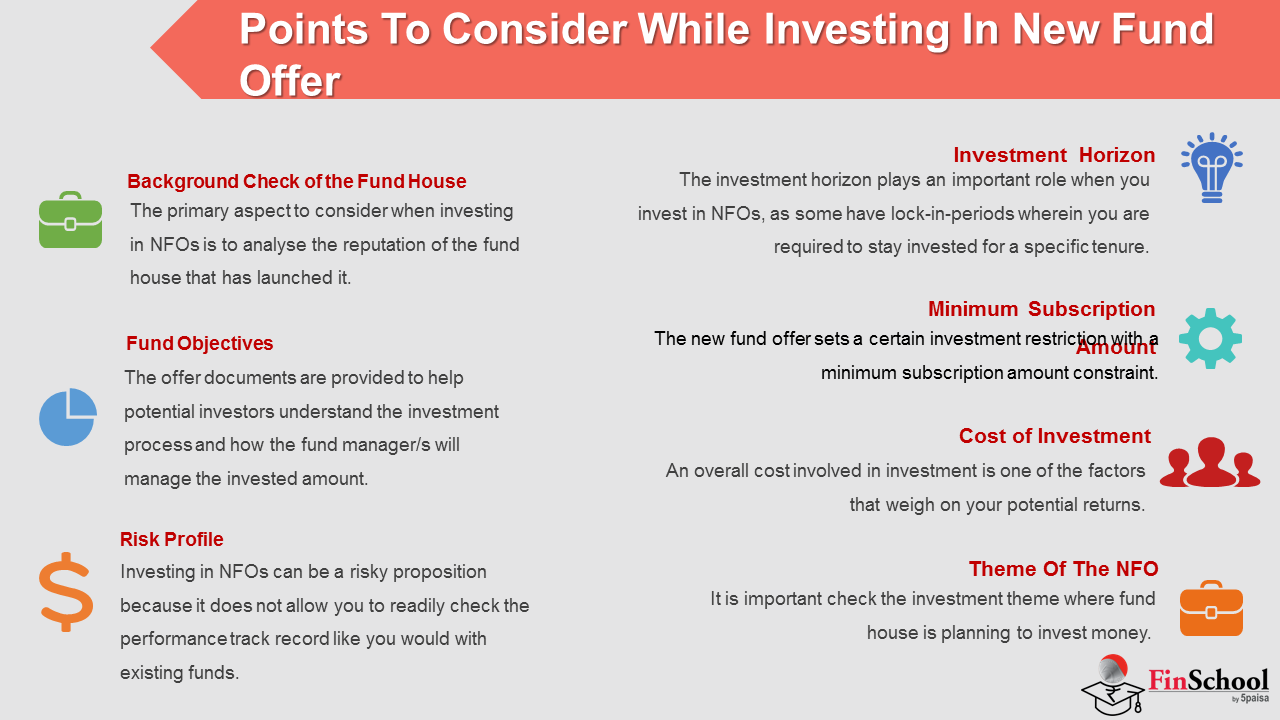

2.3 Points To Consider While Investing In New Fund Offer

Background Check of the Fund House

- The primary aspect to consider when investing in NFOs is to analyse the reputation of the fund house that has launched it. You can take a look at past performance of fund manager. It is also important to check the credibility of fund house before investment. The qualification and experience of the fund manager play a vital role in the fund’s performance.

- New entrants in the mutual fund industry usually have less experience as compared to the existing fund houses that have survived various market cycles. One must analyse the performance of the fund house and the performance it has delivered during various phases of the markets. If it has a proven track record, then there is a possibility that the NFO will be managed prudently and may perform well.

Fund objectives

- The new fund offers are launched along with scheme related information in the documents such as Scheme Information Document (SID), product presentation, etc. These documents highlight the main objectives of the fund, the asset allocation, investment strategy, benchmark index, level of risk, liquidity, fund management team, and other relevant information.

- One should read all the scheme related documents carefully to develop a perception of the viability of the NFO. In simple words, the offer documents are provided to help potential investors understand the investment process and how the fund manager/s will manage the invested amount. Do note that, your investment goals must align with the mutual fund’s objectives to make it a worthy investment for your portfolio.

Risk Profile

- The most important aspect to consider before investing in any NFO is to ensure your risk tolerance. Investing in NFOs can be a risky proposition because it does not allow you to readily check the performance track record like you would with existing funds. Ensure that your risk appetite balances with the fund’s risk profile.

- You should not invest in any NFO that indicates high risk when your risk tolerance is moderate to low. Hence, it is crucial to analyse the risk factor before investing in NFOs. In addition, check if your portfolio is capable of surviving the market volatility as well.

Investment Horizon

- The investment horizon plays an important role when you invest in NFOs, as some have lock-in-periods wherein you are required to stay invested for a specific tenure. This means, you may be unable to redeem it before maturity; and you could be charged an exit load. Evaluate these aspects carefully before investing in NFOs and ensure that your investments are in-line with your investment horizon and goals.

Minimum Subscription Amount

- The new fund offer sets a certain investment restriction with a minimum subscription amount constraint. The minimum investment amount is clearly mentioned in the SID and the application form. It may range from as low as Rs 500 to Rs 5,000. In case, if the minimum subscription amount is higher than what you planned, you can consider opting for the Systematic Investment Plan (SIP), if it is available in the particular NFO.

Cost of Investment

- An overall cost involved in investment is one of the factors that weigh on your potential returns. Most of the NFOs do not have any entry load, but some do charge an exit load. It is deducted from the total redemption amount, which includes your returns, if you redeem before the desired tenure of investment.

- Another element that may affect your returns is the expense ratio. It is the annual fees charged to manage your money invested in the fund. Ensure the fund has a lower expense ratio, as per the SEBI norms.

Theme of the NFO

- It is important check the investment theme. This means where fund house is planning to invest money. Their investment theme (small cap, mid cap, large cap, balance etc.) should match with your objective.

- In addition to this if fund house has unique investment strategy one should look at that.

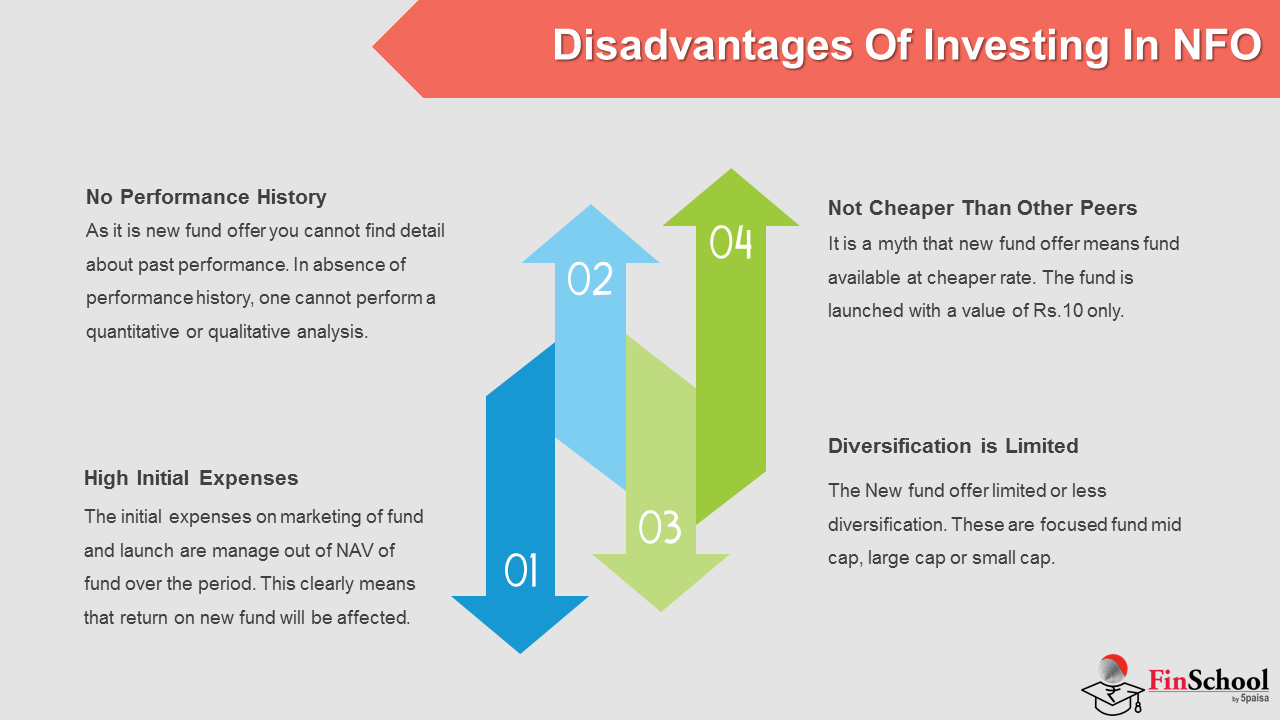

2.4 Disadvantages Of Investing In NFO

- No Performance History

As it is new fund offer you cannot find detail about past performance. In absence of performance history, one cannot perform a quantitative or qualitative analysis.

- High Initial Expenses

The initial expenses on marketing of fund and launch are manage out of NAV of fund over the period. This clearly means that return on new fund will be affected.

- Not cheaper than other Peers

It is a myth that new fund offer means fund available at cheaper rate. The fund is launched with a value of Rs.10 only. The fund collected from investors is used for investing in equity and based on the performance of equity NAV will be declared.

- Diversification is Limited

The New fund offer limited or less diversification. These are focused fund mid cap, large cap or small cap. As fund offer limited diversification it is risky to invest in the fund.

2.5 Offer Document

Similar to the prospectus of a newly listed company, the Offer Document is the most important source of information about mutual fund scheme for investors. It is a legal document and it and describes the product and all the important aspects surrounding its management and maintenance. The OD discloses the following components –

- The names and background of fund managers;

- Details of the investor relation officer;

- Details of the AMC and its directors;

- Details of the custodian and the registrar;

- Details of the transfer agent; and

- Details of the statutory auditor.

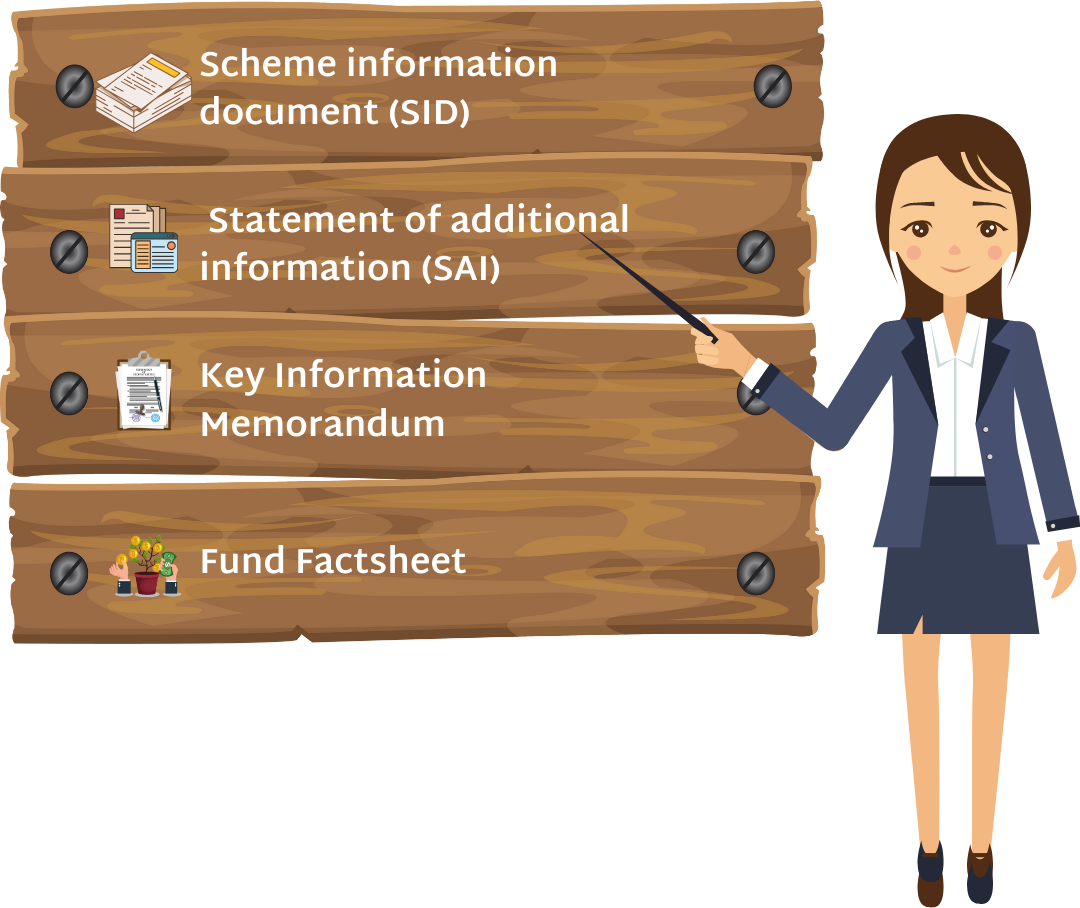

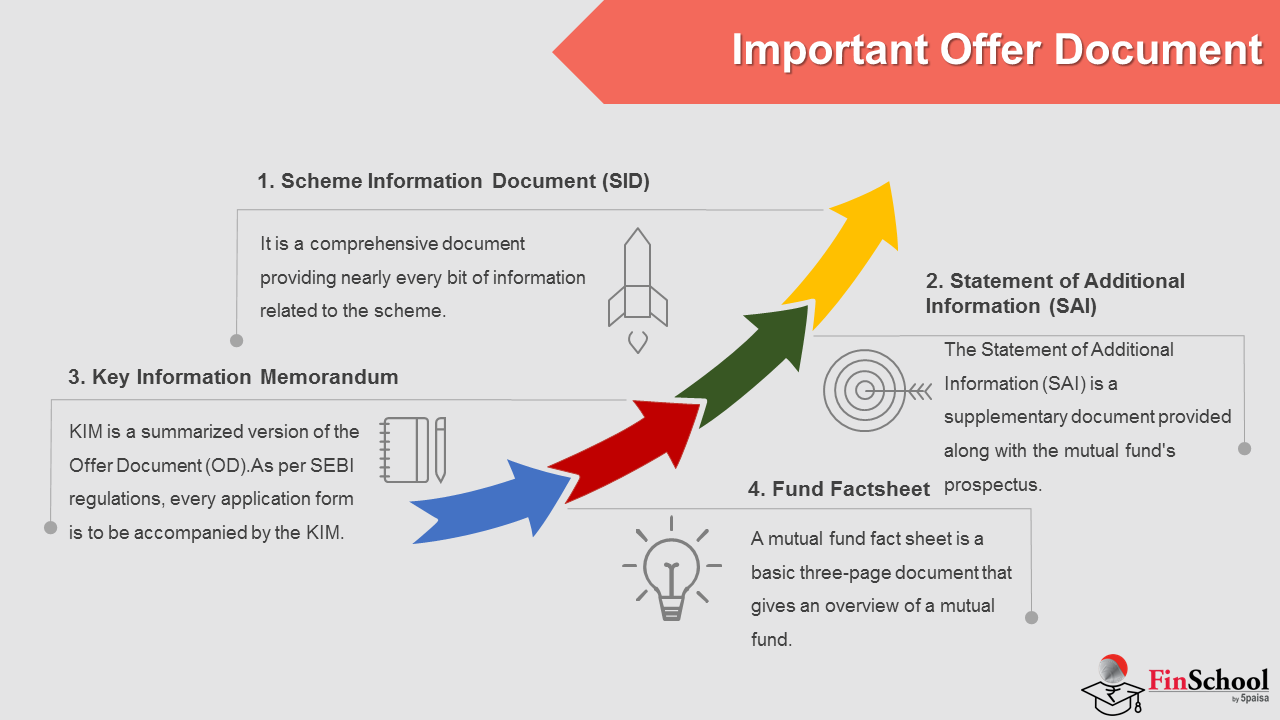

Important Offer Document

1. Scheme information document (SID)

This document comprises the details of one specific mutual fund scheme.

It is a comprehensive document providing nearly every bit of information related to the scheme. Here are the key sections that are important to read:

-

-

Type of Scheme

-

This section indicates whether the scheme is open-ended or close-ended and whether it’s an equity, debt, hybrid or other type of scheme. While open-ended schemes can be redeemed with the mutual fund itself at any time, close-ended schemes can only be redeemed (with the mutual fund) after the defined period or sold on the stock exchange where they are listed. Equity funds carry a higher return potential, though with higher risk; debt funds have a lower return potential than equity, but also carry a lower amount of risk. Hybrid funds (part equity and part debt) carry moderate risk-return potential.

-

-

Investment objective

-

This section enumerates what the scheme aims to achieve. You can find out about the goals of the fund and the expected composition of the underlying portfolio. You can also get a fair idea of the strategies that the fund manager will use to achieve the said objectives. Match these objectives with your investment objectives (i.e. whether to generate regular income through investment in debt instruments or provide long-term capital appreciation through investment in equity and equity-related instruments) and your risk appetite.

-

-

Suitability

-

This section explains what kind of investors should consider the scheme. For instance, for an open-ended equity scheme, it will state that the scheme is suitable for investors who seek long-term capital appreciation and investments in high-growth companies along with the liquidity of an open-ended scheme through investments primarily in equities. This helps you decide whether you will be comfortable investing in the scheme based on its objectives and risks.

-

-

Riskometer

-

This is a visual that looks like the speedometer of a car; it indicates the level of risk inherent in the scheme. It has five sections- low, moderately low, moderate, moderately high, high. The needle points to the level of risk attributed to the scheme. This helps you assess whether you will be comfortable with the inherent risk in the scheme.

-

-

Asset allocation

-

This section states how much of the corpus will be invested in each asset class. The mix between debt & equity is provided

-

-

Benchmark index

-

The index to which the performance of the scheme will be compared is stated here. For instance, for an equity fund, the benchmark index may be the Standard & Poor’s Bombay Stock Exchange (S&P BSE) Sensex or the Nifty 500. This will help you assess the scheme’s performance vis-a-vis a suitable index as a benchmark.

The SID will also provide details such as the plans available (direct plan or regular plan), minimum, maximum and incremental investments, scheme expenses that investors need to bear, systematic investment plan/systematic transfer plan (SIP/STP) information, dividend policy and similar information. Other than these sections, a large amount of legal and process-based content may help you in better understanding the fund.

2. Statement of additional information (SAI)

The Statement of Additional Information (SAI) is a supplementary document provided along with the mutual fund’s prospectus. The document contains additional information about the mutual fund. It also contains multiple disclosures regarding the functionality of the mutual fund. The document is not a mandatory attachment and does not need to be sent to prospective investors except upon request. The statement of additional information helps the mutual funds expand on the details about the funds that are not disclosed within the prospectus. Regular updates take place within the Statement of Additional Information.

It carries the following information:

- Definitions, abbreviations

- Information about the mutual fund (e.g. constitution of the fund, sponsor, trustee, asset management company)

- How to apply for schemes of the mutual fund

- Rights of unit holders

- How securities are valued by the fund

- Tax, legal and other information

3. Key Information Memorandum

KIM is a summarized version of the Offer Document (OD).As per SEBI regulations, every application form is to be accompanied by the KIM. The first time investor should read detailed offer document, once he has gained familiarity with the AMC, he can just refer to KIM.

4. Fund Factsheet

A mutual fund fact sheet is a basic three-page document that gives an overview of a mutual fund. For potential investors, this is a necessary and easy report to read before delving more deeply.

The fact sheet will give you the following information:

- Fees: Before you buy a fund, you need to analyze what fees it comes with, including the fee paid to the fund’s manager. Good returns can be easily obliterated by high fees.

- Risk assessment: The fact sheet will show how risky a fund is. Depending on your age and other holdings, a fund may be too risky for you.

- Returns: The fact sheet will show the fund’s results over the last 10 years. This is crucial to know before you buy a fund, as it gives a sense of the fund’s history and current trajectory.