Chapters

- Introduction

- NFO & Offer Documents

- Learn About Classification of Mutual Funds From Mutual Fund Course

- Things To Know Before Buying MFs

- Understand Measures of Risk & Return in Mutual Fund

- What Are ETFs

- What Are Liquid Funds

- Taxation of Mutual Funds

- Mutual Fund Investment & Redemption Plan

- Regulation of Mutual Funds

- Study

- Slides

- Videos

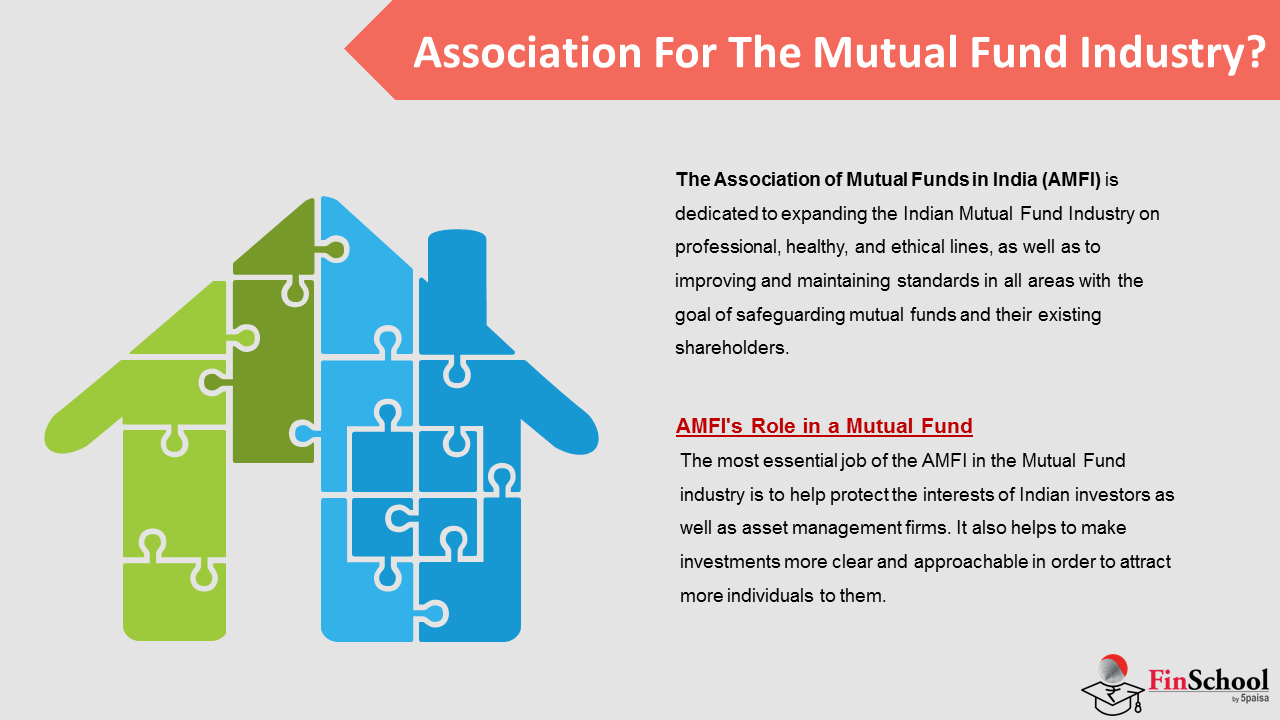

10.1 Association For The Mutual Fund Industry?

- The Association of Mutual Funds in India (AMFI) is dedicated to expanding the Indian Mutual Fund Industry on professional, healthy, and ethical lines, as well as to improving and maintaining standards in all areas with the goal of safeguarding mutual funds and their existing shareholders.

- On August 22, 1995, AMFI, the association of all Asset Management Companies of SEBI regulated mutual funds in India, was established as a non-profit company. There are 45 asset management companies registered with SEBI as of today.

AMFI’s Role in a Mutual Fund

- The most essential job of the AMFI in the Mutual Fund industry is to help protect the interests of Indian investors as well as asset management firms. It also helps to make investments more clear and approachable in order to attract more individuals to them.

- As a result, fund houses, trustees, advisors, intermediaries, and other interested parties should register with AMFI through its website in order to make Mutual Fund investments more accessible.

- Even the advertising put forth by AMFI, in order to enhance clarity in the Mutual Fund market, advise investors about the risks that come with such.

10.2 What Are The Objectives Of AMFI?

The All India Mutual Fund Association has a number of goals. The following are a few of them:

- Assist in the establishment of uniform and professional ethical standards for all Mutual Fund operations.

- Ensure that investors and member companies follow the rules and behave ethically in the course of their operations.

- Assist distributors, advisers, agents, asset management firms, and other entities (those involved in financial services or capital markets) in adhering to the established rules.

- Cooperate closely with SEBI and adhere to its Mutual Fund requirements.

- Educates investors across the country about the many dangers connected with mutual fund investing.

- The RBI, SEBI, the Finance Ministry, and other bodies involved in money market investments are represented by the AMFI.

- AMFI plays a key role in Mutual Funds by disseminating information about these investments and hosting workshops on various funds.

- Ensure that everyone participating follows the code of behaviour, and take disciplinary action if they do not.

- The All India Mutual Fund Association has also established a system via which individuals can lodge grievances or register complaints against fund managers or any asset management organisation, in order to protect the interests of investors.

On the other hand, it aids in the protection of asset management companies’ interests.

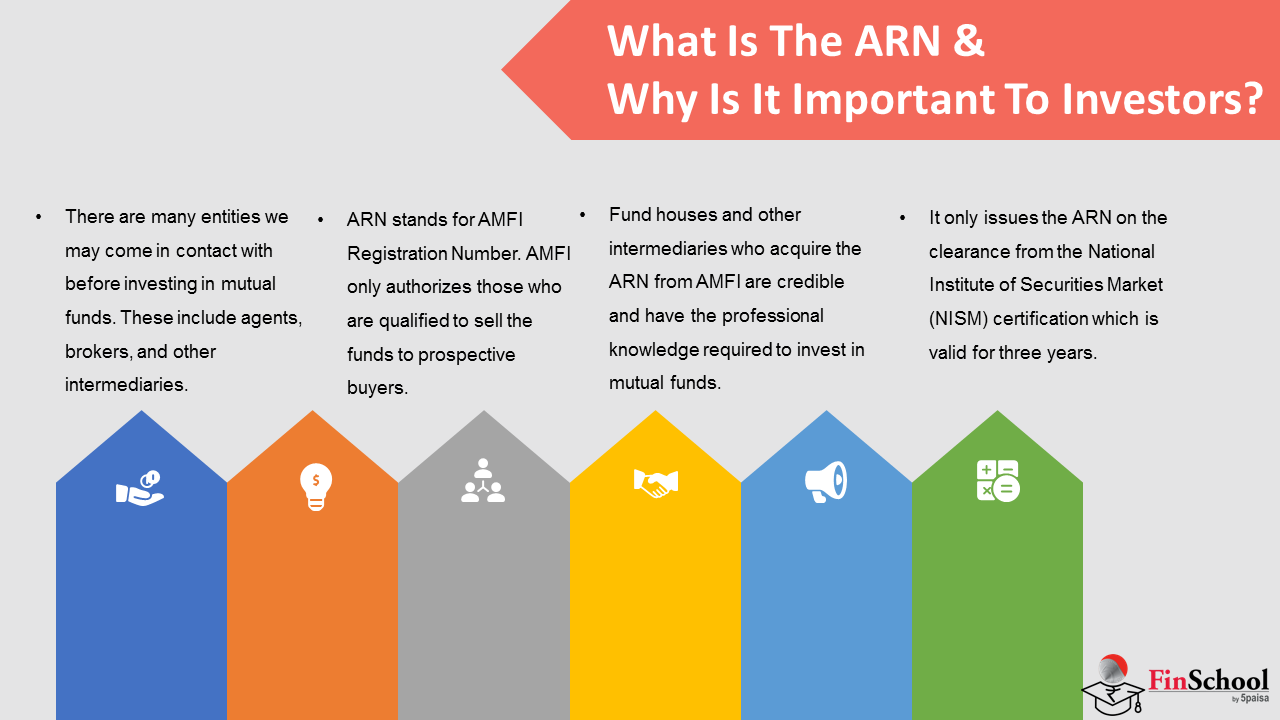

10.3 What Is The ARN & Why Is It Important To Investors?

- There are many entities we may come in contact with before investing in mutual funds. These include agents, brokers, and other intermediaries. But how do we know which of these are credible? This is where the ARN comes into play. ARN stands for AMFI Registration Number.

- AMFI only authorizes those who are qualified to sell the funds to prospective buyers. If any fund manager, broker agent, or any other company wants to deal with mutual funds they have to get a permit from AMFI to do so. This will be provided to them by AMFI in the form of ARN.

- Fund houses and other intermediaries who acquire the ARN from AMFI are credible and have the professional knowledge required to invest in mutual funds. It is a legal offense if anyone sells or recommends mutual fund units to investors without the ARN license

- It only issues the ARN on the clearance of the National Institute of Securities Market (NISM) certification which is valid for three years. The NISM is a training institute that offers certifications related to the securities market.

- It is very important for investors to ensure that the third-party agents or intermediaries have an ARN before investing.

/3

/3