- Introduction to Fundamental Analysis

- Know Steps & Economic Analysis In Fundamental Analysis

- Understanding Basic Terms In Fundamental Analysis

- Understanding Financial Statements in Stock Market

- Understanding Stock Balance Sheet in Stock Market

- Understanding Income Statements in Stock Market

- Understanding Financial Ratios for Stock Analysis

- Understanding Cash Flows

- Understanding Liquidity Ratio in Stock Market

- Understanding Activity Ratio in Stock Markets

- Understanding Risk/Leverage Ratios In Stock Market

- Understanding Profitability Ratios in Stock Market

- Understanding Valuation Ratios in Stock Market

- Study

- Slides

- Videos

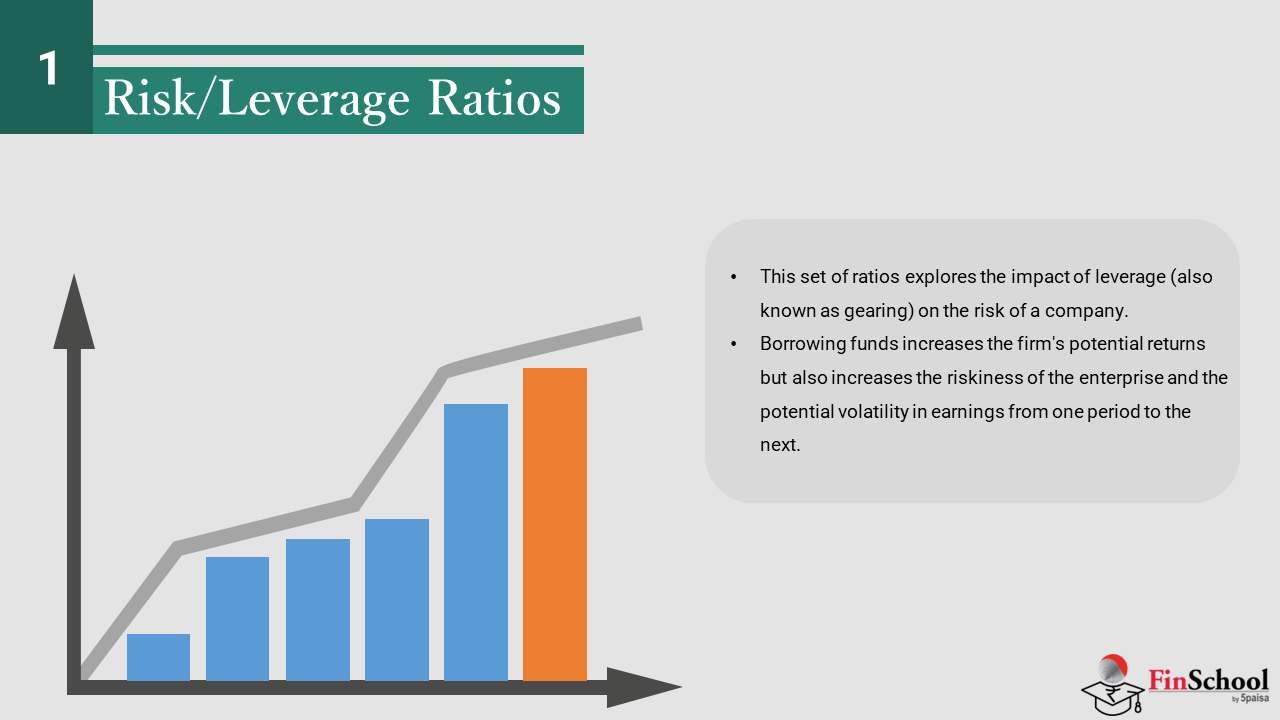

11. Risk/Leverage Ratios

This set of ratios explores the impact of leverage (also known as gearing) on the risk of a company. Borrowing funds increases the firm’s potential returns but also increases the riskiness of the enterprise and the potential volatility in earnings from one period to the next.

11.1 Debt/Equity Ratio

The debt-equity ratio compares a company’s total liabilities to its total shareholders equity. This is a measurement of how much suppliers, lenders, creditors and obligors have committed to the company versus what the shareholders have committed.

It measures the amount of the total debt with respect to the total equity capital. A value of 1 on this ratio indicates an equal amount of debt and equity capital. Higher debt to equity (more than 1) indicates higher leverage and hence one needs to be careful. Lower than 1 indicates a relatively bigger equity base with respect to the debt.

The formula to calculate Debt to Equity ratio is:

Debt Equity Ratio = [Total Debt/Total Equity]

Debt usually includes both long term & Short term debt.

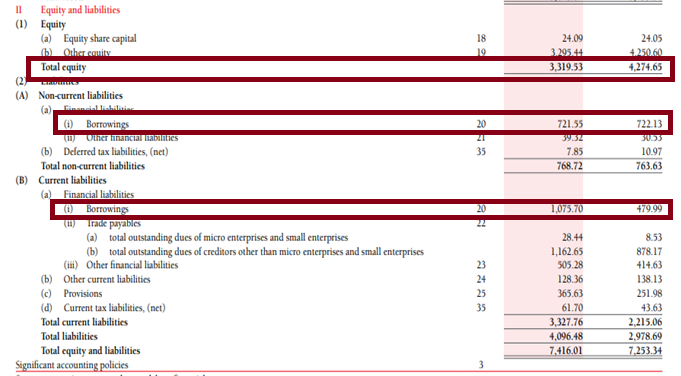

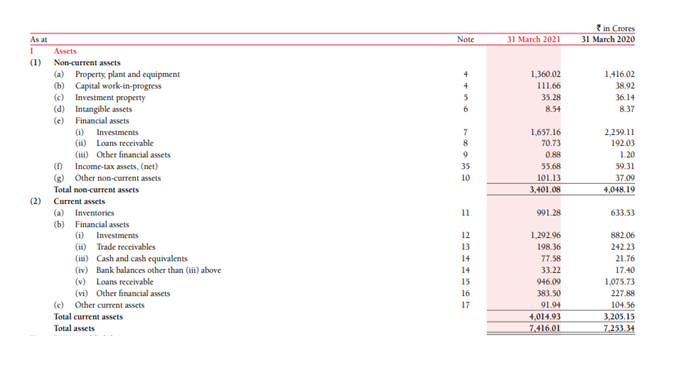

Since Exide industries doesn’t have a long term debt on its books. We wont be able to calculate these ratios for Exide. Thus to understand this better- lets take the balance sheet of Britannia Industries:

Debt= Long term debt+ short term= 721.55+1075.70= 1797.25 crs

Total Equity= 3319.53 crs

Debt/Equity= 1797.25/3319.53= 0.54

11.2 Debt Ratio

The debt ratio compares a company’s total debt to its total assets, which is used to gain a general idea as to the amount of leverage being used by a company. A low percentage means that the company is less dependent on leverage, i.e., money borrowed from and/or owed to others. The lower the percentage, the less leverage a company is using and the stronger its equity position. In general, the higher the ratio, the more risk that company is considered to have taken on.

Debt Ratio = Total Debt/Total Assets

The debt ratio gives users a quick measure of the amount of debt that the company has on its balance sheets compared to its assets. The more debt compared to assets a company has, which is signaled by a high debt ratio, the more leveraged it is and the riskier it is considered to be. Generally, large, well-established companies can push the liability component of their balance sheet structure to higher percentages without getting into trouble.

In case of Britannia- the total debt we know is Rs.3319.53crs

Total Assets is Rs.7416.01crs

Thus Debt/Total Asset= 3319.53/7416.01= 0.44 0r 44%

This means roughly about 44% of the assets held by Britannia is financed through debt capital and therefore 56% is financed by the owners.

11.3 Financial Leverage Ratio

This ratio of the total assets to total equity. This compares the entire asset base on the left hand side of the balance sheet with only that portion of shareholders equity that belongs to the common shareholders. From the perspective of the common shareholders, the firm’s financial leverage measures how much “stuff” the company owns as compared to how much money they have put in.

Financial Leverage = Total assets/ Total common equity

For Britannia Industries- total common equity is Rs.3319.5crs

Thus Financial Leverage Ratio= 7416.01/3319.5= 2.23

This means Britannia Industries supports Rs.2.23 units of assets for every unit of equity. Do remember higher the number, higher is the company’s leverage.

11.4 Interest Coverage Ratio

If the firm has leveraged its shareholder capital by borrowing, it must pay interest on the borrowed funds. The interest coverage ratio (also known as the times interest earned ratio) measures the firm’s ability to meet existing debt payments given the current level of earnings. The relevant measure of income for calculating the interest coverage is earnings before interest and taxes (EBIT) since interest payments are themselves a tax-deductible expense.

The lower the ratio, the more the company is burdened by debt expense. When a company’s interest coverage ratio is only 1.5 or lower, its ability to meet interest expenses may be questionable.

Interest Coverage Ratio = EBIT/ Interest expense

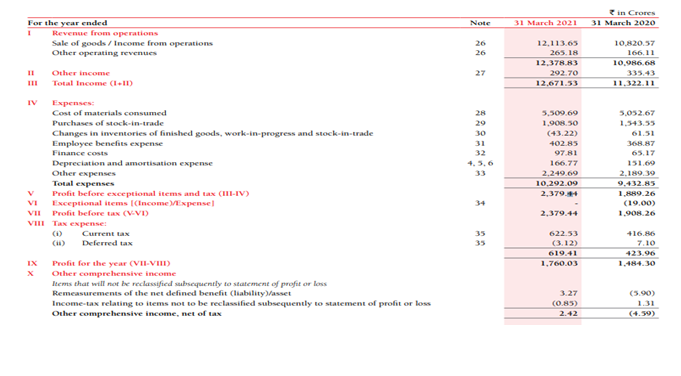

Incase of Britannia industries-

EBIT= Profit before exceptional items & tax+ Finance cost – Other Income

= 2379.44+97.81-292.70

= Rs.2184.55crs

Interest= Rs.97.81

Interest Coverage ratio (2184.55/97.81) = 22.33

Interest coverage ratio of 22.33x suggests that for every Rupee of interest payment due, Britannia industries is generating an EBIT of 22.33times.