- Introduction to Fundamental Analysis

- Know Steps & Economic Analysis In Fundamental Analysis

- Understanding Basic Terms In Fundamental Analysis

- Understanding Financial Statements in Stock Market

- Understanding Stock Balance Sheet in Stock Market

- Understanding Income Statements in Stock Market

- Understanding Financial Ratios for Stock Analysis

- Understanding Cash Flows

- Understanding Liquidity Ratio in Stock Market

- Understanding Activity Ratio in Stock Markets

- Understanding Risk/Leverage Ratios In Stock Market

- Understanding Profitability Ratios in Stock Market

- Understanding Valuation Ratios in Stock Market

- Study

- Slides

- Videos

10. Activity Ratios

-

Operating Ratios also called ‘Activity ratios’ or the ‘Management ratios’ indicate the efficiency of the company’s operational activity. It is another commonly used measurements of liquidity relate to turnover, which can be thought of as the speed with which goods and payments flow into and out of the company or, alternatively, a measurement of how quickly noncash assets are converted into cash. Basically, these ratios look at how efficiently and effectively a company is using its resources to generate sales and increase shareholder value. In general, the better these ratios are, the better it is for shareholders.

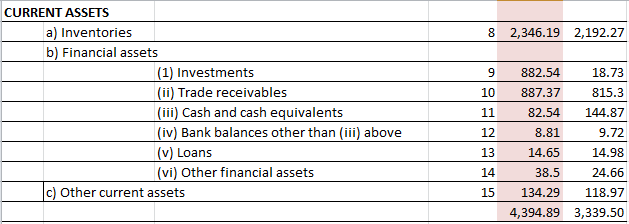

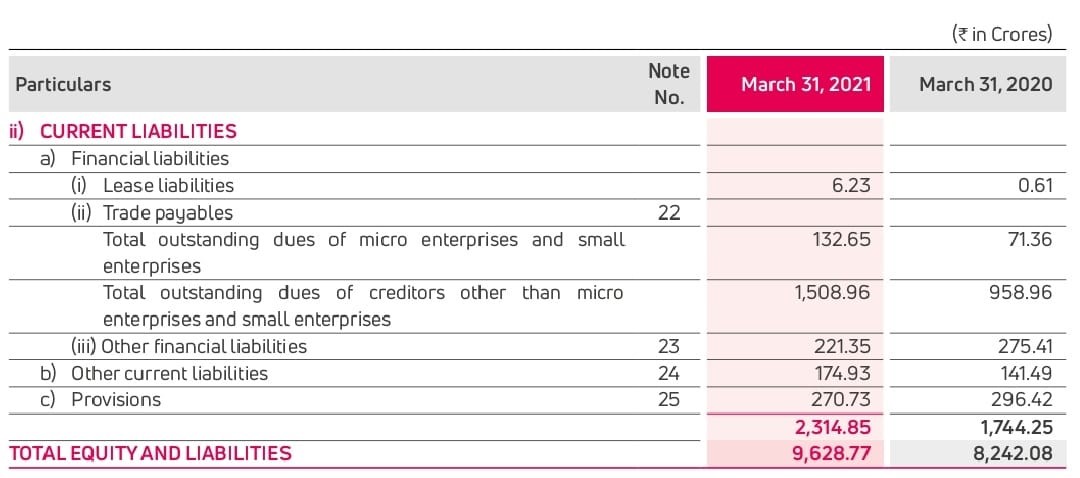

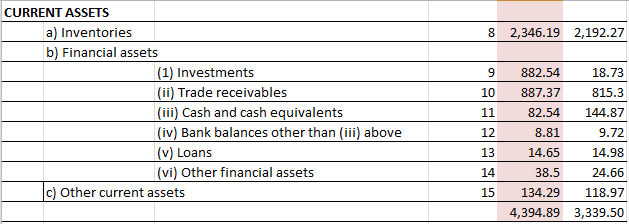

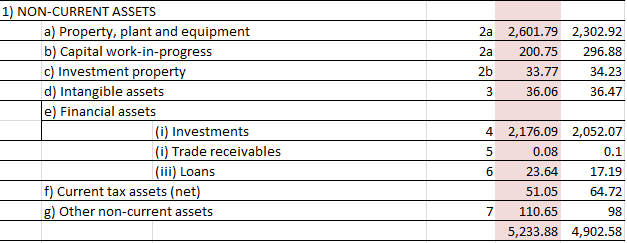

Snapshot of current assets and current Liabilities of Exide Industries: –

10.1 Inventory Turnover Ratio

Inventory Turnover Ratio

Inventory turnover measures how many times the inventory is depleted and restocked in the process of producing the goods sold by the firm during the period. It compares the average amount of inventory held to the total amount of raw materials consumed in the course of one period (COGS).

If a company is selling popular products, then the goods in the inventory gets cleared rapidly, and the company has to replenish the inventory time and again. This is called the ‘Inventory turnover’. For example – Ribbons & Ballons is known for selling cakes. Since they are popular, they probably knows how many cakes he is likely to sell on any given day. For example, he could sell 500 cakes daily across India. This means he has to maintain an inventory of 500 cakes every day. So, in this case the rate of replenishing the inventory and the inventory turnover is quite high. This may not be true for every business.

For instance, think of a 2 wheeler manufacturer. Obviously selling 2 wheeler is not as easy as selling cakes. If the manufacturer produces 100 2W, he may have to wait for sometime before he sells these. Assume, to sell 100 2W(his inventory capacity) he will need 3 months. This means, every 3 months he turns over his inventory. Hence in a year he turns over his inventory 4 times.

Formula for Calculating Inventory Turnover:

Inventory turnover = Cost of goods sold/ Average inventory

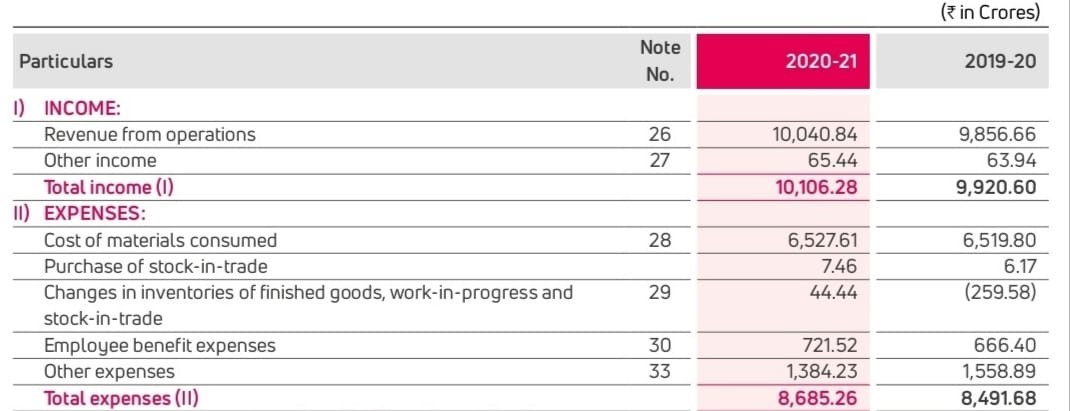

Lets take an example to calculate inventory ratio for Exide industries:

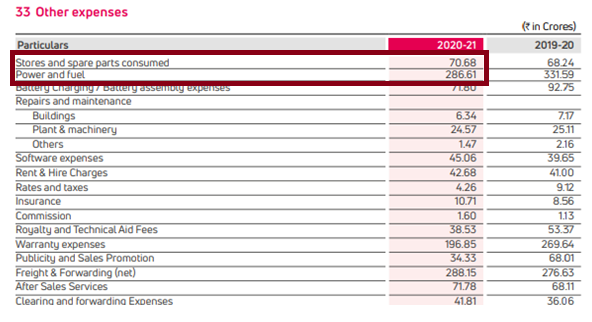

Cost of materials consumed is Rs.6527.61 Crs and purchases of stock-in-trade is Rs.7.46 Crs. These are important components of Cost of Goods Sold (COGS). Additionally there are some more expenses which are direct in nature and might relate to COGS – to identify these we looked at ‘Other Expenses’ in extract of Note 33.

There are two expenses that are directly related to manufacturing i.e. Stores & spares consumed which is at Rs.70.68 Crs and the Power & Fuel cost which is at Rs.286.6 Crs. Hence the

Cost of Goods Sold (COGS) = Cost of materials consumed + Purchase of stock in trade + Stores & spares consumed + Power & Fuel

COGS = 6527.61+7.46+70.68+286.6 = Rs.6892.35 Crs

The next component we need for calculating the inventory turnover is Avg inventory for FY21 & FY20.

From the above balance sheet- inventory for FY21 was 2346.19crs & for FY20 was Rs.2192.27crs- avg works to be 2269.23

Inventory Turnover Ratio (COGS/Avg Inventory) = 6829.35/2269.23= 3x

This means that inventory incase of exide industries turns around 3 times a year. To understand how good or bad this number is we should compare this with competitor numbers

Days In Inventory

If we assume the inventory turnover data is calculated as a yearly figure, then by dividing it into 365 days per year we can measure how many days’ worth of production demand are stored as inventory (or equivalently, how long an average item remains in inventory). This is called the days in inventory.

Days in inventory = 365/ Inventory turnover

= 365/3= 121.66 i.e ~122 days

This means Exide Industries roughly takes about 122 days to convert its inventory into cash.

There are two similar ratios dealing with financial turnover.

10.2 Payables Turnover Ratio

Payables Turnover Ratio-

This measures how long the company is taking to pay off the accounts payable (in fractions of a year), with days in accounts payable the corresponding number of days:

Payables turnover = Cost of goods sold/ Average accounts payable

Accounts payable for FY21 is Rs 1641.61crs (132.65+1508.96) & FY20 is Rs. 1030.32 (71.36+958.96) avg of this comes at Rs.1335.96crs

So Payables Turnover is = 6829.35/1335.96= 5.11x

Days in accounts payable = 365/ Payables turnover= 365/5.11= 71.4 days

This means Exide Industries roughly takes about 71 days to pay off its money to their suppliers. This essentially is the credit period that Exide industries enjoys from its suppliers

10.3 Receivables Turnover Ratio

Receivables Turnover Ratio-

Receivables turnover measures how long customers are taking to pay the company in fractional years and days in accounts receivable the corresponding number of days. Naturally a high number indicates that the company collects cash more frequently

Receivables turnover = Net sales/ Average receivables

From balance sheet-

Trade Receivables for FY21 is Rs 887.37crs & FY20 is Rs. 815.30 avg of this comes at Rs.851.35 crs

Net sales for FY21 is 10040.84crs

Receivables Turnover Ratio = 10040.84/851.35=11.8 times

This means Exide industries receives cash from its customers roughly about 11.8 times a year

Days in accounts receivable = 365/ Receivables turnover

= 365/11.8

= 30.93 days

This means Exide Industry takes about 30 days from the time it sells its products to the time it can collect its money against the sale.

10.4 Fixed Asset Turnover Ratio

Fixed Asset Turnover Ratio

This ratio is a rough measure of the productivity of a company’s fixed assets (property, plant and equipment or PP&E) with respect to generating sales. For most companies, their investment in fixed assets represents the single largest component of their total assets. This annual turnover ratio is designed to reflect a company’s efficiency in managing these significant assets. Simply put, the higher the yearly turnover rate, the better it is.

Fixed Assets Turnover = Net Sales / Total Average Asset

For Exide industry- total average asset would include fixed assets & the capital work in progress.

For FY21- total fixed assets= 2601.79+200.75+33.77= Rs.2836.31crs

FY20- total fixed assets= 2302.92+296.88+34.23= Rs.2634crs

Avg total fixed asset = Rs.2735.15crs

Fixed Asset Turnover = 10040.85/2735.15= 3.67x

10.5 Total Asset Turnover Ratio

Total Asset Turnover Ratio

The total asset turnover (TAT) ratio measures the degree to which a firm generates sales with its total asset base. Here the assets include both the fixed assets as well as current assets. A higher total asset turnover ratio compared to its historical data and competitor data means the company is using its assets well to generate more sales

Total Asset Turnover = Net Sales / Average Total Assets

For Exide Industries- total assets for FY21 is Rs.9628.77 & FY20 is Rs.8242.08- avg comes to 8935.42

Net Sales is Rs.10040.85crs

Total Asset Turnover = 10040.85/8935.42

= 1.12x

10.6 Working Capital Turnover Ratio

Working Capital Turnover Ratio

Working capital, which measures the short-term liquidity of the company and is equal to the difference between the current assets and current liabilities. A company must maintain an adequate buffer of working capital to guarantee that current assets are enough to cover short-term liabilities and avoid an interruption in operations due to an inability to make payments on its obligations. This underscores the significance of “current,” as it applies both to assets (they should be liquid and readily convertible into cash) and liabilities (anything that is coming due in the near term, including the current portion of long-term debt).

Working Capital = Current Assets – Current Liabilities

If the working capital is a positive number, it implies that the company has working capital surplus and can easily manage its day to day operations. However if the working capital is negative, it means the company has a working capital deficit. Usually if the company has a working capital deficit, they seek a working capital loan from their bankers.

The working capital turnover ratio is also referred to as Net sales to working capital. The working capital turnover indicates how much revenue the company generates for every unit of working capital. Suppose the ratio is 8, then it indicates that the company generates Rs.8 in revenue for every Rs.1 of working capital. Higher the number, better it is- as it suggests that the company is generating better sales in comparison with the money it uses to fund the sales.

Working Capital Turnover= Net Sales/ Avg Working Capital

Lets calculate this for Exide Industries:

Working Capital for FY21= Current Assets- Current Liabilities

= 4394.89crs- 2314.85crs

= Rs.2080.04crs

Working Capital for FY20= Current Assets- Current Liabilities

= 3339.50crs- 1744.25crs

= Rs.1595.25crs

Avg. Working Capital [(2080.04+1595.25)/2] = Rs.1837.62crs

Working Capital Turnover (Net Sales/Avg. Working Capital) = 10040.84/1837.5= 5.46x

The number indicates that for every Rs.1 of working capital, the company is generating Rs.5.46 in terms of revenue.