- Study

- Slides

- Videos

6.1 Risk & Return of the Securities

There are significant risk and return differences between debt and equity securities because of differences in cash flow, voting rights, and priority of claims.

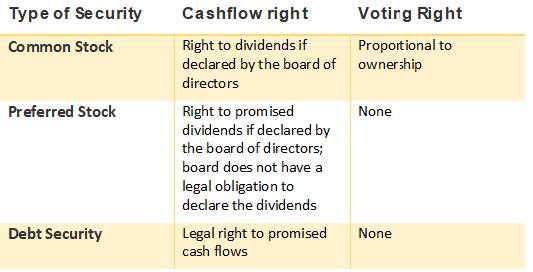

Table below shows the three main types of securities and their typical cash flow and voting rights:

The return potential for both debt securities and preferred stock is limited because the cash flows (interest, dividends, and repayment of par value) do not increase if the company performs well. The return potential to common shareholders is higher because the share price rises if the company performs well. Relative to holders of debt securities and preferred stock, common shareholders expect a higher return but must accept greater risk. The voting rights of common shareholders may give them some influence over the company’s business decisions and thereby somewhat reduce risk.

Debt securities are the least risky because the cash flows are contractually obligated. Preferred stock is less risky than common stock because it ranks higher than common stock with respect to the payment of dividends. The risk of preferred stock is also reduced to some degree by the expectation of a dividend each year. Although the dividend is not a contractual obligation, companies are reluctant to omit dividends on preferred shares. Common stock is considered the riskiest of the three because it ranks last with respect to the payment of dividends and distribution of net assets if the company is liquidated

6.2 Priority of Claims

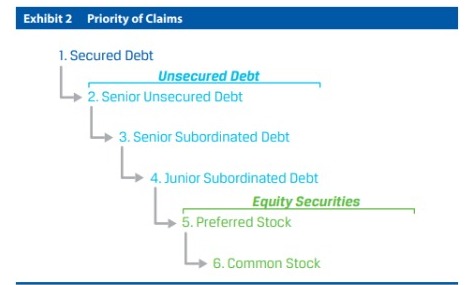

In the event of the company being liquidated, assets are distributed following a priority of claims, or seniority ranking. This priority of claims can affect the amount that an investor will receive upon liquidation. Diagram below illustrates the priority of claims

Debt capital is borrowed money and represents a contractual liability of the company. Debt investors thus have a higher claim on the company’s assets than equity investors.4 After the claims of debt investors have been satisfied, preferred stock investors are next in line to receive what they are due..

Common shareholders are last in line and known as the residual claimants in a company. Common shareholders share proportionately in the remaining assets after all other claims have been satisfied. If funds are insufficient to pay off all claims, equity investors will likely receive only a fraction of their investment back or may even lose their entire investment. Accordingly, investing in equity securities is riskier than investing in corporate debt securities.

6.3 Liability of these Investors

Equity investors are at least protected by limited liability, which means that higher claimants, particularly debt investors, cannot recover money from other assets belonging to the shareholders if the company’s assets are insufficient to fully cover their claims. Because a company is a legal entity separate from its shareholders, it is responsible, at the corporate level, for all company liabilities. By legally separating the shareholders from the company, an individual shareholder’s liability is limited to the amount he or she invested. So, shareholders cannot lose more money than they have invested in the company.

It is important to note that limited liability of shareholders can actually increase the losses of debt investors as the company approaches bankruptcy. As a company moves closer to a bankruptcy filing, shareholders do not have any incentive to maintain or upgrade the assets of the company because doing so might require additional capital, which they might be unwilling to invest. The consequent deterioration in asset quality hurts debt investors because the liquidation value of the company decreases. Debt investors are thus motivated to closely monitor the company’s actions to ensure that the company operates in accordance with the debt contract.

Given the fact that equity securities are riskier than debt securities, shareholders expect to earn higher returns on equity securities over the long term. Because equity is riskier than debt, risk-averse investors may prefer debt securities to equity securities. However, although debt is safer than equity for a given entity, debt securities are not risk-free; they are subject to many risk factors