- Introduction To Mutual Funds

- Funding Your Financial Plans

- Reaching Your Financial Goals

- Understanding Money Market Fund

- Understanding Bond Funds

- Understanding Stock Funds

- Know What Your Fund Owns

- Understanding The Performance Of Your Fund

- Understand The Risks

- Know Your Fund Manager

- Assess The Cost

- Monitoring Your Portfolio

- Mutual Fund Myths

- Important Documents In A Mutual Fund

- Study

- Slides

- Videos

1.1 Introduction

Establishing realistic financial goals is an essential first step toward successful investing. Understanding the investments best suited to helping you achieve your goals is equally important. Most people invest to meet long-term goals, such as ensuring a secure retirement or paying for a child’s college education, but many also have more immediate goals, like making a down payment on a home or automobile.

Mutual funds can fit well into either long- or short-term investment strategy, but the success of your plan depends on the type of fund you choose. Because all funds invest in securities markets, it is crucial to maintain realistic expectations about the performance of those markets and choose funds best suited to your needs.

Returns In Perspective

Successful investors base their performance expectations on historic average returns, and keep short-term market movements in perspective. Although many investors have enjoyed strong returns on their investments in recent years-market volatility can affect the returns.

If one’s investment expectations are too high, and the market reverts to lower level, one may fail to reach their financial goals.

To achieve their goals, it helps to follow a few basic rules of investing as we have discussed in the previous modules:

1. Diversify your investments;

2. Understand the relationship between risk and reward;

3. Maintain realistic expectations about investment performance;

4. Keep short-term market movements in perspective;

5. Consider the impact that fees and taxes will have on your investment return; and

6. Remember that an investment’s past performance is not necessarily indicative of its future results.

1.2 About Mutual Fund

A Mutual Fund is a trust that collects money from investors who share a common financial goal, and invest the proceeds in different asset classes, as defined by the investment objective. Simply put, mutual fund is a financial intermediary, set up with an objective to professionally manage the money pooled from the investors at large.

By pooling money together in a mutual fund, investors can enjoy economies of scale and can purchase stocks or bonds at a much lower trading costs compared to direct investing in capital markets. The other advantages are diversification, stock and bond selection by experts, low costs, convenience and flexibility.

An investor in a mutual fund scheme receives units which are in accordance with the quantum of money invested by him. These units represent an investor’s proportionate ownership into the assets of a scheme and his liability in case of loss to the fund is limited to the extent of amount invested by him.

The pooling of resources is the biggest strength for mutual funds.

The relatively lower amounts required for investing into a mutual fund scheme enables small retail investors to enjoy the benefits of professional money management and lends access to different markets, which they otherwise may not be able to access. The investment experts who invest the pooled money on behalf of investors of the scheme are known as ‘Fund Managers’. These fund managers take the investment decisions pertaining to the selection of securities and the proportion of investments to be made into them. However, these decisions are governed by certain guidelines which are decided by the investment objective(s), investment pattern of the scheme and are subject to regulatory restrictions. It is this investment objective and investment pattern which also guides the investor in choosing the right fund for his investment purpose.

Today, there are a variety of schemes offered by mutual funds in India, which cater to different categories of investors to suit different financial objectives e.g. some schemes may provide capital protection for the risk-averse investor, whereas some other schemes may provide for capital appreciation by investing in mid or small cap segment of the equity market for the more aggressive investor

The diversity in investment objectives and mandates has helped to classify and sub-classify the schemes accordingly. The broad classification can be done at the asset class levels. Thus we have Equity Funds, Bond Funds, Liquid Funds, Balanced Funds, Gilt Funds etc. These can be further sub-classified into different categories like mid cap funds, small cap funds, sector funds, index funds etc.

1.3. Different fund Different Features

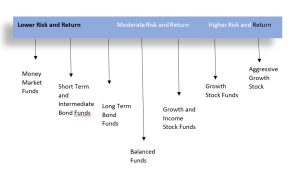

There are three basic types of mutual funds-stock (also called equity), bond, and money market. Stock mutual funds invest primarily in shares of stock listed on the Indian Stock Exchanges. Bond mutual funds invest primarily in bonds. Money market mutual funds invest mainly in short-term securities issued by the government and its agencies, companies, and state and local governments.

Risk and Reward Potential for Types of Funds

Generally, risk and reward go hand in hand with mutual fund investments.

1.4. Why Invest in Mutual Fund ?

Mutual funds make saving and investing simple, accessible, and affordable. The advantages of mutual funds include professional management, diversification, variety, liquidity, affordability, convenience, and ease of recordkeeping-as well as strict government regulation and full disclosure.

Professional Management- Even under the best of market conditions, it takes an astute, experienced investor to choose investments correctly, and a further commitment of time to continually monitor those investments. With mutual funds, experienced professionals manage a portfolio of securities for you full-time, and decide which securities to buy and sell based on extensive research. A fund is usually managed by an individual or a team choosing investments that best match the fund’s objectives. As economic conditions change, the managers often adjust the mix of the fund’s investments to ensure it continues to meet the fund’s objectives

Diversification– Successful investors know that diversifying their investments can help reduce the adverse impact of a single investment. Mutual funds introduce diversification to your investment portfolio automatically by holding a wide variety of securities. Moreover, since you pool your assets with those of other investors, a mutual fund allows you to obtain a more diversified portfolio than you would probably be able to comfortably manage on your own-and at a fraction of the cost.

In short, funds allow you the opportunity to invest in many markets and sectors. That’s the key benefit of diversification

Variety Within the broad categories of stock, bond, and money market funds, you can choose among a variety of investment approaches.

Low Costs Mutual funds usually hold dozens or even hundreds of securities like stocks and bonds. The primary way you pay for this service is through a fee that is based on the total value of your account. Because the fund industry consists of hundreds of competing firms and thousands of funds, the actual level of fees can vary. But for most investors, mutual funds provide professional management and diversification at a fraction of the cost of making such investments independently.

Liquidity It is the ability to readily access your money in an investment. Mutual fund shares are liquid investments that can be sold on any business day. Mutual funds are required by law to buy, or redeem, shares each business day. The price per share at which you can redeem shares is known as the fund’s net asset value (NAV). NAV is the current market value of all the fund’s assets, minus liabilities, divided by the total number of outstanding shares

Convenience You can purchase or sell fund shares directly from a fund or through a broker, financial planner, bank or insurance agent, by mail, over the telephone, and increasingly by personal computer. You can also arrange for automatic reinvestment or periodic distribution of the dividends and capital gains paid by the fund. Funds may offer a wide variety of other services, including monthly or quarterly account statements, tax information, and 24-hour phone and computer access to fund and account information.

1.5. How a Fund Determines Its Share Price

Market Value of a Fund’s Assets (including income and other earnings)= (Rs.60,00,000)

MINUS

Fund’s Liabilities (including fees and expenses)= (Rs.60,000)

DIVIDED BY

Number of Investor Shares Outstanding = 500,000

EQUAL TO

Fund Share Price or Net Asset Value (NAV) Rs. 11.88

Fund share prices appear in the financial pages of most major newspapers. Actual calculations of a fund’s share price can be found in its semi-annual and annual reports