- Study

- Slides

- Videos

8.1 Introduction

Swap refers to an exchange of one financial instrument for another between the parties concerned. This exchange takes place at a predetermined time, as specified in the contract. A swap in simple terms can be explained as a transaction to exchange one thing for another or ‘barter’. In financial markets the two parties to a swap transaction contract to exchange cash flows. A swap is a custom tailored bilateral agreement in which cash flows are determined by applying a prearranged formula on a notional principal. Swap is an instrument used for the exchange of stream of cash flows to reduce risk.

8.2 Advantages & Disadvantages of Swaps

The advantages of swaps are as follows:

1) Swap is generally cheaper. There is no upfront premium and it reduces transactions costs.

2) Swap can be used to hedge risk, and long time period hedge is possible.

3) It provides flexible and maintains informational advantages.

4) It has longer term than futures or options. Swaps will run for years, whereas forwards and futures are for the relatively short term.

5) Using swaps can give companies a better match between their liabilities and revenues

The disadvantages of swaps are:

1) Early termination of swap before maturity may incur a breakage cost.

2) Lack of liquidity.

3) It is subject to default risk

8.3 Equity Swaps

An equity swap is an agreement between two counterparties where one party receives the return on an asset from the other party and makes a payment to the other party based on a fixed or floating rate of interest. The return can be either the price return or the total return (i.e. including dividends). Equity swaps can be combined so that one party receives the return on one asset and pays the return on another asset.

An equity swap can be used to provide long or short exposure to a stock, a stock basket, an index, or a basket of indices. One party receives the returns on the asset and the other party receives financing payments and, typically, net payments are made at periodic reset dates. Equity swaps are OTC contracts so terms can be tailored to suit the investor.

8.4 Example Of Equity Swap

Let’s say an asset manager who manages a fund called Alpha Fund follows a passive investment strategy and his portfolio tracks the Nifty 50 Total Returns Index. The asset manager can enter into an equity swap contract with a counterparty say Goldman Sachs with the following terms:

Notional Principal: Rs.10crs

Alpha Fund pays: Total returns on the Nifty50 Index

Goldman Sachs pays: Fixed 5%

Payments to be made at the end of every six months, that is, 30th June and 31st December

The swap has a maturity of 3 years.

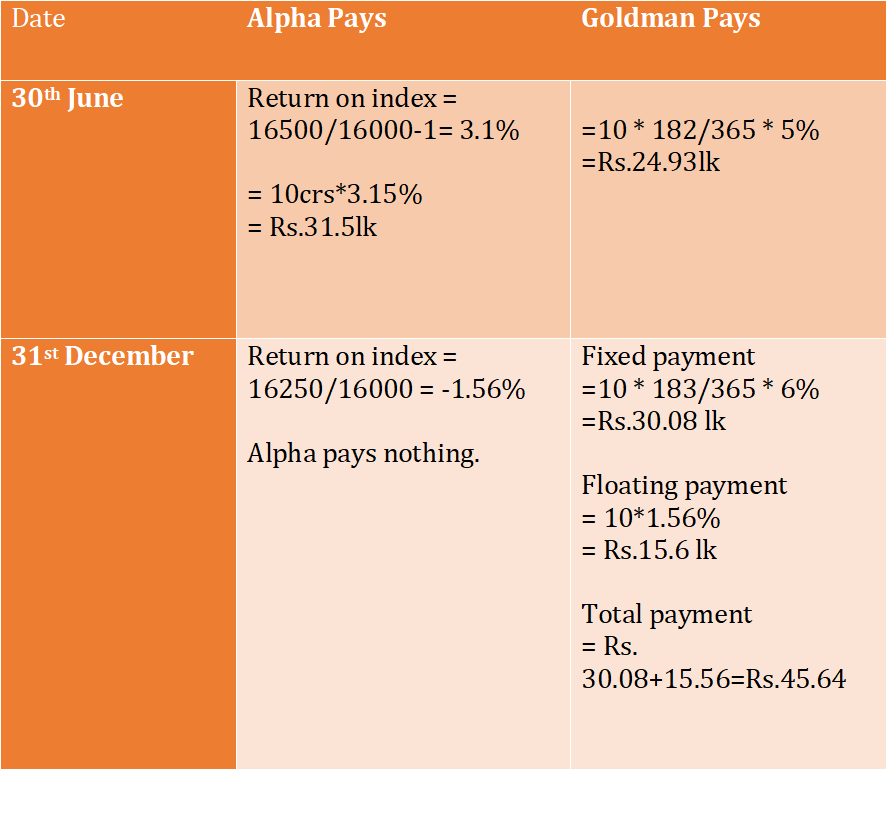

Let’s see how the cash flows turn out in the first year. At the beginning, the Nifty Total Return Index was at 16000 level, on 30th June it was 16500, and on 31st December it was at 16250. Let’s look at the cash flows in both the legs of the transaction.

Let’s make a few observations from the above table:

1. If the index returns are positive, Alpha Fund pays index returns to Goldman and Goldman pays fixed rate to Alpha.

2. If the index returns are negative, Alpha pays nothing and Goldman pays the fixed rate plus any loss on the index returns. It’s as if Alpha sold out its positions in stocks and had a fixed rate position instead.

3. The fixed payments are calculated on actual/365 basis.

4. The amount of payment is not known till the last day of the payment.

5. The net effect of the swap is that a position in an equity portfolio has been converted into a fixed income position.

An equity swap can be of three types: the first leg will be a fixed rate, a floating rate or an equity or index return, while the other let will always be an equity or index return. So, an equity swap can have both the legs as returns from two different equities or equity indexes.

8.5 Difference Between Swap and Futures

- Swaps and futures are both derivatives, which are special types of financial instruments that derive their value from a number of underlying assets.

- A swap is a contract made between two parties that agree to swap cash flows on a date set in the future.

- A futures contract obligates a buyer to buy and a seller to sell a specific asset, at a specific price to be delivered on a predetermined date.

- Futures contract are exchange traded and are, therefore, standardized contracts, whereas swaps generally are over the counter (OTC); they can be tailor made according to specific requirements.

- Futures require a margin to be maintained, with the possibility of the trader being exposed to margin calls in the event that the margin falls below requirement, whereas there are no margin calls in swaps.