- Study

- Slides

- Videos

3.1 Introduction To Forward Contract

Forward contract is an agreement made directly between two parties to buy or sell an asset on a specific date in the future, at the terms decided today. Forwards are widely used in commodities, foreign exchange, equity and interest rate markets.

The basic difference between cash market and forwards? Assume on Nov 9, 2022 you wanted to purchase gold from a goldsmith. The market price for gold on Nov 9, 2022 was Rs. 34000 for 10 gram and goldsmith agrees to sell you gold at market price. You paid him Rs.34000 for 10 gram of gold and took gold. This is a cash market transaction at a price (in this case Rs.34000) referred to as spot price.

Now suppose you do not want to buy gold on Nov 9, 2022, but only after 1 month. Goldsmith quotes you Rs.34,500 for 10 grams of gold. You agree to the forward price for 10 grams of gold and go away. Here, in this example, you have bought forward or you are long forward, whereas the goldsmith has sold forwards or short forwards. There is no exchange of money or gold at this point of time. After 1 month, you come back to the goldsmith pay him Rs. 34,500 and collect your gold. This is a forward, where both the parties are obliged to go through with the contract irrespective of the value of the underlying asset (in this case gold) at the point of delivery.

Essential features of a forward are:

- It is a contract between two parties (Bilateral contract).

- All terms of the contract like price, quantity and quality of underlying, delivery terms like place, settlement procedure etc. are fixed on the day of entering into the contract.

In other words, Forwards are bilateral over‐the‐counter (OTC) transactions where the terms of the contract, such as price, quantity, quality, time and place are negotiated between two parties to the contract. Any alteration in the terms of the contract is possible if both parties agree to it.

In the above mentioned example, if on Jan 9, 2022 the gold trades at Rs. 34,600 in the cash market, the forward contract becomes favorable to you because you can then purchase gold at Rs. 34,500 under the contract and sell in cash market at Rs. 34600 i.e. net profit of Rs. 100. Similarly, if the spot price is 15,400 then you incur loss of Rs. 100 (buy price – sell price).

3.2 Features Of Forward Contract

-

Bilateral: Forward contracts are bilateral contracts, and hence, they are exposed to counter-party risk.

-

More Risky Than Futures: There is risk of non-performance of obligation by either of the parties, so these are riskier than futures contracts.

-

Customised Contracts: Each contract is custom designed, and hence, is unique in terms of contract size, expiration date, the asset type, quality, etc.

-

Long and Short Positions: In forward contract, one of the parties takes a long position by agreeing to buy the asset at a certain specified future date. The other party assumes a short position by agreeing to sell the same asset at the same date for the same specified price. A party with no obligation offsetting the forward contract is said to have an open position. A party with a closed position is, sometimes, called a hedger.

-

Delivery Price: The specified price in a forward contract is referred to as the delivery price. The forward price at the time of execution of contact is the delivery price that would be applicable to the contract. It is important to differentiate between the forward price and the delivery price. Both are equal at the time the contract is entered into. However, as time passes, the forward price is likely to change whereas the delivery price remains the same.

3.3 Example On Working Of A Forward Contract

Let’s assume that the company enters into an agreement to buy 100 kgs of coffee beans at Rs 1,000 per kg. The agreement value is Rs 1 Lakh.

At the time of harvest, the demand for coffee beans rises and the price per kg increases to Rs 1,200. In this case, since the coffee company’s view has come true, they make a profit. So, even though the farmer will make a loss of Rs 200 per kg (Rs 1,200-Rs 1,000) he must still obey the contract and sell the beans at a pre-decided price of Rs 1,000 per kg. Now you may be wondering the farmer is at a loss here. But that’s not the case. On the contrary, a forward contract has helped him mitigate future uncertainties. A forward contract has acted as an excellent risk mitigation tool for him.

Now let’s look at the other side of the picture. Let’s assume the supply of coffee beans rises due to abundant harvest. The price per bag falls to Rs 800. Now the farmer has made a profit of Rs 200 per kg as he has already entered into a forward contract at Rs 1,000 per kg. The company pays the price decided at the time of entering into the agreement and the farmer delivers the beans. This means the contract is settled with physical delivery of goods on the specified date. This is known as physical settlement.

There is also another way to settle a forward contract – cash settlement. The company and farmer can mutually decide to settle the contract without any physical delivery. They can settle the difference in cash based on the price of coffee beans at that point.

For ex. If the price falls to Rs 950 per kg, then the company can pay Rs 5,000 (Rs 1,000-Rs 950 * 100 kgs) to the farmer. He can then take his produce to the local market and sell it for Rs 95,000. The farmer still gets the same Rs 100,000 he was promised at the time of entering the forward contract.

3.4 Advantages Of Forward Contract

- They are easy to understand

- It is a tailor-made contract and is flexible to adjust the needs of both the parties

- Offers a complete hedge (i.e. delta neutral hedge) and helps in mitigating the risk

- It can be matched with the time period and cash flows of exposure

- As it is an over-the-counter (OTC) contract, the price of contracts are not known to others, hence provide a price protection.

- There are no immediate cash outflows before settlement of the contract but might require an upfront fee i.e. margin

- It is a tool for speculation

- Payoffs are symmetrical, meaning thereby, there is a distinction as one party will gain while other making a loss of an equivalent amount.

3.5 Payoffs On Forward Contracts

Forward contracts are privately executed between two parties. The buyer of the underlying commodity or asset is referred to as the long side whereas the seller is the short side. The obligation to buy the asset at the agreed price on the specified future date is referred to as the long position. A long position profits when prices rise.

The obligation to sell the asset at the agreed price on the specified future date is referred to as the short position. A short position profits when prices go down.

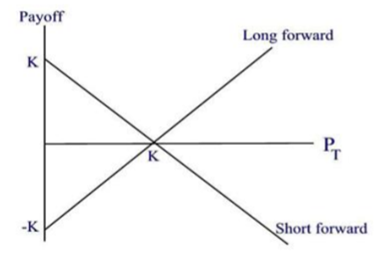

What is the payoff of a forward contract on the delivery date? Let T denote the expiration date, K denote the forward price, and PT denote the spot price (or market price) at the delivery date.

Then:

- For the long position: the payoff of a forward contract on the delivery date is PT_ K

- For the short position: the payoff of a forward contract on the delivery date is K_PT

Figure shows a payoff diagram on a contract forward. Note that both the long and short forward payoff positions break even when the spot price is equal to the forward price. Also note that a long forward’s maximum loss is the forward price whereas the maximum gain is unlimited.

For a short forward, the maximum gain is the forward price and the maximum loss is unlimited.