- Study

- Slides

- Videos

4.1 What Is A Call Option

What is Call Options?

The Call options give the taker the right, but not the obligation, to buy the underlying shares at a predetermined price, on or before a predetermined date.

For example, you discover a house that you’d love to purchase. Unfortunately, you won’t have the cash to buy it for another three months. And there is a metro station that can come up which could boost the prices upwards after 3 months. You talk to the owner and negotiate a deal that gives you an option to buy the house in three months for a price of Rs.10,00,000. The owner agrees, but for this option, you pay a price( fee) of Rs.30,000.

So the details of the arrangement is as follows –

- You pays an upfront fee of Rs.30,000- today. Consider this as a non refundable agreement fees

- Against this fees, the seller agrees to sell the land after 3 months to you

- The price of the sale( which is expected 3 months later) is fixed today at Rs.10,00,000-

- Because you have paid an upfront fee, only you can call off the deal at the end of 3 months (if you want to), the seller cannot

- In the event you calls off the deal at the end of 3 months, the seller gets to keep the upfront fees.

Let us break down this further to understand some details –

- By paying an upfront fee of Rs.30,000-, you have bound the seller into an obligation. The land price is locked in for 3 months

- The price of the land fixed by you is based on today’s price i.e. Rs.10,00,000 which means irrespective of what the price would be 3 months later you get to buy the land at today’s price.

- At the end of the 3 months, if you do not want to buy the land you have the right to say ‘no’ to the seller, but since the seller has taken the upfront fee from you, he will not be in a position to say no

- The upfront fee is non negotiable, non refundable.

Now, after initiating this agreement both you and seller have to wait for the next 3 months to figure out what actually happens. The price of the land will depend on the development of metro station. So, there can be three possible situations:

- If the metro project comes up, the price of the land would go up, so lets assume it increases to Rs.30,00,000.

- If the metro project gets abandoned, it leads to less demand of that property, and the land price fall to Rs.5,00,000.

- Nothing happens, price stays flat at Rs.10,00,000.

So, how would you react in each of these situations:

Situation 1- Price goes up to Rs.30,00,000

The metro project has come up, the land price has gone up. So, as per the arrangement, you has the right to call off the deal or execute it. Choice is with you. However, since the price has gone up the dynamics of the sale are in your favor –

Current Market price of the land = Rs.30,00,000

Sale agreement value = Rs.10,00,000

This means you now enjoy the right to buy the land at Rs.10,00,000 when in the open market the same land is selling at a much higher value of – Rs.30,00,000. So, there is profit to be made.

The seller as per agreement is obligated to sell the land at a lesser value, simply because he had accepted Rs.30,000- as agreement fees from you.

Profit calculation:

Current Price= Rs.30,00,000

Buy Price= Agreed Price+ Upfront Fees

= 10,00,000+30,000

= 10,30,000

Profit= Rs.30,00,000 – Rs.10,30,000 = Rs. 19,70,000

Situation 2- Price goes down to Rs.5,00,000–

The metro project has not come up, the land price thus has fallen. So, as per the arrangement, you have the right to call off the deal. Considering the situation, you would want to exercise your right of calling off the deal.

Because, if you execute you would have to pay Rs.10,00,000 and Rs.30,000 is already paid- thus your total cost would be Rs.10,30,000 whereas the value of the land is just Rs.5,00,000. Clearly not executing the contract and letting Rs.30,000 go is the best thing to do for you. So, you loose Rs.30,000 and the seller gets to keep that money in his pocket.

Situation 3- Price Stays at Rs.10,00,000

For whatever reasons if after 3 months the price stays at Rs.10,00,000 and does not really change. You will have an option to execute or not basis whether you want to buy the land or not.

Since the price is the same and you have already paid the upfront fee of Rs.30,000 the incremental 30,000 in any scenario is your loss.

4.2. Practical Example of Call Option

Lets now understand how call options work in a real market. Call option as you know gives the taker the right, but not the obligation, to buy the underlying shares at a predetermined price, on or before a predetermined date.

Example: Assume Dabur shares is trading at Rs.540 today. An available three month option would be an Dabur three month 540 call. The 540 call will give an option to the buyer of the contract the right, but not the obligation, to buy 1250 (lot size) Dabur shares for Rs.540 per share at any time until the expiry of three months. For this right, the buyer pays a premium (or purchase price) to the writer (seller) of the option. Lets say- the premium paid is Rs.50.

If the share price moves above Rs. 540, you can exercise your right and buy the shares at Rs. 540. If the share price stays at or below Rs. 540 you do not exercise your right and you do not need to buy the shares. All you lose is Rs. 50 in this case.

After you have bought the call of Dabur, there are only three possibilities that can occur. And they are-

1. The stock price can go up to Rs.600

2. The stock price can go down to Rs.500

3. The stock price can stay at Rs.540.

Situation 1 –

If the Dabur price goes up, then it would make sense in exercising your right and buy the stock at Rs.540.

Profit-

Buying Price= Rs.540

Premium paid =Rs. 50

Total cost = Rs.590

Current Market Price = Rs.600

Profit = 600-590 = Rs.10

Situation 2 –

If the stock price goes down to say Rs.500 obviously it does not makes sense to buy it at Rs.540. Instead you can buy in the market for Rs.500. So effectively you will loose Rs.50 that has been paid as the premium.

Situation 3 –

If the stock stays flat at Rs.540- you would not exercise the option. The loss in this case is Rs.50- the option premium that has been paid.

4.3 Buyer of a Call Option

Buying a call option can be a strategic move when you believe the price of the underlying asset, such as a stock, will rise significantly in the near future. Here are some key scenarios to consider:

- Bullish Market Sentiment: If you’re optimistic about a stock’s performance and expect its price to increase, buying a call option allows you to benefit from the price rise without committing to buying the stock outright.

- Leverage: Call options enable you to control a larger number of shares with less capital compared to buying the stock directly. This can amplify your returns if the stock performs as expected.

- Risk Management: Unlike buying stocks, where you risk losing the entire investment if the stock price drops to zero, the maximum loss with a call option is limited to the premium paid.

- Specific Events: If you anticipate a positive event, such as strong earnings reports or favourable news about the company, buying a call option can be a way to capitalize on the expected price increase.

To purchase call options, follow these steps:

- Choose a Brokerage Account: Open an account with a brokerage that offers options trading. Ensure the account is approved for options trading, as this often requires additional permissions.

- Select the Underlying Asset: Identify the stock or asset you want to trade options on. Research its performance and market trends.

- Pick the Strike Price and Expiration Date: Decide on the strike price (the price at which you can buy the asset) and the expiration date (the deadline for exercising the option). These factors influence the cost and potential profit.

- Place the Order: Use your brokerage platform to place an order for the call option. Specify the number of contracts you want to buy (each contract typically represents 100 shares).

- Monitor Your Investment: Keep an eye on the asset’s price movement and decide whether to sell the option, exercise it, or let it expire.

Would you like to dive deeper into any of these steps or explore strategies for trading options?

The biggest advantage of buying a call option is that it magnifies the gains in a stock’s price. For a relatively small upfront cost, you can enjoy a stock’s gains above the strike price until the option expires. So if you’re buying a call, you usually expect the stock to rise before expiration.

Suppose- you believe the prices of Dabur should start going up as:

- The demand for immunity products like chavanprash should increase.

- Dabur has been among top tier by volume growth and EBITDA margin resilience for the past many quarters.

- The company is now taking its toothpaste playbook to herbal shampoo. Dabur has made rapid strides in toothpaste from a top 2 player in the past few years and could soon become the number two player in toothpaste after Colgate.

- Dabur gets 55% of its sales from urban areas. Urban FMCG demand is beginning to improve as life is coming back to normal after pandemic

However, you want to avoid buying the stock for delivery (yet) as it could decline further. Additionally, there is a worry of M2M losses that prevents you from buying the stock futures as well. At the same time you don’t want to miss an opportunity of a sharp reversal in the stock price. In such a situation- buying a call option becomes the best bet.

4.4 Payoff of Buyer of Call Option

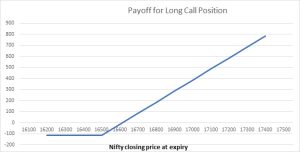

On Jan 1, 2022, Nifty is at 16460. You buy a call option with strike price of 16500 at a premium of Rs. 115 with expiry date Jan 27, 2022. A Call option gives the buyer the right, but not the obligation to buy the underlying at the strike price. So in this example, you have the right to buy Nifty at 16460. You may buy or you may not buy, there is no compulsion. If Nifty closes above 16500 at expiry, you will exercise the option, else you will let it expire. What will be your maximum profits/ losses under different conditions at expiry, we will try to find out using pay off charts.

If Nifty closes at 16400, you will NOT exercise the right to buy the underlying (which you have got by buying the call option) as Nifty is available in the market at a price lower than your strike price. Why will you buy something at 16500 when you can have the same thing at 16400? So you will forego the right. In such a situation, your loss will be equal to the premium paid, which in this case is Rs. 115.

If Nifty were to close at 16615, you will exercise the option and buy Nifty at 16500 and make profit by selling it at 16615. In this transaction you will make a profit of Rs. 115, but you have already paid this much money to the option seller right at the beginning, when you bought the option. So 10615 is the Break Even Point (BEP) for this option contract. A general formula for calculating BEP for call options is strike price plus premium (X + P).

If Nifty were to close at 17000, you will exercise the option and buy Nifty at 16500 and sell it in the market at 17000, thereby making a profit of Rs. 500. But since you have already paid Rs. 115 as option premium, your actual profit would be 500 – 115 = 385.

|

Strike Price (X) |

16500 |

|

|

|

|

Premium |

115 |

|

|

|

|

|

|

|

|

|

|

Nifty at Expiry |

Premium Paid |

Buy Nifty at |

Sell Nifty at |

Pay off for Long Call Position |

|

|

A |

B |

C |

D=A+B+C |

|

16200 |

-115 |

-16200 |

16200 |

-115 |

|

16300 |

-115 |

-16300 |

16300 |

-115 |

|

16400 |

-115 |

-16400 |

16400 |

-115 |

|

16500 |

-115 |

-16500 |

16500 |

-115 |

|

16600 |

-115 |

-16500 |

16600 |

-15 |

|

16700 |

-115 |

-16500 |

16700 |

85 |

|

16800 |

-115 |

-16500 |

16800 |

185 |

|

16900 |

-115 |

-16500 |

16900 |

285 |

|

17000 |

-115 |

-16500 |

17000 |

385 |

|

17100 |

-115 |

-16500 |

17100 |

485 |

|

17200 |

-115 |

-16500 |

17200 |

585 |

|

17300 |

-115 |

-16500 |

17300 |

685 |

|

17400 |

-115 |

-16500 |

17400 |

785 |

The contract value for a Nifty option with lot size of 50 and strike price of 16500 is 50* 16500 = 825000

The maximum loss for such an option buyer would be equal to 115 *50 = 5750

As Nifty goes above 16615, you start making profit on exercising the option and if it stays below 16615, you as a buyer always have the freedom not to exercise the option. But as seen from table and chart you can reduce your losses as soon as nifty goes above 16500. Long call position helps you to protect your loss to a maximum of Rs. 5750 with unlimited profit.

4.5 Selling/Writing a Call Option

When you write a call, you sell someone the right to buy an underlying stock from you at a strike price that’s specified by the option series. You are obligated to deliver the stock if the buyer decides to exercise the call option.

As a call writer, you are hoping that

-

The stock goes nowhere.

-

You collect the premium.

-

The option expires worthless so you don’t have to come up with a hundred shares of the stock to settle when the holder exercises the call, which is what can happen with naked call writing.

Thus, whatever happens to the option seller in terms of the P&L, the exact opposite happens to option buyer and vice versa. For example if the option writer is making Rs.70 in profits, this automatically means the option buyer is losing Rs.70

When you buy an option, the option premium is the only outflow that a participant will incur. Whereas in case of selling an option (writing option), the participant does not pay any premium. Instead, the seller receives the premium from the option buyer. When you buy an option, there is no margin money required. But when you sell an option, margin money will have to be paid upfront at the time of taking the position. So, there is a risk of getting a margin call to pay additional money in case if your position runs into a loss and your account runs out of balance.

Another major risk involved while selling an option is that the loss incurred could be unlimited. This is just opposite to that of buying an option where the loss is limited to extent of the premium paid. For example, assume that Nifty Bank Call option premium is Rs 120 for a strike price of 16,600. A trader selling a call option will receive Rs 6,000 (Rs 120*50 – the lot size) from the buyer. Say at the time of expiry, the Nifty Bank moves up to 17,000 and the premium moves up to 500. The seller of the option will have to buy back the option by paying 25,000. Thereby the option writer will incur a net loss of Rs. 19,000 (Rs.25000 minus 6000 – the option premium earned) in this transaction. The more the Nifty Bank index moves up above the strike price, the wider the loss will be.

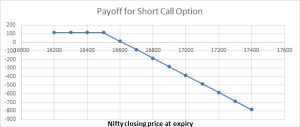

4.6 Payoff and Profits at Expiration

Whenever someone buys a call option, there has to be a counterparty, who has sold that call option. If the maximum loss for a long call position is equal to the premium paid, it automatically means that the maximum gain for the short call position will be equal to the premium received.

Similarly, if maximum gain for long call position is unlimited, then even maximum loss for the short call position has to be unlimited. Lastly, whenever, the long call position is making losses, the short call position will make profits and vice versa. Hence, if we have understood long call pay off, short call pay off chart will be just the water image of the long call pay off.

Thus at 16200 Nifty, when long call position makes a loss of Rs. 115, short call position will make a profit of Rs. 115. Similarly for 17000, when long call makes a profit of 385, short call position will lose 385.

As Nifty starts rising, short call position will go deeper into losses

|

Strike Price (X) |

16500 |

|

|

|

|

|

Premium |

115 |

|

|

|

|

|

Nifty at Expiry |

Premium Paid |

Buy Nifty at |

Sell Nifty at |

Pay off for Long Call Position |

Pay off for Short Call Position |

|

|

A |

B |

C |

D=A+B+C |

-D |

|

16200 |

-115 |

-16200 |

16200 |

-115 |

115 |

|

16300 |

-115 |

-16300 |

16300 |

-115 |

115 |

|

16400 |

-115 |

-16400 |

16400 |

-115 |

115 |

|

16500 |

-115 |

-16500 |

16500 |

-115 |

115 |

|

16600 |

-115 |

-16500 |

16600 |

-15 |

15 |

|

16700 |

-115 |

-16500 |

16700 |

85 |

-85 |

|

16800 |

-115 |

-16500 |

16800 |

185 |

-185 |

|

16900 |

-115 |

-16500 |

16900 |

285 |

-285 |

|

17000 |

-115 |

-16500 |

17000 |

385 |

-385 |

|

17100 |

-115 |

-16500 |

17100 |

485 |

-485 |

|

17200 |

-115 |

-16500 |

17200 |

585 |

-585 |

|

17300 |

-115 |

-16500 |

17300 |

685 |

-685 |

|

17400 |

-115 |

-16500 |

17400 |

785 |

-785 |

The pay off chart for a short call position is shown below. Maximum gain for an option seller, as explained earlier, will be equal to the premium received (as long as Nifty stays below strike price) whereas maximum loss can be unlimited (when Nifty starts moving above BEP).

BEP for a short call position will also be equal to X + P. BEP is independent of position (long or short), it is instrument specific (call option).

For a lot size of 50, the contract value is 50 *16500 = 825000. Premium is received by the seller of the option. However, he has to pay the margin. This is because the option seller has an obligation and since his losses can be unlimited, he can be a potential risk for the stability of the system.