- Study

- Slides

- Videos

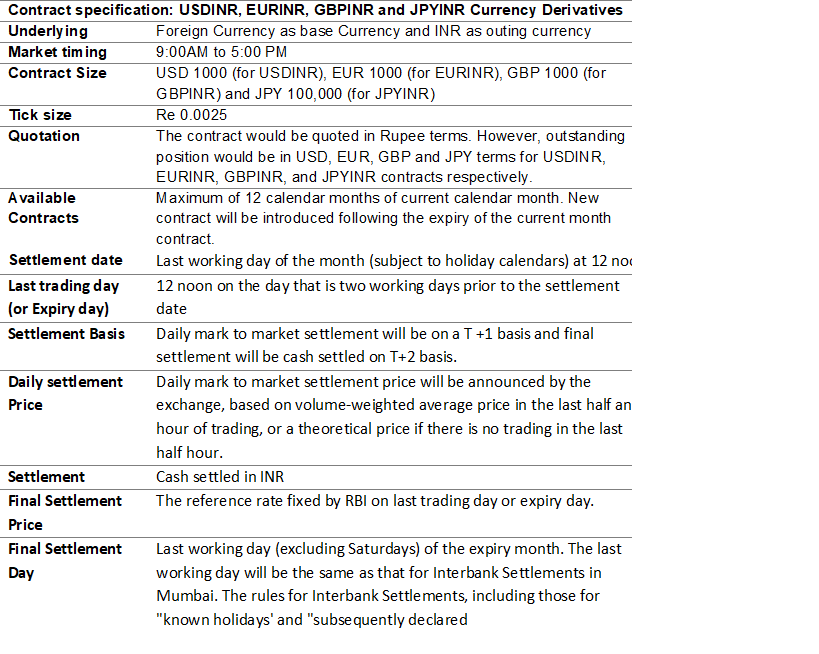

6.2 Terminologies With Respect To Contract Specifications

Base Price

Base price of the futures contracts on the first day of its life shall be the theoretical futures price. The base price of the contracts on subsequent trading days will be the daily settlement price of the previous trading day.

Settlement Price (or Closing Price)

The closing price for a futures contract is currently calculated as the last half an hour weighted average price of the contract. In case a futures contract is not traded on a day or not traded during the last half hour, a ‘theoretical settlement price’ is computed as may be decided by the relevant authority from time to time.

Tenor of futures contract

The tenor of a contract means the period when the contract will be available for futures trading, i.e. the cycle” of the contract. The currency futures contracts are available for trading for all maturities from 1 to 12 months.

6.3 Future Contract Specifications

Expiration

The last selling day of a futures contract is referred to as expiration (also known as maturation or expiry date). Following the expiration of a futures contract, the exchange follows the rules outlined in the contract specifications document for final settlement and delivery.

Size of the Contract

The contract size, often known as the lot size, is the smallest tradable unit of a contract. It is frequently one of the contract’s defined units. For example, the current PMEX sugar contract size is 10 tonnes. This means that trading one contract produces a 10-ton sugar stake. The contract size for the PMEX rice deal is 25 tonnes.

Initial Margin

The minimal collateral needed by the trade before a trader may take a position is known as initial margin. Initial margins can be paid in a variety of ways, as determined by the market, and vary from commodity to commodity and over time. The amount of base value is determined by the contract’s price volatility. The margin requirements for more risky items are usually larger.

Price Quotation

The units in which the traded price of a contract is displayed are known as price quotations. It differs from the contract’s trading size and is frequently dependent on industry standards and norms.

Size of the Tick

In Price Quotation, the tick size is the smallest movement permitted by the market. For instance, the PMEX 100gms gold futures contract has a tick size of Re. 1, whereas the PMEX 10oz gold futures contract has a tick size of $0.01 or 1cent.

Value of a Tick

Tick Value is the smallest profit or loss that can be made from owning a single contract position. The tick value is determined by the contract’s size and tick size. While it is frequently stated directly in contract specifications, it can be estimated using the following formula:

Contract Size x Tick Size = Tick Value

Mark To Market (MTM)

In the futures market, at the end of each trading day, the margin account is adjusted to reflect the investor’s gain or loss depending upon the futures closing price. This is called marking-to-market

Date of Arrival

The exchange specifies the time within which the seller must make delivery in accordance with terms of a contract and rules, and this is referred to as the delivery date or delivery schedule. Especially in the case of physically delivered commodities, the delivery date is frequently later than the contract’s expiration date.

Settlement on a daily basis

The procedure by which the exchange debits and credits all accounts with daily profits and losses estimated by the mark-to-market mechanism is known as daily settling. In order to recoup losses and pay profits to respective accounts, daily settlement is required.

6.4 Types Of Orders

The system allows the trading members to enter orders with various conditions attached to them as per their requirements.

These conditions are broadly divided into the following categories:

- Time conditions

- Price conditions

- Other conditions

Several combinations of the above are allowed thereby providing enormous flexibility to the users. The order types and conditions are summarized below

Time conditions

Day order

A day order, as the name suggests is an order which is valid for the day on which it is entered. If the order is not executed during the day, the system cancels the order automatically at the end of the day.

- Immediate or Cancel (IOC): An IOC order allows the user to buy or sell a contract as soon as the order is released into the system, failing which the order is cancelled from the system. Partial match is possible for the order, and the unmatched portion of the order is cancelled immediately

Price conditions

Market Orders

Market orders are orders for which no price is specified at the time the order is entered (i.e. price is market price). For such orders, the trading system determines the price. For the buy order placed at market price, the system matches it with the readily available sell order in the order book. For the sell order placed at market price, the system matches it with the readily available buy order in the order book.It is a good order to use once you have made a decision about opening or closing a position. It can keep the customer from having to chase a market trying to get in or out of a position.

Limit Order

The limit order is an order to buy or sell at a designated price. Limit orders to buy are placed below the market while limit orders to sell are placed above the market. Since the market may never get high enough or low enough to trigger a limit order, a customer may miss the market if he uses a limit order. (Even though you may see the market touch a limit price several times, this does not guarantee or earn the customer a fill at that price.)

When buying, if the order price is lower than (below) the current market price, it is a Buy Limit. As an example, with the market trading at 7800, Buy 1 Dec DJIA 7700 on a Limit (or better fill at 7700 or lower). Order can only be filled at the stated price (7700) or lower (better).

When selling, if the order price is higher than (above) the current market price, it is a Sell Limit. As an example, with the market trading at 7800, Sell 1 Dec DJIA 7900 on a Limit (or better fill at 7900 or higher). Can only be filled at the stated price (7900) or higher (better).

Stop Order

This facility allows the user to release an order into the system, after the market price of the security reaches or crosses a threshold price e.g. if for stop-loss buy order, the trigger is Rs. 44.0025, the limit price is Rs. 44.2575 , then this order is released into the system once the market price reaches or exceeds Rs. 44.0025. This order is added to the regular lot book with time of triggering as the time stamp, as a limit order of Rs. 44.2575. Similarly, for a stop-loss sell order, the trigger is 44.2575 and the limit price is 44.0025. This stop loss sell order is released into the system once the market price is reaches or drops below 44.2575. This order is added to the regular lot book with time of triggering as the time stamp, as a limit order of 44.0025.

Thus, for the stop loss buy order, the trigger price has to be less than the limit price and for the stop-loss sell order, the trigger price has to be greater than the limit price

Let us explain the above concept of limit order and stop loss order with an example. Assume you are holding a long USDINR currency future position at 45. You are concerned about increasing losses with likelihood of INR appreciation. You want to square off (sell) the long position if the price falls below 44.80 and limit your losses. In such a case, you would place a stop loss sell order with trigger price as 44.80.

Similarly, assume that you are of the view that INR to depreciate but its technical confirmation could happen if USDINR one month futures contract trades above 44.80. You want to initiate a long position as soon as the contract breaches 44.80 on the upward side. In this scenario, you would place a stop loss buy order with trigger price as 44.80. From the above examples, please note that for stop loss sell order the trigger price is greater than the limit price and is lower than the limit price for stop loss buy order.

6.5 Order Matching

Order Matching takes place after order acceptance wherein the system searches for an opposite matching order. If a match is found, a trade is generated. The order against which the trade has been generated is removed from the system. In case the order is not exhausted further matching orders are searched for and trades generated till the order gets exhausted or no more match-able orders are found. If the order is not entirely exhausted, the system retains the order in the pending order book. Matching of the orders is in the priority of price and timestamp. A unique trade-id is generated for each trade and the entire information of the trade is sent to the relevant Members.

Rules Followed:

The best buy order will match with the best sell order. An order may match partially with another order resulting in multiple trades. For order matching, the best buy order is the one with highest price and the best sell order is the one with lowest price. This is because the computer views all buy orders available from the point of view of a seller and all sell orders from the point of view of the buyers in the market. So, of all buy orders available in the market at any point of time, a seller would obviously like to sell at the highest possible buy price that is offered. Hence, the best buy order is the order with highest price and vice-versa.

Members can pro actively enter orders in the system which will be displayed in the system till the full quantity is matched by one or more of counter-orders and result into trade(s). Alternatively members may be reactive and put in orders that match with existing orders in the system. Orders lying unmatched in the system are ‘passive’ orders and orders that come in to match the existing orders are called ‘active’ orders. Orders are always matched at the passive order price. This ensures that the earlier orders get priority over the orders that come in later.