- Study

- Slides

- Videos

3.1 Currency Pair

Unlike any other traded asset class, the most significant part of currency market is the concept of currency pairs. In currency market, while initiating a trade you buy one currency and sell another currency. Therefore same currency will have very different value against every other currency. It is basically the amount you would pay in one currency for a unit of another currency. For instance, when a trader is quoted EUR/USD 1.13 it means that the trader can exchange 1 Euro and receive 1.13 US Dollars.

When a currency’s value changes, it changes relative to another currency. If the EUR/USD quotation goes from 1.13 today to 1.15 tomorrow it means that the Euro has appreciated relative to the US dollar, or that the US dollar has depreciated relative to the Euro because it will cost more US dollars to purchase 1 Euro.

This peculiarity makes currency market interesting and relatively complex. For major currency pairs, economic development in each of the underlying country would impact value of each of the currency, although in varying degree.

Major Currency Pair: The definition of ‘major currency pairs will differ among traders, but most will include the four most popular pairs to trade – EUR/USD, USD/JPY, GBP/USD and USD/CHF.

The most traded currency pairs are listed below. They represent some of the world’s largest economies and are traded in high volumes. Higher volumes tend to lead to smaller spreads.

- EUR/USD – Euro Dollar

- USD/JPY – Dollar Yen

- GBP/USD – Pound Dollar

- USD/CHF – Dollar Swiss France

3.2 Base Currency / Quotation Currency

Every trade in FX market is a currency pair: one currency is bought with or sold for another currency. One need’s to identify the two currencies in a trade by giving them a name. The names cannot be “foreign currency” and “domestic currency” because what is foreign currency in one country is the domestic currency in the other. The two currencies are called “base currency” (BC) and “quoting currency”(QC).

The base currency is the first currency in a forex pair quotation referred to as the transaction currency. The base currency can be used to represent all profits and losses of a company. This currency also functions as a company’s domestic currency for accounting purposes. It is used to indicate how much of the quote currency is needed to purchase one unit of the base currency

Thus, the BC is the currency that is priced and its amount is fixed at one unit. The other currency is the QC, which prices the BC, and its amount varies as the price of BC varies in the market. What is quoted throughout the FX market anywhere in the world is the price of BC expressed in QC. There is no exception to this rule

For the currency pair, the standard practice is to write the BC code first followed by the QC code. For example, in USDINR (or USDINR), USD is the BC and INR is the quoted currency; and what is quoted in the market is the price of USD expressed in INR. If you want the price of INR expressed in USD, then you must specify the currency pair as INRUSD. Therefore if a dealer quotes a price of USD INR as 45, it means that one unit of USD has a value of 45 INR. Similarly, GBPUSD = 1.60 means that one unit of GBP is valued at 1.60 USD.

Note that in case of USDINR, USD is base currency and INR is quotation currency while in case of GBPUSD, USD is quotation currency and GBP is base currency. In the interbank market, USD is the universal base currency other than quoted against Euro (EUR), Sterling Pound (GBP), Australian Dollar (AUD), Canadian Dollar (CAD) and New Zealand Dollar (NZD)

3.3 Interbank Market And Merchant Market

There are two distinct segment of OTC foreign exchange market. One segment is called as “interbank” market and the other is called as “merchant” market.

Interbank Market

The interbank market is “between banks” with each trade representing an agreement between the banks to exchange the agreed amounts of currency at the specified rate on a fixed date. In this market dealers quote prices at the same time for both buying and selling the currency. The mechanism of quoting price for both buying and selling is called as market making.

For example, your close by vegetable vendor will quote prices only for selling and he will not quote prices for buying it. While in a wholesale market, the vegetable wholesaler will quote prices for buying vegetable from farmer and will also quote prices for selling to vegetable retailer. Thus the wholesaler is a market maker as he is quoting two way prices (for both buying and selling). Similarly dealers in interbank market quote prices for both buying and selling i.e., offer two way quotes. The goal of the Interbank Market is to provide liquidity to other market participants and garner information from the flow of money. Large financial institutions can trade directly with each other or through electronic fx interbank platforms.

The players in the interbank market are commercial banks, investment banks, central banks, hedge funds and trading companies. Except for central banks, who have an alternative end goal, most the other players are in the interbank market strictly for profits and information.

Merchant Market

The foreign exchange dealing of a bank with its customer is known as merchant business and the exchange rate at which the transaction takes place is the merchant rate. The merchant business in which the contract with the customer to buy or sell foreign exchange is agreed to and executed on the same day is known as ready transaction or cash transaction. As in the case of interbank transactions a value next day contract is deliverable on the next business day and a spot contract is deliverable on the second succeeding business day following the date of the contract. Most of the transactions with customers are on ready basis.

When the bank buys foreign exchange from the customer, it expects to sell the same in the interbank market at a better rate and thus make a profit out of the deal. In the interbank market, the bank will accept the rate as dictated by the market. It can, therefore, sell foreign exchange in the market at the market buying rate for the currency concerned. Thus the interbank buying rate forms the basis for quotation of buying rate by the bank to its customer.

Similarly, when the bank sells foreign exchange to the customer, it meets the commitment by purchasing the required foreign exchange from the interbank market. It can acquire foreign exchange from the market at the market selling rate. Therefore the interbank selling rate forms the basis for quotation of selling rate to the customer buy the bank. The interbank rate on the basis of which the bank quotes its merchant rate is known as the base rate.

3.4 Two Way Quotes

In interbank market, currency prices are always quoted with two way price. In a two way quote, the prices quoted for buying is called bid price and the price quoted for selling is called as offer or ask price. Note that these prices are always from the perspective of the market maker and not from the perspective of the price taker.

Let us understand it with an example. Suppose a bank quotes USDINR spot price as 45.05/ 45.06 to a merchant. In this quote, 45.05 is the bid price and 45.06 is the offer price or ask price. This quotes means that the bank is willing to buy one unit of USD for a price of INR 45.05 and is willing to sell one unit of USD for INR 45.06. Thus a merchant interested to buy one unit of USD will get it for a price of INR 45.06 i.e. the price at which bank is willing to sell. The difference between bid and offer price is called as “spread”. Please note that the price quoted by a market maker is valid for certain quantity of the currency pair and it may vary if the amount for which quote is sought is higher. Spread is an important parameter to note while assessing market

liquidity, efficiency of market maker and market direction. Clearly, a narrow spread indicates a higher liquidity and higher efficiency of the market maker.

In USDINR spot market, the spreads are wide at the time of opening and gradually start narrowing as the market discovers the price. Similarly, for a USD 100 mn transaction the spread is likely to be higher when compared to the spread for USD 1 mn transaction.

There are certain market norms for quoting the two way quotes. Some of the important norms are as follows:

- The bid price (lower price) is quoted first followed by offer price (higher price)

- The offer price is generally quoted in abbreviated form.

In case the currency pair is quoted upto four decimal places then offer price is quoted in terms of last two decimal places and if the currency pair is quoted in two decimal places then offer price is quoted in terms of two decimal places

3.5 Appreciation/ Depreciation

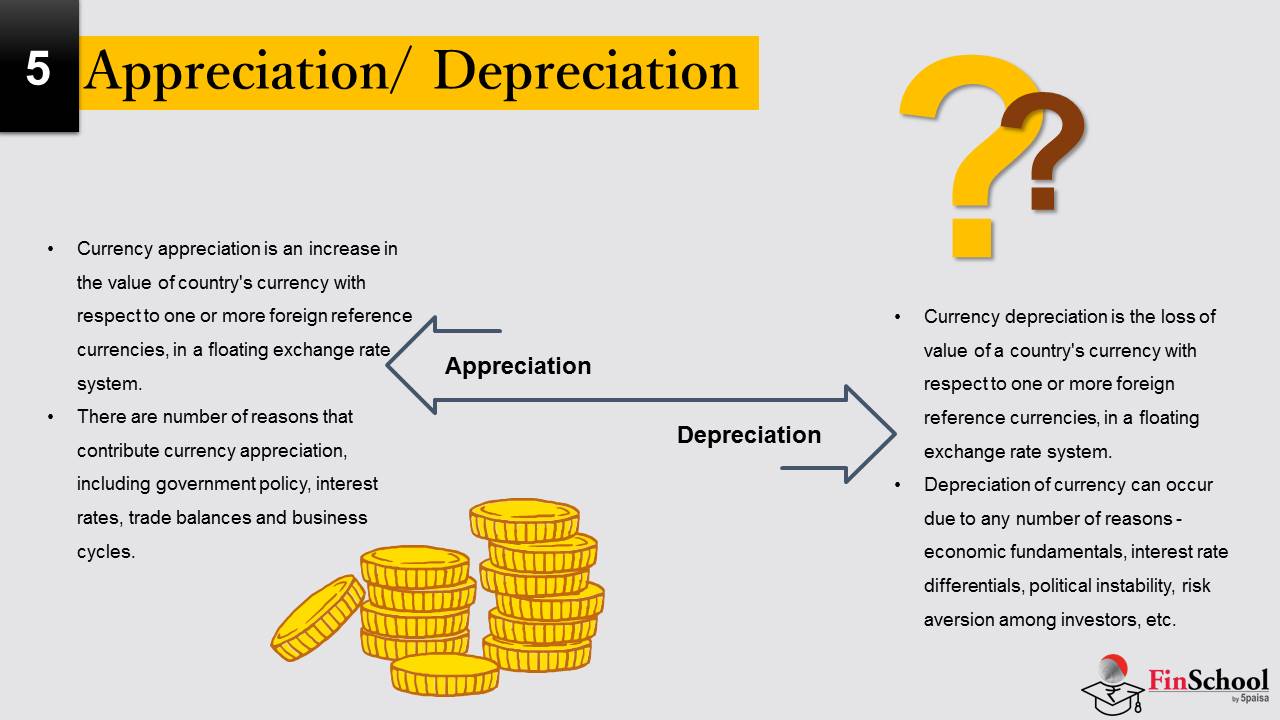

Exchange rates are constantly changing, which means that the value of one currency in terms of the other is constantly in flux. Changes in rates are expressed as strengthening or weakening of one currency vis-à-vis the other currency. Changes are also expressed as appreciation or depreciation of one currency in terms of the other currency.

Currency appreciation is an increase in the value of country’s currency with respect to one or more foreign reference currencies, in a floating exchange rate system. There are number of reasons that contribute currency appreciation, including government policy, interest rates, trade balances and business cycles.

Currency depreciation is the loss of value of a country’s currency with respect to one or more foreign reference currencies, in a floating exchange rate system. Depreciation of currency can occur due to any number of reasons – economic fundamentals, interest rate differentials, political instability, risk aversion among investors, etc.

Appreciation and depreciation of the currency can be very simple to identify. For example, USD/JPY = 100. The first of the two currencies (USD) is the base currency and represents a single unit, or the number 1 in the case of a fraction such as 1/100. The second is the quoted currency and is represented by the rate as the amount of that currency needed to equal one unit of the base currency. The way this quote reads is: One US dollar buys 100 units of Japanese yen.

For the purposes of currency appreciation, the rate directly corresponds to the base currency. For example, If the rate increases to 110, then one US dollar now buys 110 units of Japanese yen and if the currency depreciate that means one US dollar can only buy Japanese yen in the value of less than 100. Therefore, the currency depreciation and appreciation can have a part in contributing exports and imports.

Since the exchange rate has an effect on the trade surplus or deficit, a weaker domestic currency stimulates exports and makes imports more expensive. Conversely, a strong domestic currency hampers exports and makes imports cheaper.

The example to illustrate this concept is, for example, an electronic component priced at $10 in the US that will be exported to India. Assume the exchange rate is 50 rupees to the US dollar. Ignoring shipping and other transaction costs such as import duties for the moment, the $10 item would cost the Indian importer 500 rupees. Now, if the dollar strengthens against the Indian rupee to a level of 55, assuming that the US exporter leaves the $10 price for the component unchanged, its price would increase to 550 rupees ($10 x 55) for the Indian importer. This may force the Indian importer to look for cheaper components from other locations. The 10% appreciation in the dollar versus the rupee has thus diminished the US exporter’s competitiveness in the Indian market.

To conclude, when a country has stronger value of currency or appreciation, they can import more goods and services from another country (assuming that the currency of exporting country remains the same.) than what they used to. And in the opposite way, if depreciation occurs in a country, no matter what the reason is, the number of product that they used to buy will be lesser in the same amount of money.

3.6 Cross Rate

For some currency pairs prices are not directly available and are rather derived by crossing the prices of underlying currency pairs. Crossing the prices to arrive at price of the currency pair could involve either multiplication or division of the underlying prices. In market parlance, the price of currency pair for which direct prices is not available is called as cross rate. In this section, we will explain the method and rationale of crossing the prices. Although there are methods like chain rule, Left Hand-Right hand etc prescribed in various books, we would explain the derivation of cross rate using simple commercial logic.

We will take example of EURINR:

EURINR- The underlying currency pairs for deriving prices of EURINR are EURUSD and USD/IINR. Let us assume following prices: EURUSD: 1.4351 / 1.4355; USDINR: 44.38 / 44.39 Please recollect, the prices in currency pair is quoted in terms of value of one unit of base currency. While calculating cross rates, it is important to keep in mind which is the base currency and that the price is being calculated for one unit of base currency in terms of quotation currency (also called as term currency). Therefore for EURINR currency pair, we have to calculate the price of 1 EUR in terms of INR.

Let us start the computation of cross rate, using the buy side argument i.e. price of buying 1 EUR in terms of INR. As understood from underlying currency pairs, the price of EUR is directly available only in terms of USD. Therefore you need to sell INR to buy USD; and further sell the USD received to buy EUR. It is important to identify this FX conversion path of selling one currency and buying another to calculate the cross rate. Now we need to use appropriate prices (bid price versus offer price) of underlying currency pairs. To buy 1unit of USD, the applicable price is 44.39 INR (offer side) i.e., you need INR 43.39 to buy 1 unit of USD.

Now you need to sell certain units of USD (received by selling INR) to buy 1 unit of EUR. The price for buying 1 unit of EUR is 1.4355 USD (offer side). Therefore how many INR you need to spend to buy 1.4355 USD? The answer to this question would the price of buying 1 unit of EUR in terms of INR. We identified the price of buying 1 unit of USD as 44.39. Therefore price of buying 1.4355 units of USD would be 1.4355 x 44.39 INR i.e. 63.7218 INR. Therefore the price of buying 1 unit of EUR in terms of INR is 63.7218 INR. Similarly you could use the logic for selling 1unit of EUR and derive its price in term of INR. The price comes to 63.6897 (1.4351 x 44.38). Therefore the cross rate for EUR/ INR would be 63.6897/ 63.7218.