- What Are Commodities

- What Is A Commodity Market

- How Does Commodities Business Work

- Risks Involved In Commodity Market

- Commodities Futures Trading

- Functioning Of Commodities Market

- Due Diligence

- Exchanges Involved In Commodity Market

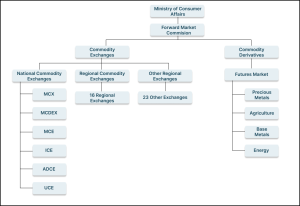

- Structure Of Commodities Market

- International Commodity Exchanges

- Forward Markets Commission

- Commodities Transaction Tax

- Financialization of Commodities

- Points To Remember Before Trading In Commodities Market

- Study

- Slides

- Videos

9.1.Structure

9.2. Recent Developments in India

The advent of economic liberalization helped the cause of laying emphasis on the importance of commodity trading. By the beginning of 2002, there were about 20 commodity exchanges in India, trading in 42 commodities, with a few commodities being traded internationally. Commodities futures contracts and the exchanges they trade in are governed by the Forward Contracts (Regulation) Act, 1952. The regulator is the Forward Markets Commission (FMC), a division of the Ministry of Consumer Affairs, Food and Public Distribution. In 2002, the Government of India allowed the re-introduction of commodity futures in India. Together with this, three screen based,nation-wide multi-commodity exchanges were also permitted to be set up with the approval of the Forward Markets Commission. These are:

- National Commodity and Derivative Exchange This exchange was originally promoted by ICICI Bank, National Stock Exchange (NSE), National Bank for Agriculture and Rural Development (NABARD) and Life Insurance Corporation of India (LIC). Subsequently other institutional shareholders have been added on. NCDEX is popular for trading in agricultural commodities

- Multi Commodity Exchange This exchange was originally promoted by Financial Technologies Limited, a software company in the capital markets space. Subsequently other institutional shareholders have been added on. MCX is popular for trading in metals and energy contracts.

- National Multi Commodity Exchange of India This exchange was originally promoted by Kailash Gupta, an Ahmedabad-based trader, and Central Warehousing Corporation (CWC). Subsequently other institutional shareholders have been added on. NMCE is popular for trading in spices and plantation crops, especially from Kerala, a southern state of India. In terms of market share, MCX is today the largest commodity futures exchange in India, with a market share of close to 70%. NCDEX follows with a market share of around 25%, leaving the balance 5% for NMCE. In order to start investing in Commodities Futures, you should have comprehensive knowledge about all the above Commodity Futures, which will help you further in learning about the basics of commodity futures contract and it’s various features.

In terms of total number of contracts traded, MCX has become the world’s largest commodity futures exchange in gold and silver, second largest in natural gas, and third in crude oil. The top four commodities (gold, silver, copper and crude oil) form 85 percent of MCX’s total trading business. NCDEX, on the other hand, deals with a large number of agricultural and metal commodities, while NMCE’s portfolio includes major agricultural commodities and metals

9.3. Status of Regional Commodity Exchanges

Before the introduction of national commodity futures exchanges, there were 24 regional commodity exchanges in India. The regional exchanges are commodity specific and mostly cater to the needs of a local area (such as Bikaner Commodity Exchange Ltd. for trading in guar seed). Currently, almost all of regional exchanges are on the verge of closure. Almost 17 out of 24 registered regional exchanges have not traded for the past 5 years and 13 of them have not carried out trading in the last 10 years.

The disappearance of regional exchanges is not a positive development as only a handful of national exchanges are monopolizing the futures market. This is despite the fact that regional exchanges better reflect region specific prices. Rather than allowing them to disappear, the government should strengthen the regional commodity exchanges through sharing a common technology platform and allow a few regional exchanges to emerge as national exchanges over a period of time.

What is even more surprising is the fact that NABARD – a government-owned development bank with a mandate for facilitating credit flow for promotion and development of agriculture and small-scale industries in rural India – was not allowed to establish a commodity futures exchange on its own. Instead, it was made to enter into partnership with MCX and NCDEX to set up national level privately-owned commodity futures exchanges