- What Are Commodities

- What Is A Commodity Market

- How Does Commodities Business Work

- Risks Involved In Commodity Market

- Commodities Futures Trading

- Functioning Of Commodities Market

- Due Diligence

- Exchanges Involved In Commodity Market

- Structure Of Commodities Market

- International Commodity Exchanges

- Forward Markets Commission

- Commodities Transaction Tax

- Financialization of Commodities

- Points To Remember Before Trading In Commodities Market

- Study

- Slides

- Videos

6.1.Price Discovery

The prices of commodities are discovered on commodity futures exchanges, which are seamlessly disseminated through various mediums.

Price discovery is based on the interaction of supply and demand forces. In addition to this, several interrelated factors affect price discovery. These could include quantity, location, and competitiveness of buyers and sellers; and market information and price reporting. Moreover, efficiency of price discovery necessitates knowledge of players on commodities, easy entry and exit, and availability of fungible trading instruments. Notably, commodity futures market enables trading in fungible commodity futures contract to a diverse mix of players, and hence bring in high liquidity. Consequently, price discovery in futures market is more efficient than that in physical markets

Thus when the participants on futures exchanges put in their bid and ask prices based on their assessment of demand and supply at that time, their orders are a composite reflection of specific market-related information, expert views and comments, government policies, international trade, inflation, weather forecasts, hopes and fears, market dynamics, and so on. The successful execution of trades between buyers and sellers indicates an assessment of an ‘unbiased fair value’ of the particular commodity. An unbiased price, thus evolved, is the discovered price that is freely available for uninterrupted dissemination real time through trading terminals. The discovered price on an exchange is the rational market price agreed upon by both the buyer and the seller. Hence, the last traded price is considered to be the discovered price. The market participants and commodity traders view the futures prices as a leading ‘price indicator’. The price discovered on a futures exchange gives an idea today about the price that is likely to prevail at a future point in time. Importantly, the price discovered is continuously disseminated to all commodity stakeholders through various mediums, such as ticker-boards, newspapers, and television. This helps in bringing about the much-desired price transparency in physical market transactions.

Equipped with this knowledge, the farmer/producer can decide on which crop to sow when and whether to postpone or sell his produce or to simply use that price as a fair reference price for negotiations with traders.

6.2.Price risk management or Hedging

Unprecedented volatility in commodity prices has been a source of great risk, greatly affecting economies and stakeholders. To tackle this, price risk management through hedging has emerged as a well-established trade mechanism that protects business from adverse effects of temporal price volatility. It is somewhat comparable with the concept of insurance in the sense that insurance offers financial cover against specified risks just as hedging offers cover against price risk fluctuations in commodities that impact cash-flow

Hence, in commodities, hedging through futures market has emerged as one of the popular market-mediated price risk management mechanism. It is used as a preferred instrument to manage price risk by a large number of stakeholders who have an exposure to the physical commodity. In fact, the first-ever organized commodity futures exchange in Chicago was set up in 1848 as a platform for hedging in grains by farmers and traders in the U.S.

Hedging is actually a strategy to offset price risk that is inherent in the spot market by taking an equal but opposite position in the futures market. The idea is to offset the loss in one market with profit in the other market, that is, the futures market as against the physical/spot market. The futures market is used by hedgers to protect their businesses from adverse price movements which could dent their profitability. Producers like farmers, manufacturers, and mining companies; and consumers like processors, merchandisers, manufacturers, exporters, and importers benefit from hedging. An illustration of hedging follows.

Hedging by a Wheat Miller

A miller enters into an agreement to sell wheat flour to a bread manufacturer. He agrees to deliver an agreed quantity at an agreed price on an agreed date, say in four months. The miller is apprehensive that the price of wheat may increase in the interim, that is, from the date of signing the agreement to the date of delivery. To manage his price risk, the wheat miller decides to take a buy position or going long4 on the futures platform. He buys the number of wheat contracts on the exchange that are equal to his requirement four months hence. When the deadline for the supply of wheat flour nears, he finds that wheat prices have gone up in the spot market. He ends up paying more for the wheat. This increases the cost of wheat flour, squeezing his margins. However, the loss in the spot market is offset in the futures market as the miller has hedged on the futures exchange. By squaring off his position, that is, by selling an equal amount on the exchange, he makes a profit. Thus the miller offsets his loss in the spot market by making a profit in the futures market. This enables the miller to protect his margin to a great extent

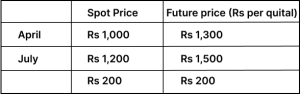

The wheat miller goes long and buys a futures contract at Rs 1,300 in April and subsequently squares up his position in July by selling the contract at Rs 1,500, making a profit of Rs 200 per contract.

In the spot or physical market, he could have purchased wheat at Rs 1,000 but ends up buying at Rs 1,200 in July. By not buying in the physical market in April at Rs 1,000 he has incurred a loss of Rs 200, which has been compensated by the Rs 200 he makes in the futures market.

6.3.Protecting market share through predictable pricing

The demand for certain commodities like edible oils is highly price elastic. The manufacturers have to ensure that the prices are stable over an extended period so as to protect their market share. By buying on the exchange ,the manufacturers and processors are assured of stable and uniform prices over a fairly long period. This predictability allows them to get into forward sale contracts at fixed prices with their stockists, wholesale buyers, and distributors, bringing in predictability in domestic prices. Thus hedging helps reduce the effects of losses in input prices on the price of their final product. Without futures market, the processors/manufacturers would have found it difficult to balance severe short-term price movements of raw materials and the necessity to maintain price stability. In the absence of futures, this would have meant buying and storing raw material in bulk, incurring more financial outgo and adding to the cost of production. It would also have meant fewer funds for other profitable ventures or investments.

6.4.Stable markets benefit farmers/agriculture

The futures market brings in price stability that is beneficial to farmers and farming. Price stability is important to the farm economy as unstable market means unpredictability in the income of farmers. Income unpredictability would also mean less farm-related investments and poor planning of agricultural activities. The free and wide dissemination of futures price information to farmers will empower them in negotiating and extracting a ‘fair’ or better price for their produce from traders/buyers. Moreover, as there is a time lag between planning and production, the futures market-discovered price information will encourage farmers to make investment decisions based on market demand.

6.5.Processors Benefit from reduced intrest rates and premium

Hedging mitigates the need for processors to buy in advance large quantities of raw material to ensure reasonable raw material prices and protect against adverse price movements over time. Thus, it reduces expenses, such as working capital requirement, interest on capital, premiums associated with marketing risks, and processing margins, and ensures greater returns to the processor.

6.6.Benefits to value chain operators

The following are a few key ways in which futures exchanges are helping value chain operators:

o Enabling price stabilization (reduces the amplitude of price variations).

o Enabling an integrated national and international price structure.

o Facilitating operation of lengthy and complex production and manufacturing activities. o Helping in balancing supply and demand position throughout the year.

o Acting as a price barometer to farmers and other stakeholders.

o Encouraging competition.

6.7.Import – Export competitiveness

Futures markets help importers and exporters hedge their price risks and improve their competitiveness. Many physical traders involved in international trading hedge their risks on futures exchanges through futures, forwards, and options. For instance, a textile mill needs to get into contractual export, at least three months forward, since their buyers need to have an undisrupted supply. In the oilseeds sector, international buyers prefer to buy at least a year forward.

Normally, exporters who enter into such forward contracts do not possess the entire committed stocks. They may have to purchase the shortfall from the physical market. This exposes them to price risks resulting in potential losses. Exporters manage such risks in three ways: a) refuse demand for long period contracts; or b) hold more-than-required inventory; or c) hedge their risk in proposed purchase .Without hedging through futures market, such risks can only be managed through meticulous, time-consuming, and costly planning to time the physical transactions. Importers too go through a similar ordeal if they do not hedge. Thus, futures markets allow exporters and importers to cut down their marketing costs, safeguard processing margins, and compete internationally.

6.8.Improved accesibility to Bank credit

Without proper risk management tools, the marketing and processing of commodities become high-risk business for banks to finance. Even a small movement in price can negate a huge proportion of the margins, thus, at times, making it virtually impossible to pay back the loan. Due to this, banks are extremely reluctant to fund the commodity trade. In such a situation, many banks insist that borrowers hedge their risk on exchanges. Even if banks fund borrowers who have not hedged their risks, they tend to charge high interest rates besides forcing stringent terms and conditions of repayment.