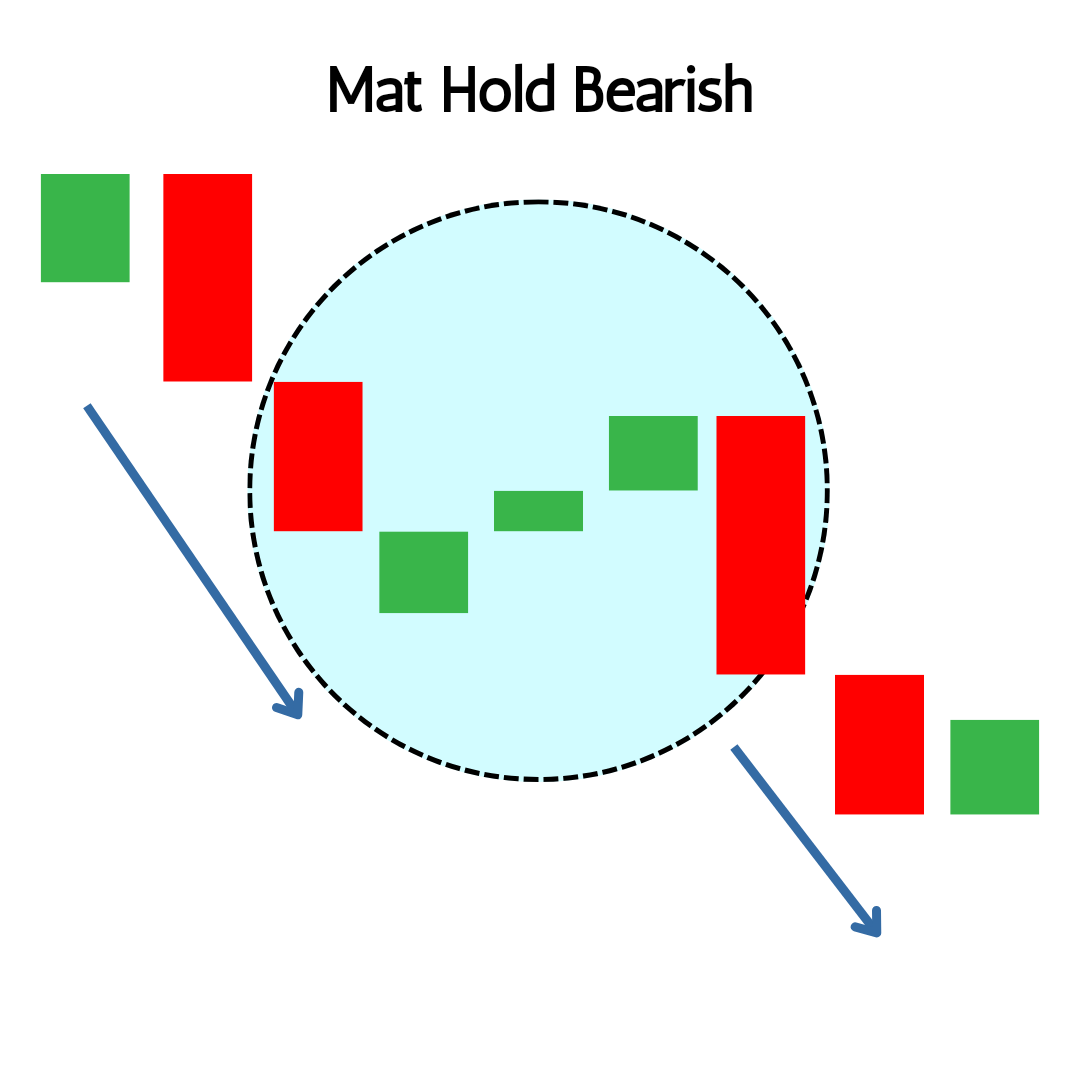

Candlestick patterns are key tools in technical analysis, used by traders to predict future price movements based on past price data. The Bearish Mat Hold pattern is a specific type of candlestick pattern, categorized as a continuation pattern. It forms during a downtrend and suggests that the bearish trend is likely to continue after a brief pause or consolidation. The Bearish Mat Hold pattern is particularly valuable because it confirms the continuation of an existing trend, offering trader’s confidence to hold onto their short positions or initiate new ones.

What is Mat Hold Candlestick Pattern?

The Mat Hold Candlestick Pattern is a specific type of continuation pattern in technical analysis. It can appear in both bullish and bearish forms, depending on the trend direction prior to its formation. This pattern suggests that the current trend (uptrend or downtrend) will likely continue after a brief period of consolidation.

Structure of the Mat Hold Pattern:

The Mat Hold pattern consists of five candlesticks and can occur in two variations:

- Bullish Mat Hold Pattern:

- Trend: Occurs in an uptrend.

- First Candle: A strong bullish candle, indicating continued buying interest.

- Next Three Candles: Three smaller bearish or neutral candles follow, staying within the range of the first candle. These candles suggest a temporary pause in the uptrend.

- Fifth Candle: A long bullish candle that closes above the close of the first candle, confirming the continuation of the uptrend.

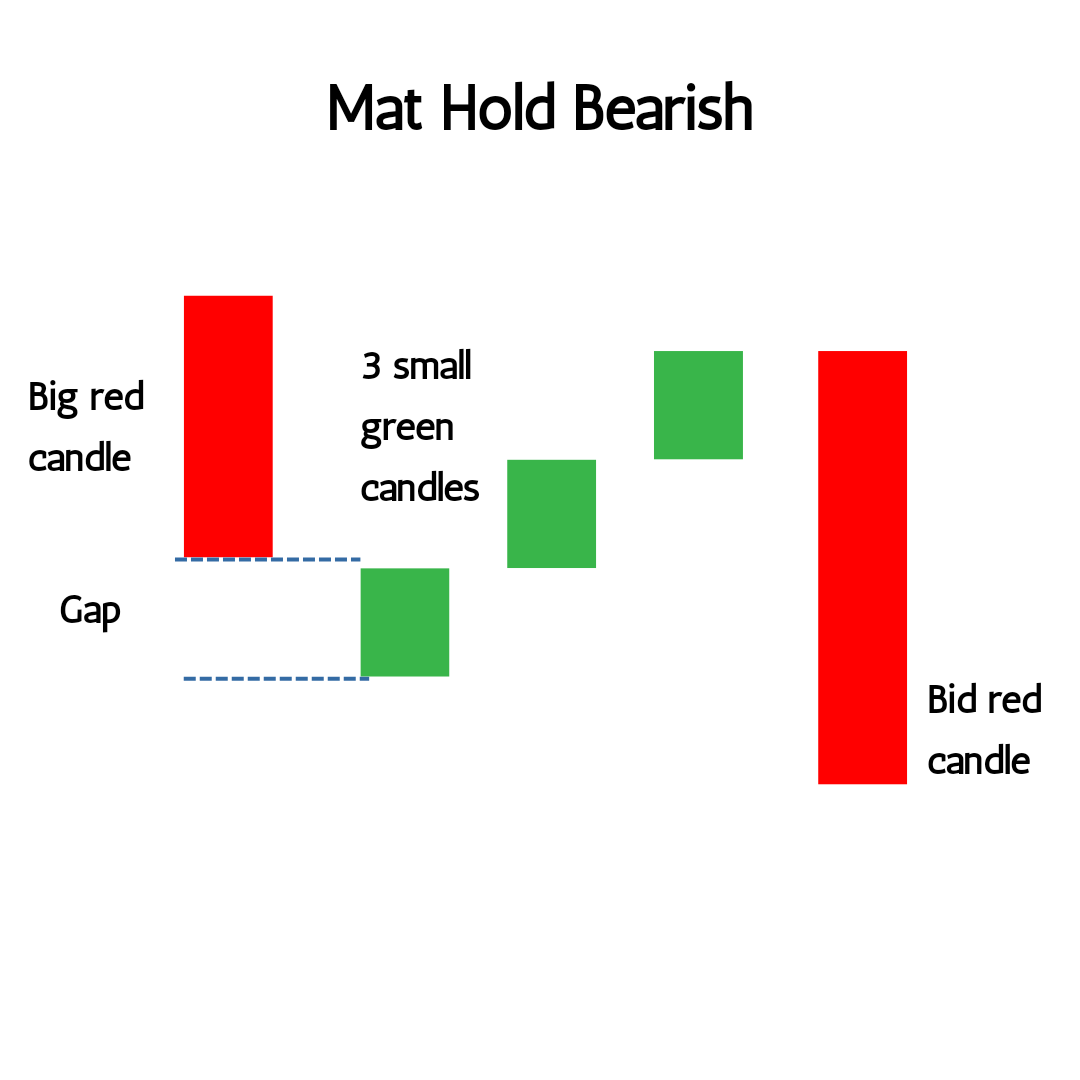

- Bearish Mat Hold Pattern:

- Trend: Occurs in a downtrend.

- First Candle: A strong bearish candle, reflecting continued selling pressure.

- Next Three Candles: Three smaller bullish or neutral candles follow, staying within the range of the first candle. These candles represent a brief consolidation or pause in the downtrend.

- Fifth Candle: A long bearish candle that closes below the close of the first candle, confirming the continuation of the downtrend.

Key Characteristics of the Mat Hold Pattern:

- Continuation Pattern: The Mat Hold is a continuation pattern, meaning it signals that the existing trend (either bullish or bearish) is likely to continue after the brief consolidation period.

- Volume: During the three middle candles, volume typically decreases, reflecting the temporary pause in the trend. In the final candle, volume often increases, signaling a return to the dominant trend.

- Reliability: The Mat Hold pattern is considered reliable, especially when the final candle confirms the direction of the trend.

What is Bearish Mat Hold Candlestick Pattern?

The Bearish Mat Hold Candlestick Pattern is a continuation pattern that appears during a downtrend, signaling that the current downward momentum is likely to continue after a brief pause or consolidation period. It is a strong indicator of bearish market sentiment.

How to Identify Bearish Mat Hold Candlestick Pattern

The Bearish Mat Hold pattern is composed of five candlesticks:

- First Candle:

- A long bearish (black or red) candlestick, indicating strong selling pressure and continuation of the downtrend.

- Next Three Candles:

- Three smaller bullish (white or green) candlesticks follow the first candle.

- These candles generally have small bodies and trade within the range of the first bearish candle. They show a temporary, weak buying interest.

- The highs of these candles may rise slightly, but they do not close above the open of the first bearish candle, indicating that the bulls are not strong enough to reverse the trend.

- Fifth Candle:

- The final candlestick is a long bearish candle that closes below the close of the first candle.

- This candle confirms the continuation of the downtrend, showing that the selling pressure has returned with force.

How Does The Bearish Mat Hold Candlestick Pattern Differ From Other Candlestick Patterns?

The Bearish Mat Hold candlestick pattern is unique in its structure and significance, particularly when compared to other candlestick patterns. Here’s how it differs from other patterns:

1. Type of Pattern: Continuation vs. Reversal

- Bearish Mat Hold: This is a continuation pattern that occurs during a downtrend, signaling that the current downtrend will likely continue after a brief pause.

- Reversal Patterns: Many candlestick patterns, such as the Hammer or Engulfing patterns, are reversal patterns. These indicate a potential change in the current trend (e.g., a downtrend reversing into an uptrend or vice versa).

2. Structure: Number and Arrangement of Candles

- Bearish Mat Hold: This pattern consists of five candles: a strong bearish candle, followed by three smaller bullish candles, and another strong bearish candle. The three small candles indicate a brief consolidation within the overall downtrend.

- Other Patterns: Many candlestick patterns consist of fewer candles. For instance:

- Doji: Typically involves just one candle with a very small body, indicating indecision in the market.

- Engulfing Pattern: Comprises two candles where the second candle completely engulfs the body of the first one, indicating a potential reversal.

3. Significance: Confirmation of Trend

- Bearish Mat Hold: This pattern confirms the continuation of the existing downtrend after a short consolidation. The final bearish candle that closes below the first candle’s low is key to confirming the pattern.

- Other Patterns:

- Reversal Patterns: Focus on indicating a potential trend change. For example, a Bullish Engulfing pattern signals the end of a downtrend and the start of an uptrend.

- Indecision Patterns: Patterns like Doji suggest market indecision rather than a clear continuation or reversal.

4. Market Sentiment: Interpretation of Buyer/Seller Strength

- Bearish Mat Hold: Indicates a strong bearish sentiment. Even though there is a brief period where buyers push the price higher (seen in the three small bullish candles), sellers ultimately regain control, pushing the price lower and continuing the downtrend.

- Other Patterns:

- Hammer: Suggests that buyers are starting to gain strength in a downtrend, potentially leading to a reversal.

- Morning Star: Shows a shift from bearish to bullish sentiment over three candles, indicating a potential reversal from a downtrend to an uptrend.

5. Rarity: Frequency of Occurrence

- Bearish Mat Hold: This is a relatively rare pattern, particularly in its textbook form, making it a powerful signal when it does appear.

- Other Patterns: Many candlestick patterns, such as Doji or Engulfing patterns, are more common and may appear frequently in various market conditions.

6. Trading Strategy Implications: Use in Decision-Making

- Bearish Mat Hold: Traders view this pattern as a strong signal to continue holding or enter new short positions, expecting the downtrend to continue.

- Other Patterns:

- Reversal Patterns: May prompt traders to close existing positions or enter new positions in the opposite direction of the current trend.

- Indecision Patterns: Often lead traders to wait for further confirmation before making a decision.

What Are The Advantages And Disadvantages Of Trading The Bearish Mat Hold Candlestick Pattern?

Trading the Bearish Mat Hold candlestick pattern can be effective, but like any trading strategy, it has its advantages and disadvantages. Here’s a breakdown:

Advantages of Trading the Bearish Mat Hold Pattern:

Strong Continuation Signal:

The Bearish Mat Hold is a powerful continuation pattern that provides a clear signal that the downtrend is likely to continue. This makes it a valuable tool for traders looking to capitalize on ongoing bearish market conditions.

Reliable Pattern:

The pattern’s structure, which includes a brief consolidation followed by a strong bearish move, often results in a reliable indication that the selling pressure is returning. When the final bearish candle breaks below the first candle’s low, it confirms the pattern, reducing the likelihood of false signals.

Clear Entry Point:

The pattern provides a clear entry point for traders. Once the final bearish candle closes below the first candle’s low, traders can confidently enter or add to short positions.

Risk Management:

The pattern allows for relatively straightforward risk management. Traders can place a stop loss above the highest point of the three small bullish candles, minimizing potential losses if the trade goes against them.

Versatility Across Markets:

The Bearish Mat Hold pattern can be applied to various financial instruments, including stocks, forex, commodities, and indices. It’s a versatile tool that can be used in different markets and timeframes.

Disadvantages of Trading the Bearish Mat Hold Pattern:

Rarity:

The Bearish Mat Hold is a relatively rare pattern, especially in its ideal form. This means that traders might not encounter it frequently, limiting its use as a consistent trading strategy.

False Signals in Low-Volume Markets:

In markets with low volume or during periods of low volatility, the pattern might not form as reliably. The consolidation phase (the three small bullish candles) could lead to a false sense of security, resulting in losses if the market unexpectedly reverses.

Delayed Confirmation:

Waiting for the final bearish candle to confirm the pattern can sometimes mean entering the trade late, missing out on the initial momentum of the downtrend. This delay could reduce the potential profit of the trade.

Dependence on Market Context:

The effectiveness of the Bearish Mat Hold pattern depends on the broader market context. In a strong downtrend, it can work well, but in choppy or range-bound markets, the pattern might not lead to a significant continuation, leading to less profitable trades.

Psychological Challenges:

The brief bullish consolidation within the pattern might cause hesitation for some traders, as it can appear as a potential reversal signal. This might lead to missed opportunities or premature exits from the trade.

Common Mistakes Traders Make When Trading The Bearish Mat Hold Candlestick Pattern?

Trading the Bearish Mat Hold candlestick pattern can be effective, but there are several common mistakes traders make when using this pattern. Here’s a look at some of these pitfalls:

1. Misidentifying the Pattern:

- Mistake: Traders sometimes mistake other patterns or formations for the Bearish Mat Hold. For instance, they might confuse a simple pullback within a downtrend with a Mat Hold pattern.

- Solution: Ensure the pattern meets all the criteria—especially the presence of a strong bearish candle followed by three smaller bullish candles within its range, and a final bearish candle that closes below the first candle’s low.

2. Ignoring the Overall Trend:

- Mistake: The Bearish Mat Hold is a continuation pattern, so it should only be traded within a clear downtrend. Traders sometimes attempt to trade this pattern in a range-bound or unclear market, leading to poor results.

- Solution: Always confirm that the market is in a well-established downtrend before relying on this pattern. Use additional indicators like moving averages or trendlines to confirm the trend.

3. Entering the Trade Prematurely:

- Mistake: Some traders enter the trade before the final bearish candle fully forms, thinking they’ve spotted the pattern early. This can lead to losses if the pattern doesn’t complete as expected.

- Solution: Wait for the final bearish candle to close below the first candle’s low to confirm the pattern. Entering too early can expose you to unnecessary risk if the pattern fails.

4. Setting Inappropriate Stop-Loss Levels:

- Mistake: Traders may set their stop-loss levels too tight, placing them within the range of the consolidation candles. This can lead to getting stopped out prematurely due to normal market fluctuations.

- Solution: Place the stop-loss above the highest point of the three smaller bullish candles to avoid getting stopped out by minor price movements.

5. Ignoring Volume Analysis:

- Mistake: Failing to consider volume can lead to false signals. The pattern is more reliable when the volume decreases during the consolidation phase and increases during the final bearish candle.

- Solution: Pay attention to volume trends during the formation of the pattern. A decrease in volume during the three small candles followed by a spike in volume on the final bearish candle strengthens the signal.

6. Overlooking Market Conditions:

- Mistake: Traders may attempt to trade the Bearish Mat Hold pattern in low-volume or highly volatile markets, where the pattern’s reliability is reduced.

- Solution: Trade this pattern in markets with sufficient liquidity and clear trends. Avoid using it in low-volume periods or during times of high market volatility, such as during major economic news releases.

7. Not Using Additional Confirmation:

- Mistake: Relying solely on the Bearish Mat Hold pattern without considering other technical indicators or market factors can lead to poor trading decisions.

- Solution: Use additional tools like RSI, MACD, or moving averages to confirm the bearish continuation signal before entering the trade. Combining signals can improve the accuracy of your trades.

8. Overtrading the Pattern:

- Mistake: Traders might see the Bearish Mat Hold pattern in every minor consolidation within a downtrend, leading to overtrading and potentially poor trade outcomes.

- Solution: Be selective in identifying the pattern. Ensure that it fits all the criteria and occurs in a strong downtrend before committing to a trade.

9. Failing to Manage Risk Properly:

- Mistake: Even with a confirmed pattern, some traders might risk too much of their capital on a single trade, leading to significant losses if the trade goes against them.

- Solution: Always use proper risk management techniques, such as limiting the amount of capital risked on each trade (e.g., 1-2% of the trading account) and setting appropriate stop-loss levels.

10. Ignoring the Broader Market Context:

- Mistake: Traders might focus too narrowly on the Bearish Mat Hold pattern without considering the broader market context, such as upcoming economic news or major market events.

- Solution: Consider the overall market environment, including economic news, market sentiment, and other factors that could influence price movements. This helps to avoid trading against broader market forces.

How Do Traders Use The Bearish Mat Hold Candlestick Pattern To Create A Trading Plan?

Traders use the Bearish Mat Hold candlestick pattern to create a trading plan by incorporating the pattern’s key features into their overall strategy

1. Identify the Pattern:

- Trend Confirmation: Ensure that the market is in a clear downtrend. The Bearish Mat Hold pattern is only relevant in a bearish context.

- Pattern Recognition: Look for the specific structure: a long bearish candle, followed by three smaller bullish candles within the range of the first candle, and a final long bearish candle closing below the low of the first candle.

2. Confirm the Pattern:

- Volume Analysis: Check that volume decreases during the formation of the three small bullish candles and increases during the final bearish candle. This supports the reliability of the pattern.

- Additional Indicators: Use other technical indicators (e.g., Moving Averages, RSI, MACD) to confirm the bearish trend and ensure that the market conditions align with the pattern’s signal.

3. Define Entry Points:

- Entry Signal: Plan to enter a short position after the final bearish candle has closed below the low of the first bearish candle, confirming the continuation of the downtrend.

- Order Types: Consider placing a market order to enter the trade immediately after confirmation, or a limit order at a specified price level if you want to enter at a more favourable price.

4. Establish Stop-Loss Levels:

- Stop-Loss Placement: Place the stop-loss above the highest point of the three smaller bullish candles. This level should be where the trade would be considered invalid if the market reverses.

- Risk Management: Ensure that the stop-loss level allows for a reasonable risk-to-reward ratio, typically aiming for at least a 1:2 ratio between potential risk and reward.

5. Determine Profit Targets:

- Target Levels: Set profit targets based on the expected continuation of the downtrend. This can be done by identifying previous support levels, trendlines, or using technical analysis tools to estimate potential price movements.

- Trailing Stops: Consider using trailing stops to lock in profits as the price moves in your favor. This approach allows you to capture more gains if the downtrend extends beyond your initial target.

6. Plan for Execution:

- Order Execution: Decide whether to use limit orders or market orders for entering and exiting trades. Market orders execute immediately, while limit orders are used to enter at specific prices.

- Trade Management: Monitor the trade regularly to ensure that it aligns with your plan. Adjust stop-loss and profit target levels if necessary based on market conditions.

7. Review and Adapt:

- Performance Review: After the trade, review the outcome to assess how well the Bearish Mat Hold pattern worked in the given context. Analyze whether the entry, stop-loss, and profit targets were effective.

- Adapt Strategies: Based on the review, adapt your trading plan and strategy to improve future trades. Consider what adjustments might be needed for different market conditions or variations of the pattern.

8. Maintain a Trading Journal:

- Record Keeping: Keep a trading journal to document trades involving the Bearish Mat Hold pattern. Record details such as the pattern’s appearance, trade setup, entry and exit points, stop-loss levels, and overall performance.

- Learning and Improvement: Use the journal to identify patterns in your trading behavior and outcomes. This will help you refine your approach and make better-informed decisions in future trades.

Managing Risk Associated With Trading The Bearish Mat Hold Candlestick Pattern?

Managing risk effectively is crucial when trading the Bearish Mat Hold candlestick pattern. Here’s a detailed approach to managing risk for this specific pattern:

1. Position Sizing:

- Determine Trade Size: Calculate the size of your position based on your overall risk tolerance and account size. A common guideline is to risk only a small percentage of your trading capital on any single trade, typically 1-2%.

- Adjust Position Size: If the stop-loss distance is large, consider reducing the position size to ensure that the potential loss remains within your acceptable risk limits.

2. Setting Stop-Loss Orders:

- Stop-Loss Placement: Place your stop-loss above the highest point of the three small bullish candles in the Bearish Mat Hold pattern. This level should be just beyond the consolidation phase to protect against false breakouts or reversals.

- Risk-to-Reward Ratio: Ensure that the distance between your entry point and stop-loss level provides a favourable risk-to-reward ratio. Aim for at least a 1:2 ratio, meaning the potential reward should be at least twice the risk.

3. Monitoring Volatility:

- Adjust for Volatility: Consider the market’s volatility when setting your stop-loss and take-profit levels. In highly volatile markets, you might need to set wider stop-loss levels to avoid being stopped out prematurely.

- Volatility Indicators: Use indicators such as the Average True Range (ATR) to gauge market volatility and adjust your stop-loss and position size accordingly.

4. Using Trailing Stops:

- Trail Your Stop: As the price moves in your favor, consider using trailing stops to lock in profits while allowing the trade to continue if the downtrend persists. This can help protect gains and manage risk as the market moves.

- Adjust Trailing Stops: Set trailing stops based on technical levels or a percentage of the current price to maintain flexibility in managing risk.

5. Establishing Profit Targets:

- Set Realistic Targets: Determine profit targets based on previous support levels, trend lines, or technical indicators. This helps in defining where to exit the trade and lock in profits.

- Reassess Targets: Adjust profit targets if the market shows signs of a reversal or if the trend extends further than initially expected. Be flexible in adapting your plan based on market conditions.

6. Avoiding Overtrading:

- Limit Trades: Avoid overtrading the Bearish Mat Hold pattern, especially if it appears infrequently. Focus on high-quality setups and avoid forcing trades when the pattern is not clearly formed.

- Review Performance: Regularly review your trades to ensure that you are sticking to your plan and not taking excessive risks.

7. Using Stop-Limit Orders:

- Stop-Limit Orders: Consider using stop-limit orders to control the execution of your stop-loss and limit orders. This helps to avoid slippage and ensures that you exit the trade at a predetermined level.

8. Backtesting and Practice:

- Backtest Strategy: Backtest the Bearish Mat Hold pattern on historical data to understand its performance and risk characteristics. This helps in refining your risk management approach and improving trade outcomes.

- Paper Trading: Practice trading the pattern using a simulated account to gain experience without risking real money. This allows you to refine your approach and risk management techniques.

9. Considering Market Conditions:

- Assess Market Environment: Take into account broader market conditions and news events that could impact price movements. Avoid trading the pattern during high-impact news events or periods of extreme market volatility.

10. Maintaining Emotional Discipline:

- Stick to the Plan: Follow your trading plan and risk management rules strictly. Avoid making impulsive decisions based on emotions or short-term market fluctuations.

- Stay Informed: Stay updated on market conditions and news that could affect your trades, but avoid letting emotions drive your trading decisions.

Conclusion

The Bearish Mat Hold candlestick pattern offers several advantages, including its strong continuation signal, reliability, and clear entry points. However, it also has disadvantages, such as its rarity, the potential for false signals in low-volume markets, and the need for careful consideration of the broader market context. Traders who understand these pros and cons can use the pattern effectively within their overall trading strategy, particularly in markets with strong, clear trends.