- Introduction to Trading Psychology

- Risk Management In Trading Psychology

- Challenges in Trading Psychology

- How to Stop Overtrading

- Common Trading Mistakes

- Disciplined Trader Success Formula

- Market Dynamics Basics

- How Trading Psychology Awareness can Improve Performance

- Strategy Plus Psychology=Success

- Resilience and Stress Response Management

- Advanced Techniques for Enhancing Trading Psychology

- Study

- Slides

- Videos

2.1. Transaction Cost and Risk Per Trade

Transaction Cost:

Transaction costs refer to the costs that are incurred when buying or selling financial instruments. These costs can include brokerage fees, spreads (the difference between the bid and ask price), slippage, and taxes. In trading psychology, understanding transaction costs is crucial for several reasons:

- Impact on Profitability: High transaction costs can eat into profits, making it essential for traders to factor these costs into their strategies. Ignoring them can lead to the mistaken belief that a strategy is profitable when, in reality, it may not be after accounting for these costs.

- Decision-Making: Traders aware of transaction costs may avoid overtrading (trading too frequently) to minimize these costs. Overtrading not only increases costs but can also lead to poor decision-making driven by the need to recoup losses incurred from fees.

- Emotional Impact: Transaction costs can influence a trader’s emotions. If a trader consistently sees profits reduced by transaction costs, it can lead to frustration and impulsive decisions. Conversely, understanding and accepting these costs as part of the trading process can lead to more rational and disciplined trading.

Risk per Trade:

Risk per trade refers to the amount of capital a trader is able to risk on a particular trade. It is typically expressed as a percentage of the trader’s total account balance. Proper risk management is a cornerstone of successful trading and has significant psychological implications:

- Risk Tolerance: Understanding one’s risk tolerance is crucial for maintaining emotional stability while trading. If a trader risks too much on a single trade, it can lead to heightened anxiety and stress, especially if the trade goes against them.

- Discipline: Setting a predetermined risk per trade helps in maintaining discipline. Traders who do not set clear risk parameters may be more likely to engage in reckless behavior, such as chasing losses or increasing trade sizes impulsively.

- Confidence: Knowing that risk is controlled can boost a trader’s confidence. When a trader is confident that no single trade can significantly harm their account, they are more likely to stick to their trading plan and avoid emotional reactions to market fluctuations.

Relevance in Trading Psychology:

In trading psychology, both transaction costs and risk per trade play a pivotal role in shaping a trader’s mind-set and behavior:

- Cost Awareness: Being aware of transaction costs helps traders maintain realistic expectations about their potential returns. This awareness reduces the likelihood of frustration and emotional trading, leading to more consistent decision-making.

- Risk Management: Effective risk management through controlled risk per trade fosters a stable emotional state. Traders who manage risk well are less likely to experience significant emotional swings, allowing them to stay focused and disciplined.

- Long-Term Success: By understanding and managing both transaction costs and risk per trade, traders are more likely to develop a sustainable trading strategy. This approach reduces the impact of psychological stressors and increases the likelihood of long-term success in trading.

Example of How Transaction cost and Risk per trade is important in Trading Psychology

Transaction Cost Example:

Imagine a trader named Ajay who trades stocks using a day-trading strategy. Ajay has identified a stock that they believe will increase in value and decides to buy 1,000 shares at ₹50 per share.

Transaction Cost Details:

- Brokerage Fee: The broker charges a flat fee of ₹10 per trade.

- Spread: The bid-ask spread for the stock is ₹0.05 (meaning the stock can be bought at ₹50.05 and sold at ₹50.00).

- Slippage: Due to market volatility, Ajay ends up buying the stock at ₹10 instead of the anticipated ₹50.05.

Impact of Transaction Costs:

- Total Purchase Cost: 1,000 shares x ₹10 = ₹50,100.

- Immediate Loss Due to Spread: If Ajay immediately sold the stock at the bid price of ₹50.00, the sale value would be 1,000 shares x ₹50.00 = ₹50,000.

- Brokerage Fees: ₹10 to buy + ₹10 to sell = ₹20

- Total Cost: ₹100 (slippage) + ₹20 (fees) = ₹120

Before the stock price even moves, Ajay is already down by ₹120 due to transaction costs. If Ajay does not account for these costs, they may mistakenly believe their strategy is more profitable than it is. This could lead to frustration when profits are consistently lower than expected, potentially causing emotional stress and impulsive trading decisions.

Risk per Trade Example:

Let’s consider the same trader, Ajay, who has a trading account with ₹10,000. Ajay follows a disciplined risk management strategy where they never risk more than 2% of their account on a single trade.

Risk Management Setup:

- Account Size: ₹10,000.

- Risk per Trade: 2% of ₹10,000 = ₹200

- Trade Setup: Ajay plans to buy 1,000 shares of a stock at ₹50 per share. The stop-loss is set at ₹49. 80, meaning Ajay will exit the trade if the price drops to ₹49.80.

Calculating Position Size:

- Amount at Risk per Share: ₹50.00 – ₹49.80 = ₹0.20.

- Position Size: ₹200 (total risk) / ₹20 (risk per share) = 1,000 shares.

If the trade goes against Ajay, the maximum loss will be ₹200, which is 2% of the total account size. This controlled risk allows Ajay to trade with confidence, knowing that a single losing trade will not significantly damage their account.

Psychological Impact:

- By risking only 2% of their capital, Ajay can maintain emotional stability even after a series of losses. This prevents the emotional stress and potential for impulsive decisions that often accompany large drawdowns.

- Additionally, knowing the exact amount at risk helps Ajay avoid panic and stick to the trading plan, reducing the likelihood of fear-driven mistakes like moving stop-loss levels or exiting trades prematurely.

- If Ajay consistently sees profits diminished by transaction costs, it could lead to frustration or overtrading in an attempt to recover the lost amount, which can compound the problem.

- Understanding and accepting these costs as part of the trading process is essential to maintain a clear and rational mind-set. By strictly adhering to a predefined risk per trade, Ajay avoids the psychological trap of revenge trading (increasing trade sizes to recover losses) and maintains a disciplined approach. This helps in building long-term success and confidence, as Ajay knows that no single trade can lead to catastrophic losses.

2.2. Trading System and Sound Money Management

Trading System:

A trading system refers to a set of rules or guidelines that a trader follows to make decisions about buying and selling assets in the financial markets. A well-defined trading system typically includes:

- Entry and Exit Rules: These are the specific conditions under which a trader enters or exits a trade. These rules could be based on technical indicators, fundamental analysis, or a combination of both.

- Risk Management: This aspect of the trading system focuses on how much capital is at risk on each trade, stop-loss levels, and position sizing.

- Consistency: A trading system aims to create consistent results over time. It removes the emotional aspect of trading by relying on predefined rules.

- Back-testing: Before implementation, a trading system is often back-tested on historical data to ensure that it has the potential to be profitable.

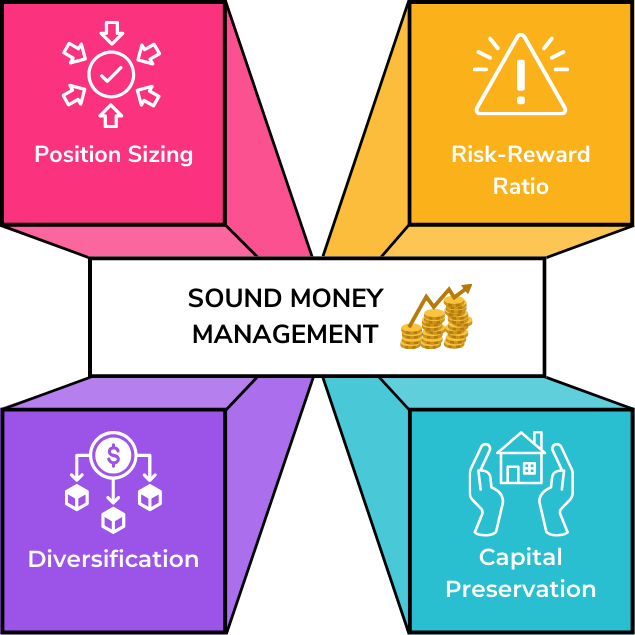

Sound Money Management:

Money management is the process of managing one’s capital to minimize risk and maximize potential returns. Sound money management involves:

- Position Sizing: Determining the size of each trade based on the trader’s risk tolerance and account size. This is crucial to ensure that no single trade can significantly harm the account.

- Risk-Reward Ratio: This is the ratio of the potential profit to the potential loss on a trade. A sound money management strategy ensures that trades with favourable risk-reward ratios are taken.

- Diversification: Diversification means distributing the investments across different assets or markets to reduce risk. This helps in avoiding a significant loss from a single trade or asset.

- Capital Preservation: The primary goal of money management is to preserve capital so that the trader can continue trading and compounding returns over time.

Both a trading system and sound money management are integral to a trader’s psychological well-being:

- Confidence and Discipline: A well-defined trading system coupled with sound money management gives traders confidence in their approach. This confidence helps maintain discipline, reducing the likelihood of making impulsive decisions based on emotions.

- Stress Reduction: Knowing that a solid system and money management strategy are in place can reduce the emotional stress associated with trading. Traders are less likely to experience anxiety over potential losses.

- Long-Term Success: Consistency and capital preservation are key to long-term success in trading. A solid trading system and sound money management ensure that a trader can weather losses and continue trading, which is crucial for achieving sustained profitability.

2.3. Choosing the Right Trading System

- Trading psychology is crucial in choosing the right trading system because it influences decision-making, discipline, and emotional control, all of which are essential for successful trading.

- Traders often fall into the traps of fear (leading to premature selling) and greed (holding onto losing trades too long).

- A trading system must align with a trader’s psychological profile to minimize these emotional reactions. A trading system that suits your psychology helps manage stress levels.

- If a system requires rapid decisions and you’re prone to stress, you might make poor choices. Even the best trading systems fail if the trader lacks the discipline to stick to the plan.

- A system should match your psychological ability to follow rules without deviation. Overtrading often results from boredom or the desire to recover losses quickly.

- A good trading system tailored to your psychology can help avoid these pitfalls by providing structure. The Risk taking capacity is different for different persons. Your trading system should align with how much risk you’re comfortable taking, which is heavily influenced by your psychological makeup.

- Understanding and accepting losses is part of trading. A system that aligns with your psychology will help you manage losses without panic or irrational decisions.

- Patience is key in trading, and a system that matches your psychological profile will help you wait for the right trading opportunities instead of forcing trades. Impulsive decisions can derail even the best strategies.

- A trading system that aligns with your psychological strengths and weaknesses can help curb impulsive behavior. Trading psychology also involves a willingness to learn and adapt.

- A trading system that resonates with your psychological approach will facilitate continuous learning and improvement.

- Markets are unpredictable, and a trading system that suits your psychological tolerance for uncertainty will help you navigate this unpredictability more effectively.

- Understanding your psychological profile is key to choosing a trading system that you can consistently execute without letting emotions, stress, or impulsiveness get in the way. The right system should not only be technically sound but also compatible with your mental and emotional strengths, leading to more consistent and successful trading outcomes.

2.4 Money Management Strategies for Trading

Money operation is critical for successful trading, as it helps you control threat, safeguard capital, and maximize gains.

Then are some essential plutocrat operation strategies for trading

Position Sizing threat Per Trade

Determine a fixed chance of your total trading capital to threat on any single trade( generally 1- 2).

Position Size computation

Use position sizing formulas grounded on your threat forbearance and the distance between your entry point and stop- loss position. For example, if you risk 2 of your capital and your stop- loss is 5 down, your position size should be acclimated consequently.

Diversification

- Spread threat Across Different means Avoid putting all your capital into one asset or request. Diversifying across different asset classes (stocks, bonds, goods, and forex) reduces the threat of large losses.

- Sector and Strategy Diversification Diversify across different sectors or use colorful trading strategies to manage threat more effectively. threat- price rate

- Estimate before Entering a Trade Before making a trade, insure that the implicit price justifies the threat. Aim for a threat- price rate of at least 12, meaning you anticipate to make₹ 2 for every₹ 1 you risk.

- harmonious operation Apply the threat- price rate constantly across trades to insure that over time, profitable trades overweigh losing bones

Stop- Loss Orders

- Set Stop- Loss Orders Always set a stop- loss order to limit implicit losses on a trade. A stop- loss automatically closes your position if the price moves against you by a certain quantum.

Take- Profit Targets

- Predefine Profit situations Set take- profit targets before entering a trade. This ensures you exit the trade at a predetermined position of profit rather than holding on too long and risking a reversal.

- Partial gains Consider taking partial gains at certain situations, especially in unpredictable requests, to lock in earnings while leaving some exposure for implicit farther earnings.

Influence operation

- Use influence cautiously influence amplifies both earnings and losses. Use influence sparingly and only when you have a high degree of confidence in your trade and a clear threat operation plan.

- Understand Margin Conditions insure you understand the periphery conditions of leveraged trades and keep sufficient capital to meet implicit periphery calls.

Capital Allocation

- Limit Exposure Allocate only a portion of your total capital to high- threat trades or unpredictable requests. Keep a balanced portfolio to manage threat effectively.

- Cash Reserves Maintain a portion of your capital in cash to take advantage of new openings and manage unanticipated request movements.

Avoid Overtrading

- Quality over Quantity Focus on high- quality trade setups rather than frequent trading. Overtrading can lead to increased sale costs and emotional fatigue.

- Stick to Your Plan Avoid the temptation to enter trades impulsively or to recover losses snappily. Cleave to your trading plan and strategy.

Regular Portfolio Review

- Rebalance Your Portfolio Regularly review and rebalance your portfolio to insure it aligns with your threat forbearance and request conditions.

- Assess Performance Periodically assess the performance of your trades and make adaptations as demanded. Learn from both successful and unprofitable trades.

Cerebral Control

- Stay Disciplined Emotional decision can lead to poor trading issues. Develop the discipline to stick to your plan and avoid letting fear or rapacity impact your opinions.

2.5 Dealing with Losing stripes and Drawdowns using Trading Psychology

Dealing with losing stripes and drawdowns is one of the most grueling aspects of trading, and effective trading psychology is pivotal to navigating these delicate ages. Then are strategies to help you manage losing stripes and drawdowns using trading psychology

-

Accept Losses as Part of Trading

-

Understand the Nature of Trading Accept that losses are an ineluctable part of trading. Indeed the stylish dealers witness losing stripes and drawdowns. Admit this reality to avoid emotional torture when losses do. Detach Emotionally View each trade as a probability- grounded event rather than a particular reflection of your chops or intelligence. Detaching emotionally from individual trades helps you maintain neutrality.

-

Focus on the Process, Not the Outcome

-

Cleave to Your Trading Plan Stick to your trading plan and strategy, indeed during losing stripes. Focus on following your rules, knowing that thickness over time will lead to success. Process- acquainted Mind- set rather of fixating on recent losses, concentrate on executing your trading process rightly. This mind- set shift can reduce the emotional impact of losses.

-

Reduce Position Size

-

Lower threat Exposure during a losing band, consider reducing your position sizes. This lowers your overall threat and helps to cover your capital until you recapture confidence. Minimize Emotional Impact lower position sizes reduce the emotional intensity of each trade, making it easier to stay calm and focused.

-

Take a Break

-

Step Down from the request If you’re feeling overwhelmed by losses, it might be salutary to take a short break from trading. This can help clear your mind and reduce stress, allowing you to return with a fresh perspective.

-

Estimate and Reflect Use this time to reflect on your recent trades, assess whether any emotional impulses affected your opinions, and identify areas for enhancement.

-

Dissect and Learn from Your Trades

-

Review Losing Trades dissect your losing trades to understand what went wrong. Determine whether the losses were due to poor request conditions, strategy excrescencies, or emotional opinions.

-

Identify Patterns Look for patterns in your losing stripes.

-

Are you breaking your trading rules? Are feelings impacting your opinions? Understanding these patterns can help you help unborn miscalculations. Positive affirmations can help reinforce your confidence and resilience. Your past experiences can help you gain success and your ability to overcome challenges.

7. Set Realistic Expectations

-

Understand that no trading strategy is perfect, and losses are unavoidable. Set realistic expectations about your trading performance to reduce disappointment during drawdowns. Set achievable goals that focus on the process, such as sticking to your trading plan or maintaining discipline, rather than solely on profit targets.

8. Seek Support and Guidance

-

Engaging with a trading community or discussing your experiences with other traders can provide emotional support and new perspectives. Always remember that others too face similar challenges and that can be reassuring. If you’re struggling with a prolonged losing streak or drawdown, consider seeking guidance from a mentor or trading coach. They can provide valuable insights and help you regain confidence.

9. Implement Stress-Reduction Techniques

-

Practice mindfulness or meditation to help manage stress and maintain emotional balance. These techniques can improve focus and reduce anxiety during tough trading periods. Regular physical exercise and healthy eating can positively impact your mental state, helping you to cope better with stress and maintain a clear mind.

10. Adjust Your Strategy if Necessary

-

Sometimes, losing streaks occur because market conditions have changed. Assess whether your strategy is still suitable for the current environment, and be willing to make adjustments if necessary. If your strategy is sound but your execution is suffering, consider simplifying your approach. Return to the basics of your trading plan and focus on executing simple, high-probability trades.

2.6 Balancing Capital Preservation and Capital Growth

Balancing capital preservation and capital growth is a key aspect of successful trading, requiring a thoughtful approach to risk management and trading psychology. Here’s how to achieve this balance:

1. Understanding the Trade-Off

- Capital Preservation: This involves protecting your existing capital from significant losses. It’s the foundation of long-term trading success because it ensures you can continue trading even after facing setbacks.

- Capital Growth: This focuses on increasing your capital through profitable trades. While growth is essential, it often requires taking on more risk, which can conflict with the goal of preservation.

2. Set Clear Objectives

- Define Your Priorities: Determine your primary objective—whether it’s preserving capital, growing capital, or a combination of both. Your risk tolerance, financial goals, and time horizon will influence this balance.

- Short-Term vs. Long-Term Goals: Short-term and long-term goals both are useful and should be established by the trader. For example, in the short term, your focus might be on preserving capital, while long-term goals might prioritize growth.

3. Risk Management

- Risk per Trade: Limit the amount of capital you’re willing to risk on any single trade, typically between 1-2% of your total capital. This approach helps preserve your capital while allowing room for growth.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses on trades. This is crucial for capital preservation and helps prevent small losses from turning into large ones.

4. Diversification

- Diversify Across Assets: Spread your investments across different asset classes (stocks, bonds, commodities, forex) to reduce risk. Diversification can protect your capital while still providing opportunities for growth.

- Strategy Diversification: Use multiple trading strategies (e.g., trend following, mean reversion, scalping) to balance capital preservation and growth. Some strategies might focus on steady gains, while others might target larger but riskier profits.

5. Position Sizing

- Adjust Based on Market Conditions: Increase position sizes in favourable market conditions where growth opportunities are higher. Conversely, reduce position sizes in volatile or uncertain markets to prioritize capital preservation.

- Scaling In and Out: Scale into positions gradually as the market confirms your trade, and scale out to lock in profits while protecting your capital from sudden reversals.

6. Psychological Discipline

- Avoid Overtrading: Resist the urge to chase profits by overtrading, which can jeopardize both capital preservation and growth. Focus on high-quality setups that align with your risk tolerance and objectives.

- Stick to Your Plan: Maintain discipline by sticking to your trading plan, especially during periods of market volatility. Emotional decisions often lead to unnecessary risks, undermining both preservation and growth.

7. Review and Adjust Strategies

- Regular Performance Reviews: Regularly review your trading performance to assess whether your current strategy is balancing capital preservation and growth effectively. Adjust your approach based on this analysis.

- Adapt to Market Changes: Be flexible and willing to adjust your strategies as market conditions change. A strategy that worked in a bull market might need modification in a bear market to preserve capital while still seeking growth.

8. Emphasize Process over Outcome

- Process-Oriented Mind-set: Focus on executing your trading process correctly rather than obsessing over individual trade outcomes. A well-executed process naturally balances preservation and growth over time.

- Long-Term Perspective: Keep a long-term perspective, understanding that successful trading involves a series of trades, not just one. This helps you stay committed to both preserving capital and achieving growth.

9. Psychological Resilience

- Handle Drawdowns Gracefully: Accept that drawdowns are a part of trading and focus on minimizing their impact. Recovering from drawdowns requires patience, discipline, and a focus on the long-term balance between preservation and growth.

- Stay Emotionally Balanced: Managing emotions like fear and greed is essential. Fear might push you toward excessive preservation, while greed might lead to reckless growth pursuits. Striking a balance requires emotional control.

10. Incremental Growth Approach

- Compound Growth: Aim for consistent, incremental growth rather than seeking large, quick profits. Compounding smaller gains over time can lead to significant growth while still prioritizing capital preservation.

- Locking in Profits: Regularly lock in profits by taking partial exits from winning trades. This allows you to grow your capital while securing gains, contributing to overall capital preservation.

2.7 Strategies for Increasing Trading Capital

Increasing trading capital is essential for traders aiming to grow their accounts and leverage more opportunities in the market. Here are strategies to help you increase your trading capital:

1. Reinvest Profits

-

- Compound Gains: Instead of withdrawing profits, reinvest them back into your trading account. This allows you to take advantage of compounding, where profits generate additional profits, accelerating capital growth.

- Gradual Scaling: As your capital increases, consider gradually scaling up your position sizes in line with your risk management rules. This can lead to higher profits while still managing risk.

2. Diversify Your Trading Strategies

-

- Multiple Strategies: Use a combination of trading strategies that perform well in different market conditions. For example, mix trend-following strategies with mean reversion or range-bound strategies to capture various market opportunities.

- Diversified Markets: Trade across different asset classes, such as stocks, forex, commodities, and cryptocurrencies. Diversifying your portfolio can reduce overall risk and increase potential returns.

3. Add New Capital

-

- Personal Savings: Regularly add funds from your personal savings to your trading account. Consistently adding small amounts can make a significant difference over time.

- External Income: Consider using income from other sources (e.g., salary, side jobs) to supplement your trading account. This approach allows you to grow your trading capital more quickly.

4. Leverage Carefully

-

- Controlled Use of Leverage: Leverage can amplify profits, but it also increases risk. Use leverage prudently, ensuring that it matches with your risk tolerance capacity and trading strategy.

- Margin Management: Keep a close eye on margin requirements and avoid overleveraging, which can lead to margin calls and significant losses. Use leverage only when you have a high level of confidence in your trades.

5. Consistent Risk Management

-

- Preserve Capital: The foundation of increasing trading capital is to avoid large losses. Implement strict risk management practices, such as setting stop-losses, to protect your capital.

- Risk-Reward Ratio: Aim for a favourable risk-reward ratio (e.g., 1:2 or better) in your trades. Consistently taking trades with higher potential rewards than risks can increase your capital over time.

6. Take Advantage of Market Opportunities

-

- Volatile Markets: Volatile markets often present more trading opportunities. If you’re confident in your risk management, consider increasing your trading activity during these times to capitalize on larger price movements.

- Seasonal Patterns: Some markets have seasonal patterns that can be predictable. Understanding these patterns can help you increase your trading capital by timing your trades more effectively.

7. Reduce Trading Costs

-

- Lower Commissions and Fees: Choose brokers with lower trading fees and commissions. Reducing these costs can significantly increase your net profits, contributing to capital growth.

- Efficient Execution: Focus on efficient trade execution to avoid slippage and other hidden costs. Even small savings per trade can add up over time.

8. Develop and Refine Trading Skills

-

- Continuous Learning: Invest in your trading education by learning new strategies, refining your existing ones, and staying updated on market trends. Improved skills often lead to better trading decisions and increased profits.

- Backtesting and Analysis: Regularly Backtest your strategies and analyze past trades to identify areas for improvement. A more effective strategy can lead to higher returns.

9. Consider Proprietary Trading Firms

-

- Leverage External Capital: Some proprietary trading firms offer traders the opportunity to trade with the firm’s capital in exchange for a share of the profits. This can significantly increase your trading capital without additional personal investment.

- Prove Consistency: To qualify for proprietary trading, you’ll typically need to demonstrate consistent profitability and strong risk management.

-

- Risk Capital Wisely

-

- Risk Allocation: Allocate a portion of your trading capital to higher-risk, higher-reward strategies if you have a solid foundation of preserved capital. This approach can lead to significant capital growth while protecting your core capital.

- Opportunistic Trading: Occasionally, markets present high-probability opportunities where the potential reward greatly outweighs the risk. Consider taking slightly larger positions in these scenarios, but ensure it aligns with your overall risk management strategy.

11. Seek Additional Funding Sources

-

- Investors or Partnerships: Consider bringing in outside investors or forming partnerships. By trading with other people’s money (OPM), you can increase your capital base and earn a percentage of the profits.

- Crowdfunding Platforms: Some crowdfunding platforms allow traders to pool capital from multiple investors. This can be a way to access more funds and increase your trading capital.

12. Patience and Discipline

-

- Long-Term Perspective: Growing trading capital requires patience. Focus on consistent, incremental gains rather than trying to double your account quickly. Discipline in following your strategy is key to sustained growth.

- Avoid Overtrading: Resist the urge to overtrade in pursuit of faster capital growth. Overtrading can lead to higher transaction costs and increased risk, potentially eroding your capital.

1.1. Trading Psychology-Introduction

Psychology is pivotal in trading because the financial markets are not only analysed with profitable fundamentals but also by the feelings and behaviours of dealers. Dealers are prone to cognitive impulses similar as overconfidence, loss aversion, and evidence bias. Being apprehensive of and managing these impulses through a strong cerebral frame can lead to more accurate and unprejudiced decision.

Cerebral strength helps dealers view miscalculations and losses as learning openings rather than failures. This mind set fosters nonstop enhancement and development of better trading chops. In this course you’ll learn how to know unwanted passions getting in your way of trading, damaging your judgement. Also this course covers important strategies and threat operation ways to avoid crimes that dealers constantly make.

What’s Trading Psychology??

Trading psychology refers to the feelings and internal state that dealers witness while engaging in the financial trading. It encompasses the behaviours, and emotional responses that dealer’s exhibit, which can significantly impact their trading opinions and overall performance.

1.2. Significance of Trading Psychology

There are some crucial reasons why psychology is important in trading

-

Decision Making

Decision making feelings like fear and rapacity can significantly impact decision making processes. Effective trading requires making rational, objective opinions grounded on analysis rather than emotional responses.

Illustration

The decision of a dealer can have a profound impact on their trading issues. Here is an illustration that illustrates how a dealer’s mental state and decision making process can affect their trading

- Ajay is a dealer who has a well-defined trading strategy grounded on specialized analysis. His strategy involves setting stop loss orders to limit losses and taking gains at predefined situations. One day, there’s unanticipated news that causes significant request volatility.

- The price of the stock that Ajay is trading drops fleetly, approaching the stop loss position. Ajay feels a swell of fear as the price drops snappily rather than letting the stop loss order execute as planned, Ajay manually closes the trade to avoid further implicit losses.

- The stock price soon stabilizes and rebounds sprucely, recovering all its losses and moving towards the original profit target. By letting fear mandate the decision, Ajay exits the trade precociously, missing out on the implicit recovery and gains.

- Later, the same stock starts to rise steadily, and Ajay feels confident that it’ll continue to climb. Ajay decides to ignore the profit taking strategy and keeps holding the position, hoping for indeed greater earnings.

- The stock price hits a peak and also reverses, falling sprucely due to profit taking by other dealers. By succumbing to rapacity, Ajay holds the position too long and fails to secure the gains that were originally available, ultimately performing in a lower gain or indeed a loss.

- In this illustration, Ajay’s wrong decision lead to two critical miscalculations ending a trade precociously to avoid perceived further losses, missing the eventual recovery and ignoring the predefined profit target in expedients of advanced earnings, performing in missed profit taking openings.

-

Threat operation (Risk Management)

Proper mind helps dealers cleave to their threat operation strategies. Emotional trading frequently leads to overleveraging or taking on further threat than planned, which can affect in significant losses. Threat operation is a critical element of trading psychology, as it helps dealers cover their capital and maintain long term success.

Illustration

Imagine you are a trader who has just experienced a significant loss on a trade. The market moved against your position rapidly, leading to a loss larger than you anticipated. This loss triggers a strong emotional reaction—anger, frustration, and fear of further losses. You feel an intense urge to “win back” what you lost by immediately placing another trade.

Psychological Risk: This situation is ripe for psychological risks like:

-

- Revenge Trading: The desire to quickly recoup losses can lead to impulsive decisions, often without proper analysis, increasing the risk of further losses.

- Overtrading: Emotional stress might push you to take on more trades than usual, often with poor setups, leading to higher exposure and more potential losses.

- Loss Aversion: The fear of losing more may cause you to exit trades prematurely, locking in small losses or preventing potential gains.

Risk Management Strategies:

Pause and Reflect:

-

- Step Back: Immediately after a significant loss, step away from your trading station. Take a break to allow your emotions to settle. This pause helps prevent impulsive decisions driven by emotion rather than logic.

- Breathing Exercises: Engage in deep breathing or mindfulness exercises to reduce stress and regain a calm state of mind. This helps in clearing your mind and preparing you to think more rationally.

Review the Trade:

-

- Objective Analysis: When you return, review the trade that led to the loss. Analyze what went wrong: Was it a failure in your strategy, an unexpected market event, or an emotional decision? Understanding the cause helps in learning and preventing similar mistakes in the future.

- Record Keeping: Document the trade in a journal, noting the reasons for the loss, your emotional state, and what you learned. This practice not only aids in reflection but also serves as a reference for future trades.

Set Clear Rules:

-

- Loss Limits: Establish a maximum daily loss limit. If this limit is reached, stop trading for the day. This rule prevents the emotional spiral of trying to recover losses immediately, which often leads to more significant losses.

- Cool-Off Period: After a loss, enforce a mandatory cool-off period before placing any new trades. This time allows you to reset emotionally and ensures that any new trades are based on your strategy, not emotional reactions.

Focus on the Process, Not the Outcome:

-

- Detachment from Results: Cultivate a mind-set that focuses on executing your strategy correctly, regardless of the outcome of any single trade. Understand that losses are a natural part of trading and that sticking to a disciplined process is what leads to long-term success.

- Positive Reinforcement: Reward yourself not just for winning trades, but for making disciplined decisions, even if the trade ends in a loss. This reinforces good habits and reduces the emotional impact of losses.

Seek Support:

-

- Mentorship or Community: Engage with a mentor or trading community where you can discuss your emotions and experiences. Sharing your challenges can provide perspective and support, helping you manage stress and stay grounded.

- Professional Help: If emotional reactions are consistently overwhelming and impacting your performance, consider consulting with a psychologist or counsellor specializing in trading psychology or stress management.

-

Consistency:

Successful trading requires consistency in executing strategies. Emotional control and psychological discipline ensure that traders follow their plans and do not deviate due to short-term market fluctuations. Consistency in trading psychology refers to the disciplined execution of a trading plan or strategy without being swayed by emotional impulses or short-term market fluctuations.

Example

A trader named Amit has developed a technical trading strategy based on moving averages and RSI (Relative Strength Index) indicators. His strategy includes the following rules:

- Entry Rule: Buy when the price crosses above the 50day moving average and the RSI is above 30.

- Exit Rule: Sell when the price crosses below the 50day moving average or the RSI exceeds 70.

- Position Sizing: Risk 2% of his trading capital on each trade.

- Stop Loss Orders: Set stop loss orders to limit potential losses to 2% of the trade’s value.

Amit has ₹20,000 in his trading account. He identifies a stock currently priced at ₹50 that meets his entry criteria.

Trade Execution:

-

- Entry Point: Amit buys 200 shares of the stock at ₹50 (2% risk on a ₹20,000 account means he can risk ₹400 on this trade).

- Stop Loss Order: He sets a stop loss order at ₹48 to limit his potential loss to ₹400 (200 shares x ₹2 loss per share).

Adhering to the Plan:

After purchasing the stock, the price drops slightly to ₹49, making Amit anxious. Despite his anxiety, Amit does not deviate from his strategy and keeps the trade open, adhering to his stop loss level. The stock price eventually rises to ₹55. Amit monitors the trade, and the RSI starts approaching 70. When the RSI hits 70 and the price is still above the 50day moving average, Amit decides to exit the trade, consistent with his strategy.

Outcome:

-

- Amit sells his 200 shares at ₹55

- Profit Calculation: He makes a profit of ₹1,000 (200 shares x ₹5 gain per share).

Amit follows the same consistent approach on his next trade. He identifies another stock meeting his entry criteria. Buys the stock, sets the stop loss, and exits based on his predetermined rules.

-

Stress Handling:

Trading can be stressful, especially during periods of high volatility or unexpected losses. Effective stress management through psychological resilience can help traders maintain focus and make sound decisions under pressure. Handling stress effectively is a crucial aspect of trading psychology, as it helps traders make sound decisions even under pressure.

Example

A trader named Shruti follows a swing trading strategy, focusing on holding positions for several days to weeks. Shruti has a trading account with ₹100,000 and typically risks 1% per trade. The market experiences sudden and extreme volatility due to unexpected geopolitical events. Shruti has several open positions, and the market’s rapid movements put her under significant stress.

Stress Management Techniques:

- Preparation and Planning: Before the volatility hit, Shruti had already established clear entry and exit points for each trade, including stop loss and take profit levels. This preparation helps Shruti avoid making impulsive decisions during high stress periods.

- Taking a Step Back: As the market swings wildly, Shruti feels her stress levels rising. She notices her heart rate increasing and a sense of panic setting in. Shruti steps away from her trading desk for a few minutes to take deep breaths and clear her mind. This brief break helps her regain composure and reduces immediate stress.

- Following the Plan: One of Shruti’s trades reaches its stop loss level. Instead of panicking and adjusting the stop loss to avoid the loss, Shruti allows the stop loss order to execute as planned. By following her predetermined plan, Shruti limits her loss to 1% of her account, which is within her risk tolerance.

- Using Stress Relief Techniques: Shruti practices deep breathing exercises to calm her nerves. She inhales deeply for a count of four, holds for a count of four, and exhales slowly for a count of four. After a particularly stressful trading session, Shruti goes for a walk outside. Physical activity helps reduce her stress and clear her mind.

- Reviewing and Learning: Once the market stabilizes, Shruti reviews her trades and the decisions she made under stress. She notes what worked well and where she can improve. Shruti uses this analysis to refine her trading strategy and improve her stress management techniques for future volatile periods.

-

Overcoming Biases:

Traders are prone to cognitive biases such as overconfidence, loss aversion, and confirmation bias. Being aware of and managing these biases through a strong psychological framework can lead to more accurate and unbiased decision-making. Overcoming biases is a crucial aspect of trading psychology, as cognitive biases can significantly impair decision-making and lead to suboptimal trading outcomes.

a. Confirmation Bias

Traders tend to seek out information that confirms their existing beliefs and ignore information that contradicts them. For example a trader named Amit believes that a particular stock will rise because of favourable news. He focuses on positive news articles and ignores negative analysis. Amit might overlook important risks and hold onto the stock despite signs that the price is likely to drop.

Overcoming Strategy:

Amit decides to deliberately seek out and consider opposing viewpoints. He reads bearish analyses and factors them into his decision-making process. By considering all available information, Amit can make a more balanced and informed decision, reducing the impact of confirmation bias.

b. Loss Aversion

Traders tend to prefer avoiding losses rather than acquiring equivalent gains, often leading to holding losing positions too long. For example a trader named Sarah is holding a stock that has dropped in value. She is reluctant to sell it because selling would mean realizing a loss. Sarah might hold the losing position, hoping it will recover, potentially resulting in greater losses.

Overcoming Strategy:

Sarah sets strict stop loss orders before entering trades and adheres to them regardless of her emotions. She also reviews past trades to reinforce the importance of cutting losses early. By accepting losses as part of trading and sticking to predefined exit points, Sarah can limit her losses and improve her overall performance.

c. Overconfidence Bias

Traders overestimate their knowledge, skills, and the accuracy of their predictions, leading to excessive risk-taking. For example, John has had a series of successful trades and starts believing that he has exceptional trading skills. He begins to take larger positions without proper analysis. Overconfidence leads John to take on excessive risk, which can result in significant losses when the market moves against him.

Overcoming Strategy:

John keeps a trading journal where he records his trades, reasons for entering and exiting, and outcomes. He regularly reviews his journal to remain humble and aware of his limitations. By maintaining a realistic view of his abilities and consistently analyzing his performance, John can avoid overconfidence and manage risk more effectively.

d. Recency Bias

Traders give undue weight to recent events or performance, assuming that these are indicative of future outcomes. For Example Shruti experiences a strong bullish trend in the market and assumes it will continue indefinitely. She makes trades based on this assumption. Shruti might ignore broader market indicators or signs of an impending reversal, leading to losses when the trend changes.

Overcoming Strategy:

Shruti develops a comprehensive trading plan that includes analysis of long-term trends, historical data, and market fundamentals. She uses this plan to guide her decisions rather than relying solely on recent performance. By basing her trades on thorough analysis rather than recent events alone, Shruti can make more balanced decisions and avoid the pitfalls of recency bias.

6. Patience and Discipline:

Markets do not always present clear opportunities. A strong psychological foundation helps traders stay patient and disciplined, avoiding impulsive trades that do not fit their strategy. Patience and discipline are crucial traits in trading psychology, essential for long-term success.

Example

Shruti, a seasoned trader, identifies a stock with strong fundamentals but is currently facing short-term market turbulence. She believes in the stock’s long-term potential but recognizes that the market may not reflect its value immediately. Shruti does not rush into buying the stock immediately. Instead, she waits for a confirmation signal from her technical analysis indicators, such as a moving average crossover or a breakout from a key resistance level. Despite seeing the stock price fluctuating and sometimes dropping, Shruti avoids making impulsive decisions based on fear. She reminds herself of her research and the stock’s long-term potential. Shruti maintains her focus on long-term gains rather than getting distracted by short-term market noise. She plans to hold the stock for several months or even years until it reaches her target price.

7. Adapting to Market Conditions:

Markets are dynamic and constantly changing. Psychological flexibility allows traders to adapt their strategies as needed rather than rigidly sticking to a plan that may no longer be effective. Adapting to market conditions is a vital aspect of trading psychology, as markets are dynamic and can change rapidly due to various factors.

Example

- Ajay, who is an experienced trader, has been successfully trading a particular stock using a trend following strategy. However, he notices that the market environment has shifted from a trending phase to a range bound or sideways phase. Ajay observes that the stock is no longer showing strong directional movement.

- Instead, it is oscillating within a defined range, bouncing between support and resistance levels. He recognizes that his trend following strategy might not be effective in this new market condition. Understanding the need for a different approach, Ajay decides to switch to a range trading strategy.

- This involves buying near the support level and selling near the resistance level, capitalizing on the predictable price movements within the range. Ajay revises his trading plan to incorporate the new strategy. He defines new entry and exit points based on support and resistance levels and adjusts his risk management rules accordingly.

- Ajay keeps himself updated with market news and events that could impact the stock’s price movements. He is aware that the market could break out of the range at any time, and he is prepared to adapt again if necessary. Despite the strategy change, he remains disciplined in executing his new plan.

- He does not get tempted to revert to his trend following strategy until there is clear evidence that the market has resumed trending. By adapting to the new market conditions, he avoids losses that might have occurred if he had continued with his trend following strategy.

- His new range trading approach proves effective, allowing him to generate profits in the sideways market. When the market eventually breaks out of the range and resumes trending, Ajay is ready to switch back to his original strategy.

8. Learning from Mistakes:

Psychological strength helps traders view mistakes and losses as learning opportunities rather than failures. This mind-set fosters continuous improvement and development of better trading skills.

Example

- Shyam a novice trader, has experienced several losing trades due to impulsive decisions and a lack of a structured trading plan. He takes a step back to reflect on his recent trading performance.

- He reviews his trading journal, noting the reasons for each loss, such as entering trades without proper analysis, not setting stop loss orders, and exiting trades prematurely due to fear.

- By analyzing his trading history, he identifies a pattern of emotional trading. He realizes that he often makes impulsive decisions driven by market news or short-term price movements, leading to poor trade outcomes.

- Understanding the need for improvement, he decides to educate himself further. He reads books on trading psychology, attends webinars, and follows experienced traders to learn about effective trading strategies and risk management techniques.

- With new knowledge, Shyam creates a detailed trading plan that includes specific criteria for entering and exiting trades, risk management rules, and guidelines for maintaining emotional control. He commits to following this plan, strictly monitors his trades closely, adhering to his trading plan and avoiding impulsive decisions.

- He keeps a trading journal to document each trade, including the rationale behind it, the outcome, and any emotional responses experienced. By learning from his mistakes and making necessary adjustments, Shyam begins to see improvements in his trading performance.

- Over time, his ability to learn from past mistakes helps him develop into a more successful and confident trader. Trading is not about short-term gains but rather long-term success. A strong psychological approach helps traders maintain a long-term perspective, focusing on sustainable growth rather than quick wins.

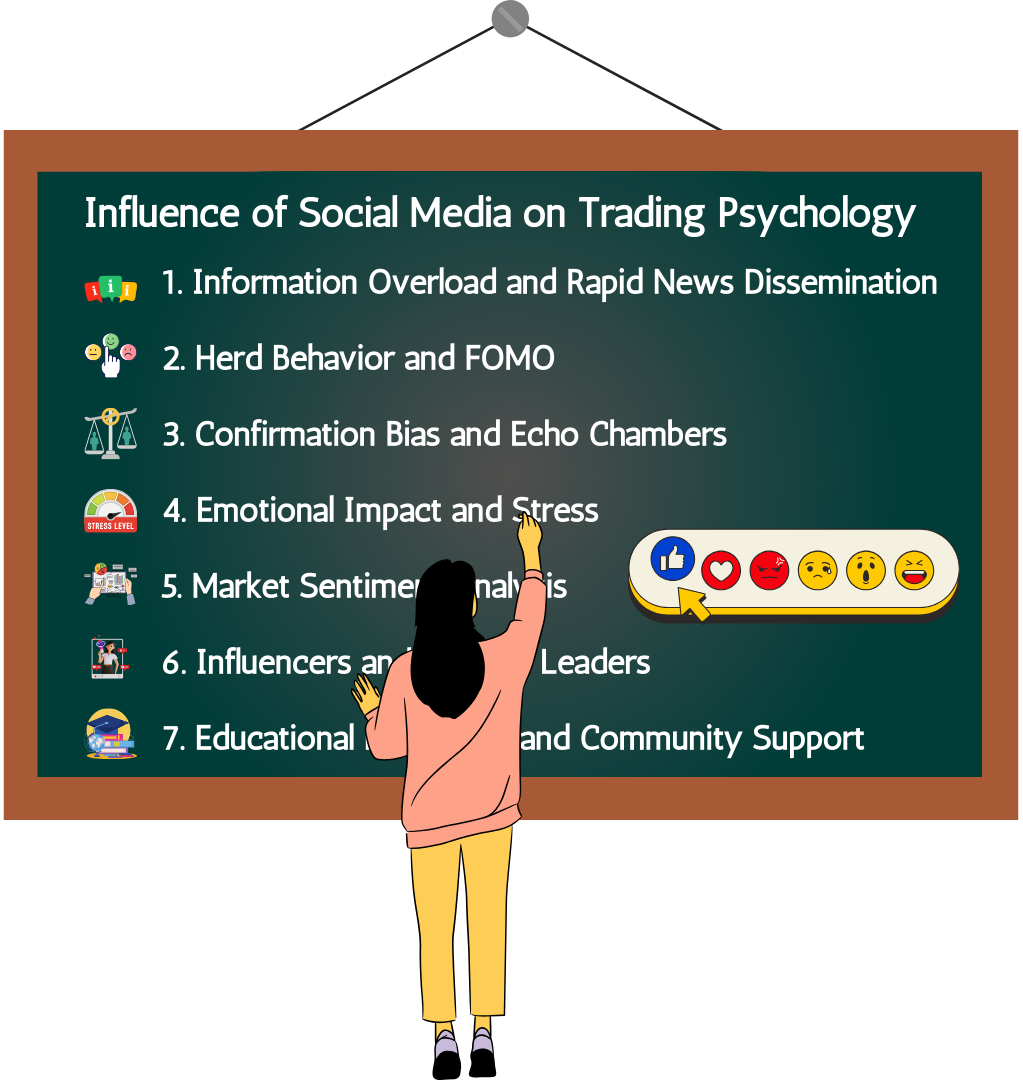

1.3. Influence of Social Media on Trading Psychology

Social media plays a significant role in shaping trading psychology in various ways:

1. Information Overload and Rapid News Dissemination

Social media platforms provide real-time news updates, which can lead to immediate market reactions. False or speculative information can spread quickly, causing traders to make impulsive decisions based on inaccurate data.

2. Herd Behavior and FOMO (Fear of Missing Out)

Seeing many people talking about or trading a particular stock or asset can lead traders to follow the crowd without conducting their own research. The fear of missing out on potential profits can drive traders to make hasty decisions, often leading to buying high and selling low.

3. Confirmation Bias and Echo Chambers

Traders might follow accounts and join groups that align with their existing beliefs, reinforcing their biases. These environments can create a false sense of consensus, making traders overconfident in their decisions.

4. Emotional Impact and Stress

Seeing others’ successes or failures can heighten emotions, leading to stress and emotional trading. Comparing one’s performance to others can create undue pressure, impacting trading decisions negatively.

5. Market Sentiment Analysis

Some traders use social media sentiment as a tool to gauge market trends and sentiment, though this can be a double-edged sword as sentiment can be volatile and manipulated.

6. Influencers and Opinion Leaders

Well-known traders and financial influencers can significantly impact market movements through their opinions and predictions. Unscrupulous individuals can use their influence to artificially inflate the price of an asset before selling it off, leaving others with losses.

7. Educational Resources and Community Support

Social media provides access to a wealth of educational content and community support, helping traders improve their skills and knowledge. Engaging with other traders can provide valuable insights and different perspectives on trading strategies and market analysis.

Example of Social Media Influence on Trading Psychology

- A notable example of social media’s influence on trading psychology in India is the case of the GameStop (GME) short squeeze in early 2021, which had global repercussions, including in India.

- This event was fueled significantly by discussions and campaigns on social media platforms like Reddit, particularly in the subreddit r/WallStreetBets. The GameStop short squeeze drew massive global attention, including from Indian traders.

- The news spread rapidly across social media platforms, leading to heightened interest and participation from traders around the world.

- Indian retail investors, influenced by the social media buzz, started looking for similar opportunities in their local market.

- There was an increase in activity on Indian stock market forums and social media groups discussing potential “short squeeze” targets in India. Stocks like Reliance Communications, Suzlon Energy, and other highly shorted stocks in India saw a significant increase in trading volumes as traders tried to replicate the GameStop phenomenon locally.

- Social media platforms such as Twitter, Facebook, and local forums like Moneycontrol’s message board saw a spike in discussions and posts about these stocks, driving more retail participation.

- Many traders jumped on the bandwagon without thorough research, driven by the fear of missing out (FOMO) on potential high returns that were being talked about on social media.

- The Securities and Exchange Board of India (SEBI) closely monitored the situation to ensure market stability and protect retail investors from potential market manipulation.

- Following the incident, there were increased efforts to educate investors about the risks of following social media trends blindly and the importance of making informed trading decisions.

1.4 Winning V/s Loosing Stripes

Winning and losing stripes are common sensations in trading, and they can significantly impact a dealer’s psychology and decision making process. Understanding how to manage these stripes is vital for long term success.

Winning stripes

A winning band in the stock request is a period during which a stock or index closes at an advanced price for consecutive trading sessions. However, it’s on a five day winning band, if a stock’s price increases for five consecutive days.

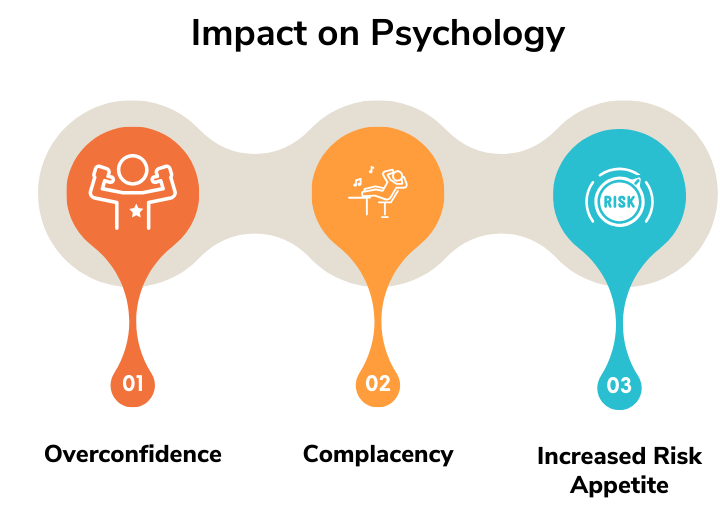

Impact on Psychology

- Overconfidence a series of successful trades can lead to overconfidence, making dealers believe they are invincible. This can affect in taking devilish risks and swinging from their trading plan.

- Complacency Dealers might come insouciant, neglecting thorough analysis and due assiduity, assuming their winning band will continue indefinitely.

- Increased trouble Appetite Buoyed by recent success, dealers may increase their position sizes, influence, or trade more constantly, exposing themselves to lower implicit losses.

Operation Strategies

- Stick to the Plan Maintain discipline by adhering to the original trading plan, including trouble operation rules.

- Review and Reflect Regularly review formerly trades to understand the reasons behind successes and ensure they were due to sound strategy rather than luck.

- Stay Humble Acknowledge that requests are changeable and that no dealer is vulnerable to losses. Staying rested helps maintain a balanced approach.

Losing stripes

- A losing band in the stock request is a period during which a stock or index closes at a lower price for consecutive trading sessions.

- However, it’s on a six day losing band, if a stock’s price diminishments for six consecutive days.

Impact on Psychology

- Loss Aversion passing losses can lead to a violent emotional response where dealers come excessively concentrated on avoiding further losses, constantly leading to poor decision.

- Fear and Hesitation after a series of losses, dealers may come fearful and reticent to take new positions, indeed if the setup is favourable.

- Revenge Trading to recoup losses snappily, dealers might engage in revenge trading, taking fallacious risks and swinging from their plan.

Operation Strategies

- Take a Break Stepping down from the request temporarily can help clear the mind and reduce emotional stress, allowing for a more objective reassessment.

- Anatomize misapprehensions Review losing trades to identify any common misapprehensions or areas for improvement. This helps in knowledge and avoiding similar pitfalls in the future.

- Focus on the Process Shift the focus from short term issues to following the trading process and strategy. Density in execution will eventually lead to better results.

1.5 Developing the Right Trader’s Mind set

Developing the right mind set is vital for successful trading. It involves cultivating internal habits and stations that can help you handle the emotional and cerebral challenges of trading.

- Self-Discipline and forbearance produce a comprehensive trading plan with clear rules and guidelines. Cleave to this plan constantly, indeed during changeable periods. Repel the appetite to make impulsive opinions rested on heartstrings or request noise. Stick to your strategy and avoid chasing the request.

- Emotional Control Learn to recognize and manage your heartstrings, analogous as fear, cupidity, and frustration. Emotional control is essential for making rational opinions. Understand that losses are part of trading. Develop inflexibility to handle setbacks without letting them affect your unborn opinions.

- Realistic prospects set realistic, attainable trading pretensions rather than aiming for unrealistic earnings. Understand that harmonious, small earnings are more sustainable than large, erratic earnings. Recognize that trading is a continuous knowledge trip. Anticipate to make misapprehensions and view them as learning openings rather than failures.

- Risk Management Use stop loss orders and position sizing to manage trouble effectively. Guarding your capital is vital for long term success. Diversify your investments to spread trouble.

- Continuous improvement Document your trades, including the explanation behind each decision and the outgrowth. Engage with other dealers, join trading communities, and seek feedback to gain new perspectives and perceptivity.

- Strictness be set to adapt your strategy rested on changing request conditions. Harshness is vital to navigating different request surroundings. Keep up with request news, trends, and developments. Continuous knowledge will help you stay ahead and make informed opinions.

- Confidence and Humility Confidence in your strategy and decision making process is important. Still, ensure that confidence doesn’t turn into overconfidence. Recognize that no strategy is wisecrack confirmation and that you can always meliorate. Stay humble and open to learning from others.

- Focus on the Process, Not the Outcome Focus on following your trading plan and strategy rather than obsessing over individual trade issues. Constantly applying your process will lead to better long term results. Don’t let a single trade’s outgrowth dictate your overall strategy or tone assessment. Base your evaluation on adherence to your plan and trouble operation.

1.6 The secret of successful Trader Psychology

The secret to successful dealer psychology lies in learning a combination of internal disciplines, emotional operation, and strategic thinking, also are vital rudiments that contribute to a successful trading mind set.

1. Tone awareness and Emotional Intelligence

Be alive of how heartstrings like fear, cupidity, and overconfidence impact your decision. Understanding your emotional triggers can help you manage them better. Develop ways to manage stress and maintain countenance. This might include mindfulness, contemplation, or simply taking breaks from trading to regain perspective.

2. Discipline and density

Develop a well-defined trading plan with clear rules and stick to it. Density in following your plan helps in managing trouble and avoiding impulsive opinions. Establish a trading routine that includes regular analysis, review of formerly trades, and drug for the trading day. Harmonious routines can help make discipline and reduce stress.

3. Risk Management

Implement strict threat operation rules, similar as using stop loss orders and limiting position sizes. Guarding your capital ensures you can continue trading over the long term. Understand your threat forbearance and acclimate your strategies consequently. Effective threat operation is pivotal for surviving and thriving in unpredictable requests.

4. Growth Mind set

Treat losses and miscalculations as learning openings rather than failures. Assaying what went wrong and making adaptations can ameliorate your trading chops. Stay curious and married to literacy. Regularly modernize your knowledge, upgrade your strategies, and seek feedback from others in the trading community.

5. Focus and neutrality

Don’t let the excitement of trading lead to overtrading. Stick to your strategy and avoid making trades grounded on feelings or request noise. Base your opinions on data and analysis rather than particular impulses or external pressures. Ideal decision helps in maintaining thickness and discipline.

6. Adaptability and tolerance

Develop adaptability to handle ages of loss without letting them affect your confidence or decision making process. Tolerance is crucial to staying for the right openings and not forcing trades. Focus on long term pretensions rather than short term earnings. Trading success frequently requires time and continuity.

7. Rigidity

Be willing to acclimatize your strategies grounded on changing request conditions. Inflexibility allows you to respond to new information and evolving request dynamics. Keep up with request trends, news, and developments to make informed opinions and acclimate your approach as demanded.

8. Awareness and Balance

Maintain a healthy work life balance to avoid collapse. Engaging in conditioning outside of trading helps in keeping a clear mind and reducing stress. Incorporate awareness ways to stay focused and calm during trading. Awareness helps in managing feelings and perfecting decision.

1.7 Becoming a Disciplined Trader

A disciplined trader is someone who constantly follows a well-defined trading plan, maintains emotional control, and adheres to established threat operation practices. Crucial

Characteristics of a Disciplined Trader

Adherence to a Trading Plan

A chastened Trader follows a detailed trading plan with specific strategies, entry and exit points, and threat operation rules. Sticks to the plan anyhow of request conditions or feelings.

Emotional Control Remains calm and composed indeed during unpredictable request conditions. Makes opinions grounded on analysis and strategy rather than feelings like fear or rapacity.

Risk Management tools stop loss orders to minimize implicit losses. Precisely sizes positions to align with threat forbearance and overall portfolio strategy. Avoids concentrating too important capital in a single asset or trade.

Nonstop literacy and enhancement Stays informed about request trends, new trading strategies, and fiscal news. Regularly reviews past trades to learn from miscalculations and successes. Adjusts strategies as demanded grounded on request conditions and particular experience.

Attestation and analysis

Maintains a detailed journal of all trades, including the explanation behind each trade, issues, and reflections. Regularly evaluates trading performance to identify areas for enhancement.

Tolerance and Discipline

Doesn’t force trades but delays for setups that meet predefined criteria. Executes trades according to plan without divagation.

Illustration

One well known illustration of a chastened dealer in India is Rakesh Jhunjhunwala, frequently appertained to as the” Warren Buffett of India.” Though he was more extensively known as an investor, his disciplined approach to trading and investing provides precious assignments for dealers. Jhunjhunwala was known for his long term investment strategies, sticking to his persuasions indeed during request volatility. He conducts thorough abecedarian analysis before making investment opinions. Rakesh Jhunjhunwala chastened approach to trading and investing has made him one of the most successful and reputed personality. His styles and gospel offer precious perceptivity for dealers and investors aiming to develop discipline and achieve long term success.

1.8 Analysing and learning from losing streaks

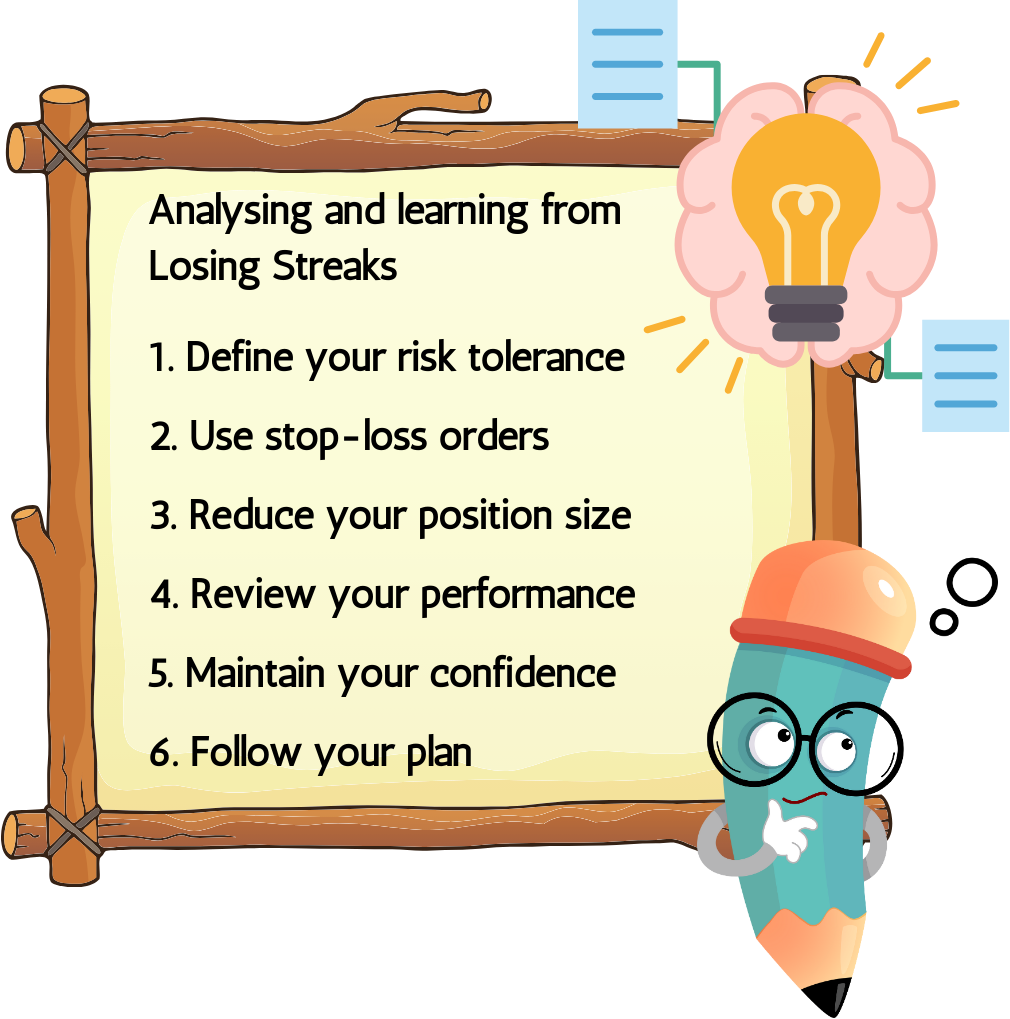

Analysing and learning from losing Streaks is pivotal for getting a successful and disciplined dealer.

1. Define your threat forbearance

Before you enter any trade, you should have a clear idea of how much you’re willing to risk and lose. This is your threat forbearance, and it depends on your trading style, pretensions, and personality. Your threat forbearance should be harmonious and realistic, not grounded on feelings. A common rule of thumb is to risk no further than 1 2 of your account balance per trade, but you can acclimate this according to your preferences.

2. Use stop loss orders

Stop loss orders are essential tools for guarding your capital and limiting your losses. They’re orders that automatically close your position at a destined price position, if the request moves against you. You should always use stop loss orders, and place them grounded on specialized analysis, not on arbitrary figures or wishful thinking. For illustration, you can use support and resistance situations, trend lines, moving pars, or pointers to set your stop loss orders.

3. Reduce your position size

One of the simplest and most effective ways to manage threat and position size during losing stripes is to reduce your exposure to the request. By trading lower quantities, you can reduce the impact of each loss on your account and your feelings. You can use a fixed chance or a fixed bone quantum to determine your position size, or you can use a threat price rate or a Kelly criterion to optimize it. The key is to be harmonious and disciplined, and not to overtrade or chase losses.

4. Review your performance

Losing stripes can also be openings to learn from your miscalculations and ameliorate your trading chops. You should review your performance regularly, and dissect your trades objectively. You should look for patterns, trends, strengths, and weakness in your and identify what works and what doesn’t. You should also keep a trading journal, where you record your entries, exits, reasons, feelings, and issues of each trade. This will help you track your progress, spot your crimes, and acclimate your strategy consequently.

5. Maintain your confidence

Losing streaks can also affect your confidence and motivation as a trader. You may start to doubt yourself, your system, or the market. You may become fearful, frustrated, or angry. You may lose sight of your long-term goals and vision. To avoid these negative effects, you should maintain your confidence and optimism during losing streaks. You should remind yourself of your past successes, your trading edge, and your potential. You should also practice self-care, such as taking breaks, exercising, meditating, or seeking support from others.

6. Follow your plan

Eventually, the most important tip on how to manage threat and position size during losing stripes is to follow your trading plan. Your trading plan is your roadmap to success, and it should include your pretensions, rules, criteria, styles, and pointers for trading. You should follow your trading plan rigorously, and not diverge from it grounded on feelings, impulses, or external influences. You should also review and modernize your trading plan periodically, and test it on different request conditions and scripts