- In today’s financial landscape, understanding the nuances between recourse and non-recourse loans is crucial for individuals and businesses alike. These terms often come into play when borrowing money, particularly in the realm of real estate and business financing. This article aims to demystify the concepts of recourse and non-recourse loans, exploring their definitions, differences, and implications for borrowers.

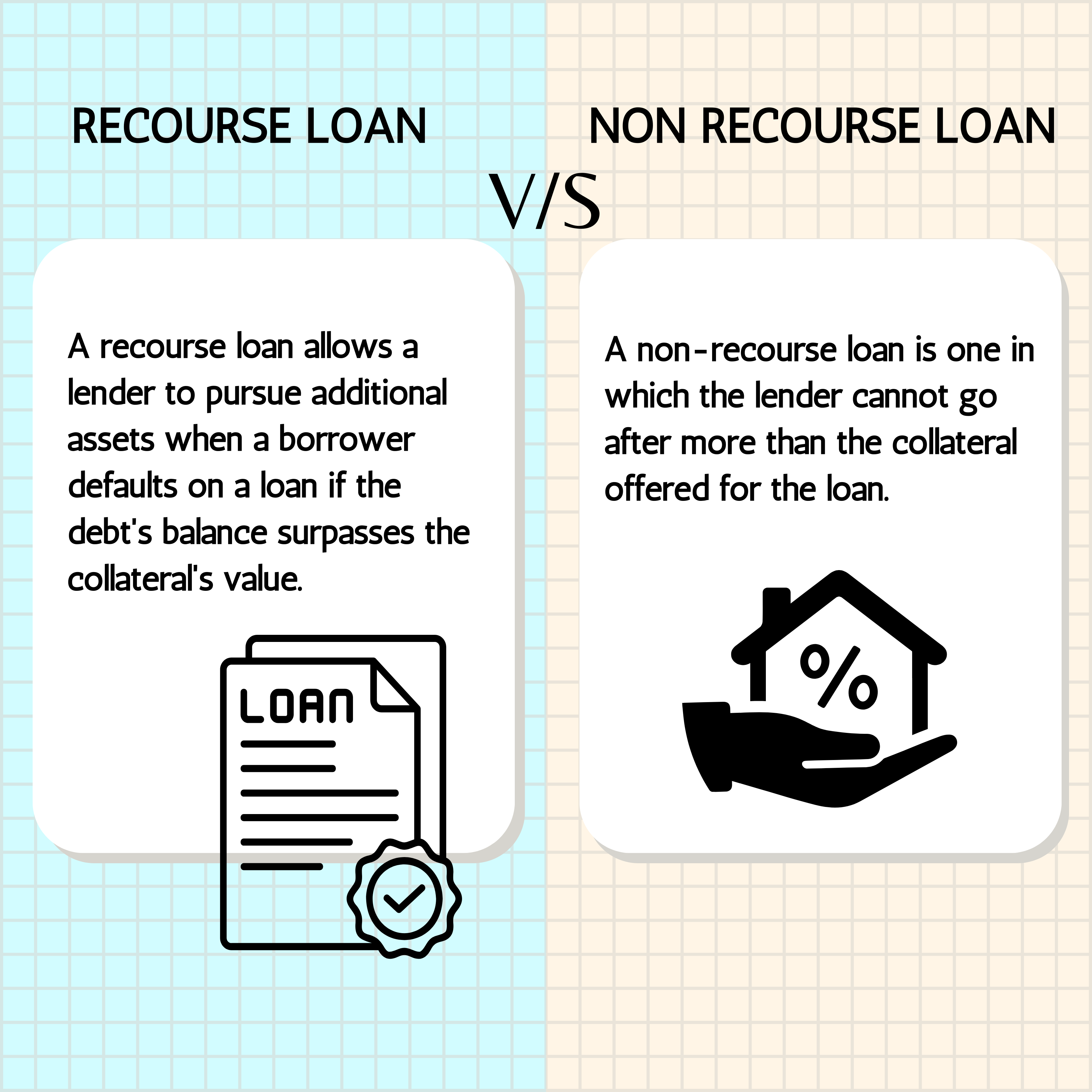

- In the realm of finance, particularly in borrowing and lending, the concept of recourse and non-recourse loans holds significant importance. These terms delineate the degree of liability and risk assumed by both borrowers and lenders in the event of default. In essence, a recourse loan provides lenders with the recourse to pursue additional assets of the borrower beyond the collateral securing the loan, offering an added layer of security.

- On the other hand, a non-recourse loan limits the lender’s recourse solely to the collateral, thus potentially exposing lenders to higher risk. Understanding the nuances between these two types of loans is crucial for borrowers, as it directly impacts their financial obligations and liabilities. By delving into the intricacies of recourse and non-recourse loans, borrowers can make informed decisions when seeking financing options, aligning their choices with their risk tolerance, financial objectives, and overall circumstances.

What is Recourse Loan ?

- A recourse loan is a type of loan arrangement where the lender retains the right to seek additional repayment from the borrower beyond the collateral put forth to secure the loan, in the event of default.

- In essence, if the borrower fails to meet their repayment obligations and the collateral’s value is insufficient to cover the outstanding debt, the lender can pursue the borrower’s other assets or income sources.

- This characteristic distinguishes recourse loans from non-recourse loans, as the lender has recourse to additional assets beyond the specified collateral. Recourse loans are commonly used in various financial transactions, including mortgage financing, where lenders may seize the borrower’s other properties or assets to recoup losses if the primary collateral falls short. While recourse loans offer lenders an added layer of security, they also expose borrowers to greater personal liability, as their other assets may be at risk in the event of default.

Examples of Recourse Loans in India

- Home Loans: Most home loans are recourse loans, where the lender can pursue the borrower’s other assets if the sale of the mortgaged property does not cover the full outstanding loan amount.

- Auto Loans: Auto loans, where the vehicle itself is the collateral, are generally recourse loans. If the borrower defaults, the lender can repossess the vehicle and pursue further recovery if needed.

- Personal Loans: Personal loans are often unsecured but may be recourse in nature. If the borrower defaults, the lender can pursue the borrower’s other assets or initiate legal action to recover the amount.

- Business Loans: Many business loans are recourse loans, especially those where personal guarantees are provided. Lenders can pursue the borrower’s personal assets if the business assets and other recoveries are insufficient.

- Gold Loans: Loans against gold or other personal assets are typically recourse loans. If the borrower defaults, the lender can sell the pledged gold and, if necessary, pursue further recovery.

- Education Loans: Education loans, though primarily secured against the future earning potential of the borrower, often come with recourse provisions. The lender can pursue the borrower’s other assets or income if the loan is not repaid.

- Consumer Durable Loans: Loans for purchasing consumer durables like electronics, where the product itself serves as collateral, are often recourse loans. If the borrower defaults, the lender can repossess the item and seek additional recovery.

What Is A Non-Recourse Loan?

A non-recourse loan is a type of loan agreement in which the lender’s sole recourse, in the event of default, is limited to the collateral securing the loan. Unlike recourse loans, where lenders can pursue additional assets of the borrower beyond the collateral, non-recourse loans restrict the lender’s remedies solely to the specified collateral. This means that if the borrower fails to repay the loan and the collateral’s value is insufficient to cover the outstanding debt, the lender cannot seize the borrower’s other assets or income sources to satisfy the debt. Non-recourse loans are commonly utilized in financing large-scale projects, such as commercial real estate developments, where the property itself serves as the primary collateral. By limiting the lender’s recourse, non-recourse loans transfer a significant portion of the risk associated with default onto the lender, as they may not fully recover their investment if the collateral’s value depreciates. However, non-recourse loans provide borrowers with a level of protection, shielding their other assets from potential seizure in the event of financial distress.

Examples of Non-Recourse Loans in India

Project Financing:

- Infrastructure Projects: Loans for large infrastructure projects (e.g., highways, airports) may be structured as non-recourse, where repayment is tied solely to the revenue generated by the project itself.

- Renewable Energy Projects: Financing for solar or wind energy projects can be non-recourse, with lenders relying on the revenue from the energy production rather than the borrower’s personal assets.

Commercial Real Estate Loans:

- Income-Generating Properties: Loans for commercial properties like office buildings or shopping malls, where the loan repayment is based on the income generated by the property, can sometimes be non-recourse.

Structured Finance Deals:

- Securitization Transactions: In structured finance, such as securitization of assets (e.g., mortgages, receivables), loans may be non-recourse as the collateral or asset-backed securities are the primary source of repayment.

Certain High-Profile Corporate Loans:

- Large Corporations: Large corporations with strong credit ratings may negotiate non-recourse terms for specific types of loans, particularly when they are able to provide significant collateral or have strong revenue-generating assets.

Debt Financing for Specific Ventures:

- Joint Ventures: Financing for certain joint ventures or special purpose entities (SPEs) can be structured as non-recourse, focusing on the cash flows or assets of the venture rather than the broader financial condition of the parent company.

Recourse V/s Non-Recourse Debt

| Aspect | Recourse Loan | Non-Recourse Loan |

|---|---|---|

| Lender’s Rights | Can pursue the borrower’s personal assets if the collateral does not cover the loan amount. | Can only claim the collateral; cannot pursue the borrower’s other assets. |

| Risk to Borrower | High, as personal assets beyond the collateral are at risk. | Lower, as only the collateral is at risk. |

| Collateral | Secured by specific assets, but lender retains rights to additional assets if needed. | Secured by specific assets, with no additional claims on the borrower’s other assets. |

| Default Consequences | Borrower may face additional claims and financial loss beyond the collateral. | Borrower’s financial loss is limited to the collateral. |

| Common Uses | Personal loans, auto loans, most home loans, and some business loans. | Certain real estate and project finance loans, often in commercial sectors. |

| Interest Rates | Generally lower due to additional security for the lender. | May be higher due to the increased risk for the lender. |

| Legal Framework | Subject to extensive legal mechanisms for recovery, such as SARFAESI Act in India. | Legal recourse is limited to the collateral; enforcement is more complex. |

| Availability | More common and widely available. | Less common, often specific to certain sectors or high-profile borrowers. |

| Impact on Borrowers | Higher personal risk; potential for significant financial strain if default occurs. | Lower risk; limited to the value of the collateral. |

| Lender’s Risk | Lower, due to ability to pursue borrower’s additional assets. | Higher, as the lender can only recover from the collateral. |

Short summary of Difference between recourse and non recourse loan

Recourse Loans

- Lender’s Rights: Can pursue the borrower’s personal assets beyond the collateral if the loan is not fully repaid.

- Borrower’s Risk: Higher, as personal assets beyond the collateral are at risk.

- Collateral: Secured by specific assets, but lenders retain rights to additional recovery if needed.

- Common Uses: Personal loans, auto loans, most home loans, and some business loans.

- Interest Rates: Generally lower due to additional security for the lender.

Non-Recourse Loans

- Lender’s Rights: Can only claim the collateral; cannot pursue the borrower’s other assets if the loan is not fully repaid.

- Borrower’s Risk: Lower, as financial loss is limited to the collateral.

- Collateral: Secured by specific assets with no additional claims on the borrower’s other assets.

- Common Uses: Certain real estate and project finance loans, often in commercial sectors.

- Interest Rates: May be higher due to the increased risk for the lender

How to Know About the Loan Type ??

Determining the most suitable loan type involves careful consideration of several factors tailored to your individual financial situation and objectives. Here are some pointers to help you navigate this decision-making process:

- Risk Tolerance:

Assess your comfort level with assuming personal liability. If you prefer to minimize the risk of your other assets being at stake in the event of default, a non-recourse loan may be preferable. However, if you are confident in your ability to repay and willing to accept greater personal liability, a recourse loan might offer lower interest rates and more favorable terms.

- Asset Portfolio:

Evaluate your existing assets and their potential exposure in case of default. If you have significant assets beyond the collateral being used to secure the loan, opting for a non-recourse loan can help protect those assets from seizure by the lender. Conversely, if you have limited assets or are confident in the value of the collateral, a recourse loan may offer more flexibility and potentially lower interest rates.

- Loan Purpose:

Consider the purpose of the loan and the associated risks. For ventures with higher uncertainty or volatility, such as speculative real estate investments, a non-recourse loan may provide greater peace of mind by limiting personal liability. Conversely, if you are seeking financing for a well-established project with reliable cash flow, a recourse loan might offer more favorable terms due to the added security for the lender.

- Lender Preferences:

Understand the preferences and requirements of potential lenders. Some lenders specialize in either recourse or non-recourse loans, depending on their risk appetite and underwriting criteria. By aligning your loan type with the lender’s preferences, you may increase your chances of approval and secure more favorable terms.

Conclusion

In conclusion, the choice between recourse and non-recourse loans is a significant decision that can have lasting implications for borrowers and lenders alike. Each loan type offers its own set of advantages and considerations, depending on factors such as risk tolerance, asset portfolio, loan purpose, and lender preferences. Recourse loans provide lenders with added security by allowing recourse to additional borrower assets in the event of default, potentially resulting in lower interest rates for borrowers. However, they also expose borrowers to greater personal liability, as their other assets may be at risk. On the other hand, non-recourse loans limit lender recourse to the specified collateral, providing borrowers with protection against personal liability but potentially carrying higher interest rates and stricter eligibility criteria. By understanding the nuances between these loan types and assessing their individual circumstances and objectives, borrowers can make informed decisions when seeking financing options. Ultimately, the choice between recourse and non-recourse loans should be guided by a thorough evaluation of the associated risks, benefits, and long-term implications, ensuring that the chosen loan aligns with their financial goals and risk tolerance.

Frequently Asked Questions(FAQs)

Non-recourse loans often require stricter underwriting standards and may be more challenging to qualify for compared to recourse loans. Lenders typically assess the risk associated with the collateral property in greater detail.

In some cases, recourse loans may be refinanced into non-recourse loans, particularly if the borrower’s financial situation improves or the property appreciates in value. However, this process typically involves renegotiating terms with the lender.

While non-recourse loans may limit personal liability for borrowers, they may also come with higher interest rates and stricter terms compared to recourse loans. Borrowers should weigh the benefits and drawbacks of each loan type before making a decision.

If the value of the collateral property decreases below the outstanding loan balance, the lender may accept a partial repayment or negotiate a loan modification with the borrower. However, the borrower’s personal assets are typically protected from seizure in this scenario.

Yes, there are various other types of loans available, each with its own unique terms and conditions. Examples include secured loans, unsecured loans, and lines of credit, which may offer different levels of collateral requirements and borrower liability.