- What Are Commodities

- What Is A Commodity Market

- How Does Commodities Business Work

- Risks Involved In Commodity Market

- Commodities Futures Trading

- Functioning Of Commodities Market

- Due Diligence

- Exchanges Involved In Commodity Market

- Structure Of Commodities Market

- International Commodity Exchanges

- Forward Markets Commission

- Commodities Transaction Tax

- Financialization of Commodities

- Points To Remember Before Trading In Commodities Market

- Study

- Slides

- Videos

2.1.Meaning of commodity market

A commodity market is a place to trade in commodities like precious metals, crude oil, natural gas, energy, and spices, among others. The commodity market can be divided into two areas: Traditional commodities traded on exchanges, and non-traditional or new markets, which are only accessible via indirect investments such as equities.

Despite the great variations between the individual commodities, all of their markets are determined by supply and demand. Since they have a relatively low level of correlation with traditional investments such as stocks or bonds, commodities can improve the risk-return profile of a traditional portfolio.

Commodities prices are influenced by the following factors:

- Performance in the areas of economic growth, interest rates, and inflation.

- Changes in inventory or availability.

- Developments with regard to the transaction currency and trade regulations.

- Weather conditions, natural catastrophes, and climatic change.

Geopolitical risks

2.2.Different methods to invest in commodity markets

- Spot (cash transaction) – The physical commodity is bought on the spot, i.e. the investor receives the commodity immediately in exchange for cash. Private investors can perform cash transactions in precious metals like gold, silver, platinum, and palladium. In general, this is not possible for other commodities.

- Futures – A common form of investment in commodities is futures, which are exchange-listed and standardized contracts for the delivery of a specific quantity of a commodity at a specific location, on a certain date, and at a specified price. Futures are derivatives, and investors first of all need to open a margin account in order to be able to trade in them. In addition, futures positions must be actively monitored because they need to be closed before maturity in order to prevent an unwanted physical delivery.

- Index products – Index products bundle several commodities futures, with a wide range of products and strategies available. The benchmark indexes generally follow a buy-and-hold strategy and hold futures in all commodity sectors. Besides the changes in the spot rate, the roll yields and the interest income have an impact on the index performance. Roll yields and losses are incurred when contracts have to be sold before their maturity dates and the earnings are reinvested in new contracts

- Structured products – Structured products provide access to commodity markets for investors who are not willing or able to open margin accounts. In commodities trading by a bank, commodity derivatives are traded and investable products are structured for private clients. The counterparty of the private investor is the issuing bank. These products are available for a whole variety of underlyings and may contain barriers or other clauses.

- Funds/exchange traded funds/exchange traded commodities – Fund managers invest the resources they have gathered from investors across the entire commodities sector in accordance with the fund prospectus. For example, they invest in commodity futures, funds, and also in stocks issued by commodity producing companies. There are also funds with physically deposited commodities and therefore involve no counterparty risk. Fund performance depends on the investment skill of the fund manager and the restrictions stated in the fund prospectus. Exchange traded funds (ETFs) are investment funds that are listed on an exchange and are traded in the same way as equities. Most ETFs are index funds that replicate an equity or bond index. Exchange traded commodities (ETCs) are also listed on an exchange. They provide a cost-effective way of investing in physical commodities or in a commodity index based on at least one commodity

- Equities – Investing directly in equities from commodity producing companies makes it possible to invest indirectly in commodities that are difficult to access. The development of the share price can deviate significantly from the performance of the underlying commodity

2.3.What are the main differences between commodity spot and derivatives market?

There are two types of commodity markets: spot and derivatives. In a spot market, a physical commodity is sold or bought at a price negotiated between the buyer and the seller. The spot market involves buying and selling of commodities in cash with immediate delivery. There are spot markets for individual consumers and the business-to-business category. Spot markets also include traditional markets such as Delhi’s Azadpur Mandi that deal in fruits and vegetables.

On the other hand, a commodity can be sold or bought via derivatives contract as well. A futures contract is a pre-determined and standardized contract to buy or sell commodities for a particular price and for a certain date in the future. For instance, if one wants to buy 10 tonne of wheat today, one can buy it in the spot market. But if one wants to buy or sell 10 tonne of wheat at a future date, (say, after two months), one can buy or sell rice futures contracts at a commodity futures exchange.

The futures contracts provide for the delivery or receipt of a physical commodity of a specified amount at some future date. Under the physically settled contract, the full purchase price is paid by the buyer and the actual commodity is delivered by the seller. But in a futures contract, actual delivery takes place later. For instance, a farmer enters into a futures contract to sell 10 tonne of wheat at $100 per tonne to a miller on a future date. On that date, the miller will pay the full purchase price ($1,000) to the farmer and in exchange will receive the 10 tonne of wheat.

However, under the cash-settled futures contract, the farmer and the miller would simply exchange the difference between the spot price of rice on the settlement date and the agreed upon price as mentioned in the futures contract and there would be no actual delivery of rice. Following the above example, if on the settlement date the price of rice was $80 per tonne, while the agreed upon price of futures contract was $100 a tonne, the miller will pay $200 to the farmer in cash and there will be no delivery of rice to the miller. If, on the settlement date, the price of rice was $120 a tonne, the farmer will pay $200 to the miller in cash and no delivery of rice will take place. In practice, most futures contracts do not involve delivery of physical commodity as contracts are settled in cash through an exchange. The financial investors prefer cash settlement because of no interest in buying or selling the underlying commodity, and lower transaction costs. Nowadays, the entire process of futures trading in commodities is carried out electronically throughout the world

There are two types of commodity markets: spot and derivatives. In a spot market, a physical commodity is sold or bought at a price negotiated between the buyer and the seller. The spot market involves buying and selling of commodities in cash with immediate delivery. There are spot markets for individual consumers and the business-to-business category. Spot markets also include traditional markets such as Delhi’s Azadpur Mandi that deal in fruits and vegetables.

On the other hand, a commodity can be sold or bought via derivatives contract as well. A futures contract is a pre-determined and standardized contract to buy or sell commodities for a particular price and for a certain date in the future. For instance, if one wants to buy 10 tonne of wheat today, one can buy it in the spot market. But if one wants to buy or sell 10 tonne of wheat at a future date, (say, after two months), one can buy or sell rice futures contracts at a commodity futures exchange.

The futures contracts provide for the delivery or receipt of a physical commodity of a specified amount at some future date. Under the physically settled contract, the full purchase price is paid by the buyer and the actual commodity is delivered by the seller. But in a futures contract, actual delivery takes place later. For instance, a farmer enters into a futures contract to sell 10 tonne of wheat at $100 per tonne to a miller on a future date. On that date, the miller will pay the full purchase price ($1,000) to the farmer and in exchange will receive the 10 tonne of wheat.

However, under the cash-settled futures contract, the farmer and the miller would simply exchange the difference between the spot price of rice on the settlement date and the agreed upon price as mentioned in the futures contract and there would be no actual delivery of rice. Following the above example, if on the settlement date the price of rice was $80 per tonne, while the agreed upon price of futures contract was $100 a tonne, the miller will pay $200 to the farmer in cash and there will be no delivery of rice to the miller. If, on the settlement date, the price of rice was $120 a tonne, the farmer will pay $200 to the miller in cash and no delivery of rice will take place. In practice, most futures contracts do not involve delivery of physical commodity as contracts are settled in cash through an exchange. The financial investors prefer cash settlement because of no interest in buying or selling the underlying commodity, and lower transaction costs. Nowadays, the entire process of futures trading in commodities is carried out electronically throughout the world

2.4.How to trade in derivatives commodities market?

You can trade in the commodities market through the following two contracts:

- Forwards Contracts: This contract is an agreement between two parties to sell or buy a certain commodity at a fixed price in the future. This contract hedges the risk for the buyer against price fluctuations, and the seller can get a guaranteed price for his product at a specified date.

Futures Contract: Futures contract is an agreement between two parties who agree to buy or sell a particular asset at a specified date and at a predetermined price. The payment and delivery of the asset are made at a future date, termed the delivery date. The buyer in the futures contract is known to hold a long position and the seller in the futures contract is said to be having a short position.

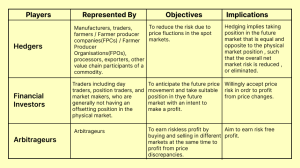

2.5.various players in the commodity derivatives market

The players in the commodity derivatives market can be classified into two major categories – risk givers and risk takers. Risk givers or hedgers refer to those who have a risk due to physical exposure to the commodity, and are looking to pass on their risk by taking a sell or buy position on Stock Exchange. Risk takers or investors refer to those who do not have physical exposure to the commodity, but who are willing to take a buy or sell position or risk with the aim of making gains from inequalities in the market. Financial investors and arbitrageurs are the investors in this market.