- What Are Commodities

- What Is A Commodity Market

- How Does Commodities Business Work

- Risks Involved In Commodity Market

- Commodities Futures Trading

- Functioning Of Commodities Market

- Due Diligence

- Exchanges Involved In Commodity Market

- Structure Of Commodities Market

- International Commodity Exchanges

- Forward Markets Commission

- Commodities Transaction Tax

- Financialization of Commodities

- Points To Remember Before Trading In Commodities Market

- Study

- Slides

- Videos

1.1 What are physical commodities

The trade in physical commodities is important for global economy. There are fundamental raw materials from which we build and power cities, run transport and feed ourselves – the basic stuff of life. Commodities are basic products, but not every basic product is a commodity. So what makes them different? It is important to stress their physical nature. Ultimately, one way or another, all commodities come out of the ground. Fundamentally, these are products created by natural forces.

There are certain implications in commodity market- 1) every shipment is unique – its chemical form depends on exactly when and where it originated 2) There is no such thing as a standard physical commodity. To be saleable, commodities have to be put into a usable form and moved to where they can be used, at the time they are needed.

COMMODITIES FOR HEAT, TRANSPORT, CHEMICAL MANUFACTURING AND ELECTRICITY

1.2.Key Characteristics

Physical commodities come in all shapes and sizes, but they also have certain characteristics in common:

- They are delivered globally, including by sea, usually in bulk.

- Economies of scale favour bulk delivery. The cost of transportation makes location a significant pricing factor.

- Commodities with similar physical characteristics are exchangeable, but these are not standard items. Exchanging them may have an effect on price and quality.

- There is no premium for branded goods. Pricing is determined by product quality and availability.

They can be stored for long, in some cases unlimited, periods. It is these characteristics that make commodities suitable for trading in global markets.

1.3.Fundamentals of commodity pricing

End-users buy physical commodities to meet staple needs. The commodity has to be fit for purpose and it needs to be available. These requirements determine the three pillars for pricing:

- Where: delivery location

- When: delivery timing

- What: the product quality or grade

Commodity trading firms bridge gaps between producers and consumers based on these three pillars, through transformations in space, time and form.

- Space: transport the commodity to alter its location;

- Time: store the commodity to change the timing of delivery;

Form: blend the commodity to affect its quality or grade.

1.4.Main Types

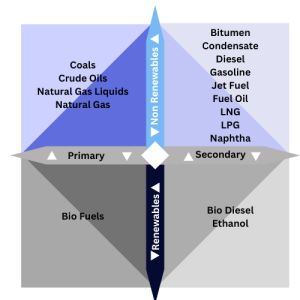

Broadly speaking, physical commodities come in two forms:

- Primary commodities are either extracted or captured directly from natural resources. They come from farms, mines and wells. As natural products that come out of the ground, primary commodities are non-standard – their quality and characteristics vary widely.

Secondary commodities are produced from primary commodities to satisfy specific market needs. Crude oil is refined to make gasoline and other fuels; concentrates are smelted to produce metals. There may be minor variations in quality depending on how a secondary commodity is produced.

1.5 Which kinds of commodities are traded in the world?

In the global markets, there are four categories of commodities in which trading takes place:

- Energy (e.g., crude oil, heating oil, natural gas and gasoline).

- Metals (e.g., precious metals such as gold, silver, platinum and palladium; base metals such as aluminium, copper, lead, nickel, tin and zinc; and industrial metals such as steel).

- Livestock and meat (e.g., lean hogs, pork bellies, live cattle and feeder cattle).

Agricultural (e.g., corn, soybean, wheat, rice, cocoa, coffee, cotton and sugar).

1.6.Factors influencing the commodity prices

- Demand & Supply: Demand for the commodity and supply of the same are the two basic factors that drives commodity prices. Higher the demand for the commodity dearer will be its price and higher the supply of commodities cheaper will be the price.

- 2. Seasonality: some commodities follow a certain schedule of production cycle which can impact the prices of the commodities. For example, agricultural commodities, in harvesting season, due to an increase in supply, prices of commodities can come down whereas in sowing season supply remains lower which results in increase in prices.

- News: just like any other financial product, commodity prices are sensitive to the news and rumours. Hence any important news / directly related news can affect the commodity prices significantly.

- Economic conditions: the domestic and macroeconomic conditions can influence the commodity prices. Various economic indicators like GDP growth rate, industrial production, inflation rate etc. plays very important role in determining price trend of the commodity.

- Weather conditions: weather is one of the important factors that can affect the prices of commodity specially agriculture commodity at high levels.

- Geo-political developments: commodities that have global demand like crude oil are subject to price fluctuations. For example, tensions in the middle-east region may affect prices of crude oil potential disturbances in supply chain.