A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It outlines the company’s assets, liabilities, and shareholders’ equity, which helps assess its financial health and stability.

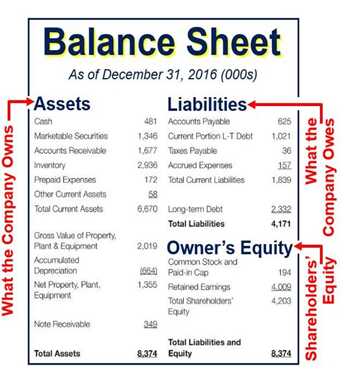

Assets represent what the company owns, such as cash, inventory, and property. Liabilities show what the company owes, including loans and other obligations. Shareholders’ equity reflects the residual interest in the assets after liabilities are settled. The balance sheet is vital for investors, creditors, and management to evaluate the company’s financial performance and make informed decisions.

What is Balance Sheet?

A balance sheet gives a snapshot of your financials at a particular moment, incorporating every journal entry since your company’s incorporation. It shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). Because it summarizes a business’ finances, the balance sheet is also sometimes called the statement of financial position. Companies usually prepare one at the end of a reporting period, such as a month, quarter, or year.

Balance Sheet: How It Works

The balance sheet operates similarly in India as it does in other countries. It is a solid financial statement that provides insights into a company’s financial position at a specific time. Understanding how the balance sheet works is crucial for creditors, investors, and other stakeholders to assess the economic health and stability of Indian companies.

In India, the balance sheet follows the same fundamental accounting equation: Assets = Liabilities + Equity. The balance sheet is prepared as per the Generally Accepted Accounting Principles (GAAP) or the Indian Accounting Standards (Ind AS) for companies following the Indian Accounting Standards.

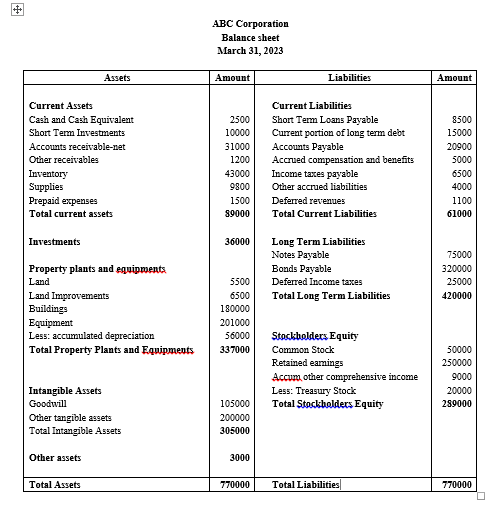

The components of the balance sheet in India are like those in other countries:

- Assets: It encompass everything a company owns or controls that has monetary value. This includes cash, accounts receivable, inventory, property, plant, equipment, investments, and other assets.

- Liabilities: It represent the company’s obligations or debts. This includes accounts payable, loans, long-term debt, accrued expenses, and other liabilities.

- Equity: It represents the residual interest in the company after deducting liabilities from assets. It includes share capital, reserves, and retained earnings.

The balance sheet in India provides valuable information about a company’s financial position and performance. It helps stakeholders assess liquidity, solvency, economic structure, and profitability. Additionally, Indian companies must prepare and present their balance sheets per the Ministry of Corporate Affairs (MCA) regulations.

Stakeholders in India analyse the balance sheet to evaluate the company’s ability to meet its financial obligations, assess its financial stability, and make informed investment decisions. The balance sheet also plays a significant role in determining the valuation of a company during mergers, acquisitions, or public offerings.

Furthermore, the balance sheet is essential for compliance and reporting purposes in India. It is a mandatory financial statement that companies must prepare and present along with other financial information, such as cash flow and income statements.

In conclusion, the balance sheet works similarly in India as in other countries. It provides insights into a company’s financial position, performance, and health. Stakeholders in India rely on the balance sheet to make informed decisions, assess financial stability, and comply with regulatory requirements. Understanding the workings of the balance sheet is crucial for practical financial analysis and decision-making in the Indian business landscape.

Why Is a Balance Sheet Important?

A balance sheet is an important financial statement that gives a snapshot of the financial health of your business at a point in time. You can also look at your balance sheet in conjunction with your other financial statements. This way, you can understand the relationships between different accounts better.

Here’s a closer look at what’s typically included in each of those categories of value: assets, liabilities, and owners’ equity.

Assets – The things your business owns that have a monetary value. List your assets in order of liquidity, or how easily they can be turned into cash, sold or consumed. Anything you expect to convert into cash within a year is called current assets.

Current assets include: –

Money in a checking account

Money in transit (money being transferred from another account)

Accounts receivable (money owed to you by customers)

Short-term investments

Inventory

Prepaid expenses

Cash equivalents (currency, stocks, and bonds)

Long-term assets, on the other hand, are things you don’t plan to convert to cash within a year.

Long-term assets include: –

Buildings and land

Machinery and equipment (less accumulated depreciation)

Intangible assets like patents, trademarks, and goodwill (you would list the market value of what fair price a buyer might purchase these for)

Liabilities- A liability is the opposite of an asset. While an asset is something a company owns, a liability is something it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet.

Just as assets are categorized as current or noncurrent, liabilities are also categorized as current liabilities or noncurrent liabilities.

Current liabilities typically refer to any liability due to the debtor within one year, which may include:

Payroll expenses

Rent payments

Utility payments

Debt financing

Accounts payable

Other accrued expenses

Noncurrent liabilities typically refer to any long-term obligations or debts which will not be due within one year, which might include:

Leases

Loans

Bonds payable

Provisions for pensions

Deferred tax liabilities

Equity

Equity is money currently held by your company. (This category is usually called “owner’s equity” for sole proprietorships and “stockholders’ equity” for corporations.) It shows what belongs to the business owners.

Owners’ equity includes-

Capital (money invested into the business by the owners)

Private or public stock

Retained earnings (all your revenue minus all your expenses since launch)

Equity can also drop when an owner draws money out of the company to pay them, or when a corporation issues dividends to shareholders.

Let’s say you invested Rs 2,500 to launch the business in 2016 and another Rs 2,500 a year later. Since then, you’ve taken Rs 9,000 out of the business to pay yourself and you’ve left some profit in the bank.

What is the balance sheet formula?

The balance sheet formula is a fundamental accounting equation that states: Assets = Liabilities + Equity. This formula represents the basic concept that a company’s total assets must always equal its total liabilities plus shareholders’ equity. The balance sheet formula provides the basis for preparing the financial statement, which provides a gist of a company’s financial position. By using this formula, businesses ensure that their balance sheets remain balanced and accurately reflect the economic health and stability of the organization.

Format of balance sheet

The Purpose of the Balance Sheet

A balance sheet provides a summary of a business at a given point in time. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Balance sheets serve two very different purposes depending on the audience reviewing them.

When a balance sheet is reviewed internally by a business leader, key stakeholder, or employee, it’s designed to give insight into whether a company is succeeding or failing. Based on this information, an internal audience can shift their policies and approach: doubling down on successes, correcting failures, and pivoting toward new opportunities.

When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio.

How is the balance sheet used in financial modelling?

The balance sheet is crucial in financial modelling as it provides essential information for forecasting and analysing a company’s economic performance. Financial modelling involves creating mathematical representations of a company’s financial situation to make projections and assess various scenarios. Here’s how the balance sheet is used in financial modelling:

- Forecasting: The balance sheet is a crucial input for projecting future financials. Financial modelers can make assumptions and estimate future values for assets, liabilities, and equity by analysing historical balance sheet data. This allows for the creation of comprehensive financial projections.

- Assessing Financial Health: Financial modelers use the balance sheet to evaluate a company’s financial health and stability. They can assess liquidity, solvency, and overall economic strength by examining ratios such as debt-to-equity, current ratio, and working capital.

- Scenario Analysis: Financial modelling involves creating multiple scenarios to analyse the impact of different variables on a company’s financials. The balance sheet is an essential component in this analysis, as changes in assumptions can affect the values of assets, liabilities, and equity, thereby impacting the overall financial position.

- Capital Structure Analysis: The balance sheet provides insights into a company’s capital structure, showing the proportion of debt and equity financing. Financial modelers can use this information to analyse the cost of capital, evaluate the impact of leverage, and make decisions regarding optimal capital structure.

- Valuation: Financial modelers often use the balance sheet to determine a company’s intrinsic value through valuation techniques such as discounted cash flow analysis. They can estimate the company’s worth by incorporating balance sheet data, including net assets and equity.

- Sensitivity Analysis: Financial modelling involves assessing the sensitivity of financial outcomes to changes in variables. By manipulating balance sheet data, such as adjusting the level of debt or working capital, modelers can analyse the impact of these changes on the company’s financials.

The general sequence of accounts in a balance sheet

The general arrangement of accounts in a balance sheet follows a specific order, typically arranged in the following manner:

- Assets: They are listed first and are categorized based on their liquidity, or the time it takes to convert them into cash. The order generally starts with current assets, which can be converted into cash within a year. Examples include accounts receivable, inventory, cash and cash equivalents, and prepaid expenses. Non-current or long-term assets follow and include items like property, plants, equipment, investments, and intangible assets.

- Liabilities: They are listed after assets and divided into current and long-term liabilities. Current liabilities are obligations due within a year, such as accounts payable, short-term loans, and accrued expenses. Long-term or non-current liabilities include long-term loans, bonds payable, and deferred taxes.

- Equity: It represents the residual interest in the company after deducting liabilities from assets. It includes share capital, retained earnings, and additional paid-in capital. Equity is typically presented after liabilities and reflects the ownership interest in the company.

The sequence of accounts in a balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity. This sequence ensures that the balance sheet remains balanced, with the total assets equalling the total liabilities and equity.

It’s important to note that the specific order and presentation of accounts may vary depending on the reporting standards followed and the jurisdiction’s regulatory requirements. However, the general assets, liabilities, and equity sequence remains consistent across balance sheets.

What are Reserves and Surplus?

Reserves and Surplus

“Reserves and surplus” is a critical component of a company’s financial statements, representing the accumulated profits and retained earnings set aside for specific or general purposes. Reserves are created to strengthen the company’s financial position, while surplus represents the excess funds available after distributing dividends and fulfilling obligations. Together, they reflect the company’s financial stability and growth potential.

Reserve and Surplus Meaning

The term “reserve and surplus” refers to the portion of a company’s earnings that is retained and allocated to various purposes, such as reinvestment, contingency planning, or dividend payments. It indicates the financial health of an organization and acts as a buffer to safeguard against unforeseen circumstances.

What Is Reserve and Surplus in Balance Sheet

In the balance sheet, reserves and surplus appear under the “Equity and Liabilities” section, categorized as a part of shareholders’ equity. Reserves include retained earnings, capital reserves, and revenue reserves, while surplus refers to the excess of income over expenditure. These collectively show the internal funds available to the company.

Borrowings in Balance Sheet

Borrowings in a balance sheet refer to the funds a company has raised through loans, debentures, or other financial instruments. They appear under liabilities and are classified as short-term (due within a year) or long-term (due after a year). Borrowings play a key role in financing the company’s growth and operations

Equity Capital + Reserves Is Called As

The sum of equity capital and reserves is often referred to as “shareholders’ equity” or “net worth.” This represents the owners’ stake in the company and serves as a crucial indicator of financial strength.

Difference Between Reserves and Surplus

Reserves are funds earmarked for specific uses, while surplus represents the unallocated earnings retained by the company. Reserves are created with a purpose, such as reinvestment or contingencies, whereas surplus is the leftover profit after meeting all financial obligations

Conclusion

The balance sheet serves as a window into a company’s financial health, providing vital information to investors, creditors, and other stakeholders. One can effectively assess a company’s solvency, liquidity, and overall financial stability by understanding its structure, components, and significance. The balance sheet and other financial statements play a crucial role in decision-making, strategic planning, and evaluating investment opportunities. So, dive into the realm of the balance sheet and unlock the power of financial understanding.