- Introduction To Mutual Funds

- Funding Your Financial Plans

- Reaching Your Financial Goals

- Understanding Money Market Fund

- Understanding Bond Funds

- Understanding Stock Funds

- Know What Your Fund Owns

- Understanding The Performance Of Your Fund

- Understand The Risks

- Know Your Fund Manager

- Assess The Cost

- Monitoring Your Portfolio

- Mutual Fund Myths

- Important Documents In A Mutual Fund

- Study

- Slides

- Videos

14.1 Important Documents

Ankita, 27, stares at the TV screen. The screen flashes an advertisement for a mutual fund scheme. The advertisement ends with a disclaimer, ‘Mutual fund investments are subject to market risks; read all scheme-related documents carefully’. Ankita has been watching the advertisement without really paying attention to it. However, when she hears this, she suddenly becomes alert.

She realizes that she signed a mutual fund application form the previous day based on a recommendation from a mutual fund distributor who usually makes rounds at her office to sell mutual fund schemes to the employees. The distributor asked Ankita a number of questions pertaining to her finances, her affinity towards investment risk and her demographics (e.g. age, income). However, on her part, Ankita was not really bothered to check anything about the scheme. She invested in it purely on this distributor’s recommendation. She decides to check out the investment documents the very next day.

There are 3 important documents that Ankita will have to check:

Key Information Memorandum (KIM),

Scheme Information Document (SID) and

Statement of Additional Information (SAI).

These are prepared by the Asset Management Company (AMC) about a particular scheme, and submitted to the Securities and Exchange Board of India (SEBI) for approval.

14.2. Scheme Information Document

Type of scheme: This section indicates whether the scheme is open-ended or close-ended and whether it’s an equity, debt, hybrid or other type of scheme. While open-ended schemes can be redeemed with the mutual fund itself at any time, close-ended schemes can only be redeemed (with the mutual fund) after the defined period or sold on the stock exchange where they are listed. Equity funds carry a higher return potential, though with higher risk; debt funds have a lower return potential than equity, but also carry a lower amount of risk. Hybrid funds (part equity and part debt) carry moderate risk-return potential.

Investment objective: The investment objective of a scheme states the main aim of the scheme. Some examples of different investment objectives adopted by mutual fund schemes are:

- tax benefit

- long-term capital appreciation

- consistent returns, etc.

This section also tells investors how the scheme plans to achieve the stated objectives. By looking at a scheme’s investment objective, investors can gauge whether it is in alignment with their personal investment goals. In case a scheme’s objective is modified, the fund house has to mandatorily update the SID for the same.

Scheme Suitability

This section explains what kind of investors should consider the scheme. For instance, for an open-ended equity scheme, it will state that the scheme is suitable for investors who seek long-term capital appreciation and investments in high-growth companies along with the liquidity of an open-ended scheme through investments primarily in equities. This helps you decide whether you will be comfortable investing in the scheme based on its objectives and risks.

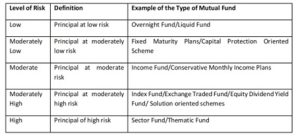

Riskometer

To enable investors to take informed decision regarding their investments, a pictorial representation of the risk to the principal invested in a mutual fund product is depicted using a ‘Riskometer’. The riskometer will categorize the risk in the scheme at one of five levels of risk, as shown in the picture below.

The above riskometer indicates that investors should understand that their principal will be at moderate risk. There is also a written statement of the risk to the principal below the ‘Riskometer’.

Percentage asset allocation

The scheme information document states the portion (in percentage) of the fund’s pool that will be allocated to different asset classes, like equity, debt, gold, etc. Under normal market conditions, the fund has to maintain the percentage of allocation as stated in the SID.

A small-cap fund, for instance, has to invest a minimum 80% of its assets in equity belonging to small-cap companies. The remaining can be invested in other areas such as large caps, debt or money market instruments. A fund that allocates a larger portion of its pool to riskier asset categories like mid-caps and small-caps may be highly exposed to market volatilities. This information can help investors judge the scheme’s risk profile before making an investment.

Benchmark index:

The index to which the performance of the scheme will be compared is stated here. For instance, for an equity fund, the benchmark index may be the Standard & Poor’s Bombay Stock Exchange (S&P BSE) Sensex or the Nifty 500. This will help you assess the scheme’s performance vis-a-vis a suitable index as a benchmark.

Investment amount and related details

The SID includes information like:

- The minimum amount for various scheme-related transactions

- Investment amount for Systematic Investment Plan (SIP) option

- Investment amount for lump-sum transactions

- Minimum redemption amount

- Minimum transaction amount for

- Switching of funds

- Systematic Transfer Plan (STP) and

- Systematic Withdrawal Plan (SWP)

In this section of SID, investors can also find details such as fees and expenses that are applicable to the scheme, such as:

- Expense ratio,

- Exit load,

- Transaction charges, etc.

A scheme with a lower expense ratio can allow higher net returns in the hands of investors. However, while taking an investment decision, investors must consider other factors in combination with the expense ratio instead of solely focusing on expense ratio.

14.3. Statement of Additional Information

The Statement of Additional Information (SAI) is a supplementary document provided along with the mutual fund’s prospectus. The document contains additional information about the mutual fund. It also contains multiple disclosures regarding the functionality of the mutual fund. The document is not a mandatory attachment and does not need to be sent to prospective investors except upon request.

The statement of additional information helps the mutual funds expand on the details about the funds that are not disclosed within the prospectus. Regular updates take place within the Statement of Additional Information.

The SAI carries the following information:

- Definitions, abbreviations

- Information about the mutual fund (e.g. constitution of the fund, sponsor, trustee, asset management company)

- How to apply for schemes of the mutual fund

- Rights of unit holders

- How securities are valued by the fund

- Tax, legal and other information

Thus, it is a handy document that the mutual fund companies provide. The document extends the details mentioned in the prospectus and gives detailed and additional information about the same. The investors could find multiple information about the mutual fund in the Statement of Additional Information. This information can assist the investor in making optimal financial decisions if his / her financial objectives align with that of the mutual fund company and its program.

14.4. Key Information Memorandum

KIM is a summarized version of the Offer Document (OD).As per SEBI regulations, every application form is to be accompanied by the KIM. The first time investor should read detailed offer document, once he has gained familiarity with the AMC, he can just refer to KIM.

It specifically provides the following information:

- Scheme suitability

- Riskometer

- Investment objective

- Asset allocation pattern

- Investment strategy

- Risk factors and risk mitigation factors

- Plans and options

- Minimum investment

- Dividend policy

- Information about the fund manager/s

- Historical performance of the scheme

- Expenses of the scheme

- Scheme’s portfolio – top 10 holdings as a percentage of the net asset value (NAV)

- NAV reporting information

- Contact for investor grievance

- Other information that applies to unit holders, such as loads on bonus/dividend reinvestment, commissions to distributors, taxes, depository information, transaction charges and account statements

14.5. Fund Factsheet

The factsheet is a document that puts up all the information related to a fund/scheme. By and large, everything that you need to know before investing in a particular fund is available in the fund fact sheet. Fund factsheets are published on a monthly basis by mutual funds. The fund factsheet contains the basic information of each scheme such as the inception date, corpus size (AUM), current NAV, benchmark and a pictorial depiction of the fund’s style of managing the fund. The fund’s performance relative to the benchmark is provided for the different periods along with the benchmark returns, as required by SEBI’s regulations. The factsheet also provides the SIP returns in the scheme, portfolio allocation to different sectors and securities.

However, some fund houses do not disclose the entire portfolio but only the top 10 holdings. In the factsheet, security wise as well as sector wise allocation is provided for equity schemes. Some factsheets also disclose the derivatives exposure taken by the mutual fund schemes. In the debt funds, the factsheet discloses the rating profile of the various securities, and a snapshot of exposure of the scheme to various rating baskets.

Portfolio features such as the price-earnings ratio (PE), Beta and other risk measures such as standard deviation and Sharpe ratio (in case of equity funds), credit rating profile, average maturity and duration (in case of debt funds) are also available in the factsheet. The factsheet also provides investment details such as the minimum investment amount, the plans and options available in the scheme, the loads and expenses and systematic transaction facilities available in the fund.

Summarising the parameters captured in a fund factsheet are:

- About the scheme in brief

- Scheme type

- Investment objective

- Product suitability and riskometer

- Scheme returns over different time periods – 1 year, 3 years, 5 years and since inception. Returns are computed as compound annual growth rate (CAGR) returns (annualized returns). Returns of the scheme are compared to the scheme’s benchmark index

- NAV of the scheme

- Scheme’s portfolio: This is presented in the form of a list of securities invested in and in the form of sector-wise breakup (in case of an equity fund)

- Fund managers of the scheme: Names of the scheme’s fund managers and number of years of experience of each fund manager

- Investment options available: Dividend payout, dividend reinvestment, growth

- Minimum subscription amount and multiples

- Minimum additional investment and multiples; minimum SIP amounts and multiples, as well as SIP frequency

- Exit load on redemption/switch-out

- Dividend history

- Total expense ratio