- Introduction To Mutual Funds

- Funding Your Financial Plans

- Reaching Your Financial Goals

- Understanding Money Market Fund

- Understanding Bond Funds

- Understanding Stock Funds

- Know What Your Fund Owns

- Understanding The Performance Of Your Fund

- Understand The Risks

- Know Your Fund Manager

- Assess The Cost

- Monitoring Your Portfolio

- Mutual Fund Myths

- Important Documents In A Mutual Fund

- Study

- Slides

- Videos

9.1 Risk Analysis

There is an old saying that investors are driven by two emotions: greed and fear. It’s time to explore the fear of losing money. Regrettably, most investors have had to confront that fear head-on in recent years.

In the years, when the stock market seemed unstoppable, it was difficult for investors to believe that there could be a downside. Many investors who knew that their funds might run into trouble figured that they could just grit their teeth through the rough patches. During 2020, after all, downmarkets typically only lasted a quarter or two, and then it was off to the races again.

Although many market watchers warned that certain sectors of the market-notably technology and telecommunications stocks-were ridiculously overpriced, few investors were prepared for the viciousness of the market downturn.

It’s easy enough to say that those are just paper losses-you don’t really lose the money until you sell. But such paper losses can keep investors up nights and often lead them to sell when their funds are losing money. They worry about how much worse things might get and whether they might lose everything. Investors know that in the past the markets have recovered, but it can be hard to keep that in mind in the thick of things. As a result, people often sell at the worst time, turning their paper losses into losses in fact. Remember, funds that make big short-term gains tend to incur big losses.

You can’t get big returns without taking on a lot of risk-witness the Internet focused funds that flew high in the late 2000s and then came crashing down.

9.2. Investment Style Risk

The style box is a great way to find out how risky a fund is apt to be. Over the long term, large-value stock funds, which land in the upper left-hand corner of the style box, tend to be the least volatile-they have fewer performance swings than other stock mutual funds. On the opposite end of the spectrum, funds that fall in the small-growth square are typically the most volatile group.

A fund such as Axis Small Cap Fund, which owns small, growth-leaning stocks, is likely to experience more dramatic ups and downs than one holding large, budget-priced stocks, like Axis Blue Chip Fund. Axis Small Cap Fund might deliver higher returns over the long haul, but its performance will tend to be much more erratic. Investors may have to go on a pretty wild ride to get those returns.

You can also use the style box to get a handle on whether a fund is likely to be more or less risky than its category peers. If you’re looking at a technology fund that lands in the small-growth bin of the style box, you know it’s likely to be more volatile than a fund that falls in the large-cap row. Or if you’re looking for a bond fund that focuses on mortgage-backed bonds, you know that a fund with a long duration (a measure of interest-rate sensitivity) is apt to post more losses if interest rates go up than a fund with an intermediate-term duration.

9.3. Sector Risk

In addition to the fund’s investment style its sector concentration can also indicate how vulnerable it is to a downturn in a certain part of the market. Investors who paid attention to sectors back in 1999 did themselves a huge favor. A fund that bets a lot on a single sector is likely to display high volatility, with dramatic ups and downs. As long as the manager’s strategy doesn’t change, that volatility will continue. Sometimes the fund will make money and sometimes it will be down, but its volatility will remain high, reminding investors that even though the fund may currently be making a lot of money, it also has the potential to fall dramatically.

Although there are no rules of thumb for how much is “too much” in a given sector, you’ll do yourself a big favor if you compare your fund’s sector weightings with other funds that practice a similar style as well as with a broad-market index fund such as Index Funds.

This is not to suggest that you should automatically avoid a fund with a big wager on an individual sector; in fact, some of the most successful investors are biased toward a market sector or two. (Exhibit A: Warren Buffett, whose Berkshire Hathaway is heavily skewed toward financials stocks, particularly insurers.) But you’ll need to balance that fund with holdings that emphasize other parts of the market.

9.4 Concentration Risk

Just as a fund that clusters all its holdings in a sector or two is bound to be more risky than a broadly diversified portfolio, so funds that hold relatively few securities are riskier than those that commit a tiny percentage of assets to each stock. As mentioned, some funds has just 20 holdings, whereas some funds will have a widespread portfolio. If a few of holdings run into trouble in a 20 holding fund, they can do a lot more damage to performance than a few in a larger holding fund.

If Twenty holding fund had its money spread equally among 20 stocks, each would count for 5% of the portfolio, but a single stock would account for just 1-2% of the larger fund. If one of Twenty’s picks were to go bankrupt, it would take a far bigger bite out of returns.

Because managers almost never spread the fund’s money equally across every holding, along with checking a fund’s total number of holdings, it’s a good idea to check a fund’s top 10 holdings to see what percentage of the assets are concentrated there. Even though a fund has 100 holdings, if the manager has committed half of the fund to the top 10, that fund could be a lot more volatile than one with the same number of holdings but less concentration at the top.

ICICI Prudential Bluechip fund owns 70 stock and Axis Bluechip Fund owns 43 stocks, but ICICI pru has 57.22% of its assets in its top 10 holdings, whereas axis bluechip has 63% parked at the top. Simply because they make up so much more of its portfolio, Axis Investment is going to suffer a lot more if its top holdings run into trouble.

Indexes can be useful, but peer groups such as the same category funds, are even better because they allow you to compare the fund with other funds that invest in the same way. An index may be a suitable benchmark because it tracks the same kinds of stocks that a fund invests in, an index itself isn’t an investment option. Your choice isn’t between investing in a fund and an index but between a fund and a fund.

If you’re trying to evaluate a fund that invests in large, cheaply priced companies, compare it with other large-value funds. Armed with information about a fund’s true peer group, you’re in a much better position to judge its performance.

Say you owned Kotak Bluechip Fund. At the end of that year, you might have been very happy- sure, your fund made 17.43% for the year, but the BSE 100 gave return of 15.93%. Alongside that benchmark, your fund over performed. Also when you compare it with other funds of the same category: Kotak Bluechip fund has done better than ICICI Pru Bluechip fund & Axis Bluechip fund.

Looking at just the index doesn’t give complete insight into how your fund really did, but comparing the fund with its category tells you how well it does.

9.5 Assessing Past Volatility

Although conducting a fundamental analysis of a fund-checking its investment style and concentration in sectors and individual stocks-is one of the best ways to assess an offering’s riskiness, past volatility is also a fairly accurate indicator of future risk. If a fund has seen lots of ups and downs in the past, it’s apt to continue to have herky-jerky returns. It’s like playing poker: If you bet at the Rs.1000 table, you don’t know how much you’ll win, but you have a pretty good idea how much you could lose. Play at a higher-stakes table and you could win more money more quickly, and you could also lose a lot more. Funds with high volatility in one time period usually exhibit similar volatility in subsequent time periods. Meanwhile, even keeled funds continue to exhibit low volatility.

9.6 Standard Deviation- Most Used Measure of Risk

If you want to quickly shop among a group of funds to figure out which is the least risky- Standard deviation is probably the most commonly used gauge of a fund’s past volatility, and it enables quick comparisons among funds. Standard deviation is most used because it tells investors just how much a fund’s returns have fluctuated during a particular time period.

You can standard deviations every month, based on a fund’s monthly returns for the preceding three years. Standard deviation represents the degree to which a fund’s returns have varied from its 3-year average annual return, known as the mean. By definition, a fund’s returns have historically fallen within one standard deviation of its mean 68% of the time.

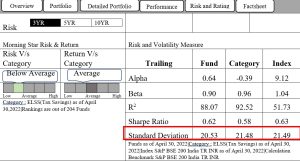

For example: Axis long term equity growth fund had a 3 year total return of 13.52% and a standard deviation of 20.53%. Those numbers tell you that about two-thirds of the time, the fund’s annualized return was within (13.52+20.53= 34.05) percentage points and (13.52-20.53= -7.01%). That’s a huge range of returns, from a 7% loss to a 34% gain.

The catch is, standard deviation doesn’t tell you much when you look at it in isolation. A fund that has a standard deviation of 25 for the past 3 years is meaningless until you start making comparisons. Just like returns, a fund’s standard deviation requires context to be useful. If you’re looking at a fund with a standard deviation of 15 for the same period, you know that the fund with the standard deviation of 25 is substantially more volatile.

An index can be a useful benchmark for a fund’s volatility as well as for its returns. Say the two funds in our example in the same category of Axis long term equity fund. The BSE200 India index is a good benchmark for that group. At the end of March 2022, the index standard deviation was 21.49% .

Most of the websites would give you this number on their analysis page to do the comparison. Screenshot below:

In this screenshot above- you can see a comparison of this fund’s standard deviation with that of other funds that invest in the same way. If you look at the category column that compares it with other funds having similar investing style the risk of the fund would be known. As one can see, Axis fund has a lower standard deviation vs other funds in that category and hence the risk category of the fund is termed as below average.

Lets look at the return matrix:

In the screenshot above- one can see that the return of axis fund over a longer horizon of 1, 3 and 5 years has been higher than that of the category as well as the index. With lower risk compared to others in the category and higher return vs others- this fund is good for investors looking for good returns with lower risk.