- Study

- Slides

- Videos

2.1 Underlying Securities

Options traded in India’s options market are only available for certain securities and the stock index like Nifty 50, Bank nifty etc. These securities are referred to as underlying securities or underlying shares. They must be listed on NSE/BSE.

Conceptually- It is considered the primary component based on which a derivative gets its value. Therefore, the value of a financial derivative depends largely on the value of an underlying security. Another name for underlying security is Underlying Asset, which one can use to determine the Basis of a derivative contract.

For instance, let’s say there is an option contract for Dabur India, and it offers an investor the right to purchase or sell the stock at the strike price until its expiration date. In this situation, Dabur becomes the underlying asset.

Calls and puts over the same underlying security are termed classes of options. For example, all call and put options listed over Dabur shares, regardless of exercise price and expiry day, form one class of option.

Let’s say you purchase a call option at the 550 strike price for Dabur. The underlying asset is the stock valued at 550. This call option gives you the right to buy the equity at 550 by the deadline. If the stock is trading at 580 before the deadline, you can execute your right to purchase it at 550—the value of the underlying asset.

Relationship With Price

There is a direct relationship between a derivative and its underlying security. The price movements of a derivative security are directly related to the price movements of the underlying asset. That is, the buyer of a call option on Dabur stock gains when the value of Dabur stock rises and loses when the value of Dabur stock falls.

In India, option contracts are available on 199 securities stipulated by the Securities & Exchange Board of India (SEBI). These securities are traded in the Capital Market segment of the Exchange.

2.2 Contract Size

In options market an option contract size is standardized. That means, one option contract of a particular securities will always represents standard underlying shares.

The contract size is an important variable to understand when entering into an options contract. This value not only defines the deliverable quantity, but is directly related to the rupee value of the transaction. While the deliverable quantity may vary with the underlying asset, there is a standard for each asset type. For example, the contract size for Dabur option is 1250 shares of stock and while that of Britannia is 200 shares

The contract size of Britannia options would remain the same irrespective of whether you enter into a call option or a put option. Irrespective of the strike price as well, the contract size remains the same for Britannia.

Thus, while all contract units are standard for a particular stock/index, it may vary between different stocks. As highlighted- the contract size for Britannia is 200 shares, while the contract size for Dabur is 1250 shares

In Indian markets- regulators prescribe that the value of the options contracts on individual securities should not be less than Rs. 5 lakhs at the time of introduction for the first time at any exchange. The permitted lot size for futures & options contracts shall be the same for a given underlying or such lot size as may be stipulated by the Exchange from time to time.

Contract Specification of an Option contract:

- Market type: N

- Instrument Type: OPTSTK

- Underlying: Symbol of the underlying security

- Expiry date: Date of contract expiry

- Option Type : CE/ PE

- Strike Price: Strike price for the contract

- Instrument type represents the instrument i.e. Options on individual securities.

- The underlying symbol denotes the underlying security in the Capital Market (equities) segment of the Exchange

- Expiry date identifies the date of expiry of the contract

- Option type identifies whether it is a call or a put option., CE – Call European, PE – Put European.

In India- The options contracts are European style and cash settled

2.3 Expiry Day

Options have a limited life span and expire on standard expiry days set by Exchange. The expiry day is the day on which all unexercised options in a particular series expire and is the last day of trading for that particular series.

In India, Options contracts expire on the last Thursday of the expiry month or last Thursday of the expiry week. If the last Thursday is a trading holiday, the contracts expire on the previous trading day.

On the expiry date, here’s what happens- In the case of options contracts, you are not bound to fulfil the contract. As such, if the contract is not acted upon within the expiry date, it simply expires. The premium that you paid to buy the option is forfeited by the seller. You don’t have to pay anything else.

For Example: If you buy an option contract 3rd March 2022- the monthly expiry of the option would be 31st March 2022 (last Thursday of the month). Let say you buy 3400 CE (call option) of Britannia Industries for Rs.93 and the price of Britannia on 31st March is 3200- then you will let the option expire and your loss would be the premium paid of Rs.93.

The expiration date varies depending on the type of derivative being traded. As highlighted earlier, in India, the date of expiration for listed stock options is the last Thursday of the contract month. At any given point of time there are three months contract which are made available i.e. Near Month, Next Month & Far Month

For example:

- Stock options expiring March 2022 (Near Month) have an expiration date on Thursday, 31st March

- Stock options expiring April 2022 (Next month) have an expiration date on Thursday, April 28th and

- Stock options expiring May 2022 (Far Month) have an expiration date on Thursday, May 26th

Effect of Expiry Date on Stock Price

Since the expiry date marks the closure of F & O contracts, there is considerable volatility on the stock exchange as a whole. Depending on the nature of the derivatives contracts settled on the expiry date, the stock market might turn bullish or bearish.

Furthermore, arbitrage trading also affects the stock market prices close to the expiry date. Arbitrage trading is when F & O traders assess the performance of the underlying assets of the contracts before the expiry date. F & O Traders also trade on the secondary markets for maximum profitability. They might buy from the secondary market and sell on the F & O market or vice-versa. This buying and selling causes price fluctuations and impacts the overall stock market. This impact, however, is short-term in nature as the stock market corrects itself once the expiry date is over

2.4. Exercise/Strike Price

The exercise price is the predetermined buying or selling price for the underlying shares if the option is exercised. The exchange gives the exercise prices for all options listed and there are a range of exercise prices available for options on the same expiry. New exercise prices are listed as the underlying share price moves.

Basically, the strike price is the anchor price at which the two parties (buyer and seller) agree to enter into an options agreement. For all ‘Call’ options the strike price represents the price at which the stock can be bought on the expiry day. When you buy a put option, the strike price is the price at which you can sell the underlying asset.

For example, if the underlying share assume Britannia is trading at Rs.3370, it is likely that option contracts with the following strike prices would be listed: 3300, 3350, 3400, 3450, 3500, 3550. A range of exercise prices allows you to more effectively match your expectations of the price movement in the underlying share to your option position.

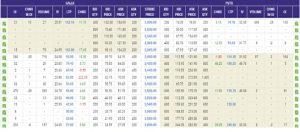

Snapshot of available Exercise Prices of Britannia on NSE website:

The table that you see above is called an ‘Option Chain’, which basically lists all the different strike prices available for a contract along with the premium for the same.

The highlight in red shows all the different strike prices that are available. As we can see starting from Rs.3300 (with Rs.20 intervals) we have strike prices all the way up to Rs.3600

Do remember, each strike price is independent of the other. One can enter into an options agreement , at a specific strike price by paying the required premium

For example one can enter into a 3380 call option by paying a premium of Rs.75- (highlighted in green)- This entitles the buyer to buy Britannia shares at the end of expiry at Rs.3380.

Strike Price vs Spot Price

Strike price and spot price can confuse the traders. Strike price is the pre-determined or set price at which the security is traded in the future. Whereas the spot price is the current market price which is considered as the reference price while the parties agree to a certain strike price.

Strike Price vs Exercise Price

The strike price is nothing different from the exercise price as they hold the same meaning. The only point of difference is that the strike price is visible from the time you enter the contract whereas the exercise price comes into the picture when you exercise the contract. Apart from this, there is no major difference between these two.

2.5 Premium

Premium is the money required to be paid by the option buyer to the option seller/writer. Against the payment of premium, the option buyer buys the right to exercise his desire to buy (or sell in case of put options) the asset at the strike price upon expiry. The premium price is arrived at by the negotiation between the taker and the writer of the option. To calculate the full premium payable for a standard size option contract, multiply the quoted premium by the number of shares per contract.

For example, a quoted premium of Rs.75 represents a total premium cost of Rs.1500 (75 x 200) per contract. To calculate the full premium payable for a Britannia option, you simply multiply the premium by the contract.

Factors That Affect Option Premium

A number of factors come together to determine the premium (or market price) of an options contract. The three most important are intrinsic value, the volatility or standard deviation of the underlying asset, and the amount of time remaining until the contract’s expiration.

- Intrinsic value –

It refers to the value of an options contract if it were to be exercised immediately (e.g., a call option with a strike price of Rs.3400 would have an intrinsic value of Rs.100 if the underlying asset was currently trading at Rs.300 because the contract buyer could immediately exercise the contract for Rs.100 profit).

You can think of an option’s intrinsic value as the difference between its strike price and its market price (if advantageous to the buyer). In the case of a call, an option has intrinsic value if the strike price is below the market price. In the case of a put, an option has intrinsic value if the strike price is above the market price.

- Volatility-

Higher implied volatility indicates a higher premium price. Whereas a lower implied volatility indicates a lower premium price. For example, if a call option has an annualized implied volatility of 30% and the implied volatility increases to 50% during the option’s life, then the premium on the call option would increase.

Implied volatility is used to indicate how volatile a stock’s price may be in the future. High implied volatility means that the market predicts that the stock will have large price swings in either direction. Low implied volatility means that the market.

- Time value-

The time value of an option contract is based on how long remains until the contract expires. The longer a contract has until expiration, the higher its time value. When a contract is approaching expiration, little time remains for the underlying asset to change in value, whereas when a contract has months until its expiration, the underlying asset has plenty of time to change in value. Other factors aside, options have higher premiums the farther they are from expiration. It’s also important to remember that time value decreases more quickly the closer a contract gets to its expiration. In other words, it decreases exponentially rather than linearly—this effect is sometimes called “time decay.”

2.6. Options Settlement

Consider this stock option agreement –

This is a Call Option to buy Dabur India at Rs.570/-. The expiry is 31st March 2022. The premium is Rs.5.85 (highlighted in green), and the market lot is 1250 shares.

There are 2 people involved in this transaction – Mr. X and Mr. Y. MR. X wants to buy this agreement (option buyer) and Mr. Y wants to sell (write) this agreement. Considering the contract is for 1250 shares, Mr. X would be required to pay

= 1250 *5.85

= Rs. 7312.5- as premium amount to Mr. Y

Now because Mr. Y has received this Premium from Mr. X, he is obligated to sell Mr. X 1250 shares of Dabur India on 31st March 2022, if Mr.X decides to exercise his agreement. However, this does not mean that Mr. Y should have 1250 shares with him on 31st March.

Options are cash settled in India, this means on 31st March, in the event Mr. X decides to exercise his right, Mr. Y is obligated to pay just the cash differential to Mr. X. Basically on the day of Expiry, the difference between the Spot Price and Exercise price is what Mr. Y would have to pay. For eg, lets assume that on 31st March Dabur shares close at Rs.600. So, in this case- Mr. Y will have to pay Mr X (600-570)= Rs.30 per share, lot size is 1250 shares- thus the total payment would be 1250*30= Rs.37500