- Study

- Slides

- Videos

5.1 What Is A Put Option?

A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. A put option buyer has a bearish view on the market as opposed to the bullish view of a call option buyer.

The put option buyer is betting on the fact that the stock price will go down (by the time expiry approaches). Hence in order to profit from this view, he enters into a Put Option agreement.

Still, options trading is often used in place of owning stocks themselves. For example, if you were bearish on a particular stock and thought its share price would decrease in a certain amount of time, you might buy a put option which would allow you to sell shares (generally 100 per contract) at a certain price by a certain time. The price at which you agree to sell the shares is called the strike price, while the amount you pay for the actual option contract is called the premium.

Essentially, when you’re buying a put option, you are “putting” the obligation to buy the shares of a security you’re selling with your put on the other party at the strike price – not the market price of the security.

When trading put options, the investor is essentially betting that, at the time of the expiration of their contract, the price of the underlying asset will go down, thereby giving the investor the opportunity to sell shares of that security at a higher price than the market value – earning them a profit.

5.2 Practical Example of an Put Option

For example, if you wanted to buy a put option on Britannia Industries stock at a strike price of Rs.3300 per share, expecting the stock to go down in price in six months to sit at around Rs.3000 or Rs.2800, then a put option would be bought

Example:

- Assume Britannia Industries is trading at Rs.3200/-

- Contract buyer buys the right to sell Britannia to contract seller at Rs.3300 – upon expiry

- To obtain this right, the contract buyer has to pay a premium to the contract seller

- Against the receipt of the premium, contract seller will agree to buy Britannia Industries shares at Rs.3300/- upon expiry but only if contract buyer wants him to buy it from him.

After you have bought the put option of Britannia, there are only three possibilities that can occur. And they are-

- The stock price can go up to Rs.3500

- The stock price can go down to Rs.2800

- The stock price can stay at Rs.3300

Situation 1 – If Britannia is trading at Rs.3500 upon expiry it does not make sense for contract buyer to exercise his right and ask contract seller to buy the shares from him at Rs.3300-. Since he can sell it at a higher rate in the open market

Situation 2 – If upon expiry Britannia is at Rs.2800/- then contract buyer can demand contract seller to buy Britannia at Rs.3300/- from him. This means contract buyer can enjoy the benefit of selling Britannia at Rs.3300- when it is trading at a lower price in the open market (Rs.2800-)

Situation 3 – If the stock stays flat at Rs.3300- you would not exercise the option. The loss in this case would be the option premium that has been paid.

Contract seller is obligated to buy Britannia at Rs.3300- from contract buyer because he has sold Britannia 3300 Put Option to the contract buyer

5.3 Buyer of A Put Option

Traders buy a put option to magnify the profit from a stock’s decline. For a small upfront cost, a trader can profit from stock prices below the strike price until the option expires. By buying a put, you usually expect the stock price to fall before the option expires. It can be useful to think of buying puts as a form of insurance against a stock decline. If it does fall below the strike price, you’ll earn money from the “insurance.”

So, As a Put Buyer you:

> Have the right [but not the obligation] to sell the underlying at a certain price (strike) for a period of time.

> Pay a certain premium for holding the right to exercise.

> Want the underlying price to decrease.

Thus, the owner of a put option profits when the stock price declines below the strike price before the expiration period. The put buyer can exercise the option at the strike price. They exercise their option by selling the underlying stock to the put seller at the specified strike price. This means that the buyer will sell the stock at an above-the-market price, which earns the buyer a profit.

Example

Assume Britannia Industries is currently trading at Rs.3200. Put contracts with a strike price of Rs.3300 are being sold at Rs. 150 and have an expiry period of six months. In total, one put lot would cost Rs.30,000 (since one put represents 200 shares of Britannia). Assume that John buys one put option at Rs.150 for 200 shares of the company, with the expectation that Britannia’s stock price will decline. The stock price is expected to fall to Rs.2800 by the time the (put) option expires.

If the price does drop to Rs.2800, John can exercise his put option to sell the stock at Rs.3300 and earn Rs.3300 – 2800. His net profit is Rs.350 (Rs.500-Rs.150). However, if the stock price remains above the strike price, the (put) option will expire worthless. John’s loss from the investment will be capped at the price paid for the put.

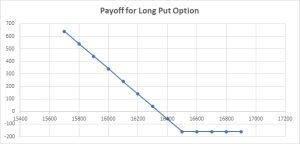

5.4 Payoff for A Buyer of A Put Option

On Jan 1, 2022, Nifty is at 16460. You buy a put option with strike price of 16500 at a premium of Rs 160 with expiry date Jan 27, 2022. A put option gives the buyer of the option the right, but not the obligation, to sell the underlying at the strike price. In this example, you can sell Nifty at 16500. When will you do so? You will do so only when Nifty is at a level lower than the strike price. So if Nifty goes below 16500 at expiry, you will buy Nifty from market at lower price and sell at strike price.

If Nifty stays above 16500, you will let the option expire. The maximum loss in this case as well (like in long call position) will be equal to the premium paid; i.e. Rs. 160. What can be the maximum profit? Theoretically, Nifty can fall only till zero. So maximum profit will be when you buy Nifty at zero and sell it at strike price of 16500. The profit in this case will be Rs. 16500, but since you have already paid Rs. 160 as premium, your profit will reduce by that much to 16500 – 160 = 16340.

Breakeven point in this case will be equal to strike price – premium (X – P). In our example breakeven point will be equal to 16500 – 160 = 16340. Thus when Nifty starts moving below 16340, will you start making profits.

The pay off chart for long put position is drawn using the below table

|

Strike Price (X) |

16500 |

|

|

|

|

Premium |

160 |

|

|

|

|

Nifty at Expiry |

Premium Paid |

Buy Nifty at |

Sell Nifty at |

Pay off for Long Call Position |

|

|

A |

B |

C |

D=A+B+C |

|

15700 |

-160 |

-15700 |

16500 |

640 |

|

15800 |

-160 |

-15800 |

16500 |

540 |

|

15900 |

-160 |

-15900 |

16500 |

440 |

|

16000 |

-160 |

-16000 |

16500 |

340 |

|

16100 |

-160 |

-16100 |

16500 |

240 |

|

16200 |

-160 |

-16200 |

16500 |

140 |

|

16300 |

-160 |

-16300 |

16500 |

40 |

|

16400 |

-160 |

-16400 |

16500 |

-60 |

|

16500 |

-160 |

-16500 |

16500 |

-160 |

|

16600 |

-160 |

-16600 |

16600 |

-160 |

|

16700 |

-160 |

-16700 |

16700 |

-160 |

|

16800 |

-160 |

-16800 |

16800 |

-160 |

|

16900 |

-160 |

-16900 |

16900 |

-160 |

The maximum loss for the option buyer is the premium paid, which is equal to 160 * 50 = Rs.8000, where 50 is the lot size. Contract value for this put option is 16500 * 50 = 825000. A put option buyer need not pay any margin. This is because he has already paid the premium and there is no more risk that he can cause to the system. A margin is paid only if there is any obligation. An option buyer (either buyer of a call option or a put option) has no obligation.

5.5 Seller of Put Options

When you sell a put option, you sell someone the right to sell an underlying stock to you at a strike price that’s specified. You are obligated to buy the stock if the buyer decides to exercise the put option.

Thus, as a Put Seller you:

> Assume the obligation [not the choice] to buy the underlying when the put buyer exercises his option.

> For that assumption you will receive a premium [from the buyer of the option]

> Will be willing to see the underlying price increase.

The appeal of selling puts is that you receive cash upfront and may not ever have to buy the stock at the strike price. If the stock rises above the strike by expiration, you’ll make money. But you won’t be able to multiply your money as you would by buying puts. As a put seller, your gain is capped at the premium you receive upfront.

Selling a put seems like a low-risk proposition – and it often is – but if the stock really plummets, then you’ll be on the hook to buy it at the much higher strike price. And you’ll need the money in your brokerage account to do that. Typically investors keep enough cash, or at least enough margin capacity, in their account to cover the cost of stock, if the stock is put to them. If the stock falls far enough in value you will receive a margin call, requiring you to put more cash in your account.

For example, if you wrote a put option on a stock for a premium of Rs.30. And the stock fell from Rs.400 to Rs.200, you (the put seller) would have a net loss of: Rs.170 (Rs.200 loss on account of purchasing the stock at a higher value than market, however Rs.30 was received earlier as premium)

5.6 Payoff for A Seller of A Put Option

The position of the option seller is just the opposite of that of the put option buyer. When long put makes profit, short put will make loss. If maximum loss for long put is the premium paid, then maximum profit for the short put has to be equal to the premium received. If maximum profit for long put is when price of underlying falls to zero at expiry, then that also will be the time when short put position makes maximum loss. The table below shows the profit/ loss for short put position. An extra column is added to the above table to show positions for short put. The pay off chart is drawn using this table.

|

Strike Price (X) |

16500 |

|

|

|

|

|

Premium |

160 |

|

|

|

|

|

Nifty at Expiry |

Premium Paid |

Buy Nifty at |

Sell Nifty at |

Pay off for Long Call Position |

Pay off for Short Put Position |

|

|

A |

B |

C |

D=A+B+C |

-D |

|

15700 |

-160 |

-15700 |

16500 |

640 |

-640 |

|

15800 |

-160 |

-15800 |

16500 |

540 |

-540 |

|

15900 |

-160 |

-15900 |

16500 |

440 |

-440 |

|

16000 |

-160 |

-16000 |

16500 |

340 |

-340 |

|

16100 |

-160 |

-16100 |

16500 |

240 |

-240 |

|

16200 |

-160 |

-16200 |

16500 |

140 |

-140 |

|

16300 |

-160 |

-16300 |

16500 |

40 |

-40 |

|

16400 |

-160 |

-16400 |

16500 |

-60 |

60 |

|

16500 |

-160 |

-16500 |

16500 |

-160 |

160 |

|

16600 |

-160 |

-16600 |

16600 |

-160 |

160 |

|

16700 |

-160 |

-16700 |

16700 |

-160 |

160 |

|

16800 |

-160 |

-16800 |

16800 |

-160 |

160 |

|

16900 |

-160 |

-16900 |

16900 |

-160 |

160 |

Contract value in this case will be equal to 16500 * 50= 825000 and premium received will be equal to

160 * 50 = 8000

Seller of the put option receives the premium but he has to pay the margin on his position as he has an obligation and his losses can be huge.