- Study

- Slides

- Videos

7.1 Introduction

One of the most important question to a common equity investor is: given what is known from the company’s financial disclosures, how much should he be willing to pay to participate in the revenues of the company as a shareholder? What is the “correct” price for a share of the company’s common stock and how does this compare with the current market price?

The process by which an analyst or investor endeavors to determine the fair price for a stock based on its financial data is called fundamental analysis. The central assumption of fundamental analysis is that it is possible to incorporate all available information about the company’s current state and future prospects into a valuation model to produce an objective price for the company

There are three basic approaches to valuing common shares:

- Discounted cash flow valuation

- Relative valuation

- Asset-based valuation

Analysts frequently use more than one approach to estimate the value of a common share. Once an estimate of value has been determined, it can be compared with the current price of the share, assuming that the share is publicly traded, to determine whether the share is overvalued, undervalued, or fairly valued.

7.2 Discounted Cashflow Model

The discounted cash flow (DCF) valuation approach takes into account the time value of money. This approach estimates the value of a security as the present value of all future cash flows that the investor expects to receive from the security. This valuation approach applied to common shares relies on an analysis of the characteristics of the company issuing the shares, such as the company’s ability to generate earnings, the expected growth rate of earnings, and the level of risk associated with the company’s business environment. Common shareholders expect to receive two types of cash flows from investing in equity securities: dividends and the proceeds from selling their shares.

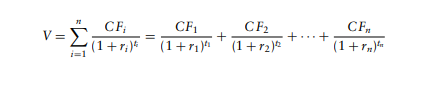

Assuming we know the n cash flows CF1, CF2,… CFn that will be produced by the asset at times t1, t2,… tn and the relevant discount rates for each r1, r2,…rn, then the present value of the asset can be expressed as:

Lets take an Example on the application of DCF approach: On 1 January 2022, an investor expects Britannia, to generate dividends of Rs.10. per share at the end of 2022, Rs.12 per share at the end of 2023, and Rs.15 per share at the end of 2024.

Furthermore, the investor estimates that the stock price of Britannia will trade at Rs.4000 per share at the end of 2024. Note that, under the DCF valuation approach, the expected price of Britannia stock at the end of 2024 (Rs4000per share) represents the present value of cash flows to investors expected to be generated by the company beyond 2024. The investor considers all risks and concludes that a discount rate of 14% is appropriate. In other words, the investor wants to earn at least an annual rate of return of 14% by investing in Britannia

The estimated value of a Britannia share using the DCF valuation approach is equal to the present value of the cash flows the investor expects to receive from the equity investment.

The investor computes the present value of the expected cash flows as follows:

Value = 10/(1.14)^1+ (12/1.14)^2+ 15/(1.14)^3+ 4000/(1.14)^3= Rs.2728

So, the investor’s estimated value of Britannia on a per share basis is Rs.2728. If shares of Volkswagen are priced at less than Rs.2728 on 1 January 2022, the investor may conclude that the stock is undervalued and decide to buy it. Alternatively, if the stock is priced at more than Rs. 2728, the investor may conclude that the stock is overvalued and decide not to buy.

This is a simplified calculations since the assumptions were given. However, in real-world finance, it will be necessary to make a few assumptions about these cash flows and discount rates. And also answer an important question related to valuations

7.3 Question- Which Cashflows To Use?

The correct answers to the question of “What cash flows and what rates?” is, of course, “All those that matter” and “At the rates that the market requires.” This may be a uselessly vague response but it is, nonetheless, the correct one. The models presented below provide a conceptual framework for determining the fair price to pay for a stock, but they are only a starting point. The role of the financial analyst is to use his understanding of the specific details of the company to produce a valuation that incorporates judicious estimates of the magnitude and timing of all future cash flows, their probabilities, and the appropriate discount rates to apply to. Each company is unique, and what matters is that the valuation makes sense and provides insight, not that it adheres to some standardized model.

Dividend discount model (DDM): The only cash flows that are actually received by the common shareholder are dividends. Therefore, the simplest answer to the question “What will I get for owning this stock?” is to compute all future dividend payments and then discount them to the present at the cost of equity.

The cost of equity, KE, is equal to the sum of the risk-free rate of interest (rf ), which can be taken as the return on a riskless government bond of similar maturity, and the equity risk premium (Rm-Rf), which is the additional amount required by investors to compensate for the riskiness associated with an equity investment.

The value of the firm under the Dividend Discount Model is then:

Here the CF = Dividends.

K= Cost of equity

As you can see: there are two basic inputs to the model – expected dividends and the cost on equity. To obtain the expected dividends, one has to make assumptions about expected future growth rates in earnings and payout ratios. The required rate of return on a stock is determined by its riskiness, measured differently in different models – the market beta in the CAPM, and the factor betas in the arbitrage and multi-factor models. The model is flexible enough to allow for time-varying discount rates, where the time variation is caused by expected changes in interest rates or risk across time.

Free Cashflows

The obvious problem with the dividend discount model is that it will not work if the company does not pay a regular dividend. A growing company with an above-average ROE would be expected to retain its earnings and channel them back into the business where they can earn an attractive return and promote growth-this hardly makes the company worthless. However, since the common stock is a claim on the present and future benefits of the company, it should not matter whether profits are paid out as dividends or retained by the company-share ownership entitles the investor to their proportional share of those profits, wherever they are. An alternate approach is therefore to value a company based on how much money it generates, regardless of whether that money is returned to investors or reinvested in the business.

A free cash flow valuation can be done in two ways:

-

Valuing only the equity portion of the firm using the free cash flow to equity (FCFE), or

-

Valuing the entire firm using the free cash flow to the firm (FCFF).

Both are measures of free cash flow (i.e., net income adjusted for mandatory expenses, depreciation, and amortization, working capital needs, etc.) with the difference that the free cash flow to equity includes only that free cash that is available for payment to equity holders as dividends, while free cash flow to the firm includes all cash available before payments on borrowed funds.

Formula for:

Free Cashflow to Firm= Cash flow from Operations – Net Investment in Long Term Assets

Free Cashflow to Equity = Cashflow from Operations- Capital Expenditure+ Net Borrowing

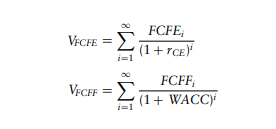

The discounting rates applied to the two types of cash flows are different. For the free cash flow to equity, the relevant discount rate is the cost of equity (rCE), the same as was used in the Dividend Discount Model. In reality, the only difference between the models is that in the FCFE model, we are valuing the company based on the cash available to pay out as dividends while in the DDM the valuation is based on the cash actually paid as dividends.

If the firm paid out all free cash flow as dividends, the Dividend discount model and free cashflow to the firm valuations would be the same. In the Free Cash Flow to the Firm model, the discounting rate must incorporate the different rates of return required on equity, debt, and preferred stock, in proportion to the weight of each in the firm’s financing mix. This is precisely what the weighted average cost of capital (WACC) does.

The two valuation models can be expressed by the following formulas:

It is important to realize that the two models are valuing different things. The FCFE valuation gives the present value of that portion of the firm’s earnings that is available to the common equity holders. The FCFF model values the entire company, including its debt and will therefore produce a higher value than valuation of only the equity.