An interest rate is a percentage charged on the total amount you borrow or paid on the amount you save. Even a small change in interest rates can have a big impact. It’s important to keep an eye on whether they rise, fall or stay the same. If you’re a borrower, the interest rate is the amount you are charged for borrowing money – a percentage of the total amount of the loan. You can borrow money to buy something today and pay for it later. Interest is what you pay for the privilege. It’s the cost you pay to ‘hire’ someone else’s money. If you’re a saver, it’s the same except the interest is paid to you – because banks are paying to hire your money.

Types of interest rate

Simple Interest

Compound Interest

Simple interest

This type of interest is calculated on the original or principal amount of loan. The formula for calculating simple interest is:

Simple interest = principal X interest rate X time

An annual interest rate of 4% translates into an annual interest payment of $12,000. After 30 years, the borrower would have made $12,000 x 30 years = $360,000 in interest payments, which explains how banks make their money.

Compound interest

Compound interest is calculated not just on the basis of the principal amount but also on the accumulated interest of previous periods. This is the reason why it is also called “interest on interest.” The formula for compound interest is as follows:

Compound interest = p X [(1 + interest rate) n − 1]

Where:

P = Principal amount

i = Annual interest rate

n = Number of compounding periods for a year

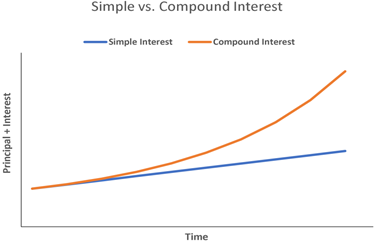

Unlike simple interest, the compound interest amount will not be the same for all years because it takes into consideration the accumulated interest of previous periods as well.

Examples-

Simple Interest vs. Compound Interest

If you put Rs 5,000 in a bank account that earns 4% interest a year, you will have Rs 5,200 by the end of the year. Now, if you keep the Rs 5,200 in the bank for another year, you will have Rs 5,408.

Simple- Simple interest would be the equivalent of receiving Rs 5,200 after the first year, withdrawing the Rs 200, and then having Rs 5,000 before the next period. Every period the individual will receive Rs 200.

Compounding– Compounding interest would increase the interest payments since you are receiving interest on your interest. If the individual left the Rs 5,200 in their bank account, they would have Rs 5,408 by the end of the next period (which is an Rs 208 gain instead of the Rs 200 with simple interest). This shows the power of compounding interest.