- Study

- Slides

- Videos

4.1 Introduction To Futures Contract

A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange. The buyer of a futures contract is taking on the obligation to buy and receive the underlying asset when the futures contract expires. The seller of the futures contract is taking on the obligation to provide and deliver the underlying asset at the expiration date

4.2 Superiority of Futures Contract

In quite a few ways, futures contracts are superior to forward contracts. Some of them are:

- No Counter-Party Risk: Since the exchange takes the responsibility of settling every trade, each party to the contract will have his portion settled, irrespective of whether the other party settles or not. But in forward contracts, the failure of one party to the contract can lead to non-settlement of the contract itself.

- Liquidity: Since futures are traded on an exchange, they are very liquid. It is possible to get in and out of futures positions pretty fast. This feature does not exist in forward contracts since they are not traded on any exchange.

- Uniformity: Futures contracts are standardized in terms of the size of the contract, the delivery date and the quality of the commodity itself. Such standardisation does not exist in the case of forward contracts.

Still, forward contracts are popular because they can be structured in a manner to suit both parties to the contract in terms of size of contract or maturity date or quality / nature of commodity or financial asset. In fact, the forward market for foreign currencies dominated by banks is the largest financial market in the world. - Marked to Market: Another difference is that in the case of futures, the exchange collects initial margin and marks to market the contract on a daily basis. So each of the parties to a contract either receives or pays out the difference. But with forwards, there is no such mark to market arrangement and all differences are settled at the maturity of the contract.

Let us illustrate this with an example:

- Mr. Sharma buys a futures contract on the exchange which entitles him to receive 100 shares of ABC Industries three months hence paying a price of Rs. 350 per share.

- Simultaneously, the counter-party to the contract, Mr. Tripathi has an obligation to deliver 100 shares of ABC three months hence and receive Rs. 350 per share.

- Given the current market price of ABC is Rs. 350, we could have three situations tomorrow:

- The price moves up to Rs. 360: Then Mr. Sharma will receive Rs. 1,000 (100 shares multiplied by difference of Rs. 10 per share) from the exchange and Mr. Tripathi will have to pay Rs 1,000 to the exchange.

- The price falls to Rs. 340 : Then Mr. Sharma will have to pay Rs. 1,000 (100 shares multiplied by difference of Rs. 10 per share) to the exchange and Mr. Tripathi will receive Rs. 1,000 from the exchange.

- The price remains unchanged at Rs 350 : Then neither Mr. Sharma nor Mr. Tripathi will have to pay or receive anything. Such marking of the contract to changes in market price does not happen with forward contracts.

4.3 Features Of Futures

- Organised Exchanges: Unlike forward contracts which are traded in an over-the-counter market, futures are traded on organised exchanges with a designated physical location where trading takes place. This provides a ready, liquid market in which futures can be bought and sold at any time like in a stock market.

- Standardisation: In the case of forward currency contracts, the amount of commodity to be delivered and the maturity date are negotiated between the buyer and seller and can be tailor- made to buyer’s requirements. In a futures contract, both these are standardised by the exchange on which the contract is traded.

- Clearing House: The exchange acts as a clearing house to all contracts struck on the trading floor. For instance, a contract is struck between A and B. Upon entering into the records of the exchange, this is immediately replaced by two contracts, one between A and the clearing house and another between B and the clearing house.

- Margins: Like all exchanges, only members are allowed to trade in futures contracts on the exchange. Others can use the services of the members as brokers to use this instrument. Thus, an exchange member can trade on his own account as well as on behalf of a client. A subset of the members is the “clearing members” or members of the clearing house and non- clearing members must clear all their transactions through a clearing member.

- Marking to Market: The exchange uses a system called marking to market where, at the end of each trading session, all outstanding contracts are reprised at the settlement price of that trading session. This would mean that some participants would make a loss while others would stand to gain. The exchange adjusts this by debiting the margin accounts of those members who made a loss and crediting the accounts of those members who have gained

- Actual Delivery is Rare: In most forward contracts, the commodity is actually delivered by the seller and is accepted by the buyer. Forward contracts are entered into for acquiring or disposing off a commodity in the future for a gain at a price known today.

4.4 Advantages Of Futures

- Opens the Markets to Investors – Futures contracts are useful for risk-tolerant investors. Investors get to participate in markets they would otherwise not have access to.

- Stable Margin Requirements – Margin requirements for most of the commodities and currencies are well- established in the futures market. Thus, a trader knows how much margin he should put up in a contract

- No Time Decay Involved – In options, the value of assets declines over time and severely reduces the profitability for the trader. This is known as time decay. A futures trader does not have to worry about time decay.

- High Liquidity – Most of the futures markets offer high liquidity, especially in case of currencies, indexes, and commonly traded commodities. This allows traders to enter and exit the market when they wish to.

- Simple Pricing – Unlike the extremely difficult Black-Scholes Model-based options pricing, futures pricing is quite easy to understand. It’s usually based on the cost-of-carry model, under which the futures price is determined by adding the cost of carrying to the spot price of the asset.

- Protection Against Price Fluctuations – Forward contracts are used as a hedging tool in industries with high level of price fluctuations. For example, farmers use these contracts to protect themselves against the risk of drop in crop prices.

- Hedging Against Future Risks – Many people enter into forward contracts for better risk management. Companies often use these contracts to limit risk that may arise from foreign currency exchange.

4.5 Disadvantages Of Futures Contracts

- No Control Over Future Events – One common drawback of investing in futures trading is that you don’t have any control over future events. Natural disasters, unexpected weather conditions, political issues, etc. can completely disrupt the estimated demand-supply equilibrium.

- Leverage Issues – High leverage can result in rapid fluctuations of futures prices. The prices can go up and down daily or even within minutes.

- Expiration Dates – Future contracts involve a certain expiration date. The contracted prices for the given assets can become less attractive as the expiration date comes nearer. Due to this, sometimes, a futures contract may even expire as a worthless investment.

4.6 Long & Short Futures Contract

Long Future Contract

Let us say a person goes long in a futures contract at Rs.100. This means that he has agreed to buy the underlying at Rs. 100 on expiry. Now, if on expiry, the price of the underlying is Rs. 150, then this person will buy at Rs. 100, as per the futures contract and will immediately be able to sell the underlying in the cash market at Rs.150, thereby making a profit of Rs. 50. Similarly, if the price of the underlying falls to Rs. 70 at expiry, he would have to buy at Rs. 100, as per the futures contract, and if he sells the same in the cash market, he would receive only Rs. 70, translating into a loss of Rs. 30.

Short Future Contract

As one person goes long, some other person has to go short, otherwise a deal will not take place. The profits and losses for the short futures position will be exactly opposite of the long futures position. a short futures position makes profits when prices fall. If prices fall to 60 at expiry, the person who has shorted at Rs.100 will buy from the market at 60 on expiry and sell at 100, thereby making a profit of Rs. 40.

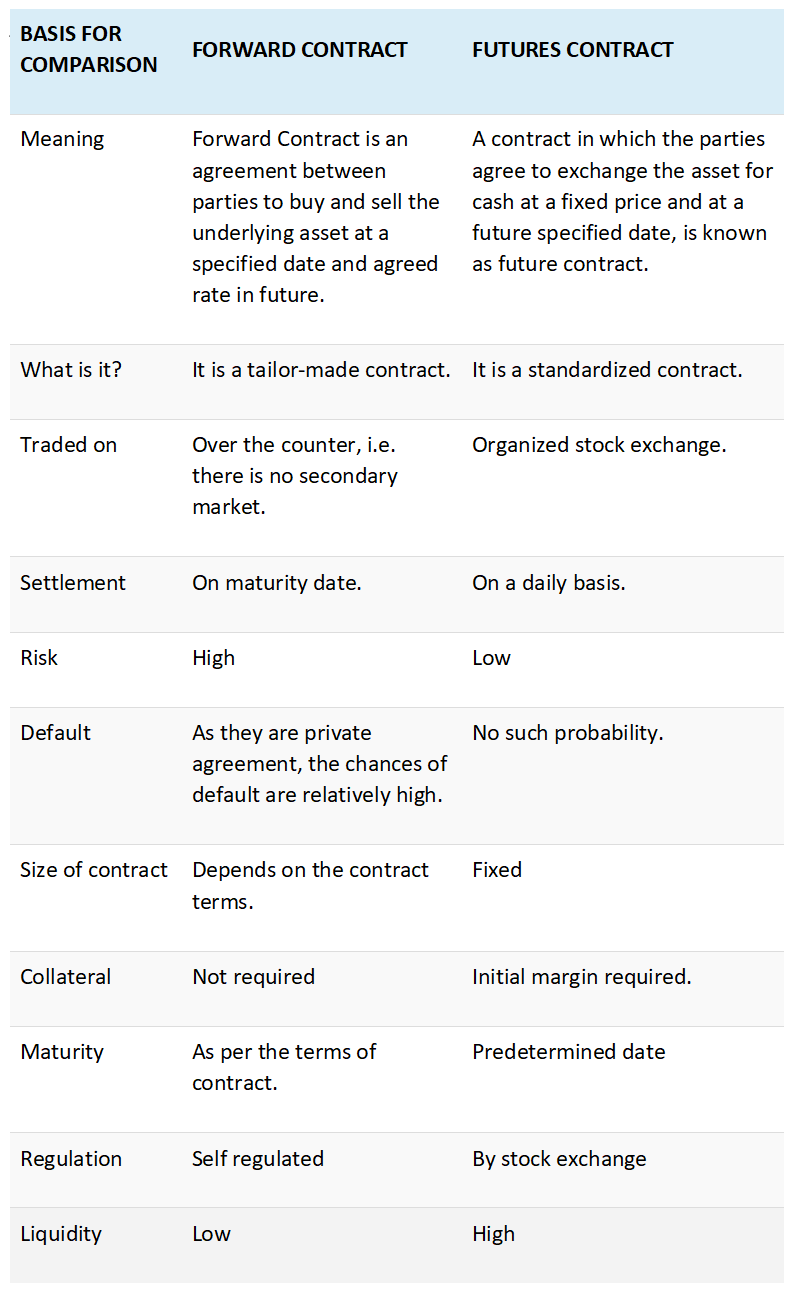

4.7 Difference Between Forward & Futures Contract

4.8 Important Terminology In Futures Contract

- Spot Price – The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. The spot price is important in and of itself because it is the price at which buyers and sellers agree to value an asset.

- Future Price – The price that is agreed upon at the time of the contract for the delivery of an asset at a specific future date. The price of a futures contract tracks the price of the underlying asset (in our case stocks) and is generally higher.

- Lot Size – Lot size is similar to buying milk from the market. There are standard lots. You can buy milk in 250 ml, 500 ml and 1 litre quantities. You cannot ask the shop keeper to give you half a glass of milk! Similarly, futures contracts also have lot sizes. For example- lot size for nifty is 50 shares

- Contract Value – Contract value is the actual value of your position. It is calculated by multiplying the lot size by the price of the futures contract. The contract size of 1 Britannia futures contract is Rs 700000 (Rs 3500*200)

- Expiry Date – Every futures contract comes with a fixed expiry date. All futures contracts expire on the last Thursday of the month. In case the last Thursday is a holiday, the contract will expire on Wednesday.

At any given point of time, there are 3 futures contracts available for trading. In the below snapshot –- Futures contract expiring in the Current Month

- Futures contract expiring in the Next Month

- Futures contract expiring in the month after that-Far Month

- Basis – The difference between current cash price and futures contract price of the same commodity. The basis is calculated by subtracting the price of the appropriate futures contract from the local cash market price.

If the futures price is greater than spot price, basis for the asset is negative. Similarly, if the spot price is greater than futures price, basis for the asset is positive.

Importantly, basis for one‐month contract would be different from the basis for two or three month contracts. Therefore, definition of basis is incomplete until we define the basis vis‐a‐vis a futures contract i.e. basis for one month contract, two months contract etc. It is also important to understand that the basis difference between say one month and two months futures contract should essentially be equal to the cost of carrying the underlying asset between first and second month. Indeed, this is the fundamental of linking various futures and underlying cash market prices together. During the life of the contract, the basis may become negative or positive, as there is a movement in the futures price and spot price. Further, whatever the basis is, positive or negative, it turns to zero at maturity of the futures contract i.e. there should not be any difference between futures price and spot price at the time of maturity/ expiry of contract. This happens because final settlement of futures contracts on last trading day takes place at the closing price of the underlying asset. - Cost of Carry – It is the relationship between futures prices and spot prices. It measures the storage cost (in commodity markets) plus the interest that is paid to finance or ‘carry’ the asset till delivery less the income earned on the asset during the holding period. For equity derivatives, carrying cost is the interest paid to finance the purchase less (minus)dividend earned. For example, assume the share of ABC Ltd is trading at Rs. 100 in the cash market. A person wishes to buy the share, but does not have money. In that case he would have to borrow Rs. 100 at the rate of, say, 6% per annum. Suppose that he holds this share for one year and in that year he expects the company to give 200% dividend on its face value of Rs. 1 i.e. dividend of Rs. 2. Thus his Net Cost Of Carry = Interest Paid – Dividend Received = 6 – 2 = Rs. 4. Therefore, break even futures price for him should be Rs.104. It is important to note that cost of carry will be different for different participants.

- Initial Margin – Money which must be deposited with the broker for each futures contract as a guarantee of fulfillment of the contract. Also known as a security deposit, initial margin or performance bond. Let us take an example ‐ On November 3,2020 a person decided to enter into a futures contract. He expects the market to go up so he takes a long Nifty Futures position for November expiry. Assume that, on November 3, 2020 Nifty November month futures closes at 10000.The Contract value = Nifty futures price * Lot size = 10,000 * 75 = Rs 7,50,000. Therefore, Rs 7,50,000 is the contract value of one Nifty Future contract expiring on November 29, 2020. Assuming that the broker charges 10% of the contract value as initial margin, the person has to pay him Rs. 75,000 as initial margin. Both buyers and sellers of futures contract pay initial margin, as there is an obligation on both the parties to honour the contract. The initial margin is dependent on price movement of the underlying asset. As high volatility assets carry more risk, exchange would charge higher initial margin on them.

- Maintenance Margin – A sum, usually smaller than the initial margin, which must be held on deposit at all times. If a customer’s equity falls below this margin level, the broker must issue a “margin call” for the amount of money required to restore the customer’s equity in the account to the original margin level. Let us understand MTM with the help of the example. Suppose a person bought a futures contract on November 3, 2020, when Nifty was at 10000. He paid an initial margin of Rs. 75000 as calculated above. On the next trading day i.e., on November 4, 2020. Nifty futures contract closes at 10,100. This means that he/she benefits due to the 100 points gain on Nifty futures contract. Thus, his/her net gain is Rs 100 x 75 = Rs 7,500. This money will be credited to his account and next day the position will start from 10,100.

- Open Interest and Volumes Traded – An open interest is the total number of contracts outstanding (yet to be settled) for an underlying asset. It is important to understand that number of long futures as well as number of short futures is equal to the Open Interest. This is because total number of long futures will always be equal to total number of short futures. Only one side of contracts is considered while calculating / mentioning open interest. The level of open interest indicates depth in the market. Volumes traded give us an idea about the market activity with regards to specific contract over a given period – volume over a day, over a week or month or over entire life of the contract.

4.9 Example Of Working Of A Futures Contract

Suppose you expect the stock prices of Britannia Industries to increase in the coming months. And you want to make money from this opportunity. You have two options –

- Buy shares of Britannia industries from the spot market.

- Buy futures with Britannia limited as the underlying.

Let’s explore the first option. Suppose the market price of one share of Britannia Industries is Rs 3,000. You want to buy 100 shares. The cost of 100 shares will be Rs 3 Lakhs!

But you only have Rs 1.5 Lakh. So, you end up buying 50 shares. As expected, the price of Britannia rises to Rs 4,500 after 3 weeks. You sell your 50 shares and book a profit of Rs 25,000. You made 50% returns in just 3 weeks! You are on top of the world! But could you have made more profit?

The answer is Yes. You could have made much higher profits if you had explored option two Investing in Britannia’s Futures. Let us see how scenario two would play out.

You have Rs 1 lakh for investment. Let’s assume that one Britannia futures contract is available at Rs 3100. One Britannia futures contract contains 200 shares. So, the total value of the contract is Rs 6,20,000. The good news is that you do not have to pay the entire Rs 6,20,000 to buy a Britannia futures contract. You simply need to pay an initial margin.

For now, assume that the initial margin required to carry one Britannia futures contract is Rs 62000 (assume margin is 10% of contract size)

So, you buy one Britannia futures contract for Rs 62000. As expected, the share price of britannia Industries rises from Rs 3,000 to Rs 4,500 in the spot market. Remember if the price of underlying asset increases, even the price of the derivative will increase.

So, the price of your futures contract increases from Rs 3100 to Rs 4600 after 3 weeks. Now you decide to sell your contract before expiry. Your buying price is Rs 3100 and your selling price is Rs 4600. So, you made Rs 1400 per share. Since, one lot of Britannia industries contains 200 shares, your total profit is Rs 2,80,000!

This is a gain of 451% in less than 1 month!

Now you do not have to be a financial genius to know that 483% gain is better than 50% gain! So, here’s what you got by trading Britannia futures instead of buying from the spot market:

- Superior returns – 451% vs 50%

- Access to better volumes – In the spot market you could buy only 100 shares. But in the futures contract, you bought 200 shares!

- Lower Capital – In spot market you invested Rs 3 Lakh, whereas in the futures market you invested only Rs 6200

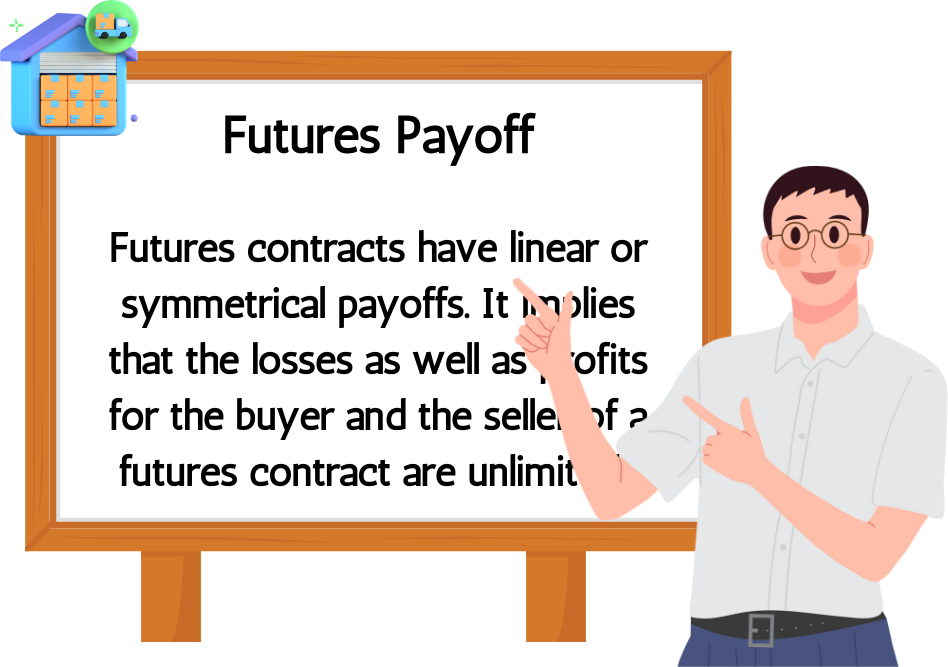

4.10 Futures Payoff

Futures contracts have linear or symmetrical payoffs. It implies that the losses as well as profits for the buyer and the seller of a futures contract are unlimited. These linear payoffs are fascinating as they can be combined with options and the underlying to generate various complex payoffs.

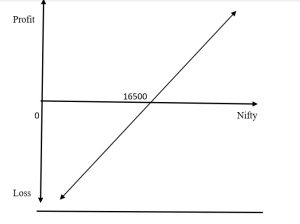

Payoff For Buyer Of Futures: Long Futures

The payoff for a person who buys a futures contract is similar to the payoff for a person who holds an asset. Take the case of a speculator who buys a two-month Nifty index futures contract when the Nifty stands at 16500. The underlying asset in this case is the Nifty portfolio. When the index moves up, the long futures position starts making profits, and when the index moves down it starts making losses. Payoff for a buyer of Nifty futures.

The above figure shows the profits/losses for a long futures position. The investor bought futures when the index was at 16500. If the index goes up, his futures position starts making profit. If the index falls, his futures position starts showing losses.

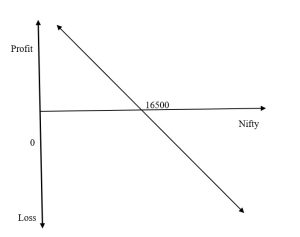

Payoff For Seller Of Futures: Short Futures

The payoff for a person who sells a futures contract is similar to the payoff for a person who shorts an asset. He has a potentially unlimited upside as well as a potentially unlimited downside. Take the case of a speculator who sells a two-month Nifty index futures contract when the Nifty stands at 16500. The underlying asset in this case is the Nifty portfolio. When the index moves down, the short futures position starts making profits, and when the index moves up, it starts making losses.

Payoff For A Seller Of Nifty Futures

The above figure shows the profits/losses for a short futures position. The investor sold futures when the index was at 16500. If the index goes down, his futures position starts making profit. If the index rises, his futures position starts showing losses.