A credit rating is an independent evaluation of the company’s ability to repay a particular debt or financial obligation by a credit rating agency. This evaluation is based on the company’s current and past earnings.

It measures the company’s earnings for timely repayment of principal & interest of a debt or financial obligation. Generally, a higher credit rating is safest so it would lead to more demand or marketability on debt i.e. bond.

Importance of Credit Rating

Better Investment Decision- No banks or money lender would like to give money to a risky company. With Credit Rating, they can get an idea about the ability of that company to repay. Thus credit rating helps banks and money lenders Companies to take Better Investment decisions.

Easy Loan Approval- With a high rating the Company seen as a risk-free company, making it easy for the company to get loan approval.

Safety assured- High Credit rating means Assurance about the safety of the money that it will be paid back with interest on time. Thus, it acts as a measure to provide safety.

Considerate rate of Interest- Credit rating helps borrowing Companies to get debt at less rate of interest because one of the major factors that determine the rate of Interest on debt that is the credit rating. Higher the rating, lower the Interest or vice versa.

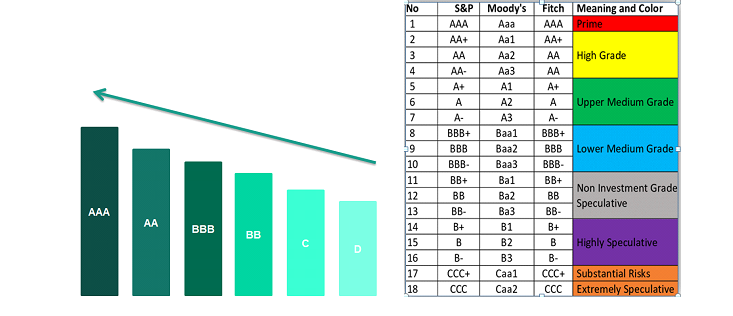

Credit Rating Scale

Credit Rating Agencies in India

CRISIL

CARE

ICRA

SMERA

India Rating and Research

CRISIL is by far the largest credit rating agency in India. It followed by CARE rating is India second largest credit rating agency.

CRISIL, CARE & ICRA are public limited companies listed on both NSE and BSE. The rest are privately held.

All the credit rating agencies are SEBI registered and RBI accredited credit rating agencies.

World’s top 3 credit rating agencies- S&P, Moody’s and Fitch rating operates in India through majority of stakes.

S&P holds majority stake in CRISIL; Moody’s investors services holds majority of stakes in ICRA & India rating and research (Ind-Ra) is a 100% owned subsidiary of the Fitch group.

Most of the credit rating agencies are full- service rating agency. They provide rating services for debt instruments like NCDs, bonds, commercial papers, etc.