Quite often you hear the general excuse that one is not able to invest because they don’t have a large enough corpus. Actually, you don’t need a large corpus. You need to focus on maximizing savings and start regular investment immediately. Here are 5 things to do while investing with little money.

Start as Early as Possible

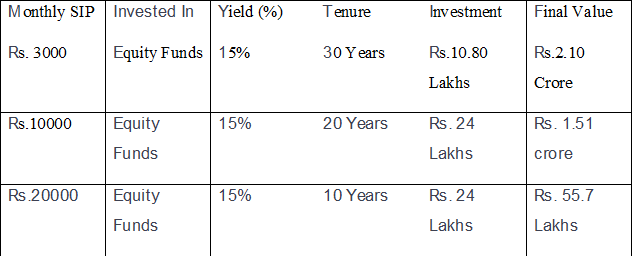

There is really no right age to start investing but the earlier you start the better it is. Over longer periods of time, even small contributions can grow to large sums of money. That is when the power of compounding really works in your favour. The longer you invest, the more your capital earns returns and the more your returns earn returns. Check this table below, where we have assumed a yield of 15%:

Interestingly, you create the maximum wealth with a monthly SIP of Rs3,000 just because you continue it for 30 years. In the other two cases, you end up with less wealth even through you contribute much more.

Adopt a SIP Approach

Don’t try to time the market with lump sum investments. That is too much of strain on your finances. Instead opt for the comfort of a systematic investment plan. It synchronizes with your inflows and also gives you the added benefit of rupee cost averaging. As the table above captures, SIP instils the discipline and that matters more than the amount you invest.

Using Diversified Mutual Funds

That brings us to the next question, if you have a small corpus to invest then where should you invest it. Obviously, if you put the money in a liquid fund earning 6% pre-tax or a debt fund giving 9% returns you cannot create meaningful wealth with a small investment. You need to take a long term view and stick to equities. Don’t fall for sectoral and thematic funds. They can be too risky and unproductive in down cycles. Rather stick to diversified equity funds and at best look at multi cap funds if you want to add the benefit of alpha from mid caps and small caps.

Buy Quality Stocks in Small Quantities

If you think that buying direct equities takes a lot of investment, just think again. When you buy shares in demat, you can even buy small quantity of a stock. A stock of Infosys costs you less than Rs.750 per or a share of SBI costs you around Rs.300. You can keep nibbling in small quantities. Remember this story from market folklore; an investment of Rs.10,000 in Wipro in 1980 would be worth Rs.600 crore today. Yes you did hear it right!

Keep a Trading Limit For Options

Even with a small corpus you can always look to options. You can take a larger position in calls or puts where conviction is higher. Of course, keep the premium as your sunk cost and go ahead. Measure the risk you can afford, but this is a great way to play the market both ways.

Moral of the story is not to be intimidated because you have a small corpus to invest. In the final analysis discipline and diligence matters a lot more.