Intraday trading can help you make extra money apart from Regular Savings. You do not need a genie to appear for fulling all needs. For every common man regular savings, are not enough to meet most of our needs especially, when the inflation is at its peak. Trading in share market, investing in mutual funds etc. are few mediums through which we can make money. But as these schemes are related to market risk, one needs to be careful before investing.

So here we will be discussing about one type of trading i.e. Intraday Trading. A trading strategy is a system that is used to buy and sell stocks. This strategy is used only after adequate amount of research is done. Intra Trading strategies are becoming popular nowadays and everyone is willing to be part of the drive. But one thing investor should remember is that Intraday Trading is not an easy task. Even though we master the intraday trading strategy, the monetary reward earning is difficult and is possible only if you have patience and discipline. The daily volatility makes market riskier, but if the traders follow the rules and through experience a lot of wealth can be earned.

Here we will make you understand what is Intraday Trading? Intra Day Trading Strategies and Tips for Intraday Trading. So let us Begin with

What is Intraday Trading?

- Intraday trading means buying and selling of stocks on the same day. Suppose Mr. Aman buys a stock of a company.

- He has to specifically mention ‘intraday’ in the portal. Intraday is also called ‘Day Trading’. Share prices keep fluctuating throughout the day and traders try to draw profits from these fluctuations by buying and selling the shares on the same day. Intraday happens on the same day before the market closes.

- For example if the stock opens trade at Rs 1000 in the morning. Soon it climbs to 1050 within an hour or two. If you had bought 1000 shares in the morning and sold at 1050 then you earn a profit of Rs 50,000. This is called intraday trading.

Best Intraday Trading Strategies

Intraday trading is all about precise timing and market understanding. A good intraday trading strategy works only after technical analysis, practical execution, using indicators and proper risk management. So here we will intraday trading strategies. This strategy can be used by beginners to start trading.

With regular practice, you can become an expert to this. When doing intraday trading, you should back up your risk with stop-loss limits to prevent loss. You will have to find out your trading style that suits your requirement and temperament. Here is the list of successful trading strategies in India.

Moving Average Crossover Strategy

- A moving average crossover occurs when two different moving average lines cross over one another. A technical tool known as a moving average crossover can help you identify when to get in and out.

- Because moving averages are a lagging indicator, the crossover technique may not capture exact tops and bottoms. But it can help you identify the bulk of a trend.

- If the moving averages cross over one another, it could signal that the trend is about to change soon, thereby giving you the chance to get a better entry.

- One thing to take note of with a crossover system is that while they work beautifully in a volatile and/or trending environment, they don’t work so well when price is ranging.

- The crossover system offers specific triggers for potential entry and exit points.

- In summary, moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending.

Reversal Trading Strategy

- Reversal Trading is also known as Pull Back Trading. This strategy involves betting on stock against their price trends, hoping them to make a “Reversal”

- In reversal intraday trading strategy, traders look for those stocks that are at extremely high and lows. They have a good chance of path reversal. As soon as the movement of the security reverses, a stop is marked and the traders wait for the securities to hit maximum fluctuation. A trade is executed when the reversal value hits the trader’s estimated limit.

- In trading, a reversal refers to the change in the direction of an asset’s price. The trend reversal trading strategy is used by both day traders and long-term investors to determine when to enter or exit a market.

- Trader’s trade reversals by analyzing price actions using trend lines and trading channels. They use technical indicators, such asmoving average (MA) and moving average convergence divergence (MACD) to help them isolate and spot reversals.

Momentum Trading Strategy:

- Momentum trading is a strategy that uses the strength of price movements as a basis for opening positions. Intraday trading strategies are all about finding moving stocks that show fluctuations on an everyday basis. You can find around 25-35% of stocks that show fluctuations. This fluctuation is referred to as momentum. Stock scanners are used to find such stocks.

- It is based on the idea that if there is enough force behind a price move, it will continue to move in the same direction. When an asset reaches a higher price, it usually attracts more attention from traders and investors, which pushes the market price even higher.

- This continues until a large number of sellers enter the market – for example, when an unforeseen event causes them to rethink the asset’s price. Once enough sellers are in the market, the momentum changes direction and will force an asset’s price lower.

- These stocks tend to move above the Moving Average without any resistance in high volume. Momentum in the stocks can be created by a catalyst like earnings but it can also be generated without any fundamental back up. This is called a technical breakout.

- In momentum trading strategy the traders try to pick up those stocks that move in a single direction in high volume. The profit to loss ratio in momentum trading strategy is 2:1.

- A trader can hold the stocks for minutes days or hours depending upon the rate of movement of the stocks.

- Momentum strategy works best during early trading hours or when the volume is high. If you are alert during opening trading hours, you can make a good amount of wealth through this strategy.

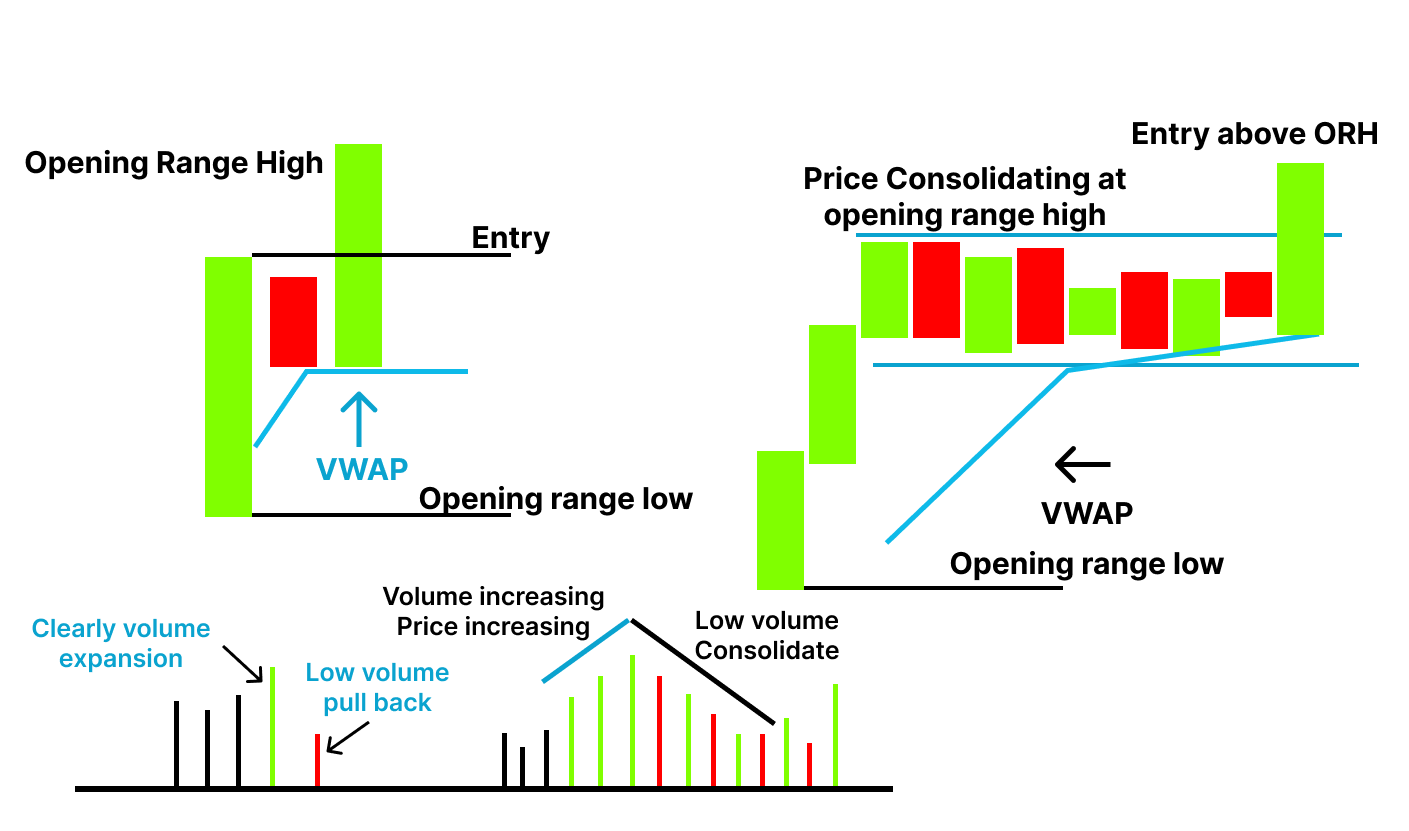

Gap and Go Trading Strategy

- A gap up means that the price of the stock opens higher than previous close. Alternatively, a gap down means that the price of the stock opens lower than previous close.

- This intraday trading strategy focuses on gapers. Gapers are those points on the stock chart where there is no executed trading. These points are called gapers. These gaps can be a result of several factors like news hike, earning announcement, or a changed trading strategy of the trader.

- The gap and go strategy is when a stock gaps up from the previous days close price. If you’re looking to do gap trading successfully then the most common strategy is to use a pre-market scanner and search for stocks that have volume in the premarket.

- This strategy is a very popular trading strategy among day traders. Every morning there’s a bunch of gapping stocks which hit the pre-market scanners.

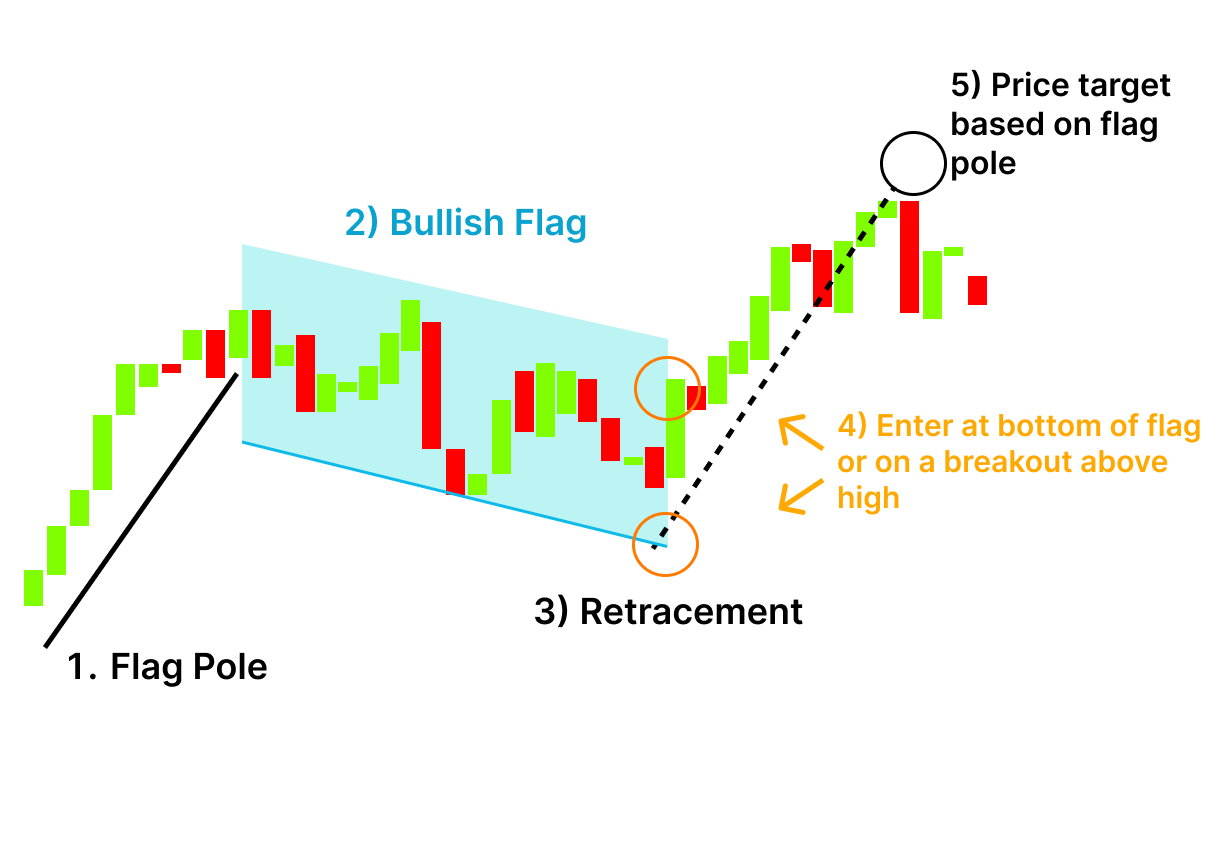

Bull Flag Trading strategy

- The bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend, before breaking out and continuing the uptrend.

- As the name itself suggests, a bull flag is a bullish pattern, unlike the bear flag that takes place in the middle of a downtrend.

- A flagpole is formed when a strong price movement takes place in a direction. When the resistance line breaks, it starts a new movement and the stocks move ahead. The bull flags are violent in the beginning. This is because it causes breakout and the bear becomes blindside.

- The bull flag represents a strong price movement in a direction and then there is a pullback in such a fashion that there is a parallel high and low pattern. It takes a lot of time for the bull flag to form and for the formation of the upper and lower line.

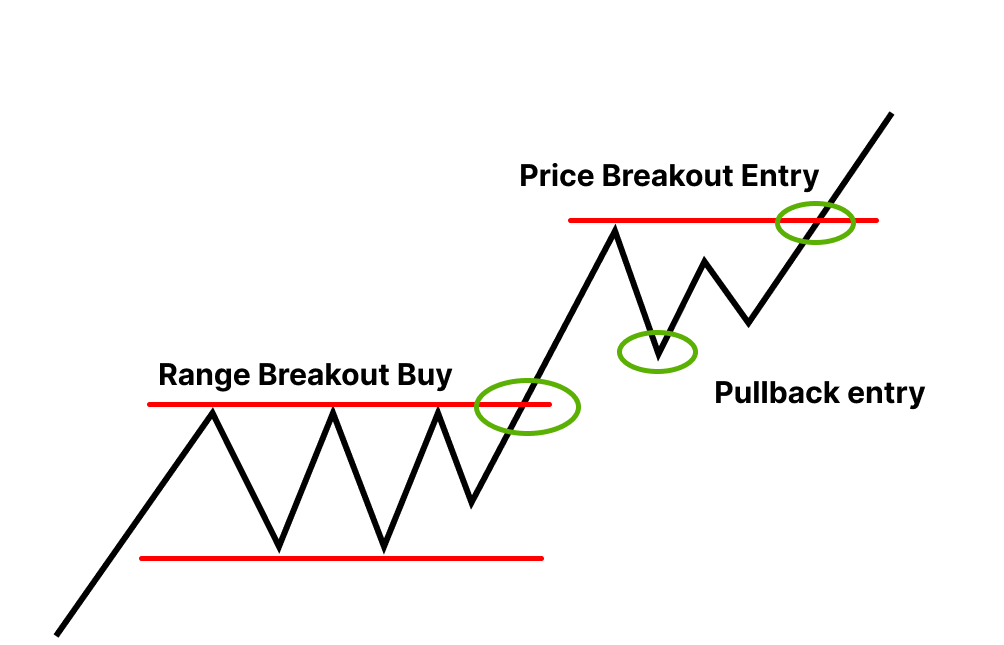

Pull Back Trading Strategy

- A pullback situation takes place when there is movement in the opposite direction of a long-term trend. The pullback strategy saves the trader from losing while he is going by the trend.

- The Pull Back Trading Strategy is for trading stocks that are extremely strong and trading on high relative volume.

- A pullback should not be confused with a trend reversal. It is said that in the pullback strategy weakness is bought and strengths are sold. A good opportunity to buy a pullback is just after the breakout.

- Pullbacks usually last for a few trading sessions, while a reversal can signify a complete change in market sentiment.

Breakout Market Strategy

- In a breakout market strategy, a trader enters the market when the price goes beyond its own resistance and support. Technical indicator volume is used by the traders to search such a pattern in the market. Breakouts need quick entries and exit. It does not involve waiting.

- Breakouts are strong trade signals that precede impulsive movements in the market. It occurs when the price impulsively breaks out of an already existing range. Hence, its name is BREAKOUT.

- The traders first calculate the breakout price level and wait for the breakout. This is a risky method of trading because after the breakout ends, there is none left for buying.

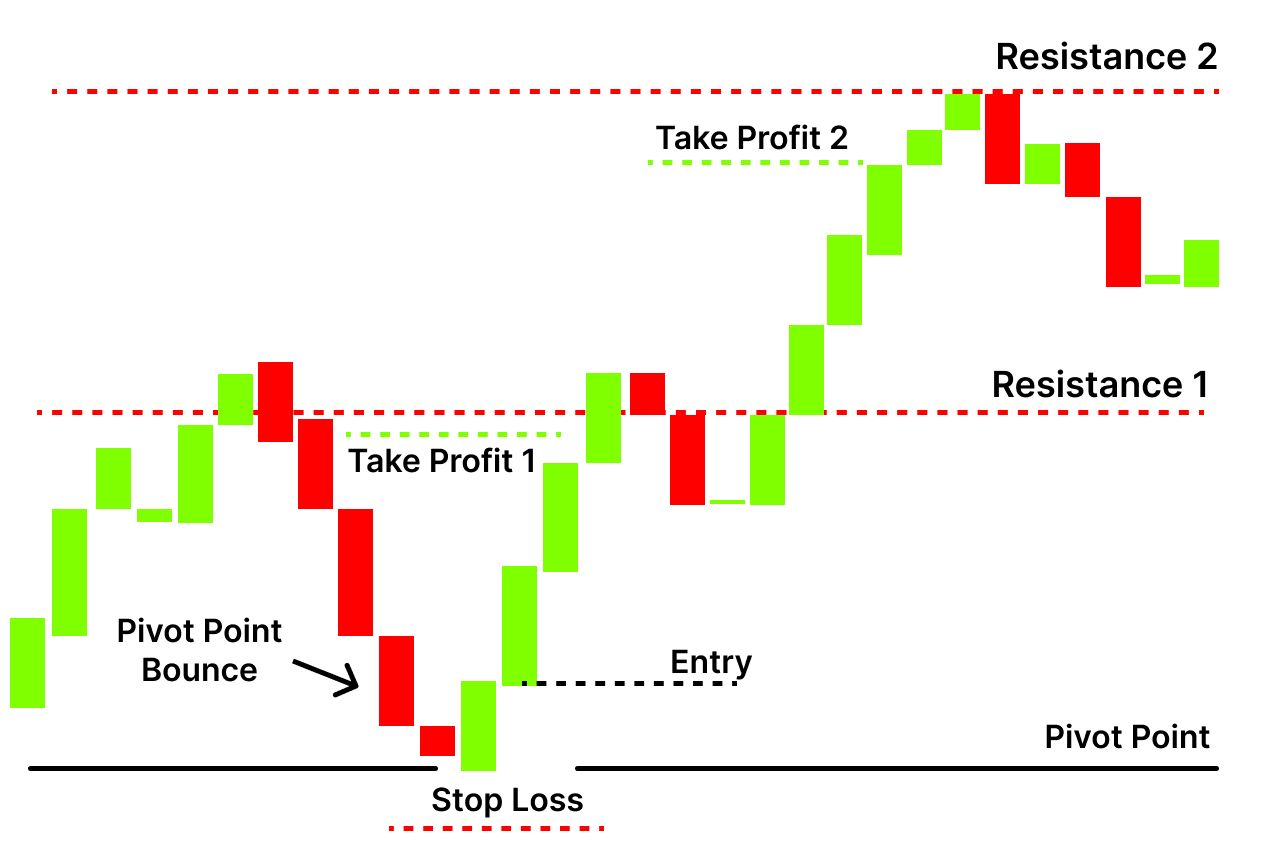

Pivot Point strategy

- A pivot point strategy is beneficial in critical support and resistance level situation. This strategy is useful in the forex market. The range-bound traders can use it as an entry strategy while the breakout traders can understand breakout levels.

- A pivot point is a level where the sentiment of the market changes from being bullish to bearish. The vice versa is also true. If the price moves past the first support or resistance, the market tends to expect that it will move to the second level.

- Therefore, pivot points are important tools that many pros use to identify where the price will move to next. They are also used to locate take-profit and stop-loss.

- Pivot points are important tools that can help you identify areas of potential support and resistance levels. They are used by most professional day traders.

CFD Strategy

- Intraday trading is hectic and generating profit requires a lot of knowledge. But instruments like CFD are a trader- friendly and easy to use. The CFD refers to the difference between the entry and exit points of a trade.

- CFD stands for contracts for difference – a derivative product that enables you to speculate on a range of global markets such as forex, commodities, indices and shares, without having to own the underlying asset.

- CFDs are a leveraged product, which means that you can gain access to a position by putting down a small deposit, known as a margin.

- Here Your profit and loss are calculated on the full size of your position – so it’s important to remember that while leverage can magnify profits, it can also lead to magnified losses, including losses that exceed deposits for individual positions.

- While there are risks associated with trading CFDs, committing time to building your knowledge can give you a significant advantage and reduce your risk.

Scalping Strategy

- Scalping is a famous strategy in the Forex market. This strategy focuses on minor price changes. You need to be accurate on timings as the trade duration is small. It is a risk-oriented strategy.

- The scalping strategy is a trade tactic in getting sure small gains from little price exchanges until you can get big ones when the profitable times come or via accumulation of the benefits.

- The strategy aims at not going for risky ventures but sure small ones to gain more in later phases. Thus, this strategy is not a one-time big win, but effective use of the snowball effect.

Intraday Trading Tips

Intraday trading is riskier than investing in the regular stock market. Most traders, especially beginners, lose money in intraday trading because of the high volatility of the stock markets. Below are a few intraday trading tips in Indian share market which will help investors in making the right decision:

1. Choose Liquid Shares :

- The first intraday trading tip is One should always choose liquid shares for intraday trading, as these shares are to be sold before end of the day.

- It is also recommended that you choose two or three large-cap shares that are highly liquid. High liquidity ensures that the stock may be purchased or sold anytime required – this aids in capturing any possible gains that may emerge from massive price activities in a single day.

2. Utilizing Stop Loss for Lower Impact:

- Stop Loss is used to automatically sell the shares if the price falls below the certain limit. You should determine the stop loss to limit your potential loss due to fall in stock prices.

- For example : If you buy a stock of Rs 1500 expecting it to rise and you then place the stop loss at Rs 1480, then if the stock is in a reverse trend, your stop loss will be triggered and you will have to bear loss of just Rs 20, even if the price goes below 1400.

3. Volatile Stocks are a no-go

- In today’s fast-paced markets, volatile stocks can offer higher profit potential. However, intraday trading can be risky and should be done only when you have a good understanding of the specific stock or sector.

- You should always set stop losses to help mitigate risk in your intraday trading strategy. If the stock price reaches your set stop-loss price, the position will be exited immediately. This action helps prevent significant losses from a sudden move in the wrong direction.

4. Correlated Stocks

- Investing in companies closely connected to an index or sector is among the most basic intraday trading methods. The success of the broad index or sector provides a clear picture of the changing market, making it relatively straightforward to generate high returns on investment.

- The NSE website allows users to monitor the profitability of a given sector and choose a stock with a definite upward or negative trend. Because the stock price movement is tied to the index or sector, it is simple to trade.

5. Choose Transparency

- It is usually good to invest in stocks of firms that provide the marketplace with adequate information about their company activities. When you consider all relevant facts, making a choice becomes simple. If critical information is concealed, you may adopt the wrong stance, resulting in losses.

- Only organizations with a straightforward business procedure should be picked for intraday trading. Another element to consider when selecting intraday stocks is stable management.

6. News-Sensitive Stocks

- Choosing stocks that are responsive to news is a common intraday stock selecting approach. These stocks usually react to any good or bad news in the news. Taking positions becomes more manageable if you understand the movements caused by the media.

- Nevertheless, you should be cautious when trading equities that are too sensitive to events. These stocks might sometimes change the direction of the news. Even though the news is favorable, the share value may plummet.

Conclusion

To succeed as a day trader, it is important to know how to pick stocks for intraday trading. Often people are unable to make profits because they fail to select appropriate stocks to trade. Day trading, if not managed properly, can have drastic results on the financial well-being of users. So with the above intraday trading strategies and intraday trading tips traders can avoid risk and earn good returns.

Frequently Asked Questions

Intraday is also referred to as Day Trading and it involves the purchase and sale of the stocks within the same trading day. When the share prices fluctuate throughout the day, intraday traders try to draw profit from these price movements by buying and selling shares during the same trading day.

According to experts the time frame between 9.30am to 10.30am is the best for intraday trading. Trading during these hours is considered beneficial.

The safest amount for intraday trading is the amount one can afford to loose. So in the beginning one cannot just wake up and start buying or selling some stocks and wait for profits. One should be thorough with the market before entering it. Another important point which beginners need to remember is in intraday trading you cannot hold the position overnight and close the position same day itself.

Intraday trading are very risky due to high price fluctuations. If there is no strategy while trading it can be extremely risky. Wrong time of exit can create loss and also the chances of blunder are very high.

To start Intraday Trading it is necessary to select the best intraday stocks. The risk is relatively higher in Intraday Trading in comparison to standard trading. Market’s volatility like unexpected fluctuations in the prices can incur losses to investors. So one need to check for volatility, choose highly liquid stocks, High Trade Volumes etc.

Tips for Intraday Trading are

- Choose Liquid Shares

- Utilize Stop Loss for Lower Impact

- Volatile Stocks are No-Go

- Choose Correlated Stocks

- Choose Transparency

- Be aware of news-sensitive stock